NewBase 04 March 2024 Energy News issue - 1704 by Khaled Al Awadi_compressed (1).pdf

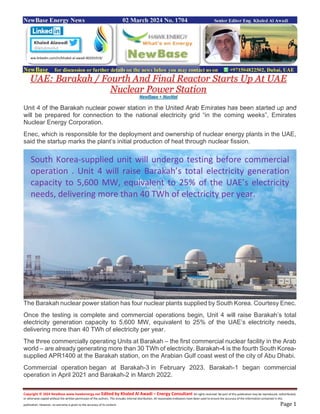

- 1. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 02 March 2024 No. 1704 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Barakah / Fourth And Final Reactor Starts Up At UAE Nuclear Power Station NewBase + NucNet Unit 4 of the Barakah nuclear power station in the United Arab Emirates has been started up and will be prepared for connection to the national electricity grid “in the coming weeks”, Emirates Nuclear Energy Corporation. Enec, which is responsible for the deployment and ownership of nuclear energy plants in the UAE, said the startup marks the plant’s initial production of heat through nuclear fission. The Barakah nuclear power station has four nuclear plants supplied by South Korea. Courtesy Enec. Once the testing is complete and commercial operations begin, Unit 4 will raise Barakah’s total electricity generation capacity to 5,600 MW, equivalent to 25% of the UAE’s electricity needs, delivering more than 40 TWh of electricity per year. The three commercially operating Units at Barakah – the first commercial nuclear facility in the Arab world – are already generating more than 30 TWh of electricity. Barakah-4 is the fourth South Korea- supplied APR1400 at the Barakah station, on the Arabian Gulf coast west of the city of Abu Dhabi. Commercial operation began at Barakah-3 in February 2023. Barakah-1 began commercial operation in April 2021 and Barakah-2 in March 2022. ww.linkedin.com/in/khaled-al-awadi-80201019/ South Korea-supplied unit will undergo testing before commercial operation . Unit 4 will raise Barakah’s total electricity generation capacity to 5,600 MW, equivalent to 25% of the UAE’s electricity needs, delivering more than 40 TWh of electricity per year.

- 2. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Enec said: “Each Unit has been started up more efficiently than the previous unit, as institutional knowledge and experience are applied to each subsequent unit. Unit 3 was delivered four months faster than the Unit 2 schedule, and five months faster than the Unit 1 schedule, demonstrating the significant benefit of building multiple units within a phased timeline.” The Barakah-4 nuclear power plant in the United Arab Emirates. Courtesy Enec. Ahead of schedule ENEC has delivered the four units of the Barakah Plant within an accelerated delivery timeline. Barakah is the first multiunit operational nuclear plant in the Arab world, with the operational teams starting up a unit every year since 2020. The Barakah Plant uses four APR-1400 pressurised water reactors capable of each producing up to 1,400 megawatts of clean electricity. Each Unit has been started up more efficiently than the previous unit, as institutional knowledge and experience are applied to each subsequent unit. Unit 3 was delivered four months faster than the Unit 2 schedule, and five months faster than the Unit 1 schedule, demonstrating the significant benefit of building multiple units within a phased timeline. Mohamed Al Hammadi, Managing Director and CEO of ENEC, said: “The start-up of the fourth unit of the Barakah Nuclear Energy Plant is a significant achievement as we now enter into a new era to deliver the full promise of the Barakah Plant. In the past five years, the UAE has added more clean electricity per capita than any other nation globally, with 75 per cent coming solely from the Barakah Plant, demonstrating how pivotal nuclear energy is in decarbonising the country’s power sector.”

