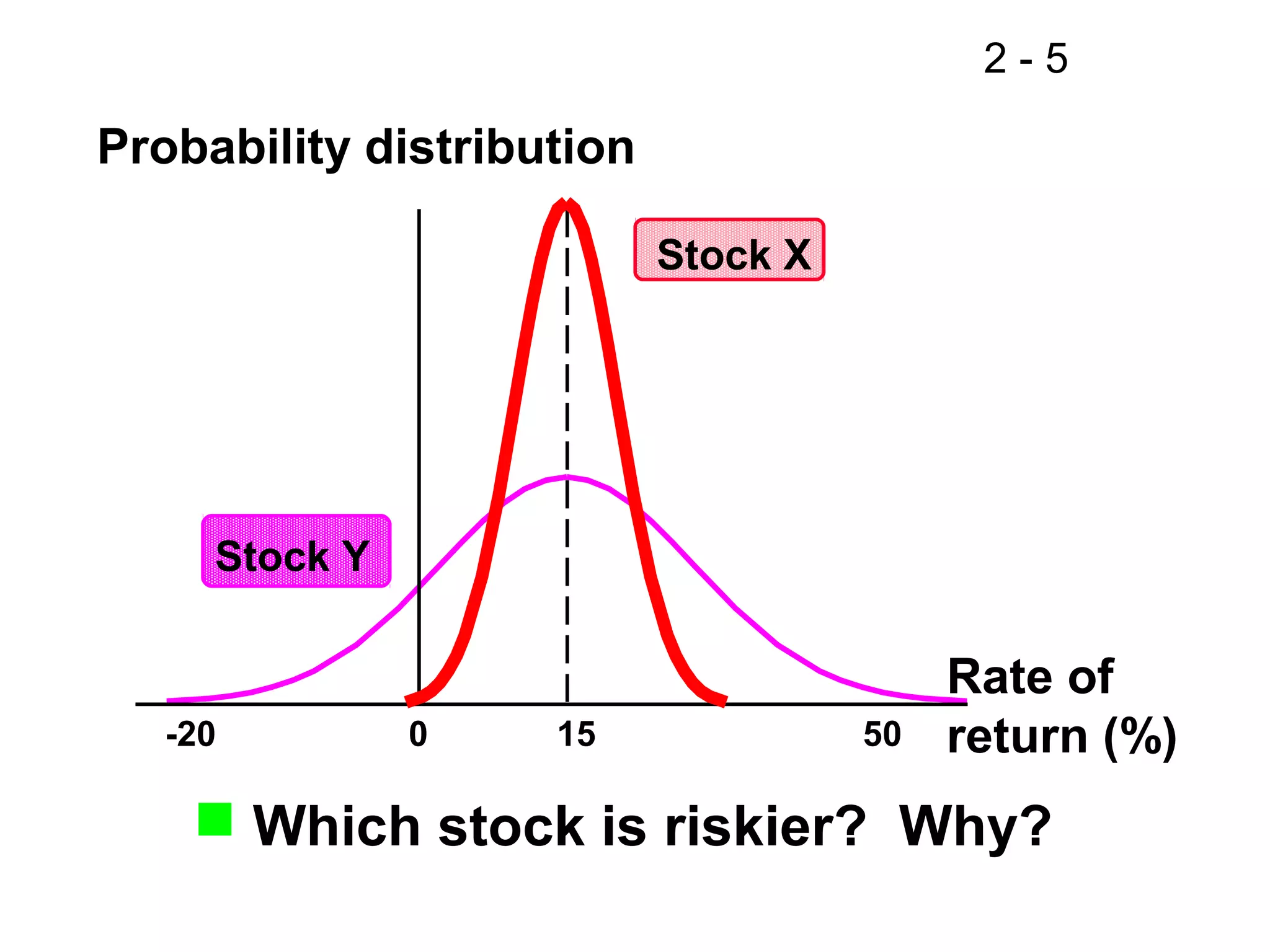

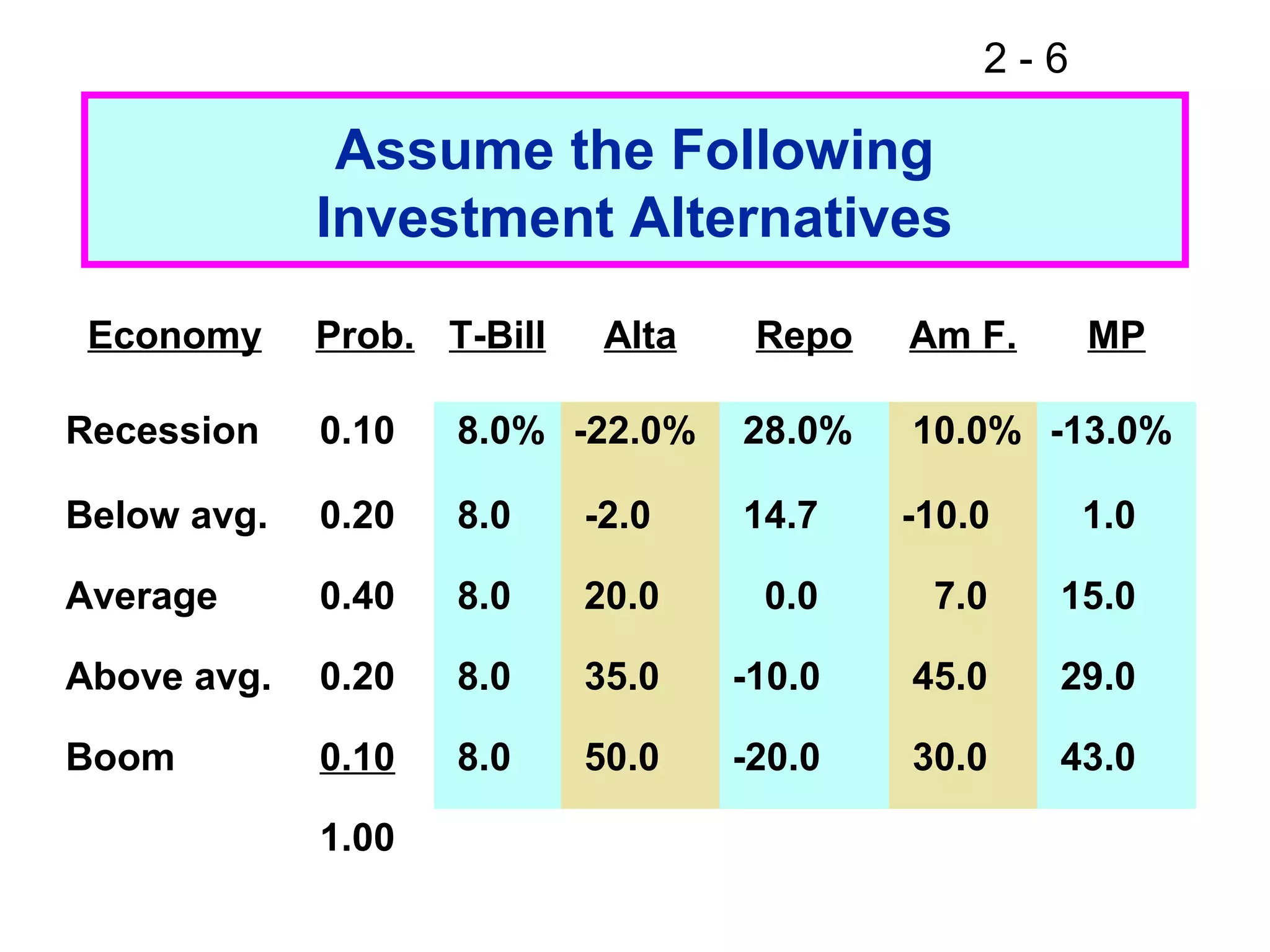

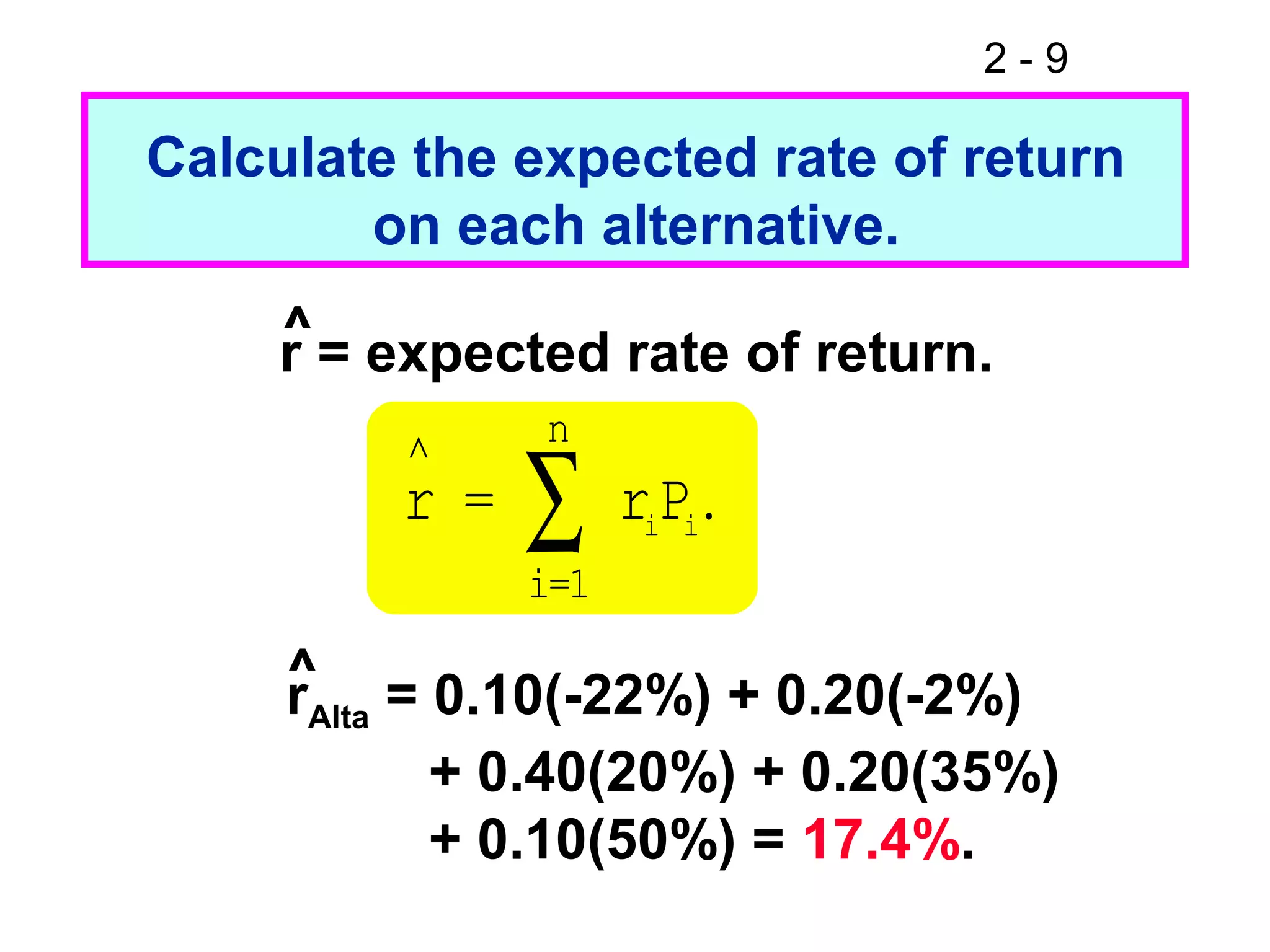

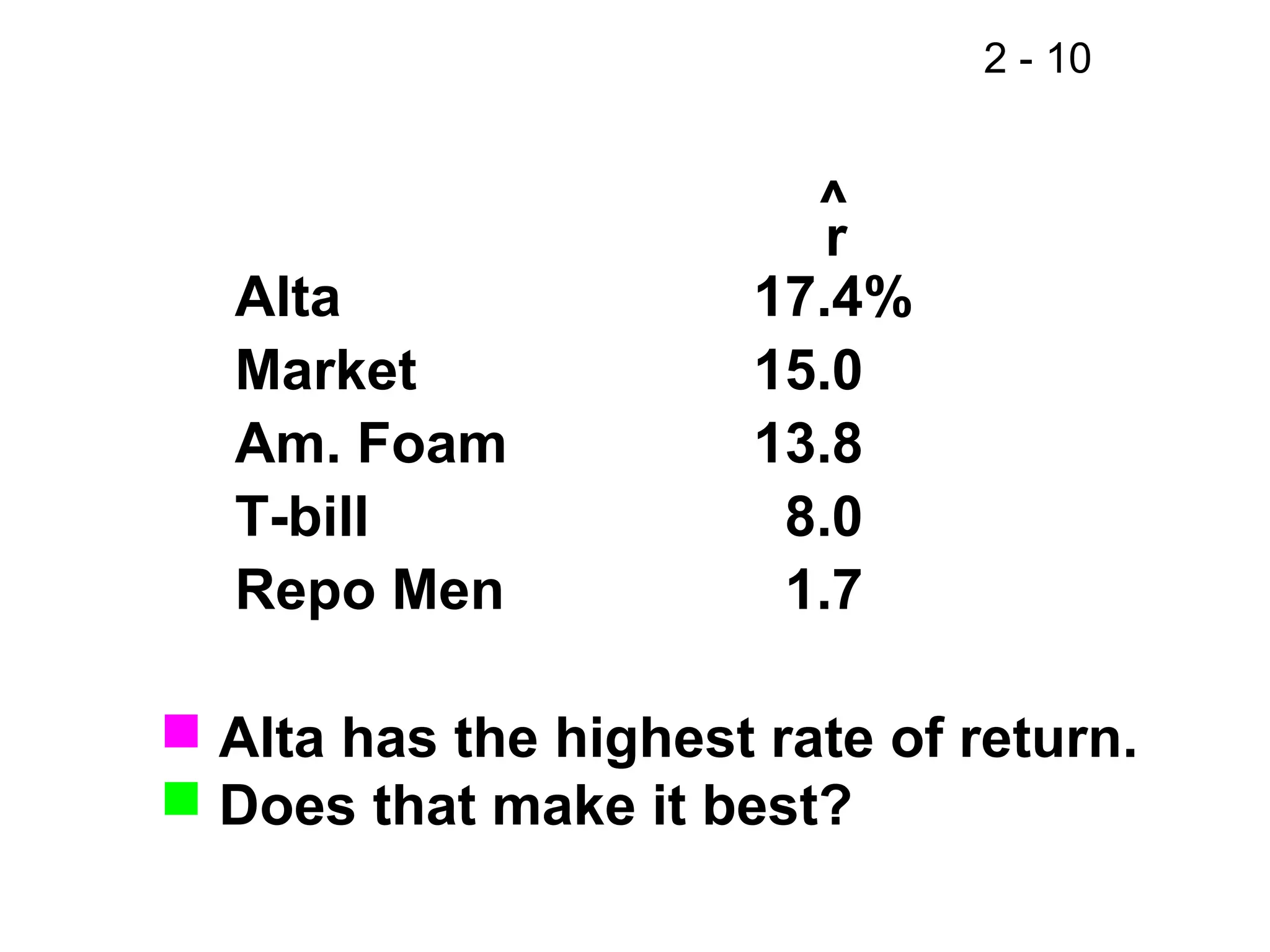

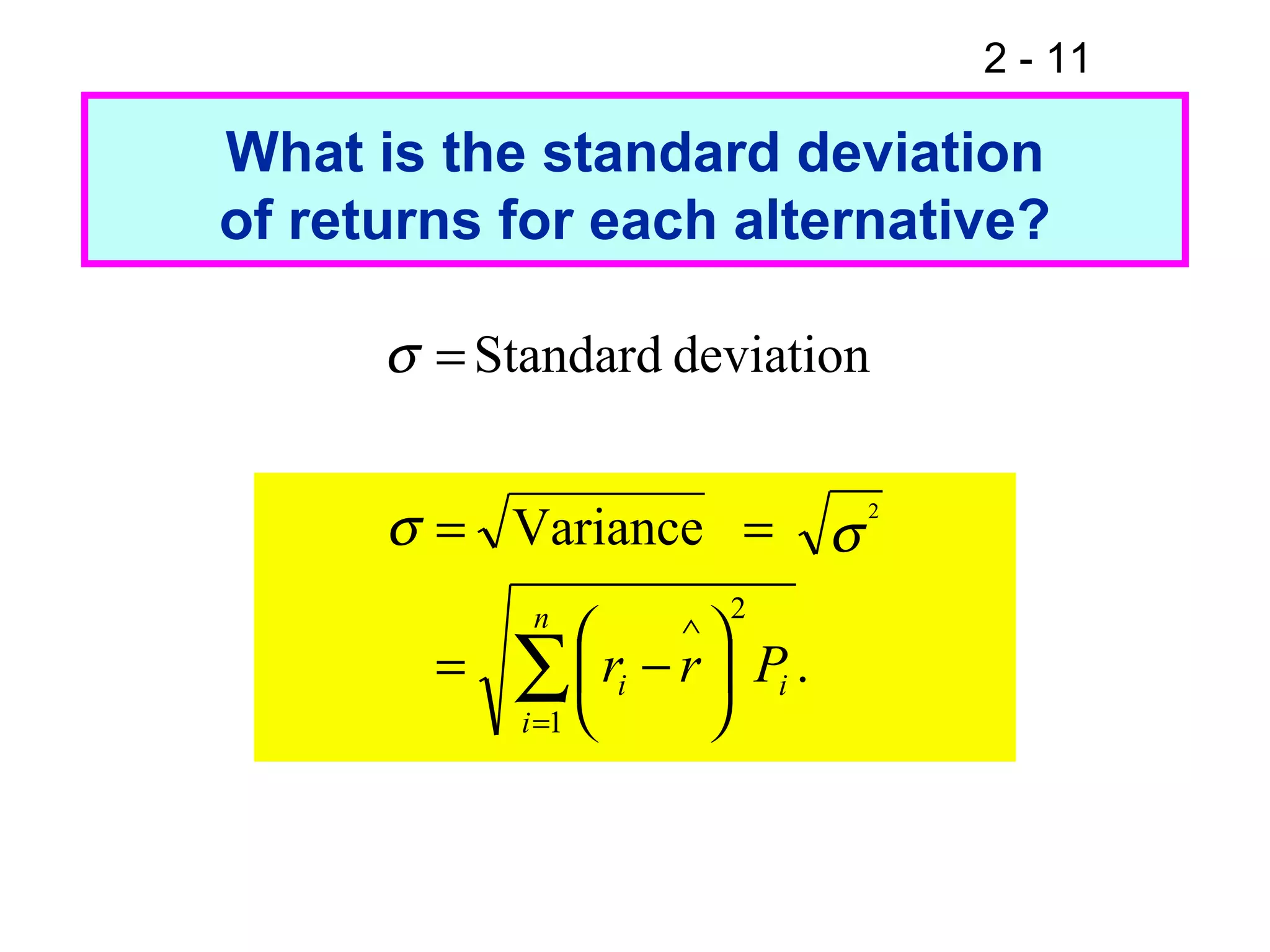

