Yemen Conflict Won't Impact Oil Flow

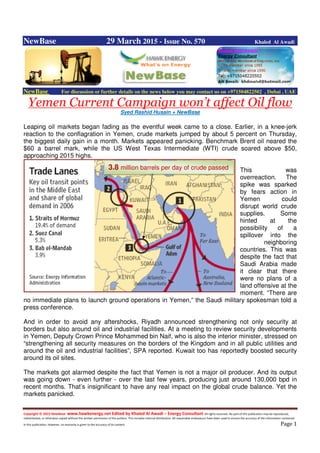

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 29 March 2015 - Issue No. 570 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Yemen Current Campaign won’t affect Oil flow Syed Rashid Husain + NewBase Leaping oil markets began fading as the eventful week came to a close. Earlier, in a knee-jerk reaction to the conflagration in Yemen, crude markets jumped by about 5 percent on Thursday, the biggest daily gain in a month. Markets appeared panicking. Benchmark Brent oil neared the $60 a barrel mark, while the US West Texas Intermediate (WTI) crude soared above $50, approaching 2015 highs. This was overreaction. The spike was sparked by fears action in Yemen could disrupt world crude supplies. Some hinted at the possibility of a spillover into the neighboring countries. This was despite the fact that Saudi Arabia made it clear that there were no plans of a land offensive at the moment. “There are no immediate plans to launch ground operations in Yemen,” the Saudi military spokesman told a press conference. And in order to avoid any aftershocks, Riyadh announced strengthening not only security at borders but also around oil and industrial facilities. At a meeting to review security developments in Yemen, Deputy Crown Prince Mohammed bin Naif, who is also the interior minister, stressed on “strengthening all security measures on the borders of the Kingdom and in all public utilities and around the oil and industrial facilities”, SPA reported. Kuwait too has reportedly boosted security around its oil sites. The markets got alarmed despite the fact that Yemen is not a major oil producer. And its output was going down - even further - over the last few years, producing just around 130,000 bpd in recent months. That’s insignificant to have any real impact on the global crude balance. Yet the markets panicked. 3.8 million barrels per day of crude passed

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Yemen’s strategic location, from a crude movement point of view, appeared contributing to the initial reaction of the markets to the events of the past week. Besides being a neighbor to the most important oil producer in the world, Yemen is also located along the oil trading chokepoint of Bab el Mandeb, a sliver of water that connects the Red Sea to the Gulf of Aden. The waters between Yemen and Djibouti, known as Bab el-Mandeb, are less than 40 kilometers wide, and considered by the US Energy Information Administration to be a “chokepoint” for global oil supplies. The passage connects oil tankers from the Mediterranean to the Indian Ocean. Crude carrying vessels need to pass through the Yemen coastline via the Gulf of Aden to get to the Suez Canal, a key passageway to Europe. As per the EIA estimate, some 3.8 million barrels per day of crude passed through Bab el-Mandeb in 2013. And the “closure of the two-mile strait would force tankers to sail around the southern tip of Africa to reach European, North American, and South American markets,” the US Department of Energy says. If the corridor is blocked, the alternative route via the Cape of Good Hope would raise tanker costs to $150,000 from $45,000. But is that a real threat in the current setup? After all, the US Navy routinely patrols the region. And additionally Egypt has sent naval vessels to help secure the passage. And this is despite the fact that the adversaries - the Houthis - do not exactly have a strong maritime presence. The conflict hence is likely to remain onshore. And any spillover from into neighboring borders also doesn’t seem feasible at this stage. Land forces are not in operation - at least - as yet. And in the meantime, not only the borders have been secured further, there are also hints that allies may also join in to protect the Saudi borders. Already Pakistan has hinted that the security of Saudi Arabia is of strategic importance to Islamabad. And it would go to any extent to protect it. Egypt in the meantime, has also indicated it would be ready to send in forces, indeed if and when required and solicited. Additionally, another thing that needs to be underlined here, from crude viewpoint, is that oil installations of the Kingdom are not only fully secured, they are thousands of kilometers away from point of action. Any disruption in crude flow, thus at best, remains a farfetched idea at this moment.