- 3. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE’s ADNOC is recognized as top investor in low-carbon solutions Zawya + NewBase A respected industry report by Energy Intelligence has recognised ADNOC as the top National Oil Company (NOC) investor in low-carbon solutions and the 5th largest in the global industry in 2023. The report, titled ‘Low-Carbon Investment Tracker: Corporate Spending Shift’, covers announced low-carbon investments of 34 leading international oil companies (IOCs) and NOCs. It also noted that ADNOC embarked on the newest low-carbon initiatives in 2023 by any IOC or NOC, as the company supports the delivery of a just, orderly and equitable energy transition. These low-carbon initiatives include two major carbon capture projects, taking ADNOC’s committed investment for carbon capture capacity to almost 4 million tonnes per annum (mtpa). It also includes ADNOC’s investments through Masdar, targeting 100 gigawatts (GW) of renewable energy capacity by 2030. Energy Intelligence noted the changing geography of investments including offshore wind projects in the UK and Poland and growing investments in Central Asia as well as the Caucasus region. In January, ADNOC’s Board of Directors increased the company’s allocation for decarbonisation projects, technologies, and lower-carbon solutions to $23 billion (AED84.4 billion). The company is targeting net zero by 2045 and has stated its ambition to double its CCS capacity target to 10 mtpa by 2030, which is the equivalent of removing over 2 million gasoline-powered cars from public highways. ADNOC is also using clean energy to provide 100 percent of its onshore grid electricity needs since the start of 2022 and connecting its offshore operations to the grid through a $3.8 billion (AED14 billion) project that, upon completion, can reduce its offshore carbon footprint by up to 50 percent. The report includes low-carbon investments across five categories – Low-Carbon Power Generation, Electricity Solutions, Hydrogen and Low-Carbon Fuels, Electric Vehicle (EV) and Mobility, and Carbon Capture Storage (CCS) and carbon removal. It is based on a proprietary, data- driven analysis of fast-growing green spending plans by Energy Intelligence, a leading energy information company. Strategic program is a key enabler of ADNOC’s Net Zero by 2050 ambition and goal to reduce carbon intensity by 25% by 2030

- 4. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Venezuela's February oil exports rise, but shipping delays persist Reuters + NewBase Venezuela's oil exports slightly increased in February to some 670,000 barrels per day (bpd), but ongoing shipping delays worsened a bottleneck of tankers waiting to load, according to documents and vessel monitoring data. State-run oil firm PDVSA's customers have rushed to send tankers to Venezuela in recent months to pick up crude and fuel before the United States potentially reimposes oil sanctions. Restrictions could resume on April 18 when an existing license expires, the U.S. has said, with PDVSA struggling to deliver cargoes ahead of the deadline. Deliveries last month to clients including U.S.-based Chevron (CVX.N), opens new tab and India's Reliance Industries (RELI.NS), opens new tab increased from January, but weaker output and a lack of diluents to produce exportable grades prevented PDVSA from raising total exports, the data showed. PDVSA and its joint ventures exported an average 671,140 bpd of crude and fuel, mainly to Asia, a 7.5% increase from January. Venezuela also shipped 197,000 metric tons of oil byproducts and petrochemicals, below the 286,000 tons in January. Chevron's shipments of Venezuelan crude to the U.S. jumped to 184,000 bpd from 107,000 bpd the previous month. Venezuela's shipments to political ally Cuba remained around 34,000 bpd, while deliveries to other Caribbean islands slightly increased. Insufficient inventories of flagship Merey 16 crude and a lack of imported diluents at Venezuela's main oil port, Jose, prevented PDVSA from further boosting exports to fulfill spot supply deals, internal company documents showed.

- 5. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Some large tankers bound for Asia have left Venezuelan ports without loading in recent days after waiting for weeks, according to LSEG vessel monitoring data. The Jose terminal has recovered from power outages and slow oil blending that affected loadings in January, the documents showed. Four out of five crude upgraders and blending stations were in service last month, which could lead to higher exports in March. As of Feb. 29, at least 18 supertankers were waiting to load near Venezuela's Jose and Amuay ports, which handle most of PDVSA's exports, up from about a dozen at the end of November, according to the data. Venezuela's fuel imports rose to 144,000 bpd from 122,000 bpd in January. Last October, Washington issued a six-month general licence for transactions involving Venezuela’s oil and gas sector following an electoral roadmap agreement signed by Venezuelan president Nicolas Maduro and opposition politicians in Barbados. Since then, Maduro has not stuck to his promises for a free election. Since the exemption was granted, the US has been importing 26% of Venezuelan crude, totalling 142,000 barrels per day, according to Vortexa. China remains the top destination for Venezuelan barrels, averaging 293,000 barrels per day in 2023. “Oil exports have picked up in Venezuela over the last two years as the US has eased sanctions since the start of 2023,” analysts at Braemar noted. “These developments show the potential fragility of oil sanctions relief deals as well as ongoing US commitment to upholding the other end of the deal in such a case,” tanker experts at rival broker Gibson suggested.

