New base energy news 19 april 2020 issue no. 1331 senior editor eng. khaled al awadi

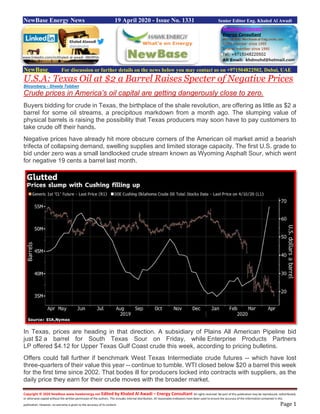

- 1. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 19 April 2020 - Issue No. 1331 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE U.S.A: Texas Oil at $2 a Barrel Raises Specter of Negative Prices Bloomberg - Sheela Tobben Crude prices in America’s oil capital are getting dangerously close to zero. Buyers bidding for crude in Texas, the birthplace of the shale revolution, are offering as little as $2 a barrel for some oil streams, a precipitous markdown from a month ago. The slumping value of physical barrels is raising the possibility that Texas producers may soon have to pay customers to take crude off their hands. Negative prices have already hit more obscure corners of the American oil market amid a bearish trifecta of collapsing demand, swelling supplies and limited storage capacity. The first U.S. grade to bid under zero was a small landlocked crude stream known as Wyoming Asphalt Sour, which went for negative 19 cents a barrel last month. In Texas, prices are heading in that direction. A subsidiary of Plains All American Pipeline bid just $2 a barrel for South Texas Sour on Friday, while Enterprise Products Partners LP offered $4.12 for Upper Texas Gulf Coast crude this week, according to pricing bulletins. Offers could fall further if benchmark West Texas Intermediate crude futures -- which have lost three-quarters of their value this year -- continue to tumble. WTI closed below $20 a barrel this week for the first time since 2002. That bodes ill for producers locked into contracts with suppliers, as the daily price they earn for their crude moves with the broader market. www.linkedin.com/in/khaled-al-awadi-38b995b

- 2. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 “I’ve never seen Texas crude oil transition to negative price” but it’s possible, said Andy Lipow, president of Lipow Oil Associates LLC in Houston. “It’s happened in the natural gas market at the Waha hub in west Texas,” Lipow added. Fast depleting storage is still a major issue against a backdrop of unprecedented demand destruction from the coronavirus pandemic, and these could pressure prices below zero fast, Lipow added. There is still at least 150 million barrels of available capacity. “But it’s the fill rate that is likely alarming the market, said Reid I’Anson, a global energy economist at Kpler, an industry research firm. Stocks at the key storage hub at Cushing, Oklahoma, have risen 18 million barrels in three weeks, which is 20% of shell capacity, he added. The good news is that negative prices -- if they do occur -- will probably be “extremely temporary,” said John Auers, executive vice president at energy consultant Turner Mason

- 3. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Oman:New gas production, diversification to buoy Omani economy Oman Observer - Conrad Prabhu An anticipated contraction in the Omani economy in 2020, attributable to the oil price downturn and the public health response to the novel coronavirus (COVID-19) pandemic, is expected to give way to a recovery in 2021-22, according to the World Bank. The international financial institution said in its latest ‘Economic Update’ for the Sultanate that the uptick will be spurred by an increase in gas output as well as infrastructure spending. “Significant new gas production in 2021 along with diversifying the economy in sectors such as manufacturing, tourism and fishing will support the growth momentum and lessen the risks,” the Washington DC-headquartered body said in its report for April. But the slump in international oil prices will weigh on the economy this year, the global organisation warned. “Low oil prices and the spread of COVID-19 are the key challenges that Oman will need to navigate in the short-run. With oil prices in the mid-$30s in 2020 and constrained oil demand, growth is expected to contract by 3.5 per cent,” it said. Also disadvantageous in the present circumstances is the Sultanate’s exposure to the Chinese market, which accounts for 45 per cent of total Omani exports (or 21.7 per cent of GDP), mostly in the form of oil exports, the WB report noted. With China in the throes of a slowdown fuelled by the pandemic, imports have dramatically fallen in recent weeks and are expected to maintain a downtrend this year. Significantly, both the hydrocarbon and non-oil sectors of the Omani economy are expected to witness a contraction this year owing to the slump in oil prices as well as the impacts of the pandemic, says the World Bank.

