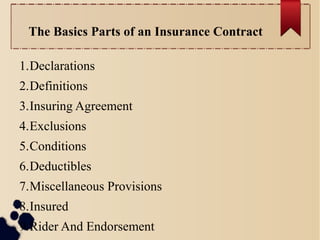

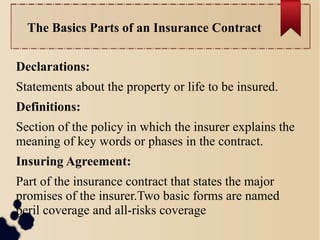

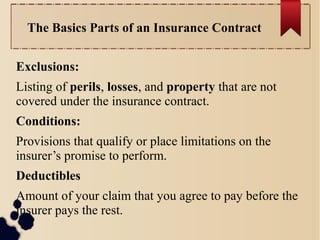

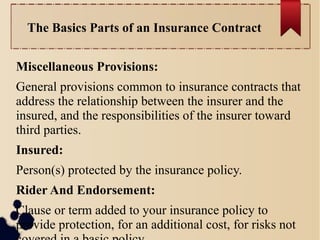

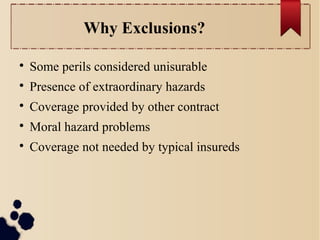

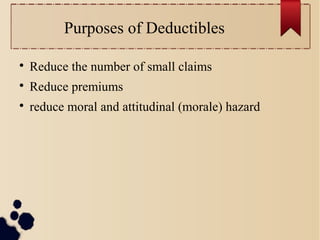

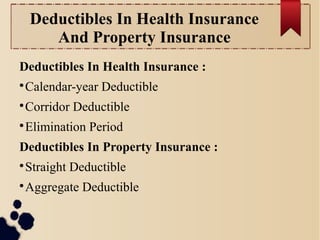

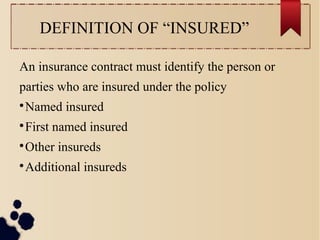

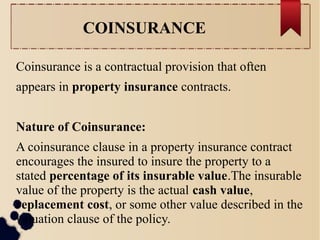

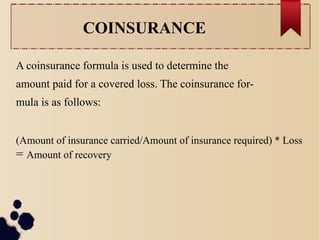

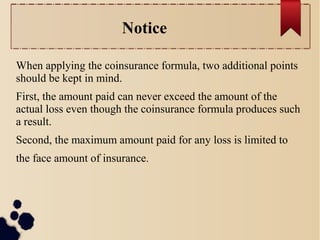

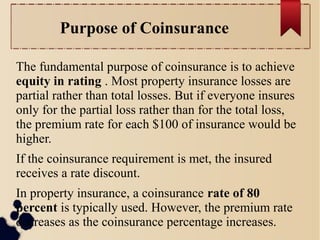

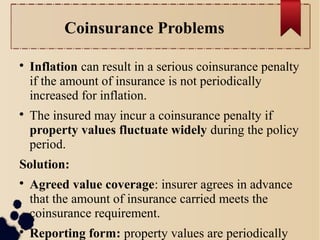

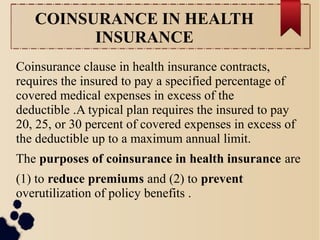

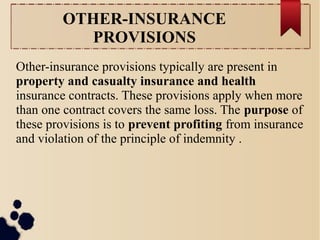

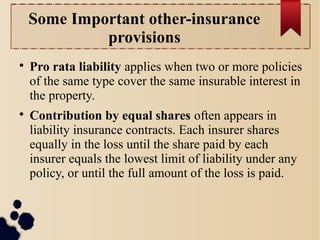

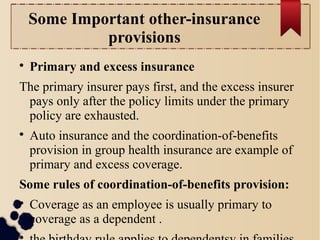

This document outlines various types of insurance including life, health, property, and casualty insurance, highlighting their roles and coverage. It details the essential components of an insurance contract such as declarations, definitions, insuring agreements, exclusions, conditions, deductibles, and provisions like coinsurance and other-insurance clauses. The text explains the purpose of these elements in managing risks, determining policy limits, and preventing abuse of insurance benefits.