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 And it is perhaps in this perspective that most analysts think of the current spike to be a temporary –short-lived - phenomenon only. Some analysts are attributing some of last week’s rally to short covering after steep losses in early March, underlining the gains should be brief as worries about a supply glut continue to linger in the market. “You don’t want to be short oil when there are stories about bombings next door to Saudi Arabia, even if it’s the Saudis who are leading the charge,” Joseph Posillico, senior vice president of energy futures at Jefferies in New York was quoted in the press as saying. “But with shorts squeezed out of the market, particularly those under $50 WTI, we are reassessing where to go. I personally don’t think this rally has legs as fundamentally nothing’s changed.” There’s no need for markets to overreact as Yemen is not a significant player in the oil industry, writes Nick Cunningham. The surge comes amid growing concerns of oil overflowing storage tanks in the US and around the world, which threaten a new round of weakness in oil prices, he emphasized. The markets are overreacting. Yemen is a negligible oil producer, and any disruption to its output would hardly be noticed on the global markets. Not only does Yemen produce very little oil, but its production has already been declining for much of the last 15 years. And this possibly means that once the initial shock of the ongoing conflict wears off, oil prices will likely pare back their gains, with markets refocusing on weak fundamentals. Crude oil storage at Cushing is three-quarters full. China’s strategic petroleum reserve is nearly full. US refineries are temporarily closing for spring maintenance. All of these things will push the price of oil back down. That however will need to be weighed against falling rig counts and perhaps the beginning of oil production declines in several key shale areas in the United States, Cunningham points out. “Just because Saudi Arabia and others conducted air strikes doesn’t mean the oil market becomes suddenly tight,” Masak Sumetsu, manager of the energy team at Brokerage Newedge in Tokyo, told Reuters. There is indeed little rationale for the oil markets to be rattled at this stage. Despite the current spike, sooner, rather than later, normalcy is bound to prevail and markets to get back to routine.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi SABIC: Trade liberalization driving force for Asia’s sustainability Saudi Gazette + NewBase The Saudi Basic Industries Corporation (SABIC) reiterates commitment to China and Asia as a partner for sustainable development and inclusive growth at the annual Boao Forum for Asia (BFA) Annual Conference 2015, China. The world’s second largest diversified global chemical company emphasized the criticality of continued investments in people and innovation. The senior leadership of the world’s second largest diversified global chemical company, SABIC, contributed their thoughts and perspectives to multilateral discussions focused around this year’s theme – “Asia’s New Future: Towards a Community of Common Destiny”. The robust discussions and commitment to a better future for all that are fostered here have played an integral role in the success story that is Asia today,” said Prince Saud bin Abdullah bin Thenayan. “Challenges doubtless lie ahead. Conventional thinking will not be adequate in addressing these challenges – bold, new paradigms and models are required. However, I am confident that with the right kind of cooperation and the right kind of policies – such as trade liberalization – these challenges can be overcome.” Trade flows between the nations of the Gulf region and the peoples of East and South Asia have been intensifying over the past decades. In no small part, that trade is what has propelled the growth trajectories of many of the region’s economies, accelerating the shift in global economic power towards emerging economies. Integral to continued growth however, will be a common

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 commitment to investment in innovation for sustainable development and growing the region’s already considerable human capital. “The right people and the right technology must also be complemented by trade liberalization, both in terms of the movement of goods and investment,” Al-Benyan underscored. “From SABIC’s perspective, this is one of the most beneficial structural reforms emerging nations could undertake – especially between East Asia and the Middle East. As China makes a successful transition from an investment-led growth model to one driven by consumption and innovation, the freer and reliable movement of high quality goods – such as chemicals – between regions, will undoubtedly fuel further sustainable prosperity and economically benefit everyone.” “At SABIC, we are passionate about building relationships, innovation and sustainability into the DNA of our operations. In particular, our focus on sustainability is intensifying. We firmly believe that sustainability cannot be an afterthought and when we look at our products and manufacturing processes, we no longer talk about a ‘cradle-to-grave’ cycle, but rather a ‘well-to-wheel, cradle-to- cradle’ cycle, wherein every bit of value must be used for the maximum sustainable benefit of society,” Al-Benyan pointed out. Operating in Asia since the 1980s, SABIC is committed to be a partner to China and the countries of Asia to support the drive to inclusive and sustainable growth. Today SABIC contributes wherever it operates