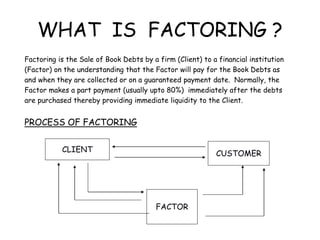

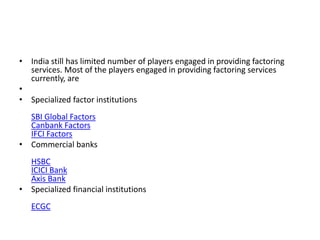

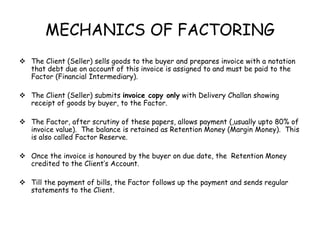

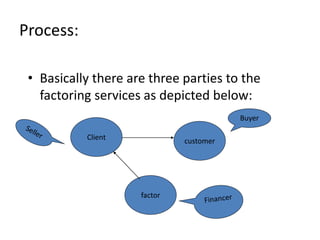

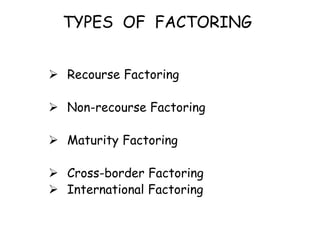

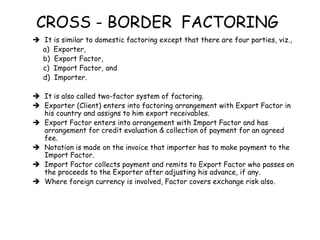

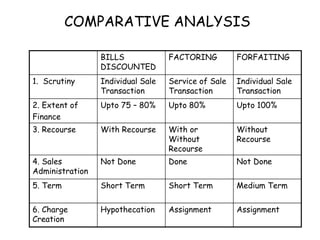

Factoring is the sale of accounts receivable (book debts) by a firm to a financial institution called a factor. The factor provides upfront cash payment for the receivables, usually 80%, and assumes responsibility for collecting payment from customers and managing credit risk. Factoring provides firms with working capital and credit protection. It involves three main parties - the client firm, its customers, and the financial institution factor. Factoring has grown in importance globally as a source of trade financing and working capital for businesses.