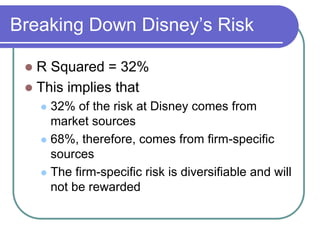

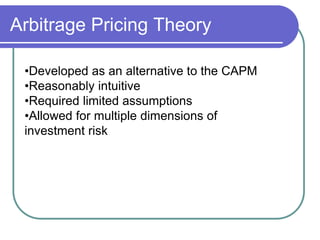

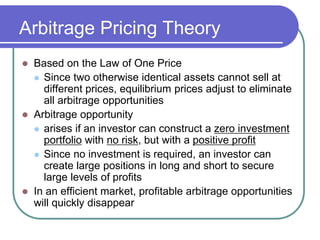

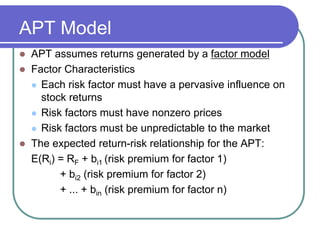

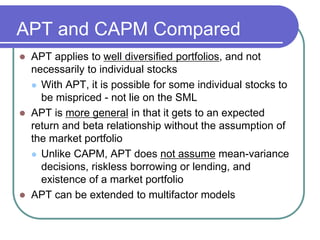

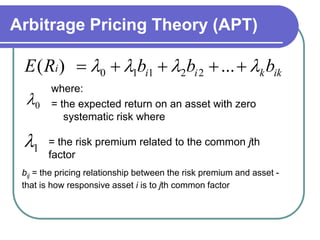

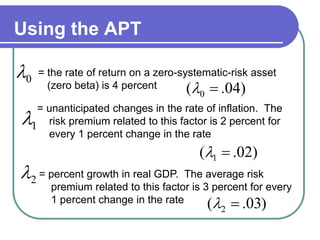

The Arbitrage Pricing Theory (APT) provides an alternative to the Capital Asset Pricing Model (CAPM) for estimating expected returns. The APT assumes returns are generated by multiple systematic risk factors rather than a single market factor. It allows for assets to be mispriced and does not require assumptions of a market portfolio or homogeneous expectations. Under the APT, the expected return of an asset is equal to the risk-free rate plus the product of each risk factor's premium and the asset's sensitivity to that factor.

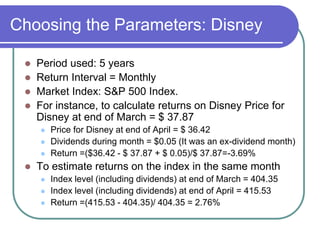

![Security Valuation with the APT:

An Example

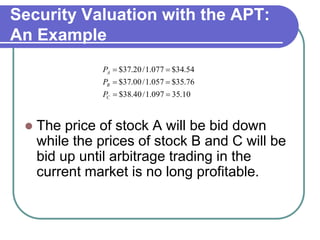

Riskless arbitrage

Requires no net wealth invested initially

Will bear no systematic or unsystematic risk but

Still earns a profit

Condition must be satisfied as follow:

1.

2

3

0i iw

0 iji ibw

0 ii i Rw i.e. actual portfolio return is positive

For all K factors [i.e. no systematic risk] and w is small

for all I [ unsystematic risk is fully diversified]

i.e. no net wealth invested

Wi the percentage investment in security i](https://image.slidesharecdn.com/chapter7-101031161331-phpapp02/85/Chapter-7-40-320.jpg)

![Security Valuation with the APT:

An Example

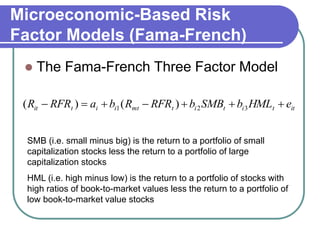

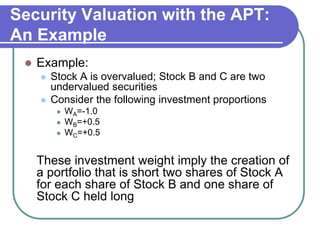

Net Initial Investment:

Short 2 shares of A: +70

Purchase 1 share of B: -35

Purchase 1 share of C: -35

Net investment: 0

Net Exposure to Risk Factors:

Factor 1 Factor 2

Weighted exposure from Stock A: (-1.0)(0.8) (-1.0)(0.9)

Weighted exposure from Stock B: (0.5)(-0.2) (0.5)(1.3)

Weighted exposure from Stock C: (0.5)(1.8) (0.5)(0.5)

Net risk exposure 0 0

Net Profit:

Stock A Stock B Stock C

[2(35)-2(37.20)]+[37.80-35]+[38.50-35] =$1.90](https://image.slidesharecdn.com/chapter7-101031161331-phpapp02/85/Chapter-7-42-320.jpg)