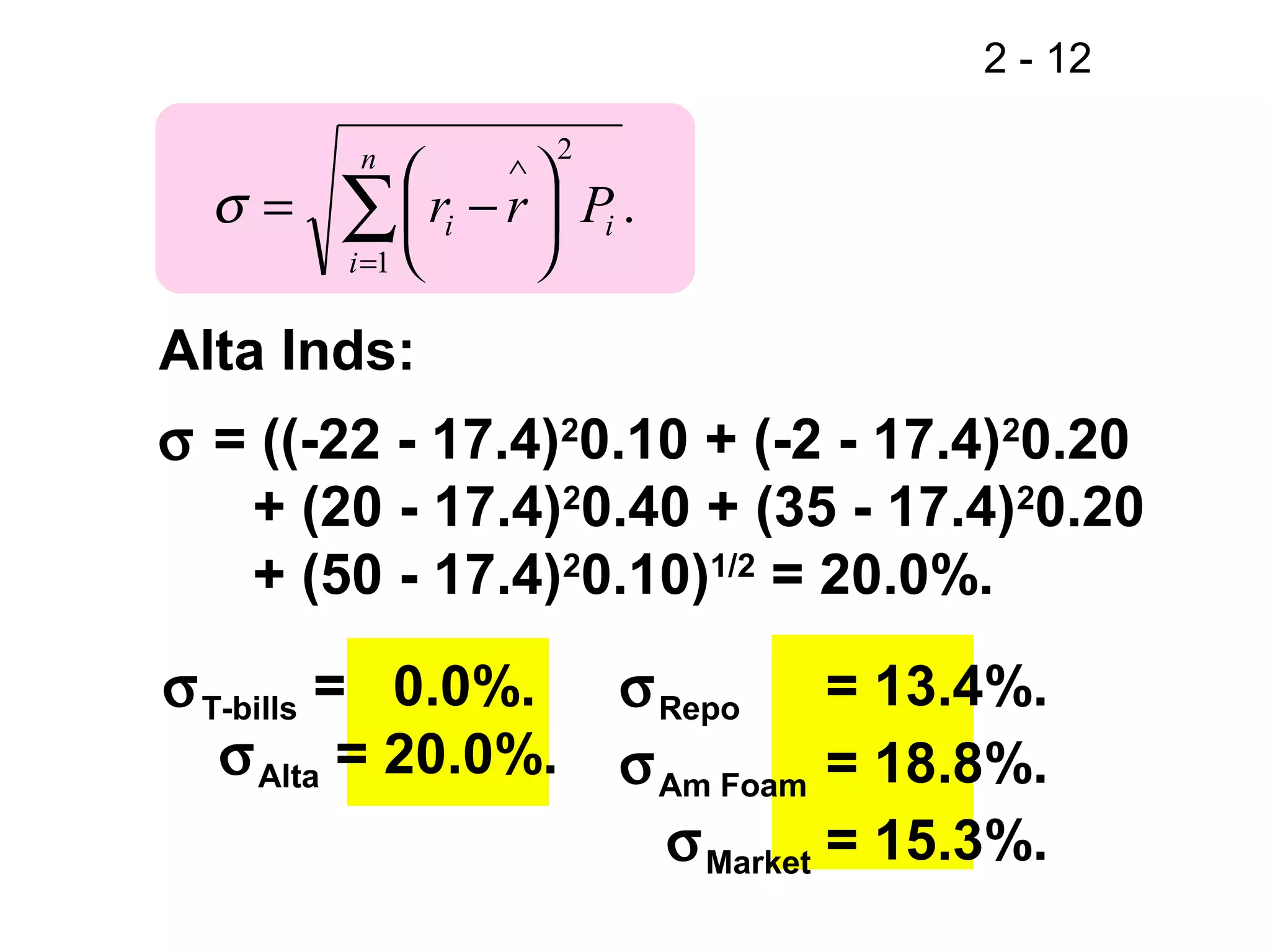

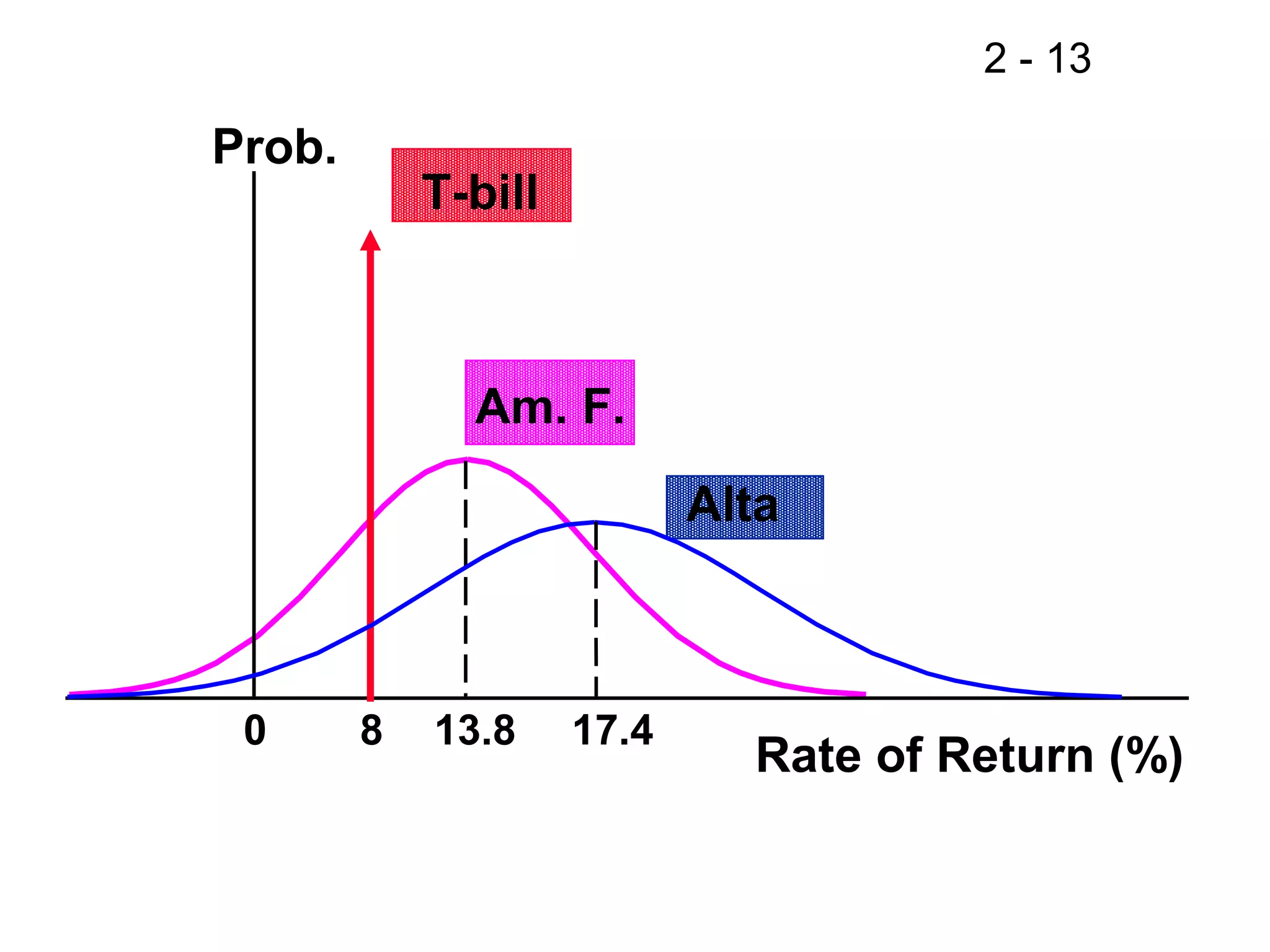

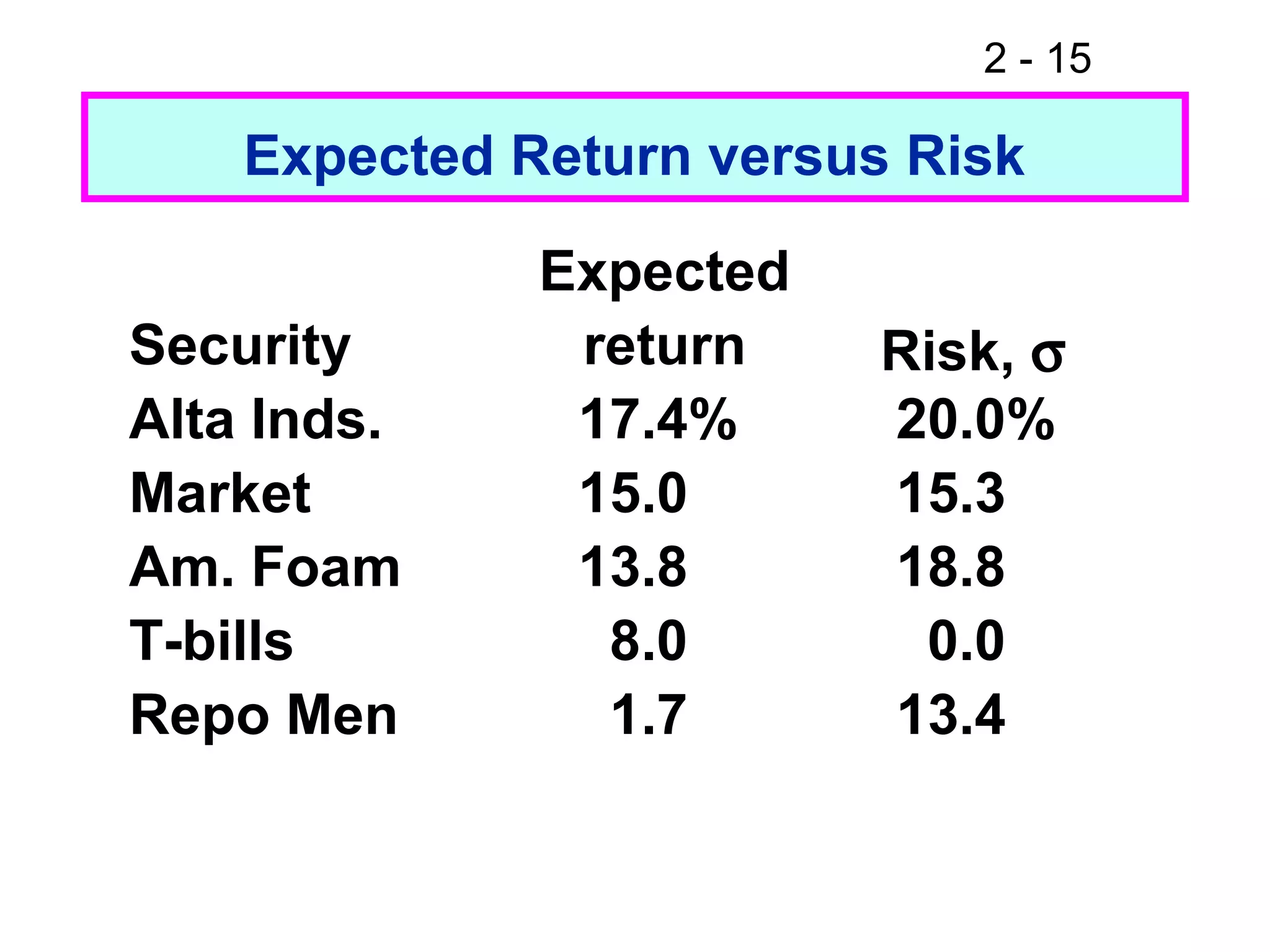

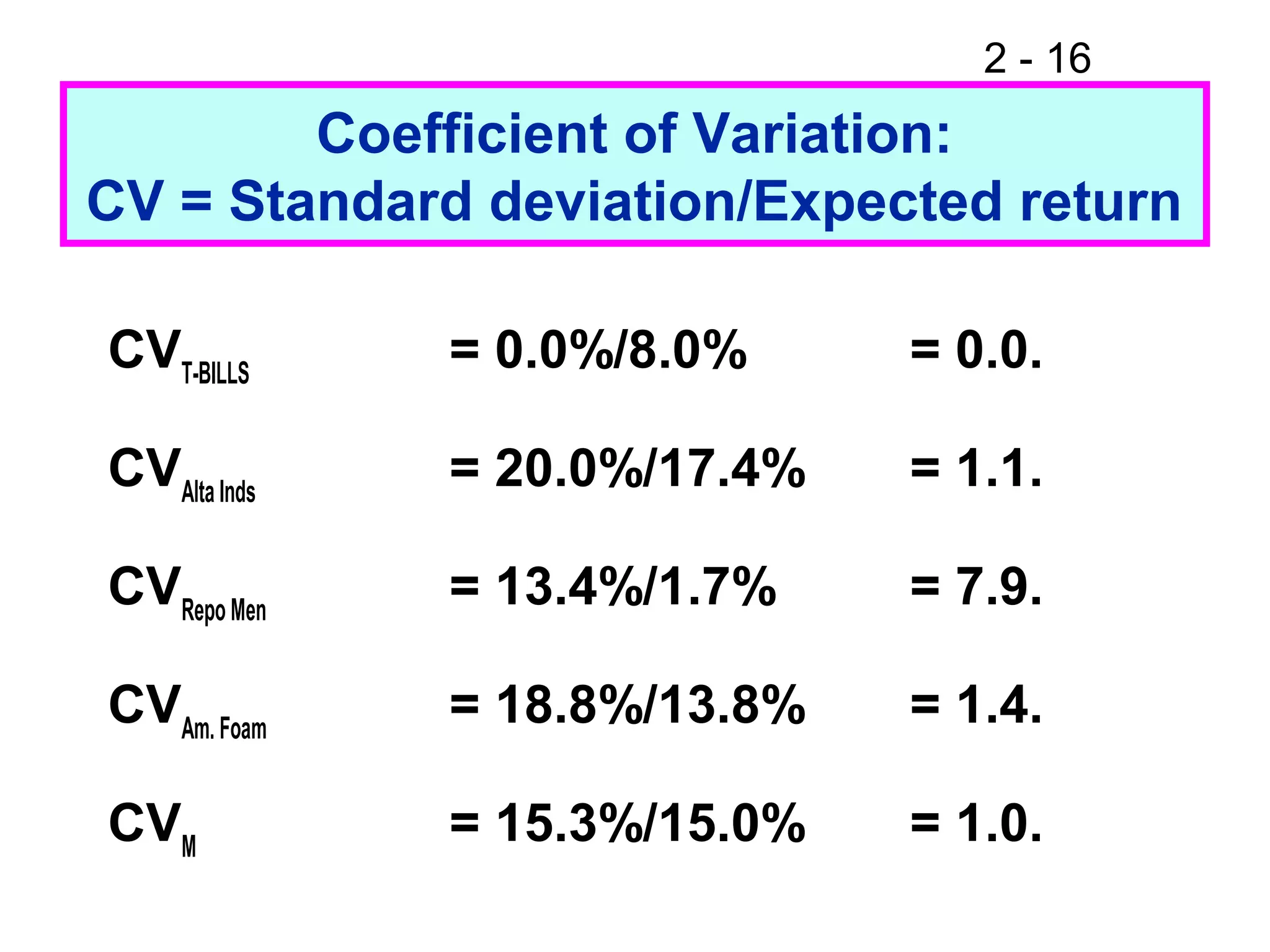

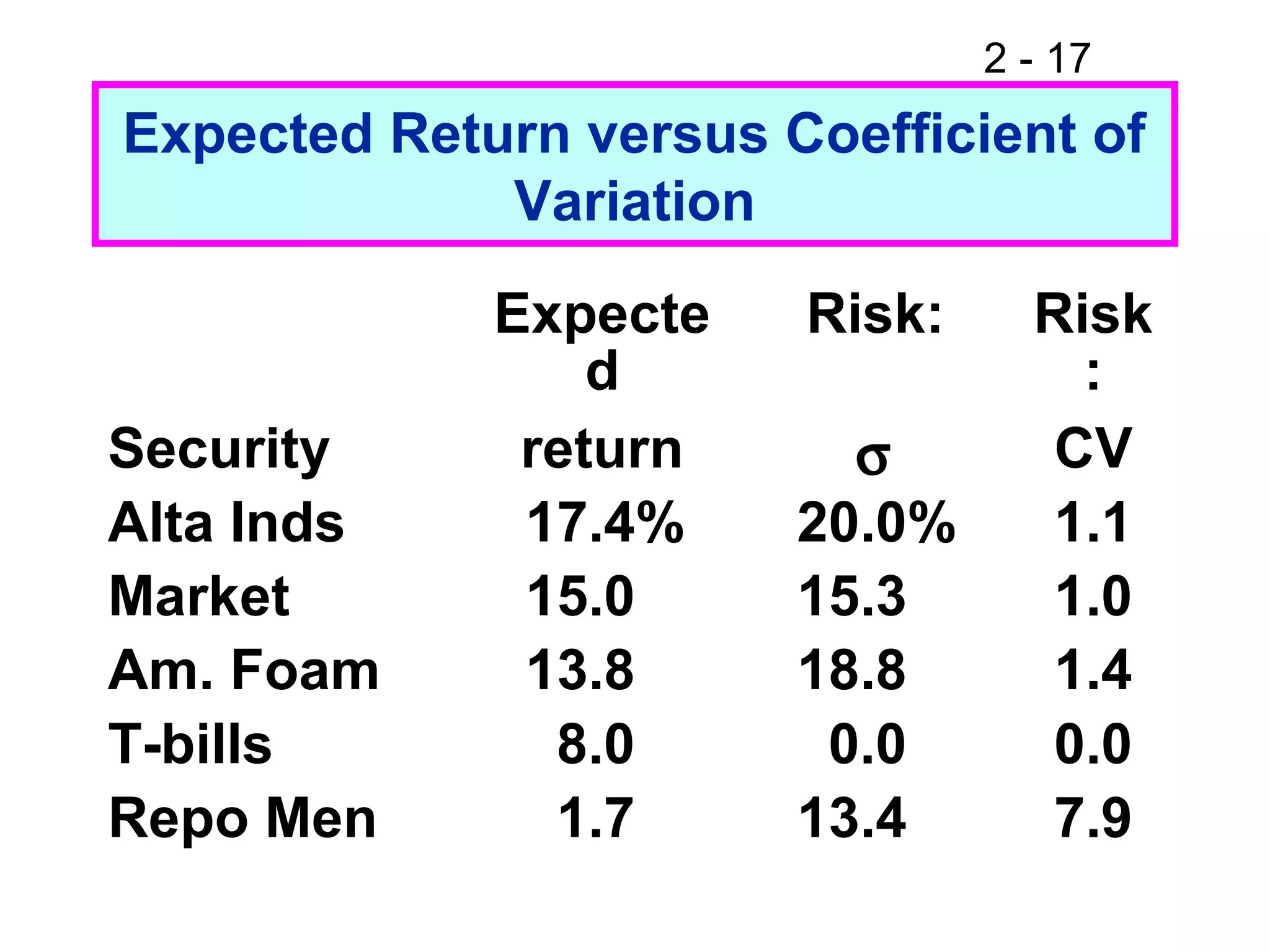