- 6. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Saudi Aramco acquires Chilean downstream fuels retailer Esmax TradeArabia News Service Aramco, one of the world’s leading integrated energy and chemicals companies, has successfully completed the acquisition of a 100% equity stake in Esmax Distribución SpA (Esmax), a leading diversified downstream fuels and lubricants retailer in Chile. Esmax has a national presence that includes retail fuel stations, airport operations, fuel distribution terminals and a lubricant blending plant. Saudi oil giant said the transaction, which was first announced in September last year, marks it first downstream retail investment in South America, thus illustrating the attractiveness of the market. It also supports the company’s strategic goal to strengthen its downstream value chain. On the strategic move, Executive Vice President (Products & Customers) Yasser Mufti said: "We are delighted to conclude the acquisition of Esmax and look forward to working with the outstanding team on the ground in Chile to achieve our shared ambitions." "Aramco aims to be a primary global retail player and this deal combines our high quality products and services, including Valvoline lubricants, with the experience and quality of an established operator in Chile," he added.-

- 7. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Indonesia and SA eye coal exports to India amid geopolitical shifts Reuters + NewBase With a decline in Europe's appetite for coal, miners in both countries are now vying for a greater share of the steady Indian coal imports market Top coal exporters Indonesia and South Africa are aiming to ramp up supplies of thermal coal to key buyer India, company executives said, as they look to regain market share in the world's second largest import market for the fuel. Indonesia and South Africa are top suppliers of thermal coal to India but have lost market share in recent years to the United States, Russia and Australia due to major changes in trade routes over geopolitical concerns. With a decline in Europe's appetite for coal, miners in both countries are now vying for a greater share of the steady Indian coal imports market. "We see our low sulphur, high calorific value coal as a big advantage to supply to the Indian market. India's steel production expected to do well and it's good for South Africa," Kgabi Masia, chief coal operations officer at Exxaro Resources said at the Coaltrans India conference. South Africa boosted supplies of the power generation fuel to Europe at India's expense after Russia's war on Ukraine to take advantage of higher prices being offered, while Indonesia lost some share to Australia as it boosted supplies to China. "For the year ending March 2025, we will supply 60MT out of South Africa, which means we will be able to supply more to India," Masia said. Falling exports not just limited to Transnet crisis South Africa's share in Indian thermal coal imports fell to 16% in 2023 from an average of about 22% in the three years before the pandemic, while Indonesia's share fell to 58% in 2023 from 65% in 2022. Indonesia is expected to supply as much as 110MT to India in 2023, Ardian Rosadi Budiman, senior manager of international marketing at Adaro Energy said, nearly 7% higher than the 103MT it supplied in 2023. The world's largest exporter of the power generation fuel is targeting record output of 710MT this year. "Despite additional domestic demand, we still expect Indian demand for Indonesian coal to be strong," Budiman told the conference.

- 8. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 India investing in improving the rail system to transport coal Clyde Russell, Reuters News India's coal sector is united about one thing. It doesn't matter if you are a miner, trader, utility or steelmaker, you are bullish, extremely bullish. The overarching theme at this week annual Coaltrans India conference in the western state of Goa is that coal production, imports and demand are all going to rise in coming years, and by substantial volumes. India may have committed to eventually starting to phase down consumption of the polluting fuel on its road to net-zero emissions by a targeted 2070, but for the coming decade the coal industry sees a ramp up. Even the most cautious of forecasts at the conference saw demand for all grades of coal reaching 1.5 billion metric tons by 2030, with some reaching as high as 1.9 billion. To put that in context, India's coal demand was 1.23 billion tons, composed of domestic production of 964 million tons and imports of around 266 million. Put another way, even the more pessimistic of forecasts expects an increase of nearly 300 million tons of coal demand in India in the next six years, an increase of 25%. To put the scale of the increase in context, 300 million tons is more than the total annual demand of Germany, the fourth-biggest coal-consuming nation after China, India and the United States. The optimism over coal's future in India's energy mix is largely built on a shift in the thinking of the government of Prime Minister Narendra Modi to prioritise energy security and domestic resources over reducing carbon emissions to mitigate climate change. The thinking is that India has massive reserves of coal, which it can mine relatively cheaply, and if it continues to invest in infrastructure, it can move the coal from where it is produced to where it will be burnt in power plants and factories.