- 4. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 “Real GDP growth is estimated to have decelerated to 0.5 per cent in 2019, down from a recovery of 1.8 per cent in 2018. This is largely driven by 1 per cent (y/y) decline in oil production, capped by the since-lapsed OPEC+ production deal. The non-oil economy is estimated to have been subdued due to the slowdown in industrial activities and services sector. Inflationary pressures are estimated to remain muted at 0.1 per cent in 2019, reflecting weak domestic demand and tame food and housing prices.”

- 5. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi oil official refutes claim that crude exports to the US rose last month CNBC - Natasha Turak@NATASHATURAK KEY POINTS A Saudi Arabian oil official on Saturday refuted the conclusion of an analytics firm that the country’s oil exports to the U.S. dramatically increased last month. Analytics firm TankerTrackers.com said on Friday that Saudi Arabian oil exports to the U.S. more than doubled from February to March as oil prices crashed. A Saudi Arabian oil official on Saturday refuted the conclusion of an analytics firm that the country’s oil exports to the U.S. dramatically increased in the last month. TankerTrackers.com said on Thursday that Saudi Arabian oil exports to the U.S. more than doubled from February to March as oil prices crashed. The firm said its data indicates that the April export figure is on track to surpass March’s number. An unnamed Saudi oil official who is familiar with the matter denied both conclusions. The official told CNBC that Saudi Arabia’s April allocation for the United States is targeted at around 600,000 barrels per day, a figure which the official said is not a significant increase over the first-quarter monthly average. TankerTrackers, which uses satellite tracking of VLCCs — the vessels that transport crude — says that Saudi crude shipments to American ports went from an average of 366,000 barrels per day (bpd) in February to 829,540 bpd in March — a multiple of 2.27.

- 6. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 TankerTrackers said that satellite tracking indicates 1.46 million barrels per day of Saudi oil shipped to the U.S. in the first two weeks of April — a figure that would mark four times February’s daily volume and the highest figure since 2014. According to Saudi state oil producer Aramco’s website, the company was loading 15 tankers for its international customers on April 1 — the day a previous OPEC production cut agreement with its oil-producing allies, OPEC+, expired — supplying the tankers with a record 18.8 million barrels in a single day. The boost in exports comes against the backdrop of one of the most dramatic periods in oil market history: Record oil output from the world’s largest oil producers juxtaposed with eviscerated demand due to worldwide coronavirus lockdowns as economic activity and global commercial transport came to a screeching halt. “Towards the end of March I saw massive boosts in gas flaring in the fields in the Eastern Province, so they went pedal to the metal and pumped out as much as possible,” Samir Madani, founder of TankerTrackers.com, told CNBC over the phone Thursday. “It lit up like a Christmas tree, the whole Eastern Province, all the flares just came back online.” Saudi Arabia’s Eastern Province is home to the world’s largest oil fields and processing facility, and the majority of the kingdom’s production. Ahead of the April 1 expiration of the previous OPEC+ cutting deal, Saudi Arabia slashed its official selling prices (OSP) to its customers. At the same time, Saudi barrels headed to its top buyer, China, likely had to be re-routed due to China’s extensive lockdown meant to combat the spread of the coronavirus in the country. “I am guessing that was in the immediate aftermath of the failed OPEC+ meeting at the beginning of March,” Tamas Varga, an oil analyst at PVM Oil Associates, told CNBC. “That’s when Saudis promised to increase production and exports significantly and cut OSP by several dollars.”