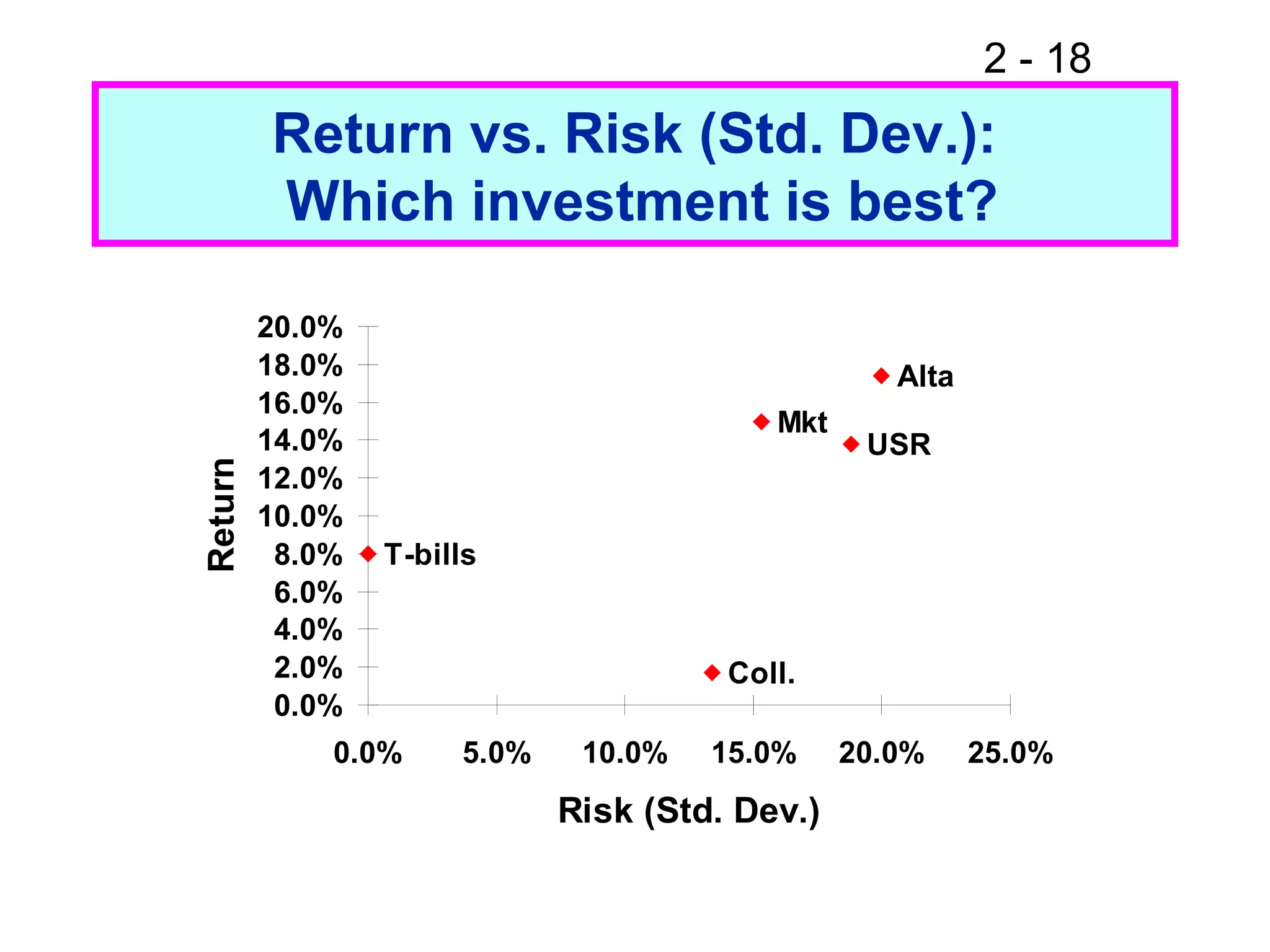

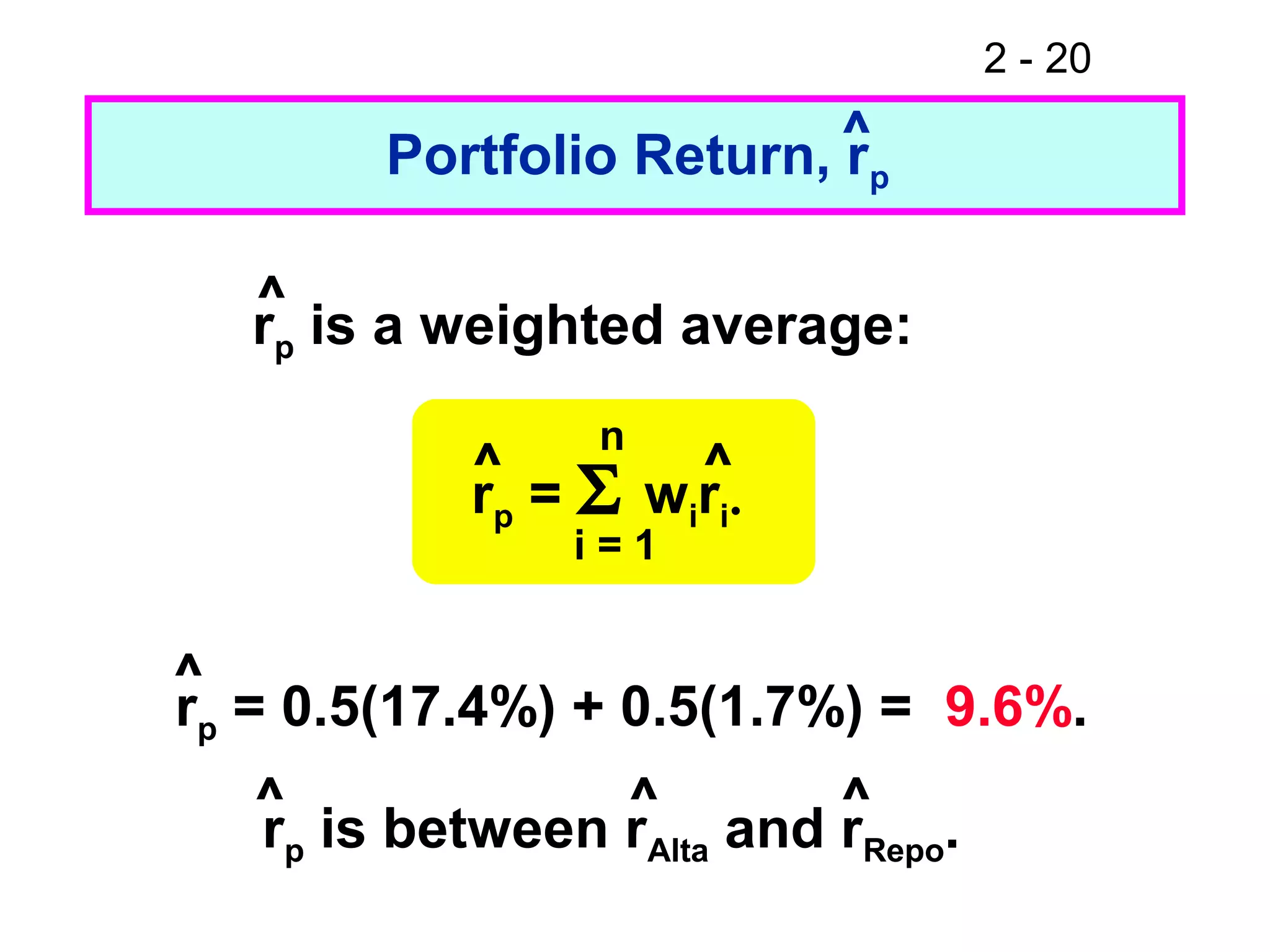

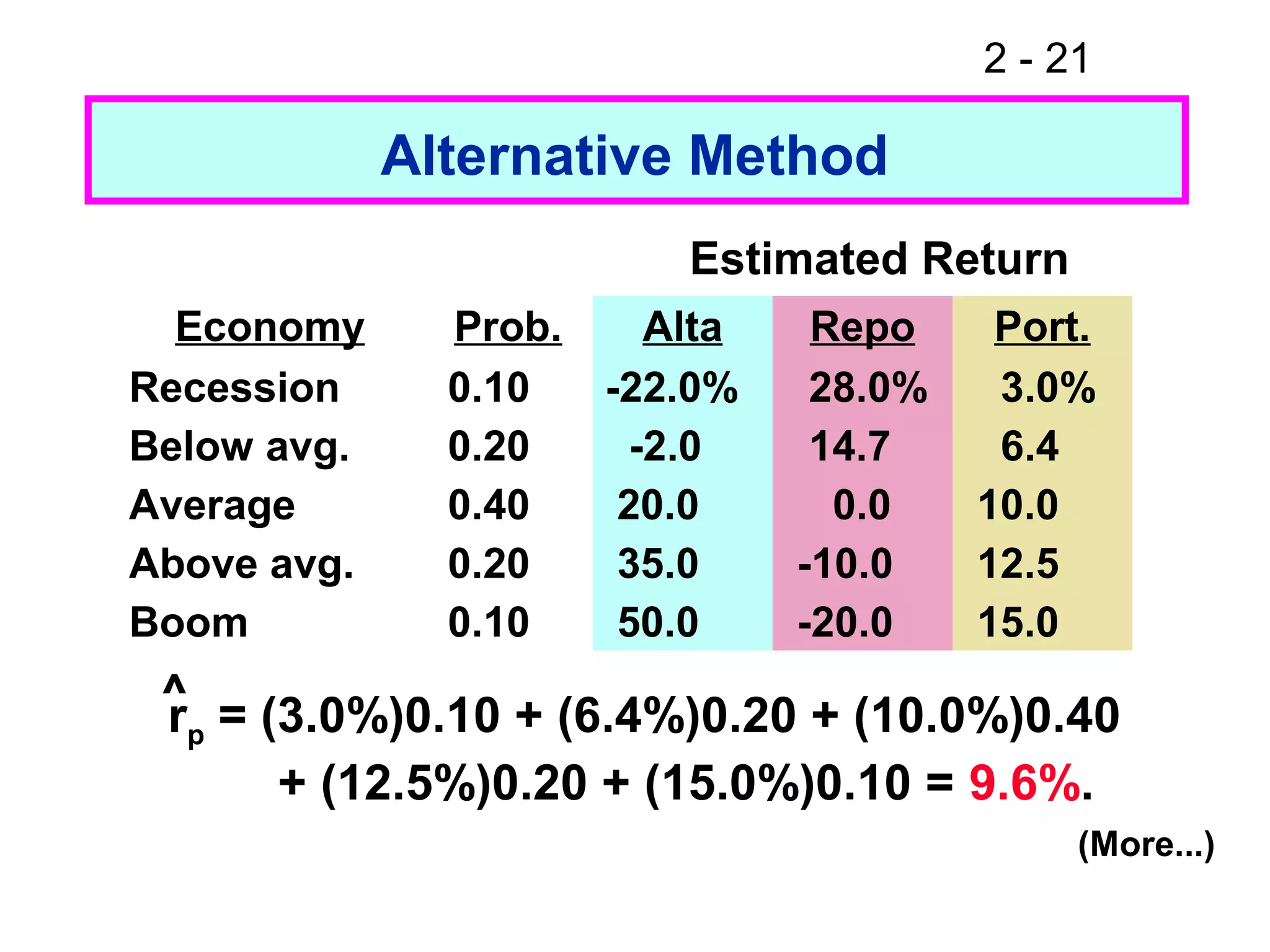

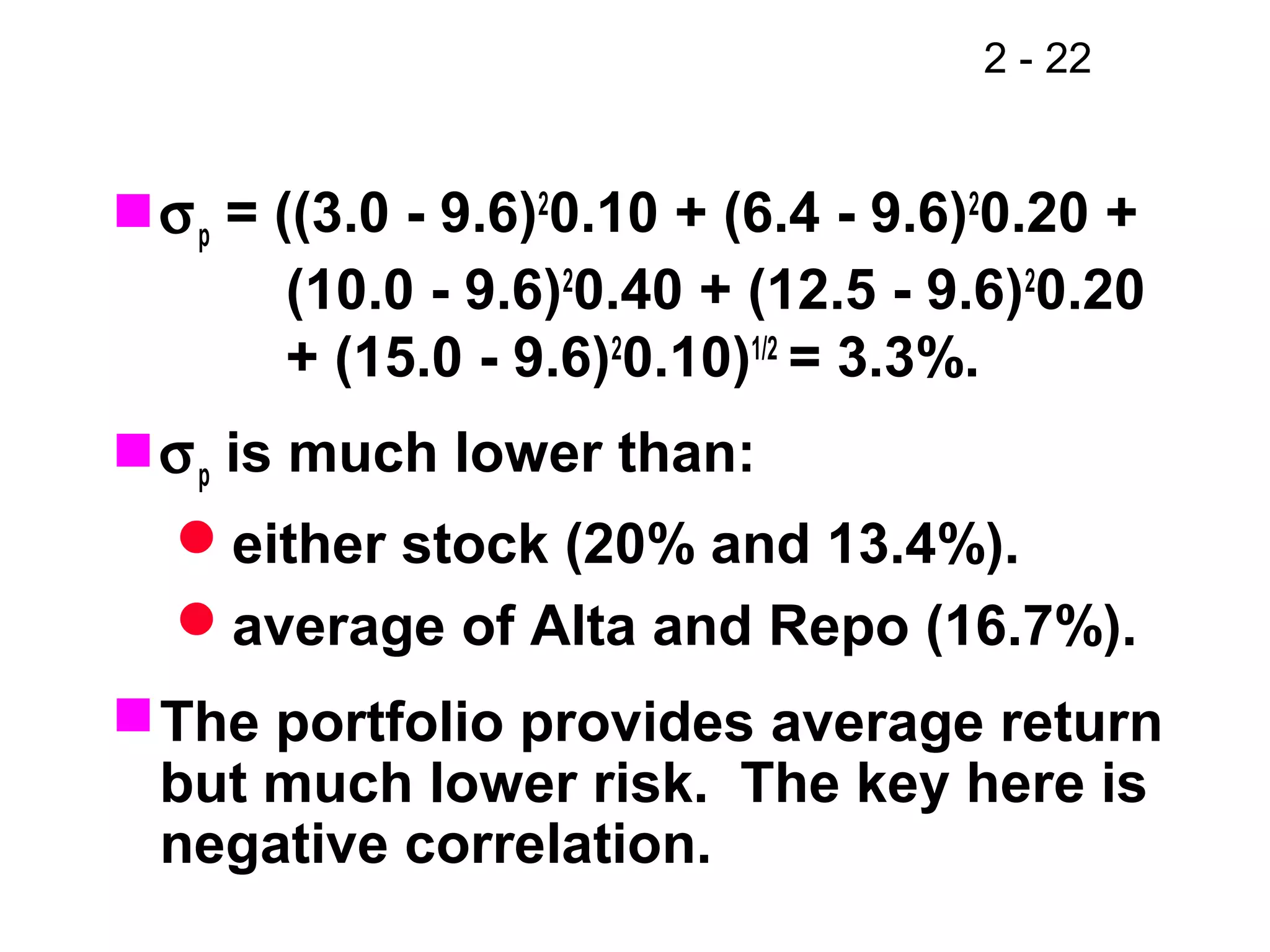

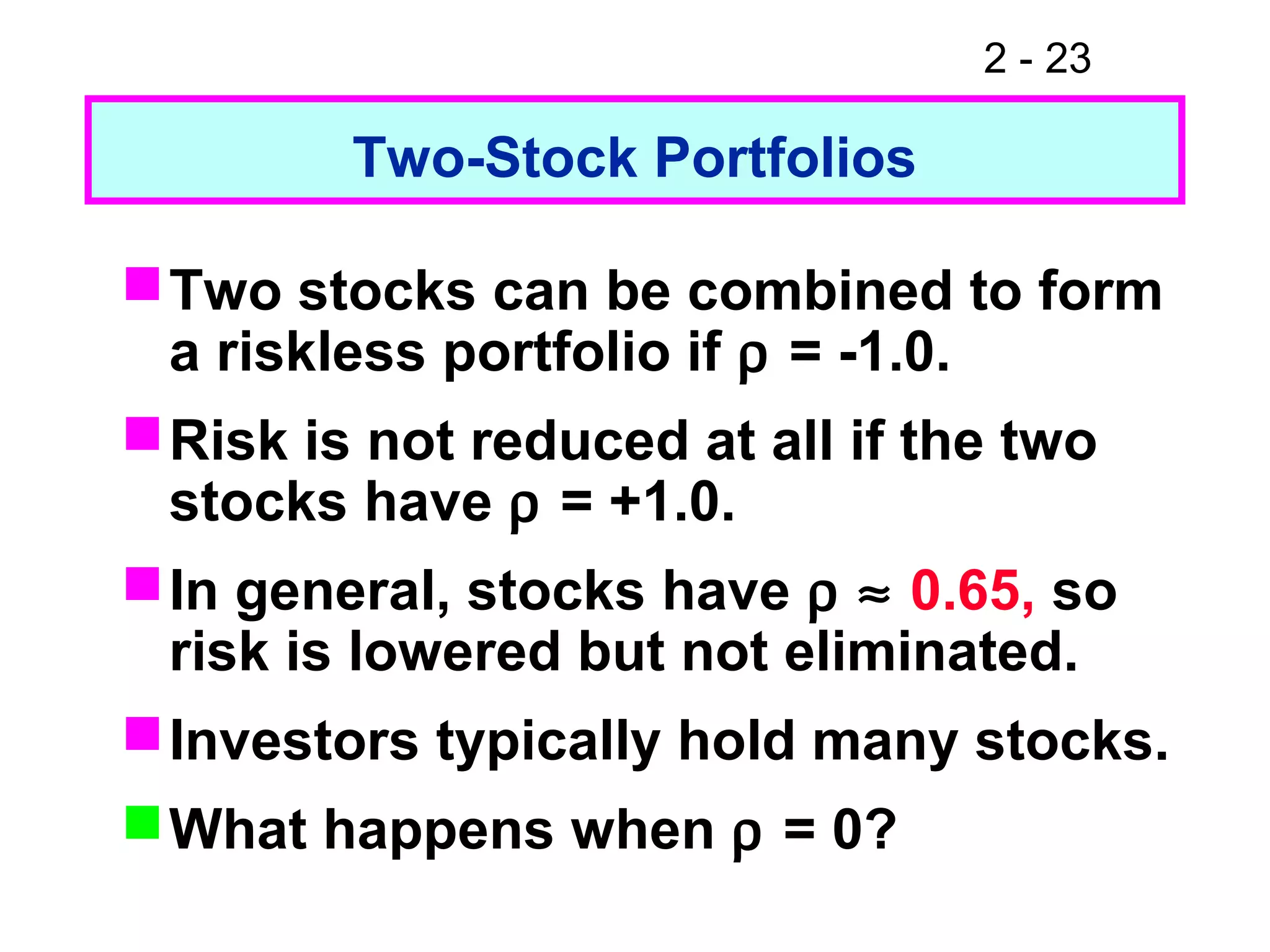

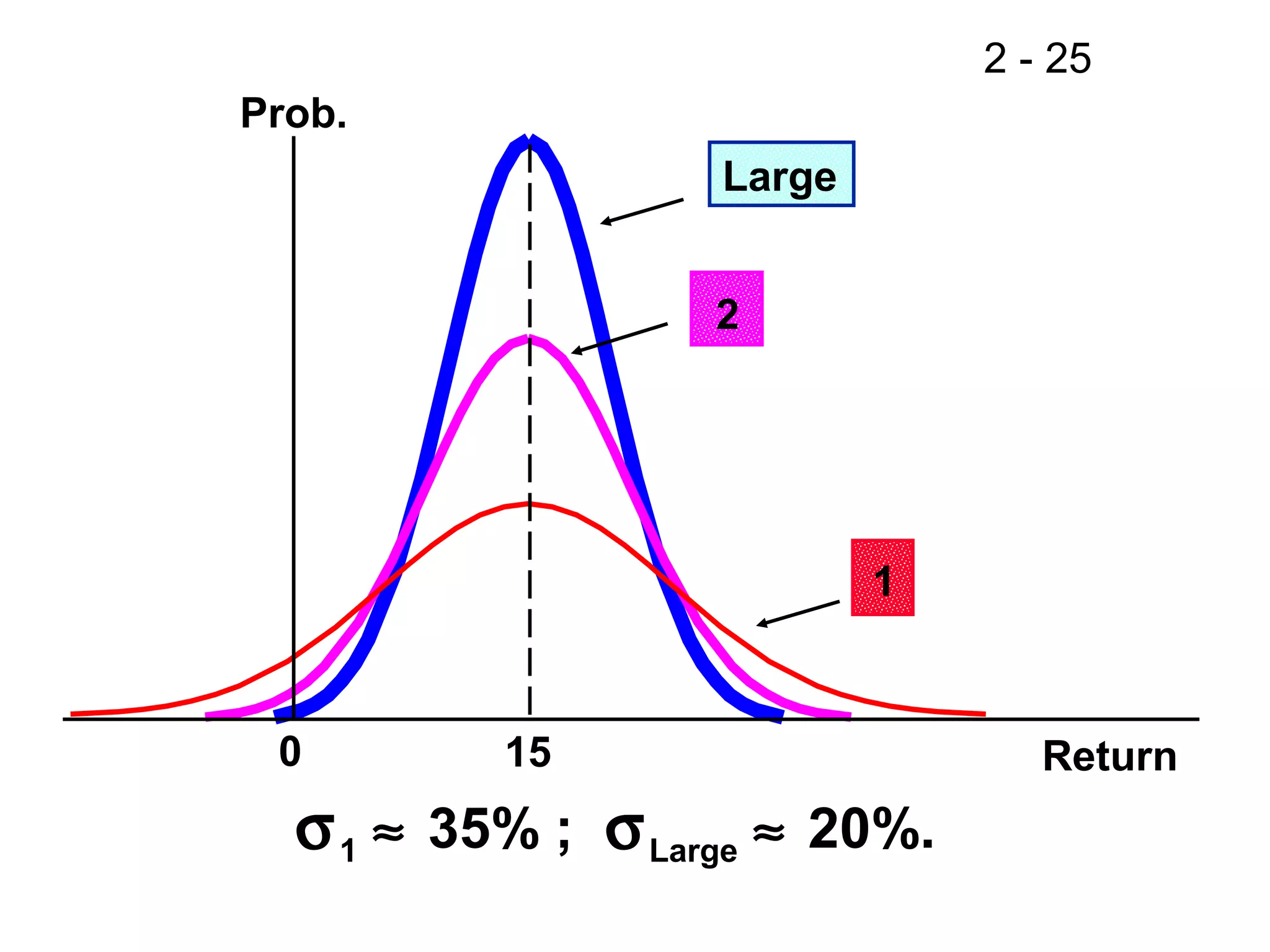

