New base energy news 07 may 2020 issue no. 1336 senior editor eng. khaled al awadi

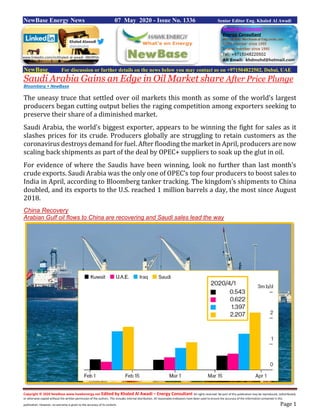

- 1. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 07 May 2020 - Issue No. 1336 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi Arabia Gains an Edge in Oil Market share After Price Plunge Bloomberg + NewBase The uneasy truce that settled over oil markets this month as some of the world’s largest producers began cutting output belies the raging competition among exporters seeking to preserve their share of a diminished market. Saudi Arabia, the world’s biggest exporter, appears to be winning the fight for sales as it slashes prices for its crude. Producers globally are struggling to retain customers as the coronavirus destroys demand for fuel. After flooding the market in April, producers are now scaling back shipments as part of the deal by OPEC+ suppliers to soak up the glut in oil. For evidence of where the Saudis have been winning, look no further than last month’s crude exports. Saudi Arabia was the only one of OPEC’s top four producers to boost sales to India in April, according to Bloomberg tanker tracking. The kingdom’s shipments to China doubled, and its exports to the U.S. reached 1 million barrels a day, the most since August 2018. China Recovery Arabian Gulf oil flows to China are recovering and Saudi sales lead the way www.linkedin.com/in/khaled-al-awadi-38b995b

- 2. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 “The Saudis are doing very well,” said Ahmed Mehdi, a research associate at the Oxford Institute for Energy Studies, referring to the battle for buyers. “Aramco has been aggressive in protecting market share in Asia.” State oil producer Saudi Aramco slashed its official selling prices for April crude sales to some of the lowest levels in decades, undercutting rivals. For cargoes loading for Asia in May, Aramco cut pricing even further, and it’s expected to widen discounts to that region for June. That helped Aramco to place its crude even amid a surge in supply. Saudi exports to China more than doubled in April to 2.2 million barrels a day, the highest level since Bloomberg began tracking flows at the beginning of 2017. Shipments to India, at 1.1 million barrels a day, were also the highest in at least three years. The case of India highlights Saudi gains. Iraq, the second-biggest member in the Organization of Petroleum Exporting Countries, edged the Saudis for the top spot in oil sales to the South Asian country for most of the last three years. Last month, however, Iraq’s exports to India plummeted to the lowest since June 2018 as the South Asian country shut down much of its economy to counter the coronavirus and refiners there reduced operating runs and rerouted cargoes. The increase in Saudi exports to India in April almost exactly offset the decline in Iraqi sales. Indian Ambition Saudi Arabia won market share frovm Iraq amid India's lockdown Source: Bloomberg tanker tracking Like other producers, Saudi Arabia must contend with a plunge in demand due to coronavirus lockdowns. Brent crude has lost about half its value this year, and the benchmark closed above $30 a barrel on Tuesday for just the first time in three weeks.

- 3. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Aramco made deeper pricing cuts than Iraq for its key grade for sale to Asia for both April and May. Barrels of Saudi Arab Light crude are even selling at a rare discount to Iraqi barrels for May. Saudi exports to the U.S. surged to an average of 1 million barrels daily, the most since August 2018. Aramco generally exports to America from the Arabian Gulf, but April’s flows included the first observed cargo from one of the kingdom’s Red Sea ports to the U.S. West Coast in at least three years. A second shipment embarked on the same route in early May. Figures for the amount of oil loaded for a specific location may rise because some tankers have yet to indicate their final destinations. The Saudis aim to defend sales from competing crude from the U.S., Russia and Africa, said Gavin Thompson, vice chairman for energy in the Asia Pacific region at consultant Wood Mackenzie Ltd. Aramco’s pricing cuts for May “gave clear notice of its strategic goal to ensure that its crude remains highly competitive in Asia,” he said in a note