- 9. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 The more the world's most-populous nation can use domestic energy, the less it has to pay for expensive imports in the form of crude oil and liquefied natural gas. Although crude oil and its refined products don't compete with coal in power generation, they may increasingly in the future as the shift to electric vehicles gathers pace. India's industrial users of coal, such as cement and ceramics, are also being encouraged to look at using gas produced from coal to power their plants, rather than imported coking coal, met coke and LNG. NOT ENOUGH RENEWABLES Another factor worth noting about the bullish view of India's coal sector is that they believe in the strong growth scenario even though the South Asian nation is ramping up the deployment of renewable energies such as wind, solar, battery storage and pumped hydropower. India is likely to exceed its target for 500 gigawatts (GW)of renewable energy capacity by 2030, but the demand for electricity is likely to outpace the capacity additions. This means India will continue to increase its fossil fuel generation, and lion's share of this will be coal, with 85 GW of new plants already under construction and likely to come online by 2030, which would boost coal-fired capacity by just over one-third from the current 237 GW. Steelmakers are also poised to increase demand for coal, the key raw material used to turn iron ore into crude steel. India produced about 140 million tons of steel in 2023, and the government is targeting that to rise to 300 million by 2030. That figure is likely optimistic, but it's possible that the country can produce more than 200 million tons in that time frame, according to several steel makers present at the Coaltrans event. India's steel and sponge iron sectors imported about 93 million tons of coal in 2023, and consultants iEnergy Natural Resources estimate this will rise to 135 million by 2030. If there was any disagreement on the outlook for India's coal sector at the conference, it was the likely future mix of domestic production and imports. India doesn't produce significant volumes of coking coal, so any increase in steel production is likely to rise in higher imports of coking coal and met coke, a beneficiated product made mainly from coking coal, but can contain some lesser quality grades. The main debate is whether a combination of state-controlled behemoth Coal India and newly- operating private coal mines will be able to raise output enough to displace imported thermal coal for the power sector. India is investing heavily in improving the rail system to transport coal, but it's still likely that coastal power plants in the south and west of the sub-continent will rely on imported fuel for years to come.

- 10. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase March 04 -2024 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil rises after OPEC+ extends output cuts Reuters + NewBase Oil prices rose on Monday after OPEC+ members agreed to extend voluntary oil output cuts of 2.2 million barrels per day into the second quarter, largely in line with market expectations. Brent futures was 14 cents, or 0.14% higher, at $83.69 a barrel at 0534 GMT, while the U.S. West Texas Intermediate (WTI) rose 3 cents, or 0.023%, to $80.00 a barrel. The output cuts by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) are expected to cushion the market amid global economic concerns and rising output outside the group, with Russia's announcement surprising some analysts. Russia will cut its oil output and exports by an additional 471,000 barrels per day (bpd) in the second quarter, in coordination with some OPEC+ participating countries, its Deputy Prime Minister Alexander Novak said on Sunday. "Signs of tightness in the physical market continue to push crude oil higher. Output cuts by the OPEC+ alliance continue to reduce supply as the market worries about the renewed tensions in the Middle East," ANZ analysts said in a note on Monday. Oil price special coverage

- 11. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Rising geopolitical tensions due to the Israel-Hamas conflict and Houthi attacks on Red Sea shipping have supported oil prices in 2024, although concern about economic growth has weighed. Yemen's Iran-backed Houthis vowed on Sunday to continue targeting British ships in the Gulf of Aden following the sinking of UK-owned vessel Rubymar. In some of the strongest comments by a senior U.S. leader, U.S. Vice President Kamala Harris on Sunday demanded Palestinian militant group Hamas agree to an immediate six-week ceasefire while forcefully urging Israel to do more to boost aid deliveries into Gaza. Washington has insisted the ceasefire deal is close and has been pushing to put in place a truce by the start of Ramadan, a week away. A U.S. official on Saturday said Israel has agreed on a framework deal. Heavyweights Saudi Arabia and Russia, alongside several other key OPEC+ producers, will extend their voluntary crude supply cuts until the end of the second quarter. OPEC+ refers to the coalition of the Organization for the Petroleum Exporting Countries and its allies, steered by Riyadh and Moscow. Saudi Arabia will stretch out its voluntary crude production cut of 1 million barrels per day until the end of the second quarter, the state-owned Saudi Press Agency said Sunday, citing an official source from the country’s Ministry of Energy. KSA’s crude production will be approximately 9 million barrels per day until the end of June, the announcement said. Russia will trim its production and export supplies by a combined 471,000 barrels per day until the end of June, Russian Deputy Prime Minister Alexander Novak said, according to a Google- translated report carried by Russian state-owned agency Tass. Moscow had volunteered to reduce its supplies by a slightly higher 500,000 barrels per day in the first quarter. OPEC key producers Iraq and UAE will also prolong their voluntary production cuts of 220,000 barrels per day and 163,000 barrels per day, respectively, until the end of the second quarter, according to Google-translated updates from their state-owned news agencies INA and WAM. Back in November, OPEC+ countries had held a formal policy of collectively reducing their output by 2 million barrels per day until the end of 2024. Separate from the group’s official strategy, several OPEC+ producers, including heavyweights Saudi Arabia and Russia, announced they would voluntarily trim their supplies by a total of 2.2 million barrels per day until the end of this year’s first quarter. The latest production cut announcement comes against a background of a languishing oil price that has largely spasmed in a narrow $75 to $85 per barrel interval since the start of the year, despite OPEC+ supply cuts, persistent Houthi maritime attacks in the crucial Red Sea route and ongoing spill-over risk from Israel’s war against the Iran-backed Palestinian militant group Hamas in the Gaza Strip. Offsetting some of this price support in the short term is lower demand amid imminent seasonal refinery maintenance in the world’s top crude importer, China, which typically exacerbates in the second quarter. Unlike formal policy changes, voluntary cuts do not require the group’s unanimous consent during an official meeting and bypass the need to distribute production cuts or increases among OPEC+ members. Typically, extracurricular output adjustments are not disputed by OPEC+ countries, as long as they align with the spirit of existing policy — currently, the supplementary cuts build on existing OPEC+ trims.

