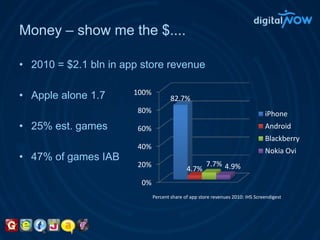

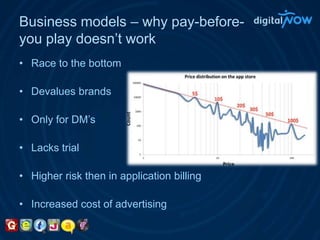

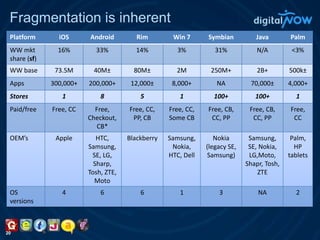

The document discusses mobile app trends and marketing strategies, highlighting GetJar as a leading app store with significant downloads and usage statistics. It emphasizes the growing value of the mobile app industry, projected to exceed $30 billion by 2015, and outlines effective marketing approaches including app monetization and distribution strategies. Additionally, it details brand engagement with mobile apps and the importance of integrating apps into broader marketing campaigns for success.