- 4. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Iraq emerging as OPEC's main laggard in making record output cut Reuters + NewBase Iraq has yet to inform its regular oil buyers of cuts to its exports, suggesting it is struggling to fully implement an OPEC deal with Russia and other producers on a record supply cut, traders and industry sources said. Less than full compliance by Iraq, as well as by smaller producers such as Nigeria and Angola, could hurt the OPEC+ group's efforts to cut output by 9.7 million barrels per day from May 1, equivalent to about 10% of world demand before the coronavirus crisis led to a slide in consumption and prices. Iraq, OPEC's second largest oil producer, has instructed its biggest company, Basra Oil Co. (BOC), to cut output from May as part of its efforts to reduce its output by 1 million bpd, or 1% of global supply, an oil ministry source said. But it has yet to agree an action plan with other oil companies such as BP, Exxon, Eni or Lukoil, which operate the biggest fields in the country, a BOC spokesman said. "Talks with international oil companies are still continuing to discuss ways of curtailing production that serve all parties and ensure mutual interests are observed," the BOC spokesman said. "We can't say talks hit deadlock. We expect a breakthrough to be reached soon." Iraq's oil ministry could not be immediately reached for comment. BP, Exxon, Eni and Lukoil declined to comment. One industry source active in Iraq said the companies were refusing the cut and that delays in forming a new government in Iraq were complicating the discussions. "It's a mess at the moment," the source said.

- 5. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 OPEC Gulf states, including Saudi Arabia, Kuwait and the United Arab Emirates, have informed their customers of cuts to exports. Kuwait, Oman and the UAE have also officially informed OPEC. Three trading sources said Iraq has not issued any such statements to its regular oil buyers yet. Two of the sources said Iraq's May export plans from the south were broadly in line with April's at around 3.3 million bpd.There is no requirement for participating countries to tell OPEC how they will make their cut, but informing customers about their oil allocations is standard practice. OPEC's Secretary General Mohammad Barkindo declined to discuss individual country compliance: "We are now focused on the full and timely implementation of this historic agreement," he told Reuters.

- 6. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 'DEADLOCK' The challenge for many OPEC+ countries arises from how much they are asking international oil companies (IOCs) to cut, said Amrita Sen of analyst firm Energy Aspects. "Beyond logistical shut- ins, some of the cuts needed from Iraq, Nigeria and others when they have barely complied with previous cuts are simply not going to happen," she said. Companies producing in Iraq's southern oilfields operate service contracts that pay them a fixed dollar fee for their output and are also compensated in crude cargoes. This type of contract shields oil companies against sharp falls in oil prices. But it also means that with the OPEC cuts, Iraq ends up with less crude to market itself. "Most operators have told Iraq, they are happy for them to cut but want their fees repaid in full. It is basically a deadlock," said a source from one of the four companies. Nigeria and Angola's current export schedules show they are currently not cutting as much as required under the OPEC+ deal, but will go further than they did under the previous OPEC+ agreement that ended on March 31. [OPEC/O] Under the latest deal, Nigeria should cap production at 1.41 million bpd in May and June. But data from price reporting agency Argus Media shows it plans to export 1.56 million bpd in May and 1.65 million bpd in June, excluding the Akpo condensate stream. A trade source who has seen Nigeria's latest loading programmes said that while Nigeria has made a significant cut to its export plans in May, they will still fall short of the pledged OPEC+ cut. Nigeria's ministry of petroleum resources did not immediately respond to a Reuters request for comment. Export plans for May and June from Africa's second biggest exporter, Angola, may also fall short of its OPEC obligations. Angola's petroleum ministry and its petroleum regulator did not immediately respond to a Reuters request for comment. May volumes were retroactively cut back to around 1.27 million bpd and June export volumes are expected to be around 1.25 million bpd, loading programmes showed. These are both higher than the 1.18 million bpd production level Angola has agreed to under the OPEC+ deal for the initial two months. 10 million bpd cut distribution for May-June & OPEC+ 8 million bpd cut distribution for July-December

