New base energy news issue 911 dated 21 august 2016

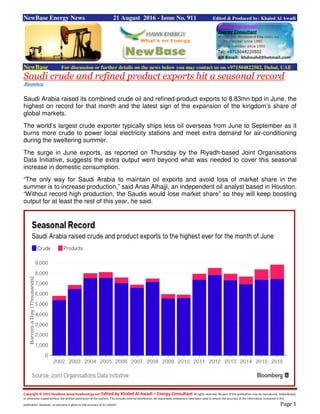

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 21 August 2016 - Issue No. 911 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi crude and refined product exports hit a seasonal record Bloomberg Saudi Arabia raised its combined crude oil and refined-product exports to 8.83mn bpd in June, the highest on record for that month and the latest sign of the expansion of the kingdom’s share of global markets. The world’s largest crude exporter typically ships less oil overseas from June to September as it burns more crude to power local electricity stations and meet extra demand for air-conditioning during the sweltering summer. The surge in June exports, as reported on Thursday by the Riyadh-based Joint Organisations Data Initiative, suggests the extra output went beyond what was needed to cover this seasonal increase in domestic consumption. “The only way for Saudi Arabia to maintain oil exports and avoid loss of market share in the summer is to increase production,” said Anas Alhajji, an independent oil analyst based in Houston. “Without record high production, the Saudis would lose market share” so they will keep boosting output for at least the rest of this year, he said.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Saudi Arabia supplied its overseas customers with 7.46mn bpd of crude and 1.37mn of refined petroleum products in June. The combined total is the most for that month since JODI started tracking flows in 2002. Output rose to 10.55mn bpd from 10.27mn in May, the data show. Saudi Arabia is engaged in a battle for market share with Iran and Russia and has cut prices to its customers in Asia. Iran is pushing for an increase in production following the loosening of international sanctions in January. Despite the growing competition, Opec officials have hinted at a potential deal, including a production freeze, during the next meeting of the International Energy Forum in Algiers in late September. Brent crude, the international benchmark, has rallied above $50 a barrel on talk of a potential freeze, despite scepticism from several analysts after a similar proposal failed in April. “At this stage we view the mentions of a freeze as a diversion from a continued drive from Saudi Arabia to gain as much market share as it can,” said Olivier Jakob, an analyst at consultants Petromatrix in Switzerland. Saudi crude and refined products exports were 450,000 bpd higher in June than in the same month of 2015 and up more than 1.1mn bpd from June 2014. Over the same period, Iran and Iraq have also boosted exports. Saudi Arabia told the Organisation of Petroleum Exporting Countries last week that its production rose further in July, reaching an all-time high of 10.67mn bpd. Khalid al-Falih, the kingdom’s energy minister, last week said the country was boosting oil production not only to meet the surge in local consumption during the summer, but also “in part to meet higher demand” from overseas customers. “We still see strong demand for our crude in most parts of the world, especially as supply outside Opec has been declining fast, supply outages increasing, and global demand still showing signs of strength,” he told the Saudi Press Agency.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Qatar’s Oil Products Demand at Record High on Planes, World Cup Bloomberg – Mohamed seirgi Drill pipes operate at the drilling head of an oil derrick in the Salym Petroleum Development oil fields near Salym, Russia, on Tuesday, Feb. 4, 2014. Salym Petroleum Development, the venture between Shell and Gazprom Neft, has started drilling the first of five horizontal wells over the next two years that will employ multi-fracturing technology, according to a statement today. Manual shutdown equipment is seen at an Anadarko Petroleum Corp. oil rig in Fort Lupton, Colorado, U.S., on Tuesday, Aug. 12, 2014. U.S. crude oil inventories rose by 1.4 million barrels in the week ended Aug. 8, to 367 million, compared with the consensus-estimated draw of 1.6 million. Qatar’s demand for oil products, boosted by an expanding airline and a pre-World Cup spending spree, is bucking a trend of slower consumption growth and even contraction in the region as economies slowed on lower oil prices. Average daily consumption of gasoline, jet fuel and other refined products was a record 228,000 barrels per day in the first five months of 2016, more than double the pace in 2011, according to data published by the Joint Organisations Data Initiative in Riyadh. Gasoline demand in Saudi Arabia, the world’s biggest crude exporter, contracted for the first time in at least a decade this year, while Oman’s consumption grew just 1 percent during the first four months of this year, below the annual average growth rate of 9.6 percent over the past decade, according to BMI Research. Qatar is in the second year of a $200 billion infrastructure upgrade ahead of hosting the 2022 soccer World Cup. It plans to build eight stadiums, a $35 billion metro and rail system, and a new city for 200,000 people north of the capital, Doha. Qatar Airways added at least 29 planes to its