- 7. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 In early March, negotiations between OPEC and its allies failed when Russia rejected Saudi Arabia’s terms to cut production in order to boost prices, leading both states to reverse course and set off a price war, with the Saudis increasing production and slashing selling prices for its customers. The move was so destructive to oil markets — particularly the U.S. shale industry — that U.S. President Donald Trump called on the producers to rein in their output, though he did not do the same for U.S. shale companies, which are now seeing bankruptcies, capex cuts and production shut-ins due to market pressure. At the same time, China’s demand for oil dropped significantly, as it kept its major economic hubs under lockdown and factories across the country of 1.4 billion remained closed. From February to March, Saudi oil shipments to China fell by nearly 800,000 bpd, picking up again to about 1.3 million bpd in the first half of April. “As the corona outbreak in China peaked in February, less crude import was contracted, and there is some weeks’ lag between contracting and delivery,” said Per Magnus Nysveen, head of analysis at Rystad Energy. “In the U.S. the refineries were still running full speed in March and some cargoes were therefore diverted to the U.S.” Ellen Wald, president of Transversal Consulting and an expert on Saudi Aramco, added that this meant that “more oil was therefore available to ship to the U.S., where Aramco owns the largest refinery in the country,” referring to the Motiva refinery in Port Arthur, Texas. For many American refineries, buying Saudi crude over American shale is also a matter of necessity — older refineries aren’t designed to be able to process the lighter grade crudes coming from U.S. shale patches, and need medium and heavy grade crudes that Saudi Arabia produces, particularly for products like diesel. OPEC and its allies last Sunday finally agreed to join forces to cut a historic 9.7 million barrels per day from the markets starting in May, in a deal that’s meant to last until 2022 — but oil prices remain depressed, with benchmark Brent crude down 55% year-to-date on Friday morning and holding its 18-year low amid grim outlooks for demand as the pandemic stretches on. Despite the deal, Saudi Arabia is still cutting its selling prices to many of its customers for May, for instance discounting its flagship Arab Light crude to East Asian customers by $4.20 a barrel compared to April prices. For the U.S., meanwhile, its selling prices are actually increasing to $3 a barrel for its light crude, after a discount of $3.75 between March and April. Its selling prices to Europe between April and May will remain unchanged after cutting prices by between $8 and $13 for April. Saudi flows to the U.S. “might stay relatively high in April, but should drop in May,” PVM’s Varga said.

- 8. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S Beer may lose its fizz as CO2 supplies shortages hits market Reuters + NewBase Dwindling supplies of carbon dioxide from ethanol plants is sparking concern about shortages of beer, soda and seltzer water - essentials for many quarantined Americans. Brewers and soft-drink makers use carbon dioxide, or CO2, for carbonation, which gives beer and soda fizz. Ethanol producers are a key provider of CO2 to the food industry, as they capture that gas as a byproduct of ethanol production and sell it in large quantities. But ethanol, which is blended into the nation’s gasoline supply, has seen production drop sharply due to the drop in gasoline demand as a result of the COVID-19 pandemic. Gasoline demand is down by more than 30% in the United States. The lack of ethanol output is disrupting this highly specialized corner of the food industry, as 34 of the 45 U.S. ethanol plants that sell CO2 have idled or cut production, said Renewable Fuels Association Chief Executive Geoff Cooper. CO2 suppliers to beer brewers have increased prices by about 25% due to reduced supply, said Bob Pease, chief executive officer of the Brewers Association. The trade group represents small and independent U.S. craft brewers, who get about 45% of their CO2 from ethanol producers. “The problem is accelerating. Every day we’re hearing from more of our members about this,” said Pease, who expects some brewers to start cutting production in two to three weeks. In an April 7 letter to Vice President Mike Pence, the Compressed Gas Association (CGA) said production of CO2 had fallen about 20% and could be down by 50% by mid-April without relief, CGA CEO Rich Gottwald said in the letter. Meat producers are also feeling the pinch, as they use CO2 in processing, packaging, preservation and shipment. Orion Melehan, CEO of Santa Cruz, California-based LifeAID, a specialty beverage company, said two of his production partners are looking for alternative CO2 sources. “It does have us up at night figuring out what our options are,” Melehan said. “It highlights the laws of unintended consequences.” A spokeswoman for National Beverage Corp, whose products include LaCroix, said the company sources from a number of national CO2 suppliers and does not anticipate a supply issue. Coca- Cola Co, SodaStream owner PepsiCo Inc , wine and beer seller Constellation Brands Inc and several bottling companies did not respond to requests for comment Walker Modic, environmental and social sustainability manager for Bell’s Brewery, said the Comstock, Michigan-based brewing company had “not experienced any curtailments or changes in the source of our CO2.”