through investment, business and community partnerships and job creation. It has set up technology and innovation centers globally to bring its research closer to its markets, tapping on local talent to develop solutions tailor-made to in-country requirements. In 2013, SABIC opened two new innovation centers in Asia with a combined initial investment of $200 million - one in Shanghai, China and the other Bengaluru, India - bringing the total number of research facilities it has around the world to 19, of which five are in Asia including Japan & Korea. SABIC also partners local educational institutions to bring together the best of academic thinking and industry expertise in China. These projects reflect SABIC’s enduring focus on embedding innovation, ingenuity and collaboration into the company’s DNA with the single-minded goal of developing a deeper understanding of – and real-world, rooted-in-sustainability solutions to – customers’ needs.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Ethiopia Expects to Produce Gas by 2017 Ethiopia could begin producing and exporting natural gas by 2017, according to Prime Minister Hailemariam Desalegn. According to news agency Reuters, officials from the mines ministry say the Calub and Hilala fields in the Ogaden Basin have deposits of 4.7 trillion cubic feet of gas and 13.6 million barrels of associated liquids, both discovered in the 1970s but not yet exploited. Several firms have already acquired licenses to explore more than 40 blocks throughout Ethiopia in the past four years, the vast majority of them in the southeastern Somali Region, Reutersadded. "Studies show the existence of natural gas reserves in several places, and they will all be gradually developed," Hailemariam told a press conference in the Ethiopian capital. Hailemariam stated that a Chinese firm is carrying out activities on the Calub and Hilala reserves. "In the next two years, we plan to start exporting and using the natural gas from these areas," Hailemariam said. China's GCL-Poly Petroleum Investments signed a production sharing deal with Ethiopia's mines ministry in late 2013 to develop both fields, according to Reuters. "GCL-Poly Petroleum Investments will fund the pipeline that will transport the Ethiopia gas to Djibouti for a total cost of more than $4 billion, of which $3 billion will be invested in the Djibouti section," said Mohamed Nour, a communications adviser at Djibouti's energy ministry.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 UK:Egdon provides update on Wressle-1 well testing Source: Egdon Resources AIM-listed Egdon Resources has announced the results of the second Penistone Flags flow test at the Wressle-1 oil and gas discovery in licence PEDL180 located to the East of Scunthorpe, where Egdon operates with a 25% interest. Zone 3a in the Penistone Flags was perforated over a 7.5 metre interval and has produced good quality oil with a gravity of 33o API. A total of 98.5 barrels of oil were recovered during the test (of which flow induced by swabbing operations produced 34.3 barrels of oil). This equates to approximately 77 barrels of oil per day (bopd). To date, the Wressle-1 well has flowed oil and gas from three separate reservoirs, the Ashover Grit, the Wingfield Flags and the Penistone Flags. The flow test result from Zone 3a has confirmed the presence of an oil column below the gas leg in Zone 3 of the Penistone Flags.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The downhole pressure and oil sample data from all tests will now be interpreted and integrated into an updated field model to inform future development planning. The next steps in evaluating the discovery will be to undertake a pumped extended well test (EWT) of the Ashover Grit and Penistone Flags oil intervals to quantify the production levels that could be attained during production. Commenting on the test results and the planned forward programme at Wressle, Mark Abbott Managing Director of Egdon Resources said: 'The results from Wressle continue to be very positive. The latest test has confirmed the presence of an oil column below the gas zone in the Penistone Flags, albeit in tighter sandstones. To date the well has successfully flowed hydrocarbons from four discrete intervals, with the Penistone Flags delivering a facilities restricted gas flowrate of 1.7 mmcfd, plus an aggregate 89 bopd; free- flowing rates of up to 182 bopd and 0.46 mmcfd from the Wingfield Flags and 80 bopd from the Ashover Grit. This totals 710 barrels of oil equivalent per day from all zones. We are now planning a pumped EWT to validate the optimised production potential that could be obtained from the Wressle discovery. We will now focus on integration and interpretation of the engineering and geotechnical data that will provide the information needed to quantify the resource volumes and optimise the field development and monetisation options. The EWT is planned to commence in mid May with operations expected to continue for up to two months.'

