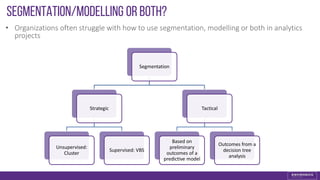

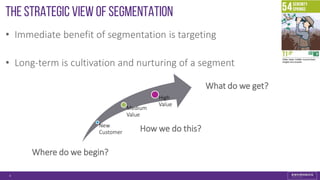

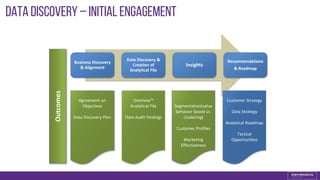

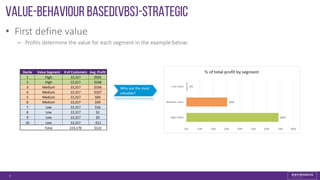

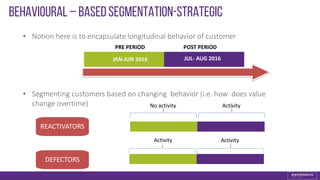

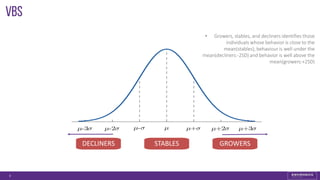

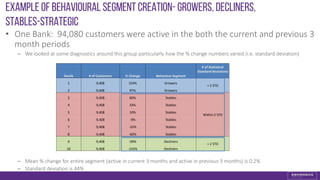

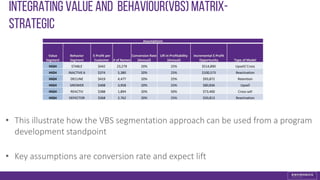

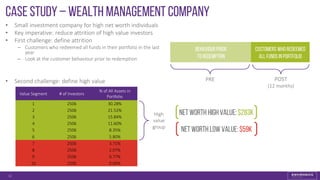

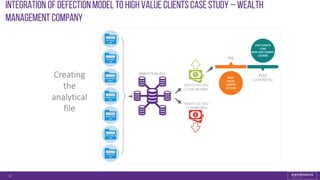

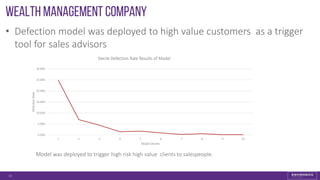

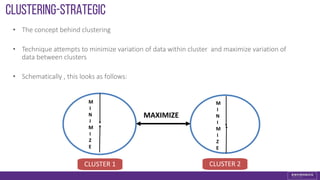

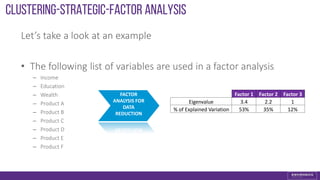

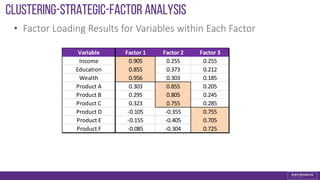

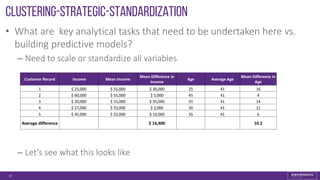

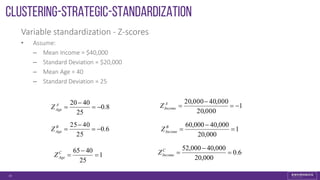

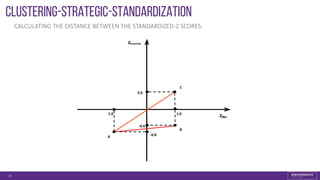

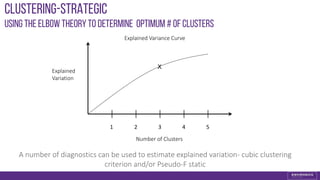

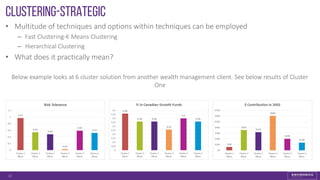

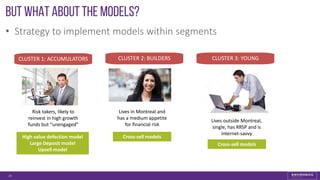

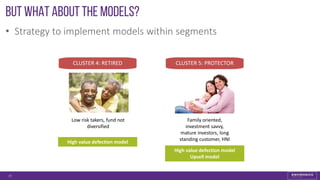

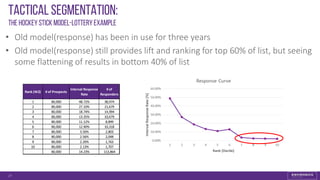

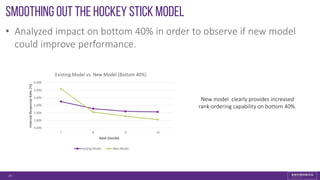

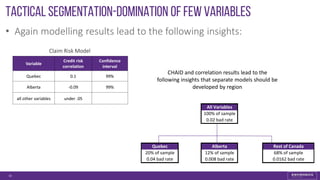

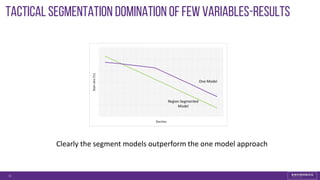

This document discusses strategies for integrating segmentation and predictive modeling. It begins by outlining a typical agenda, including whether to use segmentation, modeling, or both. It then covers strategic approaches like value-based behavioral segmentation and clustering to define customer segments. Tactical segmentation involves using outcomes from predictive models to segment customers. The document provides examples of integrating segmentation with different modeling techniques and discusses how segmented models can outperform single models. It emphasizes that both strategic and tactical approaches are useful but strategic provides more insights for improving communications.