- 9. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Chinese Oil Refiners Snapping Up Bargains as Activity Resumes Bloomberg Chinese refiners are snapping up low-price oil from all over the world as Asia’s largest economy emerges from a virus-driven slump. Varieties such as Alaska North Slope, Canada’s Cold Lake and Brazil’s Lula have been offered at steep discounts to global benchmark prices over the past week as sellers scrambled to secure buyers. Processors in China -- where throughput is back to pre-virus levels -- are snagging many of the bargains as much of the rest of the world remains in lockdown. Spot supplies of Cold Lake were sold by a European trader at a discount of between $8 and $9 a barrel to Brent on a delivered basis, while an oil major sold a shipment comprising Alaskan North Slope and Brazilian grades at a $5.50 to $6 discount, said traders who buy and sell crude in Asia. The cargoes were purchased by Chinese independent refiners, known as teapots, which have staged a strong comeback from run-rate cuts and closures in February. As for oil that’s produced closer to Asia, Chinese state-owned refiners have been buying Russia’s Sokol crude for significantly less than Dubai benchmark prices. The spot purchases were made on top of crude bought via long-term supply contracts with Saudi Arabian, Iraqi and Kuwaiti producers. At least five Chinese processors sought full contracted volumes from Saudi Aramco this week after it slashed official prices for Asian customers for a second month. Major producers are still struggling with a large overhang of physical cargoes despite the agreement this month by OPEC and its allies to curb output by almost 10%. Meanwhile, storage -- both on land and at sea -- is rapidly filling up. Brent crude has remained in a steep contango, a bearish market structure where prompt oil is cheaper than later supplies, even after the OPEC+ deal.

- 10. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase April 19-2020 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil mixed as weak Chinese data, growing U.S. supplies offset Trump plan to ease lockdown Reuters + NewBase Oil prices were mixed on Friday, with weak Chinese economic figures and rapidly filling U.S. crude storage offsetting bullishness built on U.S. President Donald Trump’s outlines for the U.S. economy to emerge from the coronavirus shutdown. U.S. crude futures hit a more than 18-year-low, extending their losses in comparison to global benchmark Brent, in part due to the coming expiration of the current May contract. However, later-dated futures contracts were also down as the country’s storage rapidly fills, and producers and traders expect output cuts in coming months. Oil prices have remained weak even after the Organization of the Petroleum Exporting Countries and other producers last weekend announced a deal to cut output by nearly 10 million barrels per day (bpd) in response to weak demand. Oil price special coverage