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Pakistan gets first gas from LNG terminal Energy-hungry Pakistan has become the newest member of global LNG importing nations with the arrival of the first tanker carrying a cargo of the chilled fuel. Excelerate Energy’s 150,900 cbm FSRU Exquisite, which is chartered by Engro Elengy, arrived at Pakistan’s first LNG import terminal at Port of Qasim on Thursday. It sailed from the Ras Laffan Port in Qatar. “At 20:40h yesterday ( March 27), we commenced discharging the gas into the grid after regasification,” Sheikh Imran-ul-Haque, Chief Executive Officer of Engro Elengy told LNG World News in an emailed statement. The fuel is supplied to the state-owned Sui Southern Gas Company’s gas distribution network via a new high-pressure pipeline. Pakistan’s first LNG import terminal, operated by Engro Elengy, has the capacity for regasification of up to 4.5 million tons of LNG per year. Pakistan heavily relies on imports of conventional fuels to fire its power stations. “LNG is much more environmentally friendly when compared to heavy oil or coal. In addition, it will be used to generate power instead of the expensive oils and will result in lower cost of generation,” Sheikh Imran-ul-Haque said earlier this week. 6, 2015

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S. ethanol exports in 2014 reach highest level since 2011 Source: U.S. Energy Information Administration, Petroleum Supply Monthly According to EIA monthly supply data through December 2014, which EIA released in late February, U.S. exports of fuel ethanol in 2014 reached their second-highest level at a total of 826 million gallons. This level was second only to the 1.2 billion gallons exported during 2011 and 33% more than exports of fuel ethanol in 2013. Similarly, U.S. imports of ethanol, which totaled approximately 377 million gallons during 2013, fell by 81% to a total of 73 million gallons in 2014, their lowest annual level since 2010. As a result, the United States was a net exporter of fuel ethanol for the fifth consecutive year and exported the fuel to 37 different countries in 2014. In the United States, ethanol is primarily used as a blending component in the production of motor gasoline (mainly blended in volumes up to 10% ethanol, also known as E10). Corn is the primary feedstock of ethanol in the United States, and large corn harvests have contributed to increased ethanol production. The U.S. Department of Agriculture estimates that the United States produced a record 14.2 billion bushels of corn in 2014, 3% higher than the previous record set in 2013. Given the uncertainty surrounding future Renewable Fuel Standard (RFS) targets and the lack of significant demand for higher ethanol blends in 2014, the growth in ethanol output had two primary outlets: it can either be blended into domestic gasoline or it can be exported. U.S. gasoline blending grew for the second consecutive year in 2014, with gasoline consumption increasing slightly from 2013 levels. As gasoline consumption increases, more ethanol is able to be used as a blendstock (as E10). Additional volumes of ethanol beyond requirements for E10 blending and relatively small volumes used in higher ethanol blends such as E85 (85% ethanol and 15% gasoline) were exported in 2014. Canada remained the top destination for U.S. ethanol exports in 2014, receiving 336 million gallons, or about 41% of all U.S. ethanol exports. Brazil, the United Arab Emirates, and the

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Philippines all imported at least 50 million gallons of U.S. ethanol in 2014; 33 other countries received less than 50 million gallons each. U.S. ethanol has been a competitively priced octane booster for gasoline in foreign markets as well as an attractive option for meeting renewable fuel and greenhouse gas emissions programs standards. In addition, countries such as Canada and Brazil have ethanol blending mandates that continue to generate demand for U.S. ethanol. Export volumes to Brazil increased by 146% in 2014 in part because of the need to meet Brazilian ethanol demand. Brazilian ethanol producers have already lost significant market share internationally over the past few years as U.S. exports have grown, in large part because of abundant U.S. corn harvests. As a result, reports state that as many as 60 Brazilian ethanol plants were temporarily