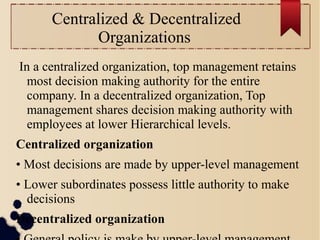

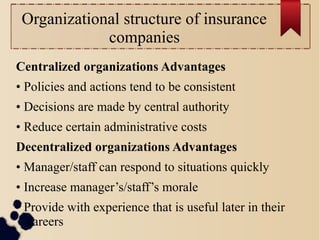

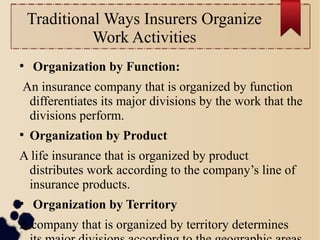

The document discusses the organization of insurers within the private insurance sector, emphasizing the trends of consolidation and convergence in the financial services industry. It outlines various types of insurance organizations, including stock insurers, mutual insurers, Lloyd's of London, and reciprocal exchanges, as well as their operational structures and changing corporate dynamics. Additionally, it covers organizational strategies like centralization versus decentralization and traditional work organization methods, highlighting their functionalities and advantages.

![TYPES OF INSURERS

ORGANIZATION

Insurance organizations are classified by basis of risk

coverage [life, general,health, property, auto]. their

agency system [independent, exclusive, direct

selling]and formation from legal point of view –

stock or mutual.

● Stock insurers

● Mutual insurers

● Lloyd’s of London

● Reciprocal exchanges](https://image.slidesharecdn.com/chapter3-141022094000-conversion-gate01/85/Chapter-3-Organization-of-insurer-6-320.jpg)

![Traditional Ways Insurers Organize

Work Activities

● Organization by Profit Center or Strategic

Business Unit: A profit center is a line of business

that [1] is evaluated on its profitability, [2] is

responsible for its own revenues and expenses, and

[3] makes its own decisions regarding its operations.](https://image.slidesharecdn.com/chapter3-141022094000-conversion-gate01/85/Chapter-3-Organization-of-insurer-20-320.jpg)