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 fleet since moving to a new airport in 2014, a facility it plans to expand before the World Cup. Demand for kerosene doubled over the past two years to an average 113,000 barrels per day in the first five months of 2016, according to the latest JODI data. Slower economic growth pushed Saudi Arabia, the United Arab Emirates, Oman and Bahrain to reduce or eliminate fuel subsidies over the past year to limit government spending because of low oil prices. Qatar, the world’s biggest liquefied natural gas exporter, has also increased domestic energy prices to trim a projected budget deficit. "Purchasing power in Qatar is extremely high, which will allow people to continue consumption of petroleum products despite price increases," John Sfakianakis, director of economics research at the Gulf Research Center, said in a phone interview. "The aviation industry’s expansion and investments in infrastructure have made Qatar an outlier in the region because its non-oil economy is still growing." Qatar’s population was 2.48 million as of June 30, up from 2.34 million a year earlier, according to government data, and 1.71 million at the end of 2011, data compiled by Bloomberg show. Its economy is expected to grow 3.4 percent this year, according to the International Monetary Fund. That’s the fastest pace in the oil-rich Gulf Cooperation Council, which includes Saudi Arabia, Kuwait, Oman, Bahrain and the United Arab Emirates.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Iraq: DNO drilling new Tawke wells on back of profits Source: DNO DNO, the Norwegian oil and gas operator, has announced a second consecutive quarter of operating profits and the launch of an aggressive drilling campaign at the company's flagship Tawke fieldin the Kurdistan region of Iraq. Following an extensive workover campaign at Tawke, five new production wells will be drilled in the second half of the year to boost capacity. Two rigs are currently active at Tawke; the Tawke- 31 well, targeting the main Cretaceous reservoir, is the first production well to be drilled at the field since late 2014 and will reach target depth of 2,200 meters in September. A third rig will be added to drill an appraisal well in the fourth quarter at the previously discovered Peshkabir field. The company's operated production in the second quarter climbed 27 percent to 122,900 barrels of oil equivalent per day. Tawke production stood at 117,000 barrels of oil per day, nearly all of which was exported at an average price of USD 34 per barrel. Company-wide revenues reached USD 61 million, marking the fifth consecutive quarter in which revenues totaled USD 50 million or higher. DNO's operating profit in the second quarter was USD 16 million, up from USD 8 million the previous quarter. 'Resumption of regular and predictable export payments underpin new investments at Tawke and other fields,' said DNO's Executive Chairman Bijan Mossavar-Rahmani. 'There is more value we can unlock in Kurdistan,' he added. The company last month launched a cash and shares offer to acquire Kurdistan-focused Gulf Keystone Petroleum conditional upon completion of the latter's financial restructuring, timely and irrevocable undertaking of support by the largest noteholders and bondholders and approvals from the Kurdistan Regional Government. Combined, DNO and Gulf Keystone would place first among European independent E&P companies in terms of production and also proven and probable (2P) reserves.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Thailand's PTT to boost LNG imports in 2017 as local fields fade Source: Reuters Thailand's largest energy firm PTT plans to import at least 5 million tonnes of liquefied natural gas (LNG) in 2017, up from 3 million tonnes this year as local gas production fades. State-controlled PTT expects to conclude in September talks with several suppliers including Royal Dutch Shell and BP to buy LNG under long-term contracts, chief executive Tevin Vongvanich told a news conference on Thursday. Thailand, which uses natural gas for nearly 70 percent of its power generation, has become increasingly reliant on LNG imports as its own domestic gas fields are slowly being depleted. PTT is the nation's sole gas provider. To boost revenue from non-oil businesses, PTT is seeking partners to open budget hotels at its petrol stations in Thailand and to open more coffee outlets at facilities in neighbouring Southeast Asia, he said. The company also plans to spend about 50-100 million baht supporting clean energy technology, chief financial officer Wirat Uanarumit said. PTT expects to continue to make profit in the second half of the year, with lower feed gas costs supporting its core gas business, Wirat said. Unlike the first half, PTT has no major shutdowns planned for the latter half of the year, he said. On Monday, PTT reported a 4.8-percent rise in second quarter net profit as its strong gas business outweighed the weak performance of its petrochemical and refining businesses. 'As domestic resources decline, we are at the last phase of gas production,' Tevin said, adding that PTT aimed to buy at least 3 million tonnes of LNG via long-term contracts, as well as making purchases in spot markets. Thailand currently has a long-term contract with Qatar for supplies of up to 2 million tonnes of LNG per year. Hit by the decline in global oil prices, PTT has cut its 2016 investment budget to 43.31 billion baht ($1.25 billion) and will focus more infrastructure including LNG terminals and gas pipelines, Tevin said. PTT is in process of doubling the intake capacity of its 5-million tonne per year LNG import terminal at Map Ta Phut in the country's east, which is expected to be completed in 2017, Tevin said.