closed in 2014. Brazilian ethanol producers were also hurt by a lack of U.S. ethanol import demand in 2014, driven by uncertainty surrounding future RFS targets in the United States, which have been a strong driver of U.S. demand for sugarcane ethanol from Brazil in previous years. Sugarcane ethanol, unlike corn ethanol, generally counts as an advanced biofuel under the RFS program, which includes targets for several distinct categories of biofuels. The United States imported 73 million gallons of ethanol in 2014, a decrease of more than 81% from 2013. About 74% of U.S. imports came from Brazil, with the remaining gallons primarily from Guatemala, Canada, and the Netherlands. U.S. import demand for ethanol was driven lower primarily because of RFS targets that are not yet finalized along with strong domestic production and import quantities of biomass-based diesel, which, like sugarcane, also counts as an advanced biofuel under the RFS program. The California Low Carbon Fuel Standard, which includes incentives for increased blending of sugarcane ethanol, did little to draw in Brazilian volumes of ethanol in 2014, with slightly more than 10 million gallons entering the United States on the West Coast, down from 126 million gallons in 2013. Given the existing ethanol production capacity coupled with the ongoing constraints for blending ethanol into domestic gasoline, the United States likely will continue to remain a strong exporter of ethanol in 2015. Ultimately, the key drivers for ethanol exports this year are the finalized levels of RFS targets for 2014 and 2015, future corn crop yields, and ethanol producer profitability. Increased exports of ethanol to Brazil in 2015 may be supported by an increase in the Brazilian ethanol blend level from 25% to 27%, which took effect in mid-March.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Oil Price Drop Special Coverage Oil prices ease as market downplays supply threat from Yemen Reuters + NewBase Oil prices fell over a percentage point on Friday as traders estimated that the threat of a disruption to world crude supplies from Saudi Arabia-led air strikes in Yemen was low. Goldman Sachs said in an overnight note that the strikes in Yemen would have little effect on oil supplies as the country was only a small crude exporter and tankers could avoid passing its waters to reach their ports of destination. Internationally traded Brent crude futures were trading at $58.44 a barrel at 0211 GMT, down 75 cents from their last settlement. U.S. crude was down 88 cents at $50.55 a barrel. Prices soared as much as 6 percent the previous day after a Saudi-led coalition of Arab nations began strikes on Shi'ite Houthis and allied army units who have taken over much of Yemen and seek to oust President Abd-Rabbu Mansour Hadi. "While Yemen is a small producer (145,000 barrels per day in 2014), the price rally is driven by fears of potential escalation and the proximity of the Bab el-Mandeb strait," Goldman said. Closure of the strait could affect 3.8 million barrels a day of crude and product flows, but analysts said tankers could be diverted to travel around Africa instead of passing Yemen. Analysts also said that the less than 40 km narrow strait between Yemen and Djibouti was heavily militarized by the West, with the United States and France both operating bases in Djibouti and NATO and other allies having a fleet presence in the Gulf of Aden to combat piracy. World oil prices rose sharply last week as Saudi Arabian jets struck rebel targets in Yemen, sparking fresh supply fears in the crude-rich Middle East. Many commodities were also buoyed as weak US data sent the

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 dollar sliding, denting confidence in the world’s top economy and throwing into question the timeline for a long-awaited Federal Reserve interest rate hike. Oil Prices rallied on Wednesday and Thursday after a Saudi Arabia-led coalition bombed rebels in support of Yemen’s embattled President Abd-Rabbu Mansour Hadi. New York crude struck a one-month high of $52.48 and Brent oil jumped to a March 9 peak of $59.78 on Thursday. Crude futures began soaring as Hadi was rushed to a secure location after a warplane attacked his presidential complex. “The geopolitical tensions in Yemen are pushing (oil) prices higher,” Daniel Ang, an investment analyst with Phillip Futures, told AFP. “Yemen is not a