- 11. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Brent futures LCOc1 rose 26 cents, or 0.9%, to settle at $28.08 a barrel while West Texas Intermediate crude contract (WTI) for June CLc2, which became the day’s more active contract, ended the session down 50 cents, or 2%, at $25.03. The less active prompt WTI for May delivery CLc1 tumbled by $1.60, or 8.1%, to $18.27, ahead of its April 21 expiration as investors rapidly switched out of that contract into June futures. The contract slumped to a low of $17.31 a barrel during the session, the lowest since November 2001. May WTI futures slumped nearly 20% on the week, based on last Thursday’s settle, while Brent dropped nearly 11%. Markets were closed last Friday for Good Friday. China’s economy shrank 6.8% year-on-year in the three months to March 31, the first such decline since quarterly records began in 1992. The nation’s daily refining output fell to a 15-month low, though there are some signs of recovery as the country begins to ease coronavirus containment measures. Prices found some support as the U.S. plans to ease lockdown measures after Trump laid out new guidelines for states to emerge from a coronavirus shutdown in a three-stage approach, but the early boost to Brent prices was largely short-lived. Lending further support, U.S. drillers cut 66 oil rigs this week, the biggest weekly cut since 2015 and bringing the total down to 438, the lowest since October 2016, energy services firm Baker Hughes Co BRK.N said. Still, fuel demand worldwide is down by roughly 30%. That prompted major producers including Russia, a grouping known as OPEC+, to agree to cut output by 10 million bpd last weekend. “If more of the global economy enacts plans to reopen and restores some sense of normality, that could help oil prices find a firmer floor in May, aided by the OPEC+ supply cuts kicking in,” said FXTM analyst Han Tan. U.S. GLUT TO PERSIST Investors in futures have been unwinding long, or bullish positions in May as stockpiles in the United States have surged by record amounts and storage limits will be tested this summer. U.S. storage at the Cushing, Oklahoma delivery hub for WTI is now 69% full, up from 49% four weeks ago, according to U.S. Energy Department figures. This has made prices for oil for delivery in nearby months much cheaper than those for future delivery - sending the market deeper into a structure known as contango, which reflects expectations for oversupply. “This morning’s major disconnect between May WTI and the rest of the energy complex could become even more pronounced during the next three sessions before the May contract goes off the board,” Jim Ritterbusch, president of Ritterbusch and Associates, said. Inflows into the U.S. oil fund (USO) has surged as investors seek exposure to cheap oil, dealers said. The fund said in a filing late on Thursday it would adjust its positioning by diversifying from 100% investments in front-month WTI contract to 80% front month and 20% in the second month. The change is already prompting some traders to sell June futures and buy July’s contract, dealers said, sending the spread between the two contracts CLM0-N0 to as much as $4.78, the widest on record.

- 12. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Money managers raised their combined futures and options net long position in New York and London by 24,323 contracts to 199,543 in the week to April 14, the U.S. Commodity Futures Trading Commission (CFTC) said. U.S. oil rigs see biggest decline in a week since February 2015: Baker Hughes Oil rigs in the United States saw their steepest cuts since February 2015 as crude prices more than halved since the start of the year despite fresh global efforts by producers to cut output to counter a glut triggered by demand destruction from the coronavirus pandemic.

- 13. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Drillers cut 66 oil rigs in the week to April 17, bringing the total count down to 438, the lowest since October 2016, energy services firm Baker Hughes Co BRK.N said in its closely followed report on Friday. RIG-OL-USA-BHI The oil rig count, an early indicator of future output, is down 47% from the same week a year ago when 825 oil rigs were active. More than half of the total U.S. oil rigs are in the Permian basin in West Texas and eastern New Mexico, where active units dropped by 33 this week to 283, the lowest since January 2017. Analysts at Raymond James projected total U.S. oil and natural gas rigs would collapse from around 800 at the end of 2019 to a record low of around 400 by the middle of the year and around 200 at the end of 2020. The investment bank forecast the rig count would average a mere 225 rigs in 2021. That compares with the current all-time low of 404 rigs during the week ended May 20, 2016, according to Baker Hughes data going back to 1940. In Canada, meanwhile, the total oil and gas rig count fell to 30, the lowest since at least 2000, according to Baker Hughes data going back that far. The prior all-time low was 29 rigs during the week ended April 24, 1992. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, last weekend agreed to reduce crude output to stop oil prices from falling as governments around the world attempt to slow the pandemic with lockdowns that are also crimping economic growth and energy demand. U.S. crude futures CLc1 traded around $18 per barrel on Friday, ahead of its April 21 expiration as investors rapidly switched out of that contract into June futures. Also, weak Chinese economic figures and rapidly filling U.S. crude storage offset bullishness built on U.S. President Donald Trump’s outlines for the U.S. economy to emerge from the coronavirus shutdown.

