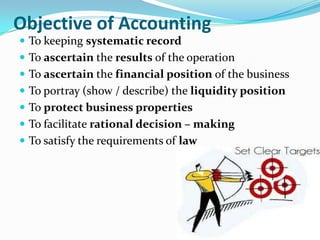

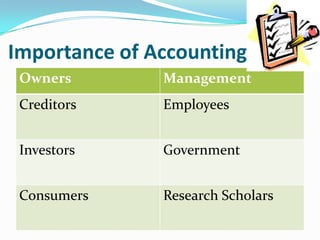

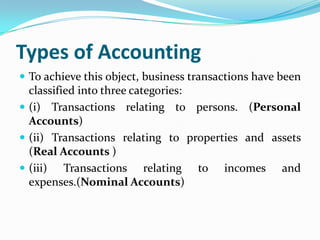

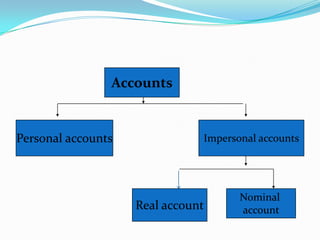

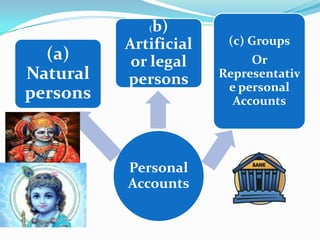

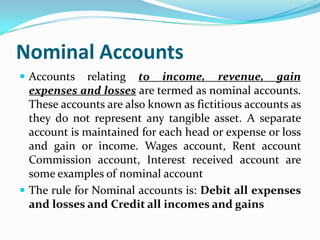

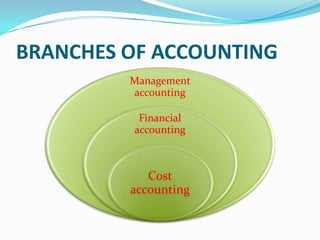

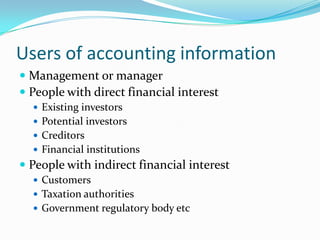

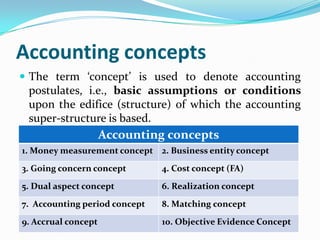

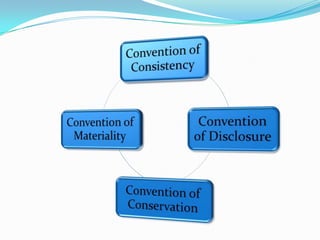

This document provides an introduction to accounting concepts and principles. It discusses the need for accounting in business and non-business organizations, defines bookkeeping and accounting, and outlines their objectives. It also describes the key elements of the double-entry accounting system, including journals, ledgers, trial balances, and final accounts. Finally, it identifies the main types of accounts (personal, real, and nominal), accounting concepts (money measurement, business entity), and conventions used in financial reporting.