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Nigeria:oil disruptions increase as a result of militant attacks U.S. Energy Information Administration, Short-Term Energy Outlook, August 2016 Crude oil production disruptions in Nigeria reached 750,000 barrels per day (b/d) in May 2016, the highest level since at least January 2009. The increased disruptions come as militants continue to focus attacks on oil and natural gas infrastructure in the West African region. Nigeria is a member of the Organization of the Petroleum Exporting Countries (OPEC) and was Africa's largest oil producer until Angola's oil production surpassed Nigeria's earlier this year. Nigeria's crude oil production disruptions are concentrated in the Niger Delta region, an oil-rich area bordering the Gulf of Guinea that is the mainstay of the country's crude oil production. Since the beginning of 2016, the Niger Delta Avengers (NDA) have conducted many attacks on oil and natural gas infrastructure throughout the region. Although not the only militant group conducting attacks in the region, the NDA is currently the most active. The NDA's attacks have resulted in immediate and severe disruptions in crude oil production, as some of the attacks have targeted key oil- gathering and export infrastructure. Nigeria's oil production averaged 1.9 million b/d in 2015. By May 2016, Nigerian oil production had fallen to 1.4 million b/d, nearly a 30-year low. After some repairs, and in the absence of major new attacks, some of the disrupted production was restored, and crude oil output averaged 1.6 million b/d in June.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Despite this recent increase, the continued threat of militant attacks poses a risk to sustained production. The NDA has claimed responsibility for several attacks since the beginning of July, and outages once again rose in July. According to trade press reports, exports of multiple Nigerian crude oil grades, including Bonny Light, Forcados, Brass River, and Qua Iboe, have been under periods of force majeure since the beginning of 2016, meaning companies are released from export obligations as a result of circumstances beyond their control. Significant disruptions in oil production resulting from NDA attacks, combined with relatively low crude oil prices, have had a significant effect on Nigeria's economy. According to Nigeria's Ministry of Budget and National Planning, Nigeria's oil sector provides 70% of government revenue and 95% of export revenue. The NDA attacks are largely in response to President Buhari's cutback on amnesty payments and termination of security contracts to former militants. The group threatens to continue the attacks until the Nigerian government meets its demands, some of which include greater regional control of local oil production, continuation of the amnesty program, and compensation to Niger Deltan communities polluted by oil exploration and production. The Nigerian government announced in June that it had agreed to a ceasefire with the NDA, but the group refutes that statement and has conducted numerous attacks since then. More recently, the Nigerian government announced it will resume payouts to the militants under the amnesty program. However, because payouts are just one of the NDA's many demands, crude oil production stoppages are likely to continue until the Nigerian government and the NDA can reach a comprehensive agreement. EIA expects Nigerian oil production to remain depressed through 2017 as a result of militant attacks.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 US: Oil Drillers Add Rigs For Eighth Week In Row by Reuters U.S. drillers this week added oil rigs for an eighth consecutive week, the longest recovery streak in the rig count in over two years, as crude prices rebounded toward the key $50-a-barrel mark that makes the return to the well pad viable. Drillers added 10 oil rigs in week to Aug. 19, bringing the total rig count to 406, compared with 674 a year ago, energy services firm Baker Hughes Inc said on Friday. The oil rig count has risen by 76 since the week ended July 1, the most weekly additions in a row since April 2014, after U.S. crude prices touched $50. Energy companies kept adding rigs despite prices dipping below $40 earlier this month but analysts have revised down rig count growth forecasts. Crude futures, however, have surged nearly $10 a barrel, or more than 20 percent, in just over two weeks on speculation that Saudi Arabia and other key members of the Organization of the Petroleum Exporting Countries will agree next month to a production freeze deal with non-OPEC members led by Russia. On Friday, U.S. crude hovered at $48 a barrel, versus its 2016 peak of $51.67. The two-month long hike in the rig count has reinforced worries of some analysts that higher oil prices could spur more output and undercut efforts to balance supply-demand in a glutted market. "The U.S. production factor has taken on a more bearish appearance as the oil rig counts have increased appreciably and weekly EIA (Energy Information Administration) production estimates have shown a surprising uptick," said Jim Ritterbusch of Chicago-based oil markets consultancy Ritterbusch & Associates. "We are maintaining a theme that the magnitude of the rig increases that have been primarily developing within the Permian will prove sufficient to force leveling into lower-48 output, with U.S. crude production likely to post an increase from next month into October."