- 14. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage The Energy world - Special 02- April-2020 IEA's Global oil demand unique analysis- April 2020 The IEA Oil Market Report (OMR) is one of the world's most authoritative and timely sources of data, forecasts and analysis on the global oil market – including detailed statistics and commentary on oil supply, demand, inventories, prices and refining activity, as well as oil trade for IEA and selected non- IEA countries. Global oil demand is expected to fall by a record 9.3 mb/d year-on-year in 2020. The impact of containment measures in 187 countries and territories has been to bring mobility almost to a halt. Demand in April is estimated to be 29 mb/d lower than a year ago, down to a level last seen in 1995. For 2Q20, demand is expected to be 23.1 mb/d below year-ago levels. The recovery in 2H20 will be gradual; in December demand will still be down 2.7 mb/d y-o-y. Global oil supply is set to plunge by a record 12 mb/d in May, after OPEC+ forged a historic output deal to cut production by 9.7 mb/d from an agreed baseline level. As April production was high, the effective cut is 10.7 mb/d. Additional reductions are set to come from other countries with the US and Canada seeing the largest declines. Total non-OPEC output falls could reach 5.2 mb/d in 4Q20, and for the year as a whole output may be 2.3 mb/d lower than last year. Refining throughput in 2020 is forecast to fall 7.6 mb/d y-o-y to 74.3 mb/d on sharply reduced demand for fuels. Global refinery intake is expected to plummet by 16 mb/d y-o-y in 2Q20, with

- 15. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 widespread run cuts and shutdowns in all regions. Although refinery runs are falling, product stocks are still expected to build by 6 mb/d. In 2H20, refining activity will slowly recover as the global market moves into deficit. Early data show China’s implied stock build in 1Q20 at 2.1 mb/d, and US stocks increased by 0.5 mb/d. OECD data show that industry stocks in February fell by 35.4 mb to 2 878 mb as a draw for products more than offset a build in crude. Total OECD oil stocks stood 42.4 mb below the five-year average and, due to the weak outlook, now provide 79.2 days of forward demand coverage. In March, floating storage of crude oil increased by 22.9 mb (0.7 mb/d) to 103.1 mb. Twin demand and supply shocks caused oil futures prices to fall by 40% in March. Brent has recovered modestly from an 18-year low as producers reached agreement to curtail output and is trading at $31/bbl. Weak demand pushed prices for crude grades such as WTI Midland and West Canadian Select below $10/bbl. Cracks for gasoline and jet fuel continued to suffer as containment measures were introduced.

- 16. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Highlights Around the world billions of people are affected by one of the worst health crises of the past century. The global economy is under pressure in ways not seen since the Great Depression in the 1930s; businesses are failing and unemployment is surging. Confinement measures are in place in 187 countries and territories, and although they vary in scope, activity in the transportation sector has fallen dramatically almost everywhere. Even assuming that travel restrictions are eased in the second half of the year, we expect that global oil demand in 2020 will fall by 9.3 million barrels a day (mb/d) versus 2019, erasing almost a decade of growth. Against this bleak background, policy makers are responding with radical steps. Governments have introduced massive emergency fiscal plans to support workers and businesses. Central banks have embarked on huge monetary stimulus programmes. We are also seeing measures being taken to tackle the oil market crisis, with two major events taking place over the past week. On Sunday, oil producers in the OPEC+ group agreed to cut output by an initial 9.7 mb/d versus their agreed baseline, effective 1 May. In light of the unprecedented depth of the crisis, the IEA has urged major consumers and producers to work together through the forum of the G20 to mitigate the impact on market stability, and an extraordinary meeting of energy ministers from G20 and other countries took place on Friday 10 April.

