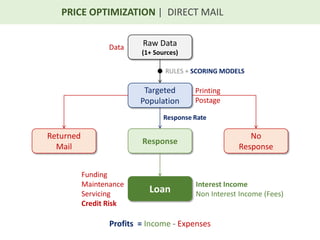

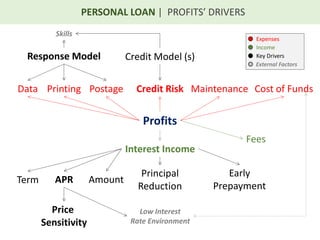

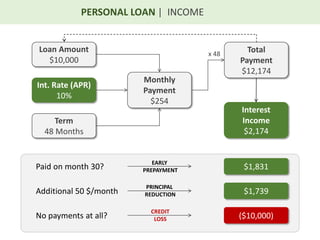

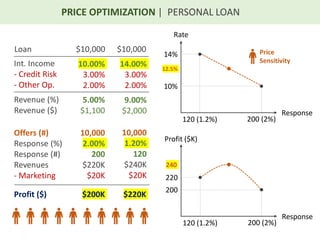

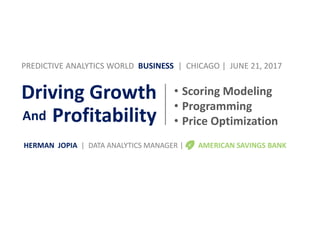

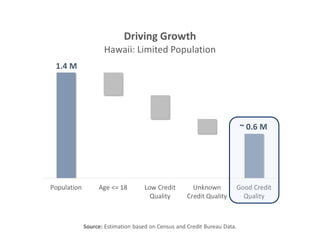

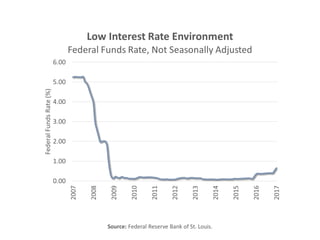

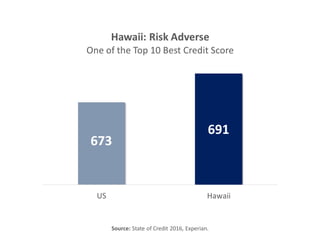

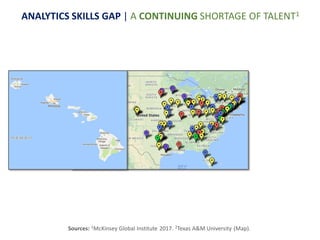

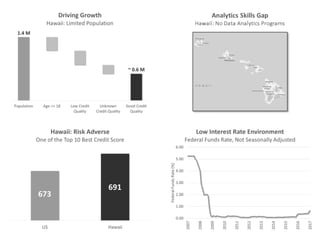

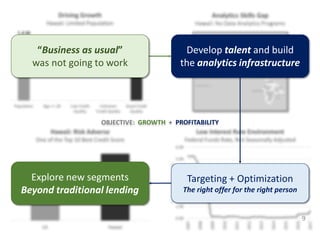

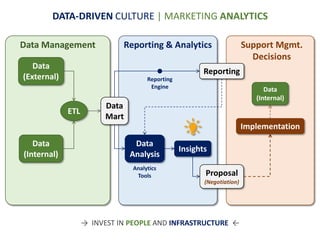

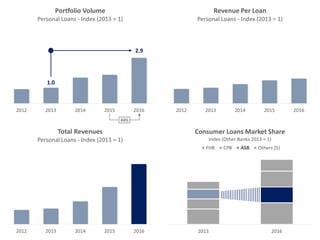

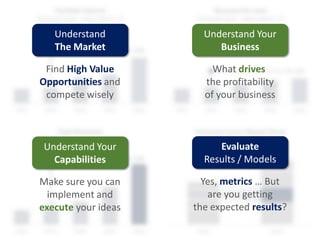

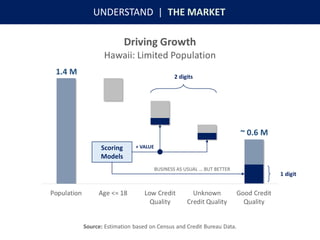

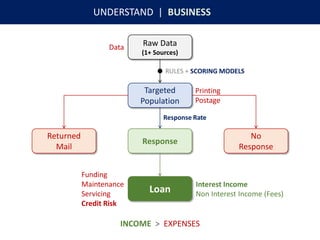

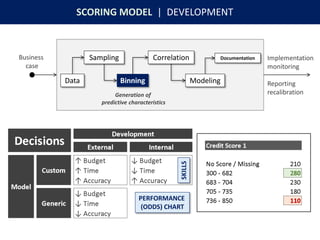

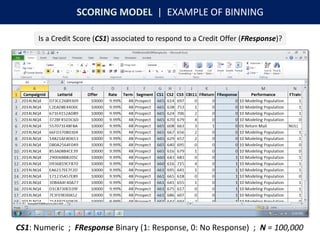

Herman Jopia discusses how American Savings Bank is using predictive analytics to drive growth and profitability. This includes developing scoring models to understand customers and the market, programming tools to optimize processes like binning data, and price optimization to determine the best offers. The goal is to move beyond "business as usual" through investing in analytical talent and infrastructure to explore new opportunities and segments for increasing profits.

![MOST EXPENSIVE

US CITIES1

3RD

DEBT TO

INCOME2

2ND

[ HONOLULU ] [ 2.1 ]

Sources: 1Kiplinger 2017, 2Smart Asset 2017.](https://image.slidesharecdn.com/1315keynotejopiashareable-170618224651/85/1315-keynote-jopia_shareable-6-320.jpg)

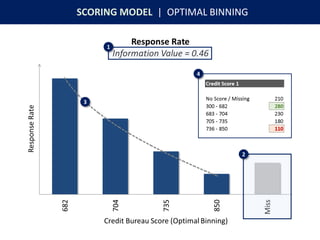

![OPTIMAL BINNING | R PACKAGE ‘smbinning’

# Once the data is loaded in R ...

> result = smbinning(df=dfpultrain, y=“FResponse”, x=“CS1”, p=0.05)

# Plot Response Rate

> smbinning.plot(result,option=“goodrate”,sub=“Credit Bureau ...”)

# Information Value

> result$iv

[1] 0.4627

www.scoringmodeling.com](https://image.slidesharecdn.com/1315keynotejopiashareable-170618224651/85/1315-keynote-jopia_shareable-25-320.jpg)