- 12. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The group’s next policy negotiations take place in June, by which point independent, third-party data providers will have finalized their assessments of group members’ production capacity baselines — the levels to which each country’s quota is assigned. Heavily coveted, a higher baseline leads to a higher output limit, allowing producers to cash in on firmer revenues in a lofty price environment. In a shock move, OPEC kingpin Saudi-controlled oil giant Aramco in late January announced it was suspending its long-standing plans to increase its crude production capacity from 12 million barrels per day to 13 million barrels per day by 2027, with Saudi Energy Minister Prince Abdulaziz bin Salman later pinning the decision on the green transition. U.S. crude touches $80 for first time since November before OPEC+ decision U.S. crude oil futures touched $80 a barrel for the first time in nearly four months, as signs point to a tightening market ahead of an OPEC+ decision on production cuts. The West Texas Intermediate contract for April gained 2.19%, or $1.71, to settle at $79.97 a barrel on Friday, marking the highest close for U.S. crude since Nov. 6. May Brent futures added 2.09%, or $1.71, to $83.94 a barrel. U.S. crude and the global benchmark booked a second consecutive monthly gain in February as near-month contracts traded at a premium to later months, typically a sign of a tightening oil market. On the supply side, a Reuters survey showed the Organization of the Petroleum Exporting Countries (OPEC) pumped 26.42 million barrels per day (bpd) on Feb-2024, up 90,000 bpd from January 2024. Libyan output rose month-on-month by 150,000 bpd.

- 13. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 OPEC+ is considering rolling over its production cuts through the second quarter and possibly the end of the year, three sources in the organization told Reuters this week. The cartel and its allies are expected to make a decision on the reductions in the first week of March, sources told Reuters. OPEC’s next formal Joint Ministerial Monitoring Committee meeting is scheduled for April 3. Brent crude futures could break out to the $95 per barrel range in the second quarter as bulls have become more aggressive in buying at ever-higher lows, Paul Ciana, a technical strategist at Bank of America, told clients in a note Thursday. A breakout through a resistance level near $85 per barrel for Brent would confirm a change to the upside, but the global benchmark will have to hold a support level of roughly $80 a barrel in March, Ciana said. If Brent falls below that level, the benchmark could drop all the way to the bottom of its range at $73-$75 a barrel, he said. On the geopolitical front, cease-fire negotiations in the Israel-Hamas war are in jeopardy after scores of Palestinians were killed in Gaza City while waiting for humanitarian aid. “I am rejecting the international pressure to end the war before we achieve all of its goals,” Israel Prime Minister Benjamin Netanyahu said at news conference Thursday.