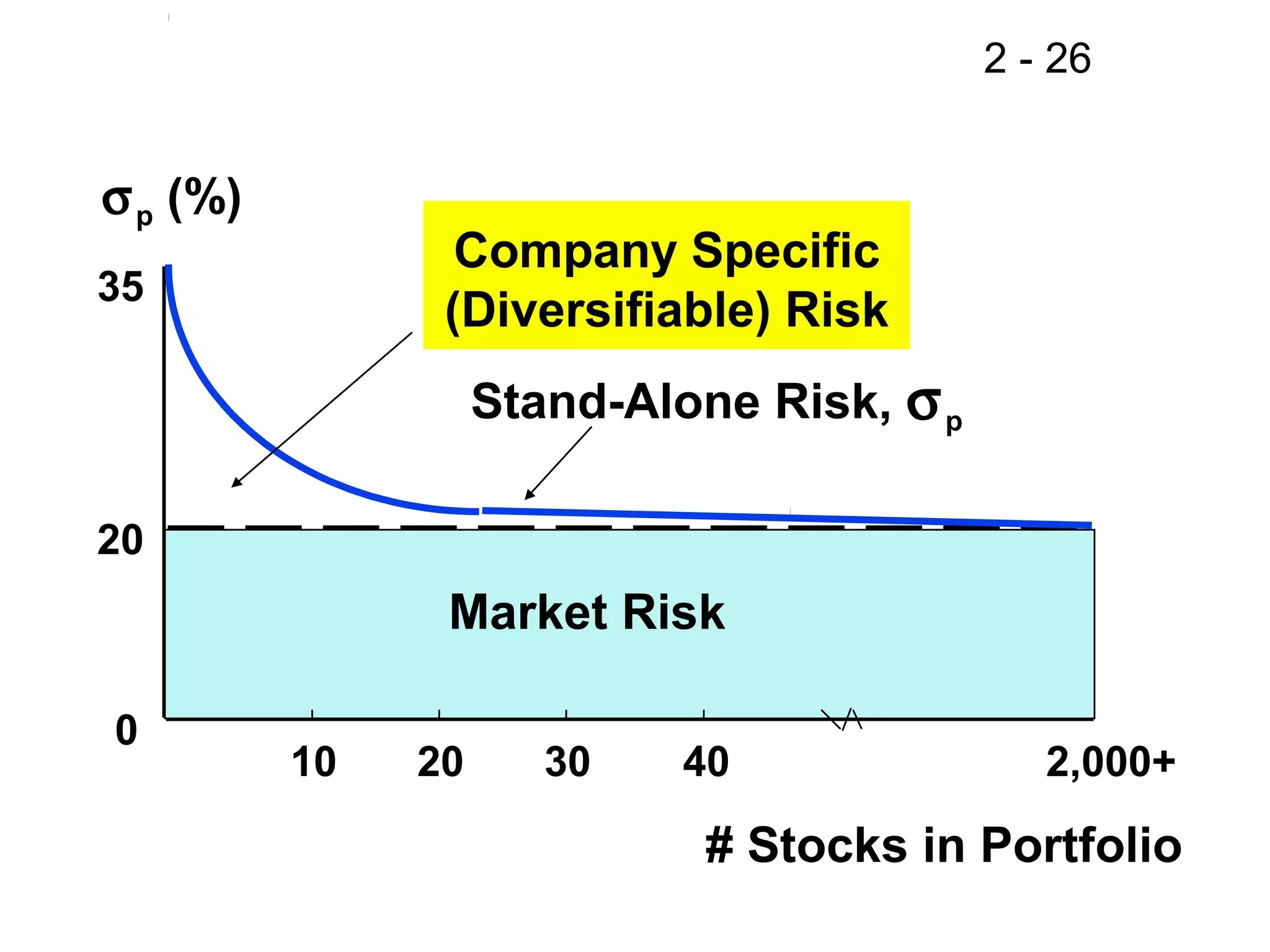

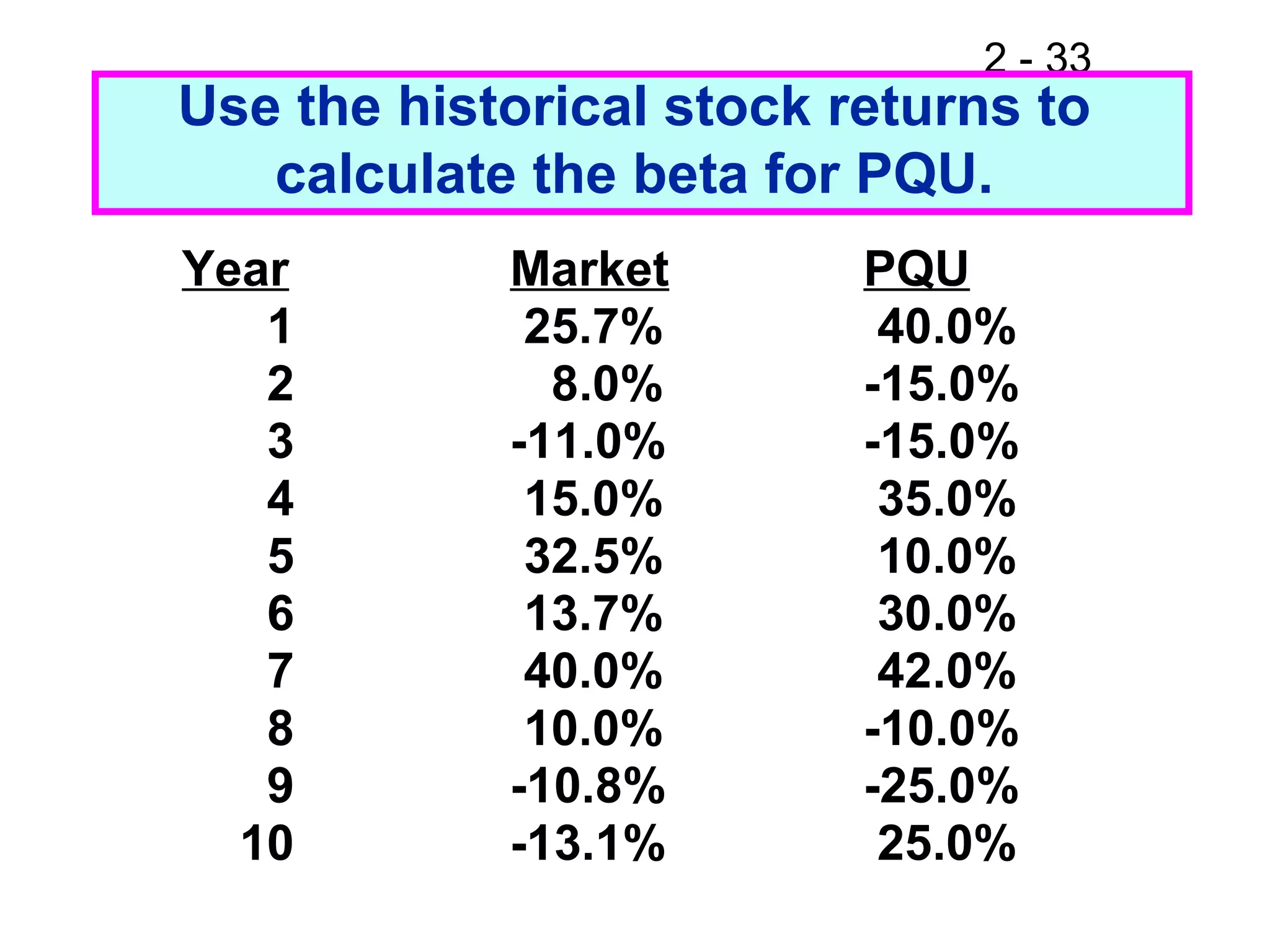

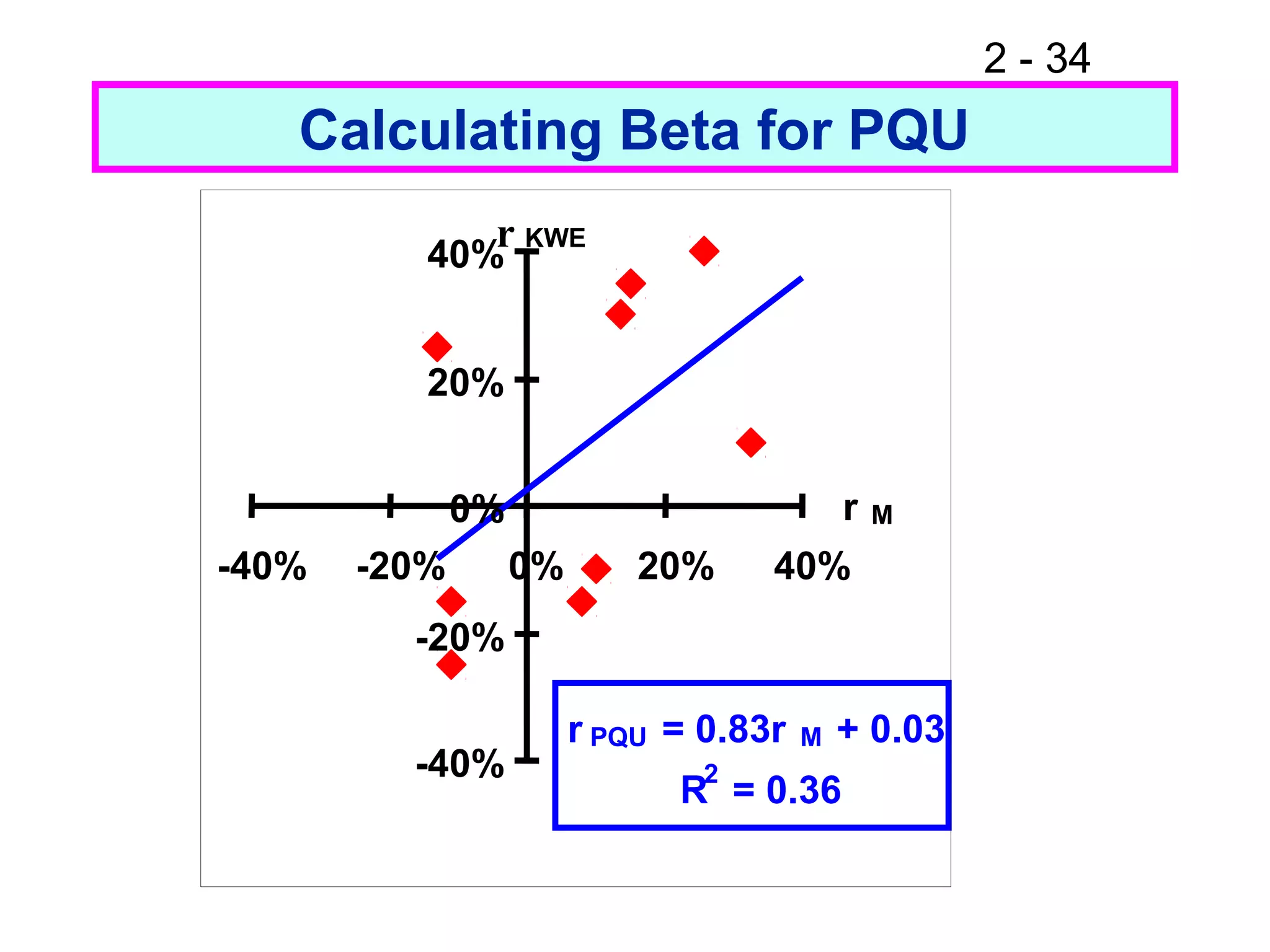

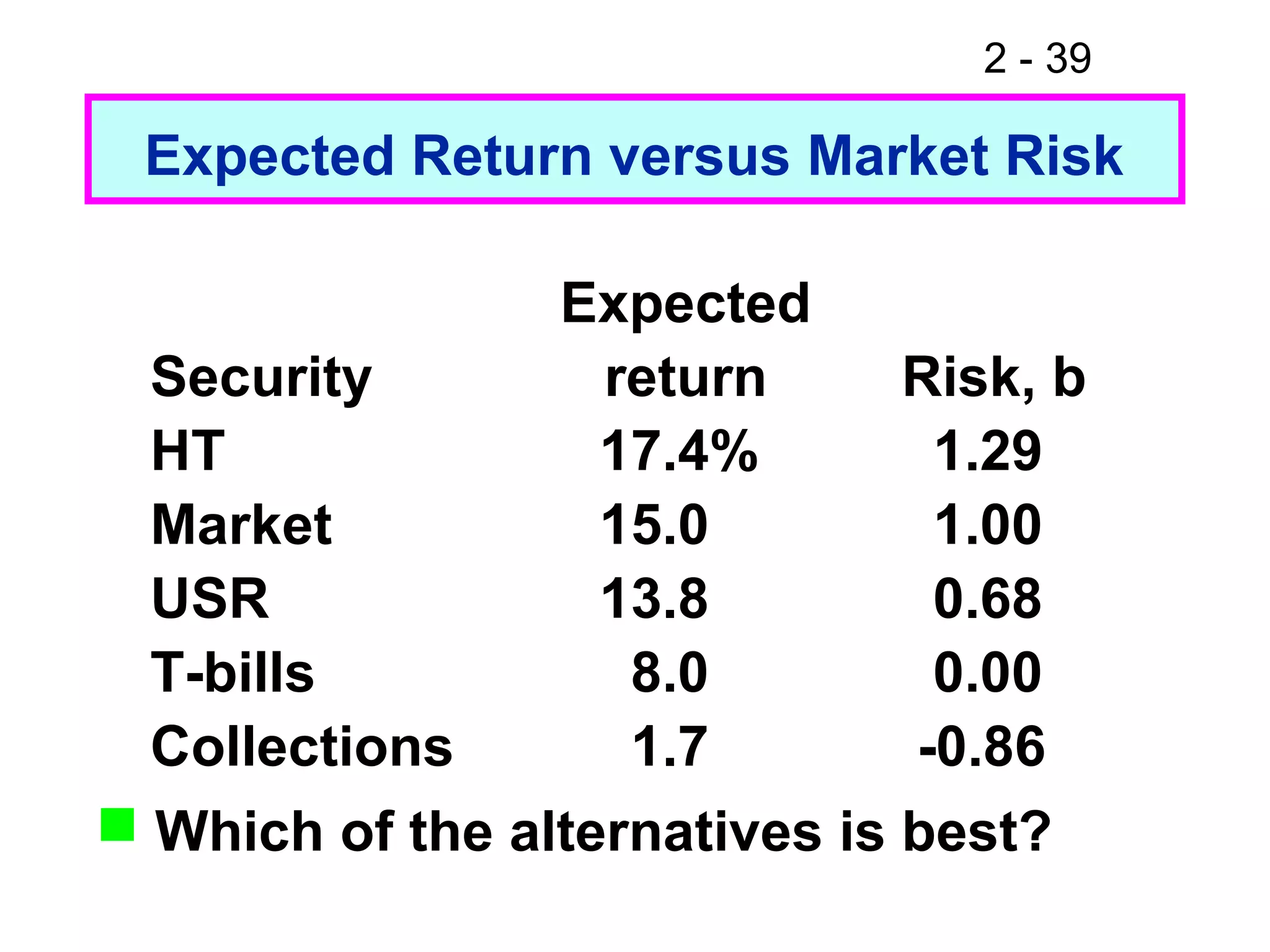

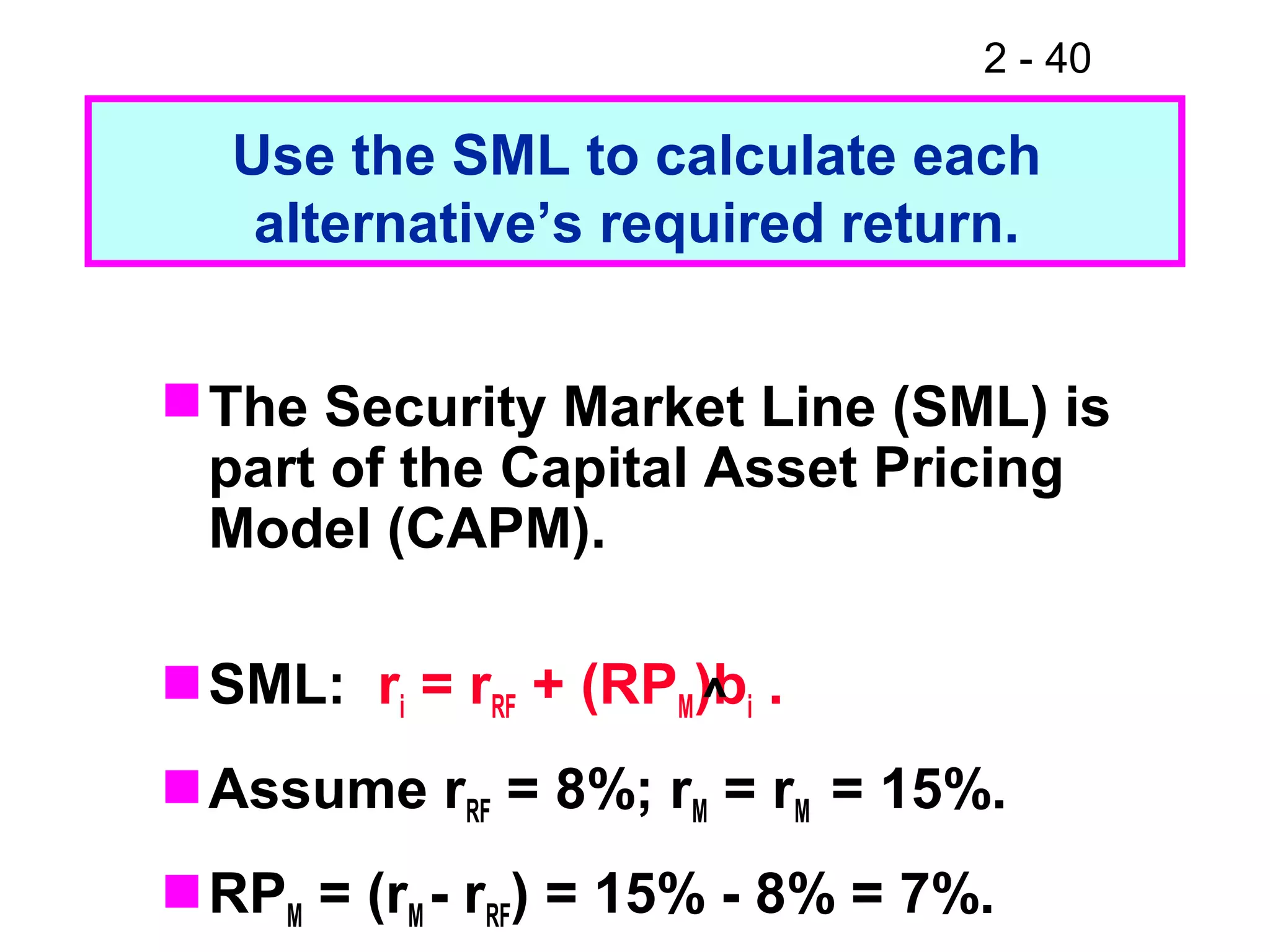