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 21 August 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Crude Oil price Caps Biggest Weekly Gain Since March Bloomberg + newBase Oil capped its strongest weekly increase in five months after entering a bull market as investors weighed speculation that OPEC talks next month could lead to an output freeze, and U.S. inventories dropped. Futures rose 0.6 percent in New York. While OPEC is unlikely to reach a deal to freeze production, its plans to hold informal talks in Algiers next month “were the spark” behind oil’s rally, according to Morgan Stanley. U.S. crude inventories dropped the most in five weeks through Aug. 12, while fuel stockpiles slid a third week, Energy Information Administration data showed Wednesday. Oil has climbed more than 20 percent since it dipped below $40 a barrel earlier in the month, meeting the common definition of a bull market. Russian Energy Minister Alexander Novak said that the nation was open to discussing a freeze after his Saudi counterpart Khalid Al-Falih said that informal talks in September may lead to action to stabilize the market. While money managers increased wagers on rising oil prices by the most since January during the week ended Aug. 9, bearish bets on crude remained at record-high levels, according to the Commodity Futures Trading Commission. Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 "It’s kind of a perfect storm that has rallied this market, but on the other hand it has nothing to do with fundamentals," said Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York. "It’s really a short-covering rally that’s been fueled by OPEC rumors." West Texas Intermediate for September delivery advanced 30 cents to settle at $48.52 a barrel on the New York Mercantile Exchange. The contract gained 9.1 percent this week, the most since March. Total volume traded was in line with the 100-day average. Output Freeze Brent for October settlement slipped 1 cent to close at $50.88 a barrel on the London-based ICE Futures Europe exchange. The contract advanced $1.04 to close at $50.89 on Thursday, also entering a bull market after climbing more than 20 percent from its early-August low. The global benchmark crude settled at a $1.77 premium to WTI for October. U.S. oil drillers added 10 rigs this week, extending the biggest and longest increases since April 2014, Baker Hughes Inc. data show. Technical analysis shows the relative strength index, or RSI, for WTI is approaching the 70-point threshold that shows prices have risen too quickly. The dollar rebounded after its longest slump since April. A stronger dollar weakens investor appetite for commodities. "One has to be impressed that the dollar’s recovery is strong and it’s impacting commodities like gold, but oil is fine," said Phil Flynn, senior market analyst at Price Futures Group in Chicago. "The momentum is still very bullish." An agreement to freeze output is within reach as Saudi Arabia, Iran and non-OPEC member Russia are producing at, or close to, maximum capacity, Chakib Khelil, former OPEC president and Algerian energy minister, said in a Bloomberg Television interview on Aug. 17. Iranian Oil Minister Bijan Namdar Zanganeh hasn’t decided yet whether to participate in the talks in Algiers next month, a spokesman said on Aug. 16. Iran’s refusal to join the April talks in Doha ultimately prompted the Saudis to block a deal. "After Doha you can never say never, but I think a lot of people see this deal coming through," said Flynn.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 OPEC Freeze Wouldn't Be So Potent as Gulf Rivals Pump More Bloomberg Even if OPEC strikes a deal with Russia next month in Algiers to freeze oil production, success will mean a lot less than when they tried and failed four months ago. (Bloomberg) -- Even if OPEC strikes a deal with Russia next month in Algiers to freeze oil production, success will mean a lot less than when they tried and failed four months ago. Oil has rallied more than 10 percent since the Organization of Petroleum Exporting Countries said that it will hold an informal meeting in the Algerian capital, fanning speculation the group could complete a supply agreement with rival producers that