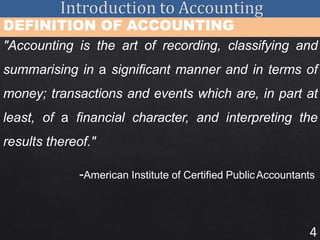

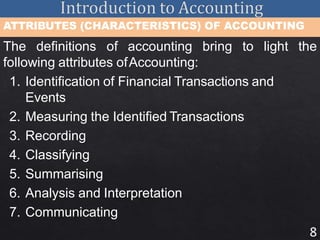

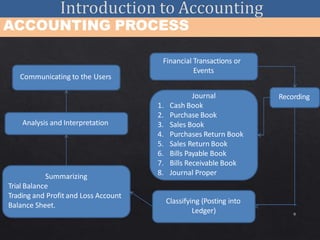

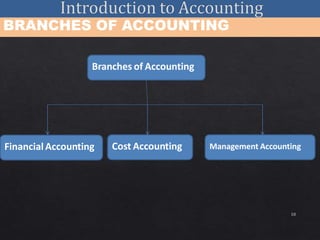

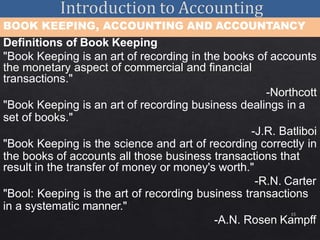

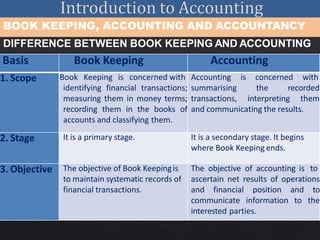

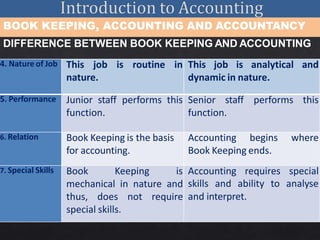

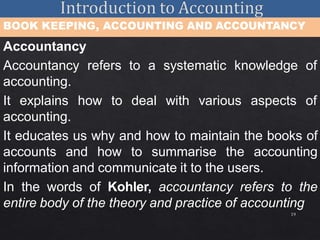

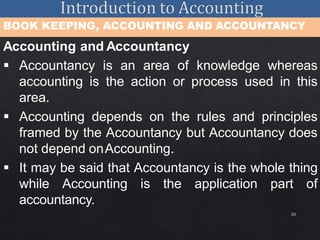

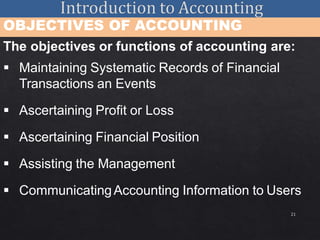

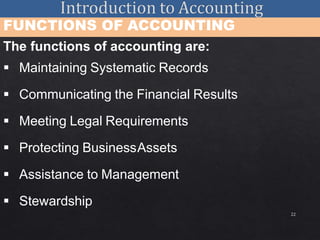

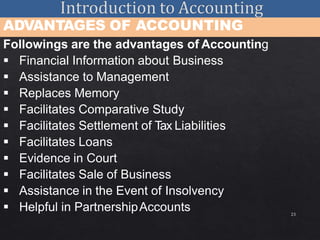

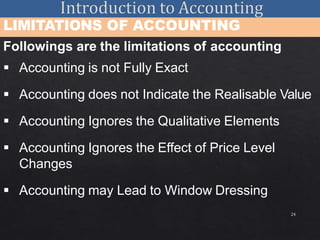

The document provides an in-depth overview of accounting, including definitions, the accounting process, branches such as financial, cost, and management accounting, and the distinction between bookkeeping and accounting. It outlines the objectives, advantages, and limitations of accounting, as well as the systems used for recording transactions, specifically the double-entry and single-entry systems. The content emphasizes accounting as a vital service activity that supports decision-making by providing qualitative financial information to various users.