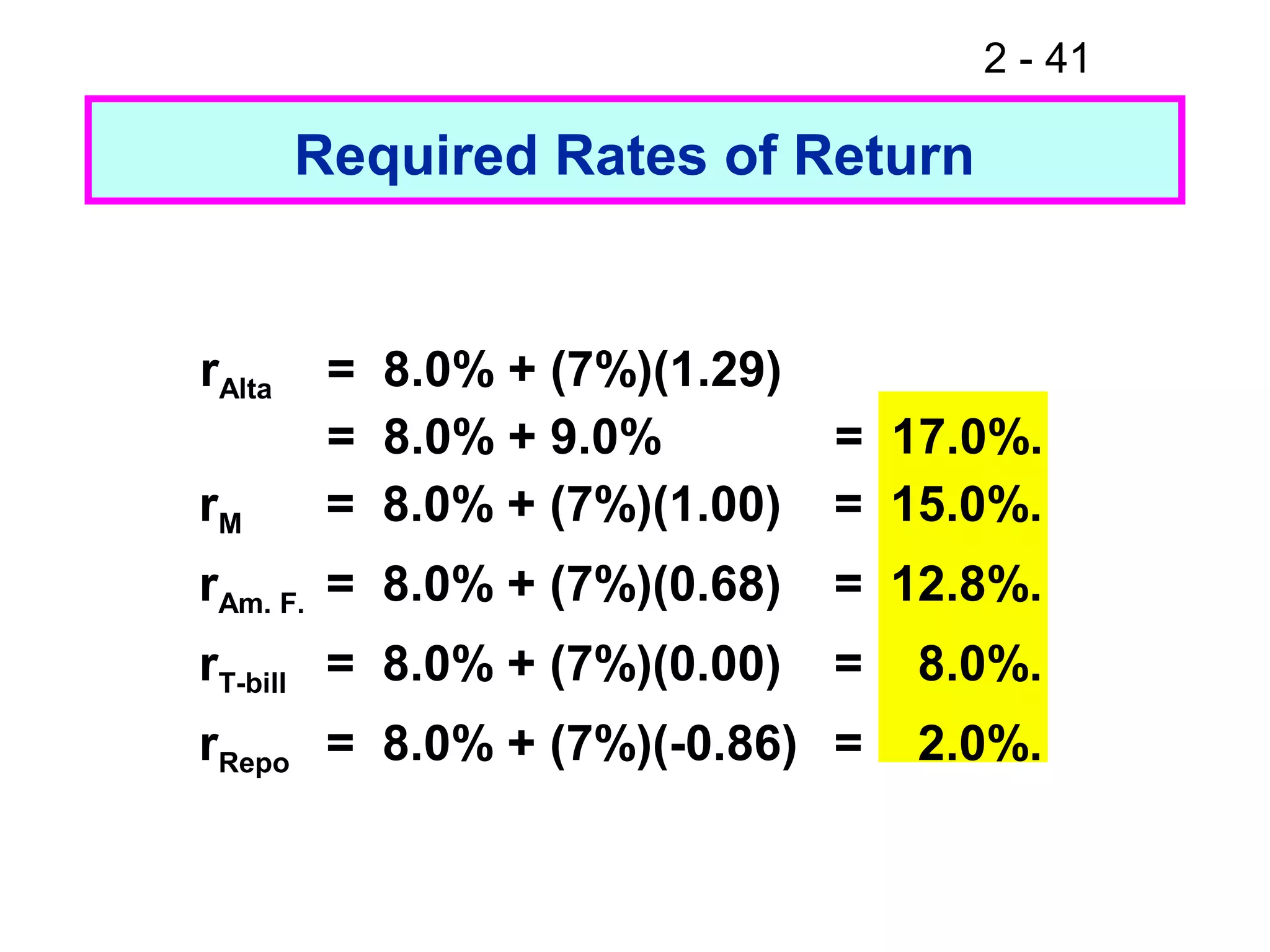

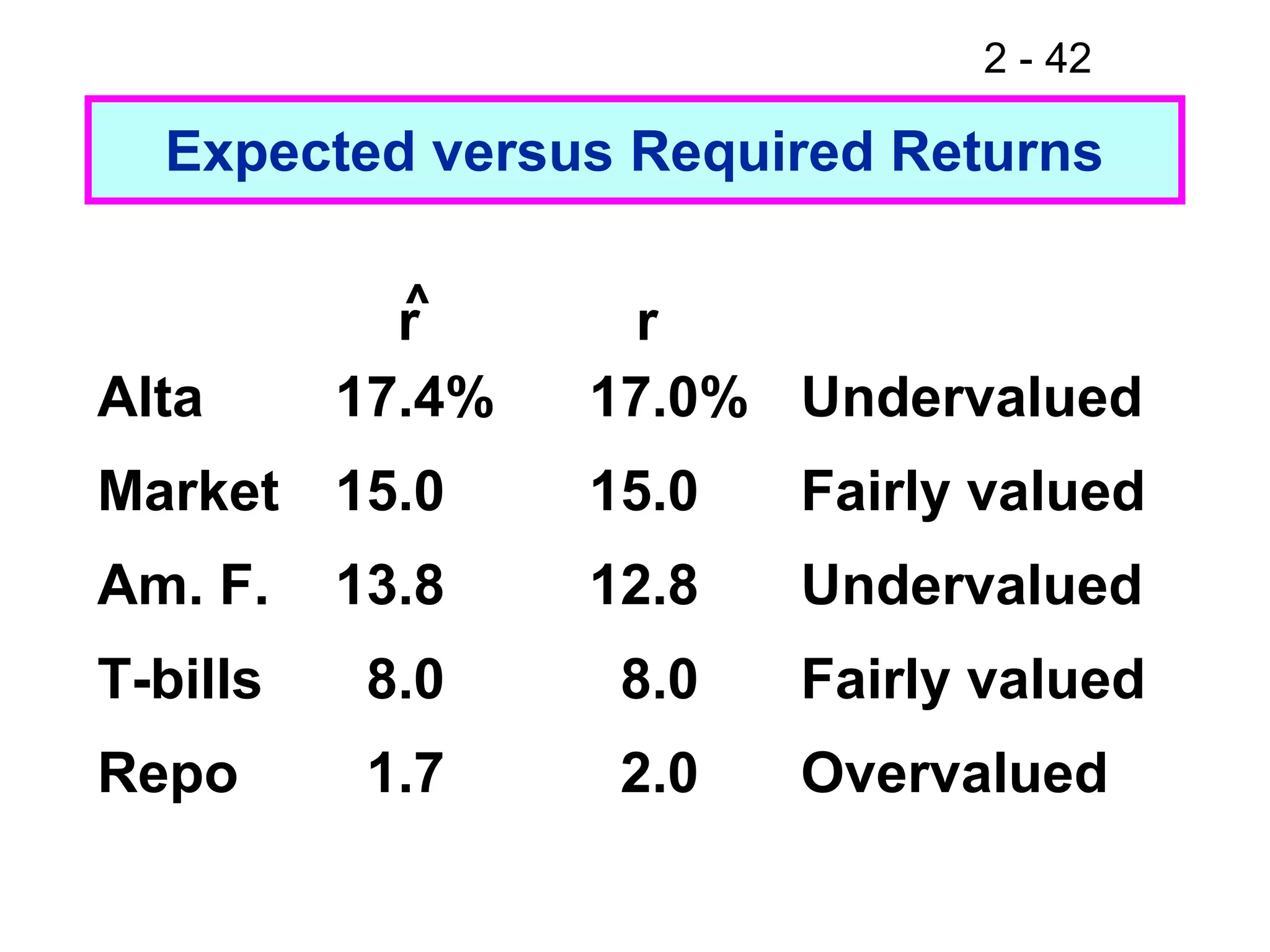

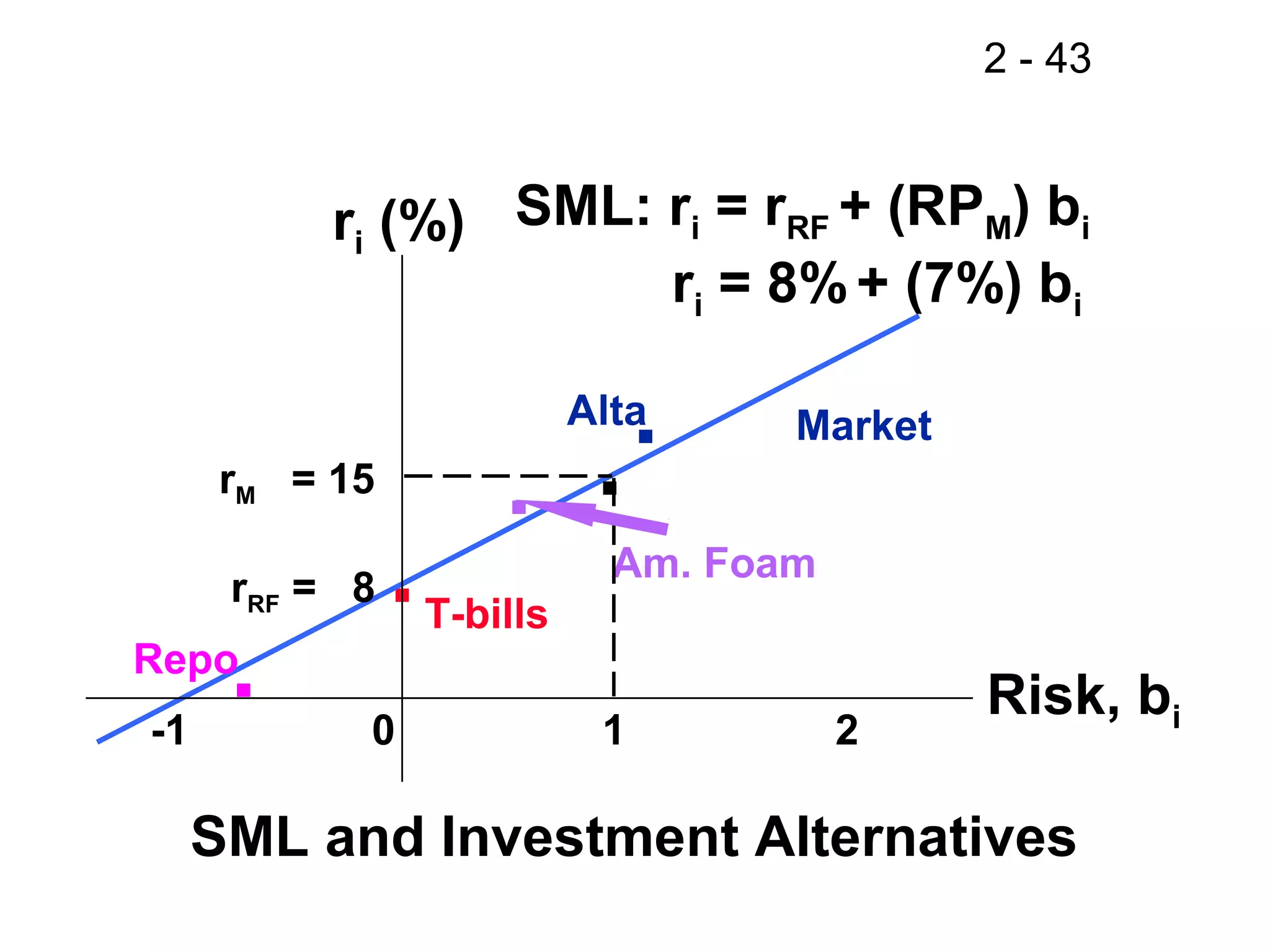

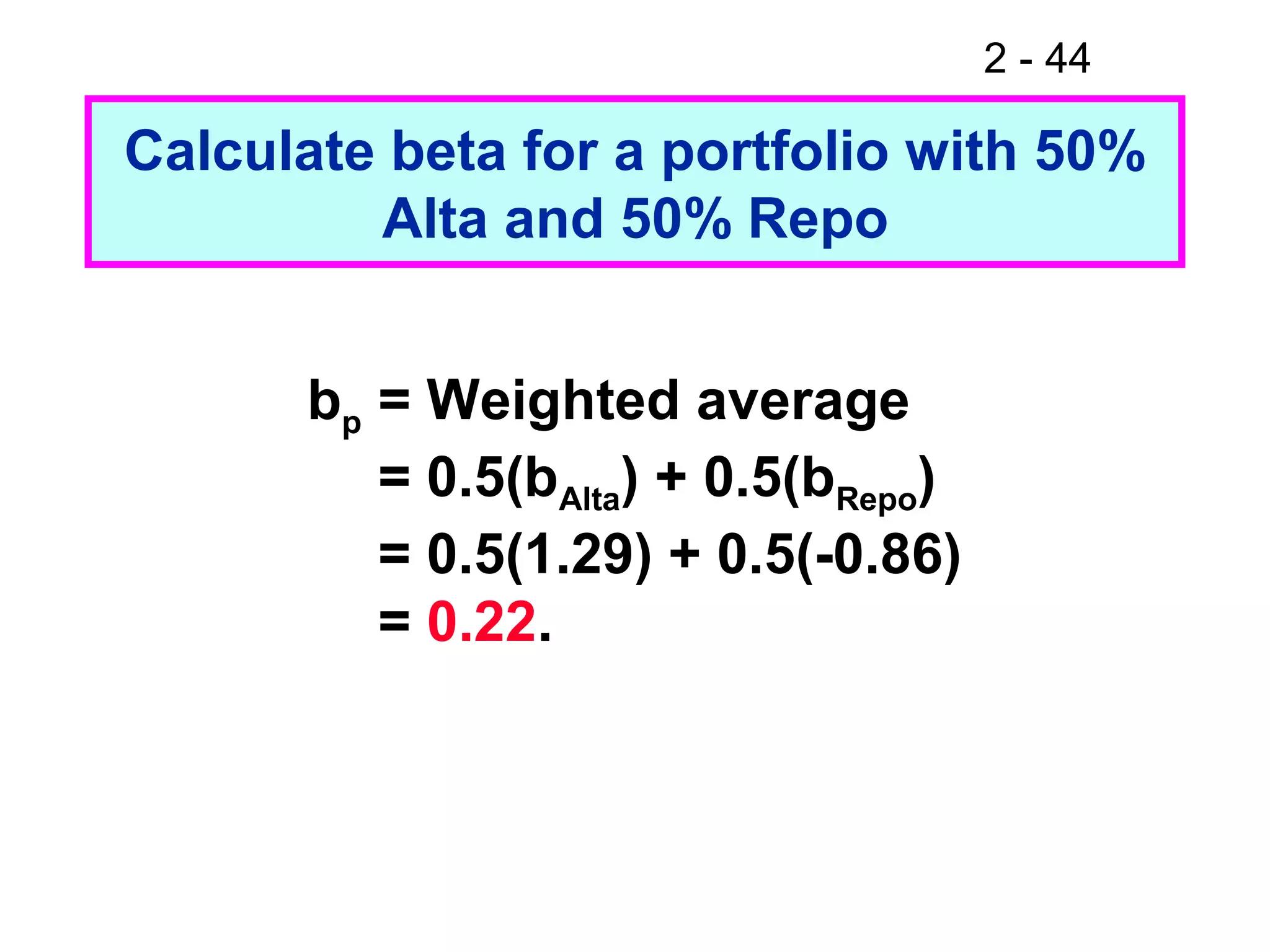

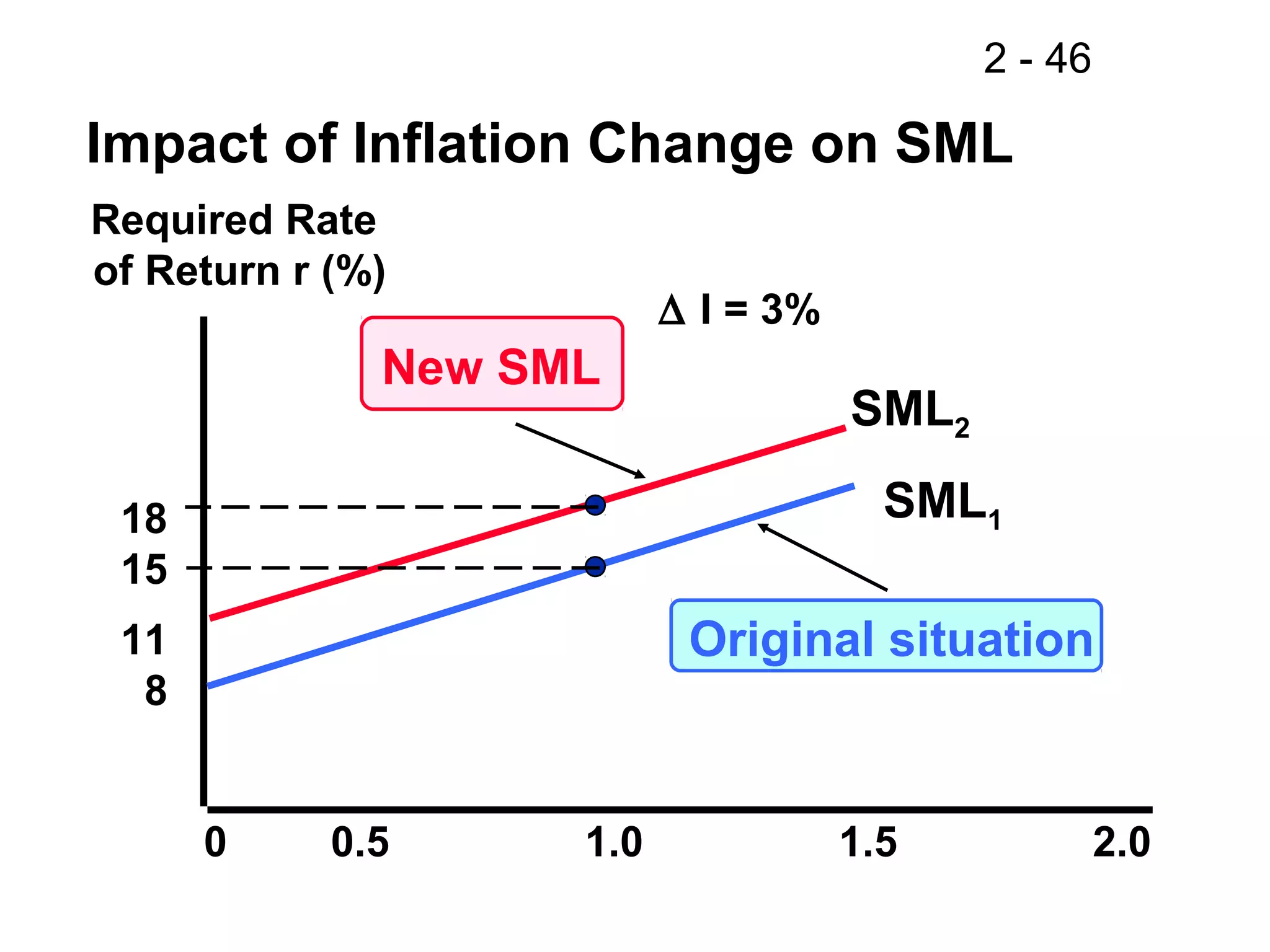