sputtered in April. Iran may now drop its refusal to join a freeze after restoring most of the crude output curbed by sanctions, a development analysts say makes a deal more likely, but also less worthwhile. “A freeze at 34 million barrels a day is not the same as one at 33 million barrels a day,” said David Hufton, chief executive officer of PVM Group in London, referring to the broker’s own estimate for total OPEC output. “It pushes the re-balancing process back at least a year.” Saudi Arabia and Iran, whose political rivalry thwarted the previous negotiations, are together pumping about 1 million barrels a day more than in January -- the proposed level of the original freeze. That additional crude has prolonged a global oversupply, preventing the market from sliding into deficit this quarter, according to Bloomberg calculations based on International Energy Agency data. Prices have struggled to go much higher than $50 a barrel. After the longest run of gains since March, Brent crude, the international benchmark, was down 0.5 percent at $50.62 at 2:40 p.m. in London on Friday. Sixteen nations representing about half the world’s oil output gathered on April 17, but talks broke down because of Saudi Arabia’s last-minute demand that Iran must also participate. Iran wasn’t at

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 the Doha meeting because it refused to consider any limits on its production, which had only been released from nuclear-related sanctions in January. Record Production Now that major producers including Iran are pumping at or close to capacity, they have little to lose by agreeing to a cap, Chakib Khelil, former OPEC president and Algerian energy minister, said in a Bloomberg television interview Aug. 17. Iran produced about 600,000 barrels a day more in July than January as it restarted oil fields shuttered during almost four years of sanctions, according to the IEA. Saudi Arabia pumped an extra 410,000 a day, lifting output to a record as it met surging domestic demand and defended its share of global markets, the IEA said. “All the conditions are set for an agreement,” said Khelil, who steered OPEC in 2008, the last time it announced a supply cut. “Russia, Iraq, Iran and Saudi Arabia are reaching their top production level. They have gained all the market share they could gain.” There are still reasons to think Iran could be reluctant to join a freeze. The nation will refuse to accept any limits as long as officials insist they can boost output further, said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. Iran is also trying to attract billions of dollars of investment from international oil companies to expand production capacity, which would conflict with submitting to a cap, said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. Iranian Oil Minister Bijan Namdar Zanganeh hasn’t decided yet whether to participate in the talks in Algiers, a spokesman said on Aug. 16. Market Psychology Other OPEC members who supported an agreement in April may now be less keen, or seek exemptions, because they are suffering output losses, said Olivier Jakob, managing director at Petromatrix GmbH in Zug, Switzerland. Nigeria’s production is near a 27-year low as militants attack oil pipelines while Venezuela’s output dipped to the lowest since 2003 amid an economic crisis. They may join conflict-hit Libya, who refused to freeze at reduced levels back in April, Jakob said. Major producers have kept expectations low. Saudi Arabian Energy Minister, Khalid Al-Falih, said only that “there is an opportunity” to discuss “possible action that may be required to stabilize the market,” according to the Saudi Press Agency. Russia sees no need for a freeze at current crude prices, while leaving open the possibility for the future, Energy Minister Alexander Novak said Aug. 8. Even with a deal, the extra oil OPEC is pumping means it would be less effective than the Doha proposal, said Algeria’s Khelil. Still, the demonstration of unity after a series of inconclusive meetings would improve the “psychology” of the market, he said. “This time it’s more psychological because they will retain the surplus in the market,” said Khelil. “It would have been better before, but it’s never too late.”