- 14. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 An oil refinery, near Shubaytah, Saudi Arabia. Photographer: Patrick Hertzog/AFP/Getty Images Saudi Arabia, de facto leader of the Organization for the Petroleum Exporting Countries, will extend its voluntary crude production cut of 1 million barrels per day until the end of the second quarter, the state-owned Saudi Press Agency said Sunday, citing a source from the country’s Ministry of Energy. Riyadh’s crude production will be approximately 9 million barrels per day until the end of June, the announcement said. Russia will trim its production and export supplies by a combined 471,000 barrels per day until the end of June, Russian Deputy Prime Minister Alexander Novak said

- 15. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15

- 16. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Specual Coverage The Energy world –March 04 -2024 CLEAN ENERGY U.S the largest liquefied natural gas supplier to Europe in 2023 IEA The United States was again the largest supplier of liquefied natural gas (LNG) to Europe (EU-27 and the UK) in 2023, accounting for nearly half of total LNG imports, according to data from CEDIGAZ. Last year marks the third consecutive year in which the United States supplied more LNG to Europe than any other country: 27%, or 2.4 billion cubic feet per day (Bcf/d), of total European LNG imports in 2021; 44% (6.5 Bcf/d) in 2022; and 48% (7.1 Bcf/d) in 2023. Qatar and Russia remained the second- and third-largest LNG suppliers to Europe last year. Qatar supplied 14% (2.0 Bcf/d), and Russia supplied 13% (1.8 Bcf/d). Combined, the United States, Qatar, and Russia supplied three-quarters of Europe’s LNG imports in 2022 and 2023. Europe’s LNG import, or regasification, capacity is on track to expand to 29.3 Bcf/d in 2024, an increase of more than one-third compared with 2021, according to data from the International Group of Liquefied Natural Gas Importers (GIIGNL) and trade press.

- 17. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Data source: CEDIGAZ and the International Group of Liquefied Natural Gas Importers (GIIGNL) Note: Other includes Angola, Argentina, Australia, Cameroon, Egypt, Equatorial Guinea, Indonesia, Libya, Mozambique, Norway, Oman, Papua New Guinea, Peru, Trinidad and Tobago, United Arab Emirates, and Yemen. LNG=liquefied natural gas Russia's full-scale invasion of Ukraine in February 2022 prompted European countries to halt most imports of natural gas from Russia via pipeline and reactivate development of previously dormant regasification projects as well as develop new projects. Germany is adding the most LNG regasification capacity in Europe: developers added 1.8 Bcf/d in 2023 and plan to add 1.6 Bcf/d in 2024. In 2022 and 2023, the Netherlands, Spain, Italy, Finland, and France increased their regasification capacity by a combined 3.2 Bcf/d. In 2024, we expect Belgium, Greece, Poland, the Netherlands, and Cyprus to add a combined 1.8 Bcf/d of new capacity. In 2023, Europe’s LNG imports averaged 14.7 Bcf/d, essentially unchanged from 2022, despite an estimated 4.2 Bcf/d of regasification capacity additions. Mild 2022–23 winter weather in the Northern Hemisphere reduced heating demand and contributed to Europe ending the winter heating season with record-high natural gas in storage. LNG imports into Europe established new records from June 2022 through April 2023, when imports peaked at 18.1 Bcf/d. Imports then declined in subsequent months because storage inventories were full, international LNG prices were relatively high, and energy conservation measures significantly reduced natural gas consumption.

- 18. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Data source: CEDIGAZ ,,, Note: LNG=liquefied natural gas In 2023, France, Spain, the Netherlands, and the UK combined accounted for almost two-thirds (9.3 Bcf/d) of Europe’s total LNG imports. Germany imported its first LNG in January 2023 and ended the year accounting for 4% (0.6 Bcf/d) of Europe’s total imports. The United States supplied more than 80% of Germany’s LNG imports. Data source: CEDIGAZ ,,,, Note: Other includes Belgium, Croatia, Finland, Greece, Lithuania, Malta, Poland, Portugal, and Sweden. LNG=liquefied natural gas

- 19. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Natural gas prices at the Title Transfer Facility (TTF) in the Netherlands—a large natural gas trading hub in Europe—started to increase in the second half of 2021, and by 2022, averaged $40.30 per million British thermal units (MMBtu) annually. TTF prices reached nearly $100.00/MMBtu in August 2022, significantly higher than the 2019–20 average of $3.86/MMBtu amid concerns over natural gas supplies for the winter given the uncertainty over the future of piped natural gas from Russia. In January 2023, however, TTF prices began to decline from a monthly average of $20.43/MMBtu to $10.06/MMBtu by May as natural gas balances in Europe continued to improve. From June 2023 through the end of the year, TTF prices averaged $11.89/MMBtu, falling below LNG prices in East Asia.

- 20. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase Energy News 04- March - Issue No. 1704 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 21. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21