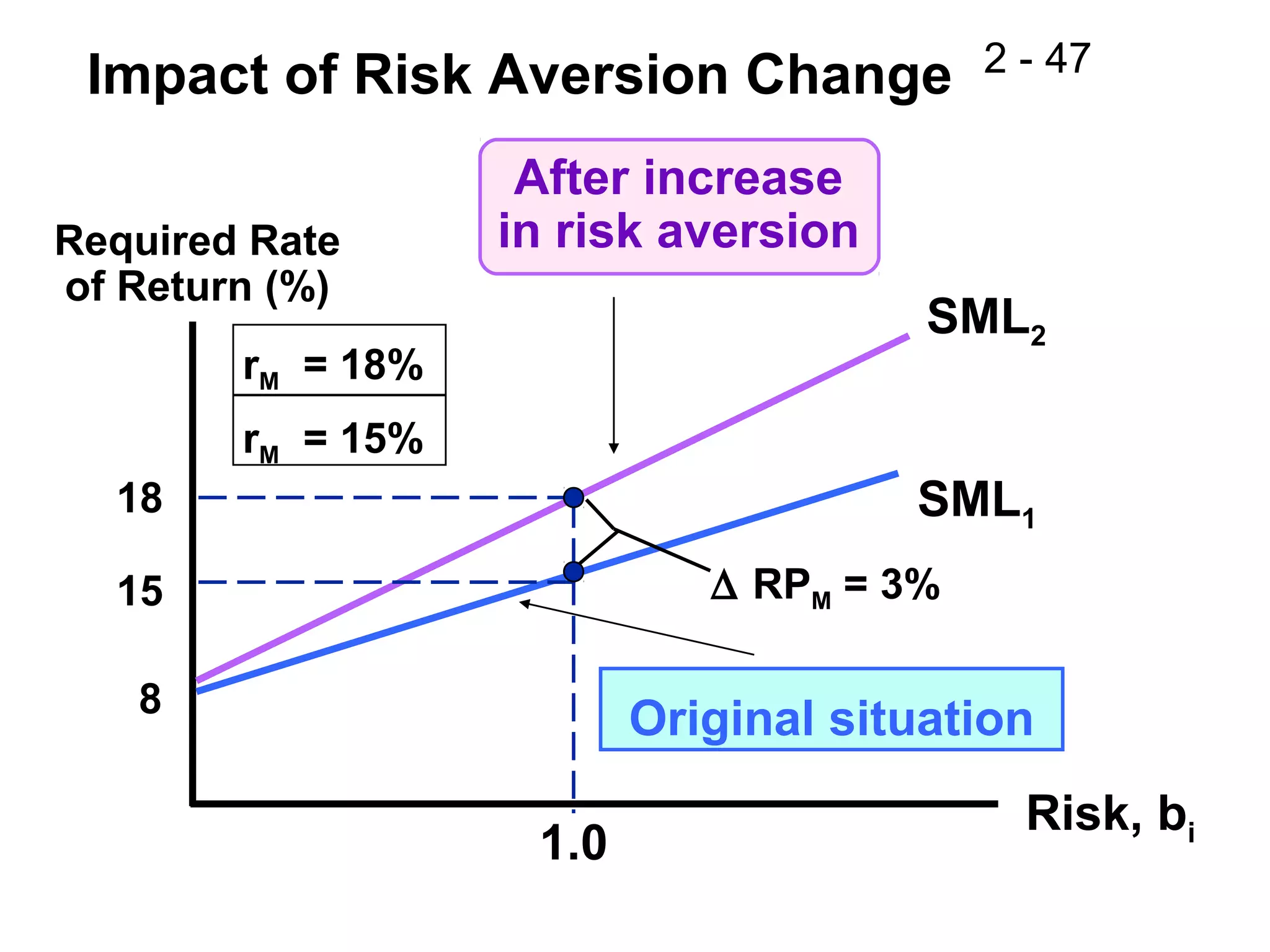

This document discusses key concepts related to investment returns and risk. It defines return as the financial results of an investment expressed in dollar or percentage terms. Risk is defined as the probability of earning a return lower than expected. Diversification across many stocks can reduce risk, as stock returns are not perfectly correlated. A portfolio's risk is measured by its beta coefficient, which represents the portfolio's volatility relative to the market. The Security Market Line (SML) shows the relationship between risk and required return in the Capital Asset Pricing Model (CAPM).