- 7. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 OPEC+ 6 million bpd cut distribution for January 2021-April 2022 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> (Reporting by Reuters OPEC Team, Alex Lawler in London, Lamine Chikhi in Algiers; Nailia Bagirova in Baku, Katya Golubkova in Moscow and Tamara Vaal in Nur-Sultan; Additional reporting by Stephanie Kelly in New York; Florence Tan in Singapore and David Ljunggren in Ottawa; Writing by Andrey Ostroukh and Dmitry Zhdannikov; Editing by Alex Richardson, Tom Brown and Peter Cooney)

- 8. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 UAE: Adnoc unlocks $1bn in value from digital hub as Covid-19 crisis accelerates roll-out of technology The National - Kelsey Warner Adnoc’s digital command centre has generated over $1 billion (Dh3.67bn) in business value and allowed the state-owned oil company to maintain operations and respond swiftly to market dynamics throughout the coronavirus pandemic, according to the company's senior vice president of digital. Since it opened in early 2018, the Panorama Digital Command Centre has provided cost savings and improved production efficiency with “an investment of less than Dh50 million”, Abdul Nasser Al Mughairbi told The National. “Technology is doing all the work of connecting us together,” he said. “The importance of embedding digital technology in businesses has never been greater and Adnoc’s continuous investment in digital transformation over the last three years allows us to be more resilient.” The energy industry is facing its biggest shock in 70 years from the coronavirus pandemic, according to the International Energy Agency, which forecasts global energy demand will fall 6 per cent this year, nearly seven times the rate of decline following the 2008 global financial crisis. The UAE, Opec's fourth-largest producer, accounts for 4 per cent of global oil production, with state- owned Adnoc responsible for much of that output. But crude producers are looking to roll back record production as travel restrictions and work-from-home orders curtail demand. “The calculation of economic survival has become extremely complex in this matter of wafer-thin margins,” The National’s energy columnist Robin Mills wrote last month. Operating costs, transport costs to market, the costs of stopping or restarting production and oil quality are all factors to watch, he added.

- 9. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 To that end, Adnoc’s Panorama is built to “monitor every molecule of hydrocarbon”, according to Mr Al Mughairbi. The command centre, located at Adnoc’s headquarters in Abu Dhabi, is now being accessed remotely by employees through a secure connection amid Covid-19, providing real-time information across Adnoc’s 14 subsidiary and joint venture companies and using artificial intelligence and data analysis to anticipate disruptions and optimise production. The state oil major has developed in-house capabilities of data gathering and reporting to reduce software and third party costs across the company. Hydrocarbon production reports can be generated in real time, with all 14 of Adnoc’s companies feeding into a single system, linking all 56 control room sites covering offshore production, gas processing, petrochemicals, refining, onshore production and condensate, according to Mr Al Mughairbi. Cost savings and value generated by Panorama is calculated on a monthly basis, he said, which brought Adnoc to the $1bn figure. Panorama is one of several digital transformation initiatives undertaken by Adnoc. Chief executive Dr Sultan Al Jaber laid out his plans for the company’s tech-driven future at Abu Dhabi International Petroleum Exhibition Conference (Adipec) last November. "The era of digital disruption is just beginning for the industry and will only gather pace over time. Yet, the oil and gas company of today can be a winner tomorrow, if it operates at a lower level of cost and a higher level of performance," he said. An Adnoc employee oversees downstream operations at Adnoc. The state oil company employs 700 women, a third of whom are in technical jobs. The pandemic is now accelerating Adnoc’s digital transformation strategy, according to Mr Al Mughairbi.