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 North Sea Oil Prices Rebound as Glut of Floating Crude Clears Bloomberg - Laura Hurst Demand for the commodity has increased as traders take advantage of remaining discounts before maintenance begins at the U.K.’s largest oil field. The result: a whittling away at the backlog of floating storage that has persisted for months. The “timing is right” for buying interest in North Sea crudes to rise, David Reid, an analyst at Vienna-based JBC Energy GmbH, said by e-mail. Planned work at the 170,000 barrel-a-day Buzzard field, scheduled to begin in mid-September and last about a month, will curtail production and push up prices, he said. The movement of crude-laden vessels to port reverses a floating-storage build-up that peaked at more than 11 million barrels in late July. Earlier in the summer, faltering demand spurred by unexpected refinery strikes led to excess storage of the fuel at sea. Now, with discounts vanishing, it’s more profitable to send the oil to shore. Declining Volumes Crude kept in North Sea tankers has declined by more than 50 percent, to five million barrels, within the last three weeks, according to ship-tracking data compiled by Bloomberg. Ships loaded with Brent and Forties oil, two of the region’s primary grades, discharged their cargoes in Germany and Rotterdam this week after being anchored for as many as four months. Other factors helping to reduce the excess in North Sea storage include supply disruptions in Nigeria and an increase in crude purchases in Asia, according to Amrita Sen, chief oil analyst at

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 London-based Energy Aspects. “Chinese buying in particular is returning slowly,” she said in an e- mail. Forties crude, one of four grades used to price Dated Brent, the global benchmark, traded at a two-month high early this week. The grade last sold at a discount of 15 cents a barrel to that benchmark, versus 65 cents two weeks earlier, according to data compiled by Bloomberg. Meanwhile, the structure of derivatives used in the North Sea for speculation or hedging is shifting toward backwardation, an indication of a strong market where existing cargoes sell at higher prices than those for later delivery. Brent futures on Thursday climbed above $50 a barrel into a bull market, capping a six-day run of price increases. Price Rally Crude moving out of North Sea storage is “consistent with what we’re seeing in the overall rally in prices,” Craig Pirrong, director at the Global Energy Management Institute at the University of Houston’s Bauer College of Business, said in a phone interview. An increase in demand will draw oil out of storage, and “it tends to come out in a run.” Two supertankers and two smaller vessel loaded with Forties, Brent and Norwegian Oseberg crude remain off the U.K.’s shores. The two-million-barrel carrier Maran Thetis has been floating near Scotland’s Hound Point terminal since July 26. A similar vessel, the Front Ariake, is anchored at Southwold, England, after receiving Forties and Brent crude via two ship-to-ship transfers three weeks ago.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Special Coverage News Agencies News Release 21 August 2016 Shale Drillers Party Like It’s 2014 as Oil Finds Bull Market Bloomberg - David Wethe Shale drillers are adding the most oil rigs since crude was worth $100 a barrel as confidence that OPEC may finally agree to freeze output pushed futures into a bull market. U.S. producers have put 76 oil rigs back to work in eight weeks, the biggest and longest increases since 101 were added a couple months before the price crash started in mid-2014, Baker Hughes Inc. data released Friday show. The count rose by 10 this week, bringing the total oil rig count to 406. "As oil has remained in the $40-$50 range, it’s not surprising to see the rig count still advancing," Luke Lemoine, an analyst at Capital One Southcoast in New Orleans, wrote Friday in an e-mail. "With oil moving towards $50, we believe the oil rig count can approach 600 rigs over the next year." Members of the Organization of Petroleum Exporting Countries are on track to agree on an output-freeze deal as its biggest producers pump flat-out, said Chakib Kehlil, the group’s former president. Russia and Saudi Arabia have both hinted that the countries are open to discussing actions that would help stabilize the market.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 "If they go to Algiers with some type of agreement, they aren’t going to back out this time," Phil Flynn, senior market analyst at Price Futures Group in Chicago, said earlier this week. "It’s definitely offering support." Bull Run Oil drillers begun returning parked rigs to service this summer after prices rebounded from a 12- year low in February. West Texas Intermediate, the U.S. benchmark crude, rose 22 percent through Thursday from a dip below $40 a barrel earlier in the month, meeting the common definition of a bull market as futures headed for the strongest weekly increase in five months. While little changed on Friday, WTI was up 8.4 percent for the week at $48.21 a barrel as of 1:31 p.m. in New York. The recent drilling expansion has led to speculation that U.S. production, which has been declining from a peak in June of last year, may rebound and bring back the specter of a growing supply glut. Output climbed by 152,000 barrels a day last week, in part because of an adjustment to address disparities between weekly and monthly data, the Energy Information Administration said Wednesday. The review showed production is holding up better than the government previously thought. Explorers in the Permian Basin of West Texas again led the week’s advance, bringing seven rigs back to work, for a total of 196 oil rigs in the nation’s biggest field. It was the Permian’s biggest weekly increase in oil rigs in a month.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 26 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 21 August 2016 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19