big producer but it is a trade hub in the region so tensions over there could cause a disruption in the trading activities for energy products,” said the Singapore-based analyst. Yemen— bordered by key Middle East oil producers Saudi Arabia and Oman—has been gripped by growing turmoil since the rebels launched a power grab in Sanaa in February. The oil market then fell on Friday, trimming its gains owing to no disruption to oil supplies. “Oil prices ... are shedding some of the strong gains they had achieved over the two previous days,” said Commerzbank analyst Carsten Fritsch. “It would appear that the initial panicky response to Saudi Arabia’s military intervention in Yemen is giving way to a more sober assessment of the situation.” Warplanes from the Saudi-led coalition kept up raids against rebels on Friday as Hadi headed to an Arab summit to garner support. There are concerns that an escalation of the conflict could disrupt oil shipments passing through the Bab el-Mandeb Strait, located between Yemen and Djibouti and through which about 3.8mn barrels of oil per day are transported. Oil gains were capped by fears over the global supply glut, which was made worse by the 11th straight weekly increase in US crude inventories. By Friday on London’s Intercontinental Exchange, Brent North Sea crude for delivery in May stood at $57.81 per barrel compared with $54.99 a week earlier. On the New York Mercantile Exchange, West Texas Intermediate or light sweet crude for May leapt to $50.16 from $46.17 for the expired April contract a week earlier. Brent settled down $2.78 at $56.41 a barrel. US crude settled $2.56 lower at $48.87. Both fell further after the market settled.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Why bombing Yemen (Tiny Oil Producer) Is Roiling the Energy Market Bloomberg+NewBase While Yemen contributes less than 0.2 percent of global oil output, its location puts it near the center of world energy trade. The nation shares a border with Saudi Arabia, the world’s biggest crude exporter, and sits on one side of a shipping chokepoint used by crude tankers heading West from the Persian Gulf. Global oil prices jumped more than 5 percent on Thursday after regional powers began bombing rebel targets in the country that produced less than Denmark in 2013. Yemen’s government has collapsed in the face of an offensive by rebels known as Houthis, prompting airstrikes led by Saudi Arabia, the biggest producer in the Organization of Petroleum Exporting Countries. The Gulf’s main Sunni Muslim power says the Houthis are tools of its Shiite rival Iran, another OPEC member, and has vowed to do what’s necessary to halt them. “While thousands of barrels of oil from Yemen will not be noticed, millions from Saudi Arabia will matter,” said John Vautrain, who has more than 30 years’ experience in the energy industry and is the head of Vautrain & Co., a consultant in Singapore. “Saudi Arabia has been concerned about unrest spreading from Yemen.” Yemen produced about 133,000 barrels a day of oil in 2013, making it the 39th biggest producer, according to the U.S. Energy Information Administration. Output peaked at more than 440,000 barrels a day in 2001, the Energy Department’s statistical arm said on its website. Shipping Chokepoint Brent, the benchmark grade for more than half the world’s crude, gained as much as $3.23, or 5.7 percent, to $59.71 a barrel in electronic trading on the London-based ICE Futures Europe exchange on Thursday. West Texas Intermediate futures, the U.S. marker, jumped 5.6 percent to $51.98 on the New York Mercantile Exchange.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 “Yemen is not an oil producer of great significance but it is located geographically and politically in a very important part of the Middle East,” said Ric Spooner, a chief strategist at CMC Markets in Sydney. Yemen is located on Bab el-Mandeb, the fourth-biggest shipping chokepoint in the world by volume, through which 3.8 million barrels a day of oil and petroleum passed in 2013, according to the EIA. Its closure may keep tankers from the Persian Gulf from reaching the Suez Canal and the SUMED Pipeline, diverting them around the southern tip of Africa, adding to transit time and cost, the EIA said on its website. Transport Threat The Suez Canal and the SUMED Pipeline serve as the link between Egypt’s ports of Ain Sukhna on the Red Sea and Sidi