- 17. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Those present offered their support for the efforts of the OPEC+ countries to stabilise the oil market and, in some cases, discussed output cuts that would take place immediately or over time. The measures announced by OPEC+ and the G20 countries won’t rebalance the market immediately. But by lowering the peak of the supply overhang and flattening the curve of the build- up in stocks, they help a complex system absorb the worst of this crisis, whose consequences for the oil market remain very uncertain in the short term. We forecast a drop in demand in April of as much as 29 mb/d year-on-year, followed by another significant year-onyear fall of 26 mb/d in May. In June, the gradual recovery likely begins to gain traction, although demand will still be 15 mb/d lower than a year ago. There is no feasible agreement that could cut supply by enough to offset such near-term demand losses. However, the past week’s achievements are a solid start and have the potential to start to reverse the build-up in stocks as we move into the second half of the year. The OPEC+ and G20 initiatives will impact the oil market in three ways. First, the OPEC+ production cut in May to reach the baseline will actually be 10.7 mb/d and not 9.7 mb/d, as April production was high. This will provide some immediate relief from the supply surplus in the coming weeks, lowering the peak of the build-up of stocks. Second, four countries (China, India, Korea and the United States) have either offered their strategic storage capacity to industry to temporarily park unwanted barrels or are considering increasing their strategic stocks to take advantage of lower prices. This will create extra headroom for the impending stock build-up, helping the market get past the hump. Third, other producers, with the United States and Canada likely to be the largest contributors, could see output fall by around 3.5 mb/d in the coming months due to the impact of lower prices, according to IEA estimates. The loss of this supply combined with the OPEC+ cuts will shift the market into a deficit in the second half of 2020, ensuring an end to the build-up of stocks and a return to more normal market conditions. At the time of publication, we were still waiting for more details on some planned production cuts and proposals to use strategic storage. If the transfers into strategic stocks, which might be as much as 200 mb, were to take place in the next three months or so, they could represent about 2 mb/d of supply withdrawn from the market. If production does fall sharply, some oil goes into strategic stocks, and demand begins to recover, the second half of 2020 will see demand exceed supply. This will enable the market to start reducing the massive stock overhang that is building up in the first half of the year. Indeed, our current demand and supply estimates imply a stock draw of 4.7 mb/d in the second half. The historic decisions taken by OPEC+ and the G20 should help bring the oil industry back from the brink of an even more serious situation than it currently faces. Even so, the implied stock build- up of 12 mb/d in the first half of the year still threatens to overwhelm the logistics of the oil industry – ships, pipelines and storage tanks – in the coming weeks. In this Report, we estimate that available capacity could be saturated in mid-year, based on our market balances. However, this is a very broad-brush assumption and the situation varies from place to place. There are already bottlenecks in other parts of the logistics chain, such as competition to buy space on pipeline systems that transport oil. There are also quality issues: it is not possible to accommodate different qualities of crude oil at many sites, and special tanks are required for some products. Floating storage is becoming more expensive as traders compete for ships. Chartering costs for

- 18. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Very Large Crude Carriers have more than doubled since February. Never before has the oil industry come this close to testing its logistics capacity to the limit. Looking beyond the immediate imbalances in the market, the IEA pointed out to the G20 energy ministers that although low prices might appear to be attractive to consumers, they are of little benefit to the approximately 4 billion people living under some form of Covid-19 lockdown. Also, low prices impact the livelihood of millions of people employed along the oil industry’s extensive value chain, and they damage the economies of weaker producing countries where social stability is already fragile. Low prices threaten the stability of an industry that will remain central to the functioning of the global economy. Even with demand falling by a record amount this year, oil companies still face the challenges of investing to offset natural production declines and to meet future growth. Global capital expenditure by exploration and production companies in 2020 is forecast to drop by about 32% versus 2019 to $335 billion, the lowest level for 13 years. This reduction of financial resources also undermines the ability of the oil industry to develop some of the technologies needed for clean energy transitions around the world. There is clearly a long way to go before we can put the Covid-19 crisis behind us. However, we are encouraged by the solidarity shown by policy makers from producing and consuming countries working together to meet this historic challenge of bringing stability to the oil market.

- 19. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 2020 K. Al Awadi

- 20. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 For Your Recruitments needs and Top Talents, please seek our approved agents below