- 10. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 “The Covid situation has shown us we need to roll out [technology] at a much faster pace,” he said, with further investments planned for remote assistants, wearable technology and remote monitors, like drones, to reduce contact between people and the number of site visits required. A bespoke health, safety and environment information system is currently being built into Panorama by harvesting information from millions of data sensors to give instant, real-time readings across its facilities. Separate from Panorama, Adnoc is investing in implementing blockchain across every step of extraction and production of hydrocarbons. Blockchain will provide a transparent and unchangeable record of how much each molecule costs to extract and turn into a product, how long it took to produce and the CO2 it generated, contributing to lowering production costs and providing a record of Adnoc's carbon footprint. At first, Adnoc planned to partner with IBM on all of its blockchain requirements. Today, Mr Al Mughairbi said they have in-house talent and access to open-source materials to pull off aspects of its blockchain programme at a much lower cost, while still partnering with IBM. Ultimately, the use of technology and embracing digital tools “will differentiate the Adnoc hydrocarbon molecule” from the rest, he said.

- 11. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 India: In Oil Market, India Pump Prices Echo $100-Plus Crude Bloomberg - Saket Sundria Crude oil has plummeted to about $30 a barrel from $115 when Prime Minister Narendra Modi first came to power six years ago, but Indian consumers are yet to enjoy the benefits of the plunge. Modi’s administration has repeatedly raised taxes on fuel to cushion worsening public finances. Diesel in the country’s capital now costs 20% more than it did in 2014, with levies accounting for nearly half the retail price, while gasoline is roughly priced the same as under Modi’s predecessor. Higher prices help avoid unnecessary use of the polluting fuel, authorities have said in the past. But, as consumption takes a dangerous dip amid the coronavirus lockdown, reducing costs could have helped citizens -- from factory owners to farmers -- at a time when millions have lost their jobs and are living on handouts from the government or the charity of neighbors. The latest increase came close to midnight on Tuesday, when the federal government imposed an additional levy of 13 rupees per liter on diesel and 10 rupees on gasoline. Pump prices will, however, not change, the government said. T hat means fuel retailers like Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. would have to absorb the higher duties. The companies’ shares plunged.

- 12. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Taxes collected by the federal government on diesel have swelled by seven times in the last six years while those on gasoline have nearly tripled over the same period. Brent was trading near $30 a barrel on Thursday after recovering from a more than 18-year low of $19.33 on April 21. The steep increase in taxes on the two fuels, which account for more than half of India’s oil demand, comes at a time when demand has plunged by about 70% following the world’s biggest lockdown. Asia’s third-largest economy is seen hurtling toward its first full-year contraction since 1980, as several businesses shut, forcing 122 million people out of work last month.

- 13. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase May 07-2020 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil steadies as China imports rebound but glut weighs Reuters + NewBase Oil prices steadied on Thursday as data showed China’s crude imports rebounded, but market watchers expect gains to be capped by the glut in supplies as the coronavirus pandemic crushes global fuel demand. Brent crude was up by 64 cents, or 02.15%, to $30.36 a barrel 10.30 GMT, after dropping 4% on Wednesday. U.S. West Texas Intermediate futures gained 69 cents, or 2.88%, to 24.68 a barrel, after declining more than 2% in the previous session. Oil price special coverage