Kerir on the Mediterranean. Ships carrying oil from Europe and North Africa won’t be able to take the most direct route to Asian markets if the Bab el-Mandeb strait is shut, according to the EIA. “As the situation in Yemen has dramatically escalated, it’s seen primarily as a threat to international shipping and oil transport,” Theodore Karasik, an independent geopolitical analyst, said from Dubai. “There’s concern that the more ungovernable Yemen becomes, the more it could become a base for piracy in the Red Sea area.” Saudi Arabia, the United Arab Emirates, Bahrain, Qatar and Kuwait responded to a request from Yemen’s President Abdurabuh Mansur Hadi, according to a statement carried by the official Saudi Press Agency. Proxy War Saudi Arabia led OPEC’s decision in November to resist calls to reduce its output target of 30 million barrels a day, a resolution that Iranian Oil Minister Bijan Namdar Zanganeh said was “not in line with what we wanted.” OPEC’s decision and an expanding U.S. supply glut have driven global benchmark oil prices to a six-year low. “In the longer term, Iran will be happy to disrupt oil supplies,” Vautrain said. “They literally want to control Saudi Arabia and Iraq. They would love that. They’re fighting a proxy war and they will continue to fight a proxy war.” The Houthis, who follow the Zaydi branch of Shiite Islam, say they operate independently of Iran and represent only their group’s interests.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Upstream capital expenditure declined 12% year-over-year in 4Q-2014 Source: U.S. Energy Information Administration, based on Thomson Reuters and Evaluate Energy Based on financial statements from selected international oil and natural gas companies, spending on upstream investments was 12% lower in fourth-quarter 2014 compared to the same period in 2013. Upstream spending on exploration and development typically accounts for the bulk of these companies' investment expenditures. Aggregating the reports of 23 global oil- and natural gas-producing companies, upstream capital expenditure totaled $77 billion in the fourth quarter of 2014, which was $10 billion, or 12%, less than in fourth-quarter 2013. Three of the four quarters in 2014 had year-over-year declines in spending, bringing full-year 2014 upstream capital expenditure to $297 billion, 6% less than full- year 2013 spending for these companies. Much more so than midstream and downstream investments dealing with the refining, distribution, and sale of oil and natural gas, spending in the upstream segment tends to correlate with changes in crude oil prices, because prices are a significant factor in any project's potential rate of return. Average crude oil prices, such as the North Sea Brent benchmark, were 30% lower in fourth- quarter 2014 compared to the same quarter in 2013, likely contributing to the postponement or curtailment of some upstream projects. Quarterly investments are compared with the same quarter of the previous year to reduce any seasonal effect of comparing quarter-over-quarter changes. Lower oil prices reduce expected returns from future production, decreasing incentives for upstream investment spending. As a result, new exploration and development projects may be delayed or canceled, and reduced investments in producing fields can ultimately slow the growth in production. The effects may not be immediate, as some projects can have lead times of many years. However, if the trend continues, future production growth could be lower than originally anticipated. With crude oil prices continuing to fall from last year's levels, some companies have already announced further capital expenditure reductions for 2015. In considering the future impact of reduced upstream capital spending, it is important to consider changes in the cost of upstream activities, which have historically been positively correlated with both oil prices and upstream investment spending. As oil prices and upstream investment spending fall, reduced demand for rigs and other oilfield services will tend to reduce the price of those services. Lower costs for oil services can make upstream investment more attractive and partially offset the effect of reduced upstream budgets on the level of upstream activity.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 29 March 2015 K. Al Awadi

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19