- 14. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Both contracts traded in an out of negative territory through the Asian morning on light trade with some markets on holiday. Oil prices were supported by data showing Chinese crude imports rose last month. Imports climbed to 10.42 million barrels day (bpd) in April from 9.68 million bpd in March, according to Reuters calculations based on customs data for the first four months of 2020. Overall exports from China also rose against expectations of a sharp drop. “Oil prices should eventually settle on a wide $10 range, with WTI crude’s upper boundary being around the $30 a barrel level, while Brent crude targets the $35 a barrel level,” said Edward Moya, senior market analyst at OANDA. While prices have risen since late April as some countries have started easing lockdowns put in place to combat the worst pandemic in a century, oil continues to be pumped into storage, leaving a massive mismatch between demand and supply. U.S. crude inventories were up for a 15th straight week last week, rising by 4.6 million barrels, the Energy Information Administration said on Wednesday. That was less than analysts had forecast in a Reuters poll, which suggested a 7.8 million-barrel rise, but the gain highlighted once again how much supply is being stored. Distillate inventories also rose sharply. Gasoline stocks, however, fell for a second week as some U.S. states eased lockdowns that had sharply hit traffic. “The latest report (on U.S. inventories) added to tentative evidence that — after a catastrophic few weeks — the pressure on the U.S. oil market is beginning to lessen,” Capital Economics said in a note. “That said, we wouldn’t rule out more turbulence in the coming weeks.” There are also signs that some oil producers are struggling to comply with an agreement between the members of the Organization of the Petroleum Exporting Countries (OPEC) and other suppliers, including Russia, to cut output by a record amount. Iraq, OPEC’s second-largest producer after Saudi Arabia, has not yet informed customers of impending restrictions on its oil exports. OPEC and allied producers — a grouping known as OPEC+ — agreed to cut production from May 1 by around 10 million bpd to stabilize prices amid the plunge in demand in economies ravaged by the coronavirus outbreak.

- 15. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage The Energy world - Special 01- May-2020 U.S.A: Low crude oil prices, record-high inventories, and low demand drive gasoline prices down https://www.eia.gov/petroleum/weekly/ On April 27, 2020, the U.S. average regular retail gasoline price was $1.77 per gallon (gal), the lowest price since February 2016. On May 4, the U.S. average gasoline price increased slightly to $1.79/gal. The United States declared a national emergency on March 13 in response to concerns regarding spread of the 2019 novel coronavirus disease (COVID-19). From March 16 to May 4, the U.S. average regular retail gasoline price fell by $0.46/gal. The lower gasoline prices reflect low crude oil prices, low gasoline demand, and rising gasoline inventories. As a result of reduced economic activity and stay-at-home orders aimed at slowing the spread of COVID-19, consumption of petroleum products and the price for crude oil (the primary input for producing gasoline) have both declined. The Brent crude oil price, which is generally more closely correlated than the West Texas Intermediate (WTI) price to the price of U.S. gasoline, settled at $18 per barrel (b) on May 1, down $15/b (45%) since March 13 and $53/b (74%) less than a year ago (Figure 1).

- 16. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Falling crude oil prices have coincided with decreasing transportation fuel demand, placing further downward pressure on gasoline prices. U.S. gasoline consumption (as measured by the four-week rolling average of product supplied) fell from 9.3 million barrels per day (b/d) the week ending March 13 to 5.3 million b/d the week ending on April 24. As consumption has decreased, gasoline inventories have risen to record levels despite refinery run cuts. On April 17, total U.S. gasoline inventories reached 263.2 million barrels, the highest level recorded since the U.S. Energy Information Administration (EIA) began collecting these data in 1990 (Figure 2). Gasoline inventories have since fallen slightly to 256.4 million barrels as of May 1. Although EIA does not collect weekly demand data on a regional basis, low refinery runs and high gasoline inventories indicate low demand in each region. As a result, gasoline prices have decreased in each region. In addition, the U.S. Environmental Protection Agency’s (EPA) temporary waiver of the requirement to switch to summer-grade gasoline is putting further downward pressure on gasoline prices. From March 16 to May 4, the average regular retail price of gasoline in the West Coast (Petroleum Administration for Defense District, or PADD, 5) fell $0.58/gal to $2.44/gal, the lowest price since March 2016. The West Coast retail gasoline price is typically higher than the average U.S. price because of the region’s tight supply and demand balance, geographical isolation from other U.S. refining centers— such as the Gulf Coast (PADD 3)—because of very limited gasoline transportation infrastructure, and gasoline specifications that are more costly to manufacture.

- 17. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Although the May 4, 2020, West Coast gasoline price is $0.65/gal higher than the U.S. average, it is $1.27/gal less than West Coast gasoline price for the same time last year. Total West Coast motor gasoline inventories increased by 5.0 million barrels from March 13 (when the national emergency was declared) to 35.0 million barrels on April 10, the largest inventory since 2013 (Figure 3). More recently, inventories have begun to decline, reflecting low refinery runs as gasoline inventories are drawn down. In the week ending May 1, weekly gross inputs into West Coast refineries fell to 1.7 million b/d, the least on record. The five weeks from April 3 through May 1 had the five lowest levels of West Coast refiner gross production of gasoline on record (going back to June 2010, when EIA began collecting these data). West Coast gasoline inventories have fallen during the past three weeks, but they are still higher than the previous five-year (2015–19) maximum. Gasoline inventories in the U.S. Gulf Coast have also increased. From March 13 to May 1, Gulf Coast gasoline inventories increased by 6.8 million barrels (8%) to 89.5 million barrels. Because of refinery run cuts and decreasing refinery yields of gasoline, Gulf Coast refinery gross production of motor gasoline fell to 2.9 million b/d for the week of April 24, the lowest level on record since June 2010, when EIA began collecting these data. The week of May 1, Gulf Coast refinery gross production of motor gasoline increased slightly to 3.0 million b/d. The high inventory levels are putting downward pressure on the price of Gulf Coast

- 18. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 gasoline, which fell to $1.49/gal on May 4, down $0.48/gal since March 16 and the lowest price since 2004. The Gulf Coast typically has the lowest retail gasoline price in the country because it has more than 50% of U.S. refining capacity and produces more gasoline than it consumes. However, the Midwest (PADD 2) had the country’s lowest gasoline price from March 30 to April 27 (Figure 4), reflecting lack of demand for gasoline in the region. The price of motor gasoline in the Midwest was $1.57/gal as of May 4, down $0.46/gal since March 16. Midwest gasoline prices were lower than Gulf Coast prices for five consecutive weeks, the first time Midwest prices have remained lower than Gulf Coast prices for more than two consecutive weeks since December 2008. As Midwest inventories have begun to decline and Gulf Coast inventories continue to build, the Gulf Coast price has again fallen below the Midwest price. The East Coast (PADD 1) and Rocky Mountain (PADD 4) regions have also seen falling gasoline prices. As of May 4, the East Coast price was $1.79/gal, down $0.40/gal since March 16. The Rocky Mountain price was $1.77/gal on May 4, down $0.55/gal since March 16.

- 19. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Like the rest of the country, both the East Coast and Rocky Mountain regions have experienced gasoline inventories higher than the previous five-year maximum. U.S. average regular gasoline price rises, diesel price falls The U.S. average regular gasoline retail price rose nearly 2 cents per gallon from the previous week to $1.79 per gallon on May 4, $1.11 lower than the same time last year. The Midwest price rose nearly 10 cents to $1.57 per gallon. The Rocky Mountain price fell nearly 4 cents to $1.77 per gallon, the East Coast price fell nearly 2 cents to $1.79 per gallon, the Gulf Coast price fell 2 cents to $1.49 per gallon, and the West Coast price fell more than 1 cent to $2.44 per gallon. The U.S. average diesel fuel price fell nearly 4 cents to $2.40 per gallon on May 4, 77 cents lower than a year ago. The Rocky Mountain price fell more than 6 cents to $2.37 per gallon, the West Coast, East Coast, Midwest, and Gulf Coast prices each fell nearly 4 cents to $2.90 per gallon, $2.51 per gallon, $2.25 per gallon, and $2.17 per gallon, respectively. Propane/propylene inventories rise U.S. propane/propylene stocks increased by 2.5 million barrels last week to 59.4 million barrels as of May 1, 2020, 7.5 million barrels (14.5%) greater than the five-year (2015-19) average inventory levels for this same time of year. Gulf Coast inventories increased by 1.2 million barrels, Midwest inventories increased by 0.9 million barrels, and East Coast and Rocky Mountain/West Coast inventories each increased by 0.2 million barrels.

- 20. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 2020 K. Al Awadi

- 21. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 For Your Recruitments needs and Top Talents, please seek our approved agents below