NewBase 29 April 2024 Energy News issue - 1720 by Khaled Al Awadi_compressed (1).pdf

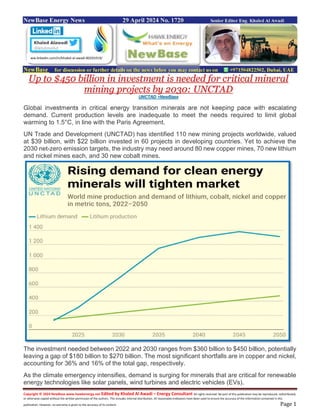

- 1. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 29 April 2024 No. 1720 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Up to $450 billion in investment is needed for critical mineral mining projects by 2030: UNCTAD UNCTAD +NewBase Global investments in critical energy transition minerals are not keeping pace with escalating demand. Current production levels are inadequate to meet the needs required to limit global warming to 1.5°C, in line with the Paris Agreement. UN Trade and Development (UNCTAD) has identified 110 new mining projects worldwide, valued at $39 billion, with $22 billion invested in 60 projects in developing countries. Yet to achieve the 2030 net-zero emission targets, the industry may need around 80 new copper mines, 70 new lithium and nickel mines each, and 30 new cobalt mines. The investment needed between 2022 and 2030 ranges from $360 billion to $450 billion, potentially leaving a gap of $180 billion to $270 billion. The most significant shortfalls are in copper and nickel, accounting for 36% and 16% of the total gap, respectively. As the climate emergency intensifies, demand is surging for minerals that are critical for renewable energy technologies like solar panels, wind turbines and electric vehicles (EVs). ww.linkedin.com/in/khaled-al-awadi-80201019/

- 2. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 UN Trade and Development (UNCTAD) projections based on data from the International Energy Agency indicate that by 2050, for example, lithium demand could rise by over 1,500%, with similar increases for nickel, cobalt and copper. The booming demand poses significant opportunities and challenges for developing countries rich in critical energy transition minerals, especially those grappling with commodity dependence – when 60% or more of a country's merchandise export revenue comes from raw materials. Such dependence hinders economic development and perpetuates inequalities and vulnerabilities across sub-Saharan Africa, South America, the Pacific and the Middle East. It currently affects 95 developing countries, almost half of the UN’s membership. A total of 29 out of the 32 nations classified as having low human development in 2021 were commodity dependent. “Commodities and commodity dependence are issues at the heart of the past and especially the future of trade and development,” UN Trade and Development Secretary-General Rebeca Grynspan says. The new critical mineral mining projects needed offer opportunities for many developing countries, especially in Africa. The continent boasts over a fifth of the world's reserves for a dozen metals essential to the energy transition, including 19% of those required for electric vehicles.But to fully capitalize on their mineral wealth, developing countries must go beyond merely supplying raw minerals and advance up the value chains.

- 3. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Critical minerals: Harnessing data key to unlocking hidden treasures An UNCTAD solution for developing countries to digitalize and share data on natural resources gains renewed significance amid soaring demand for minerals vital for the transition to clean energy. Clean energy systems are expected to raise copper demand from 23% to over 42% of total demand by 2050. Technology and data can help developing countries unlock their mineral resources treasure chest. UNCTAD has a solution for digitalizing and sharing data to facilitate the discovery of new natural resources. The global quest for a cleaner energy system has escalated the demand for critical energy transition minerals such as lithium, cobalt, nickel and copper. These minerals play a crucial role in renewable energy technologies such as solar photovoltaic cells, wind energy, battery storage and electric vehicles. For example, the demand for copper in clean energy systems is forecast to increase from 23% of total demand across all applications to over 42% by 2050, according to UNCTAD calculations based on data from the International Energy Agency. But if copper’s production continues at its current rate, the burgeoning demand won’t be met, creating a significant gap that needs to be addressed to keep global warming to no more than 1.5°C, in line with the Paris Agreement on climate change. Tech can help unlock hidden mineral treasures To meet the increasing demand, countries need to explore new resources abundant in high-grade mineral ores and attract investments into the sector, among other essential measures.

- 4. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 They can use technology and data to identify resources that traditional geologists might overlook and assist miners in determining optimal drilling locations. For example, in Zambia, a private company has used artificial intelligence to generate geological maps of the Earth’s crust, resulting in the discovery of a large-scale high-grade copper deposit. It did so by applying algorithms to analyse multiple data streams, ranging from historical drilling data to satellite imagery, enhancing the identification of potential new deposits. The breakthrough in Zambia’s exploration of new copper resources shows how developing countries can use innovative approaches to discover new reserves of critical minerals and help bridge the gap between supply and demand. “Countries need better data to benefit more from these minerals, while protecting the planet,” said Miho Shirotori, head of UNCTAD’s international trade division. Many developing countries lack the reliable data needed to attract investments into their undiscovered minerals. A network solution One key solution, first proposed by UNCTAD in 2009 and gaining renewed urgency amid the global energy transition, is the creation of an international network for digitalizing and sharing data to facilitate the discovery of new natural resources. UNCTAD's initiative, known as the Natural Resources Information Exchange (NRIE), aimed to create a repository of digital information, focusing on geoscientific historical data. The initiative previously stalled due to technical gaps in some of the potential beneficiary countries and the complexities of legal frameworks and regulations relating to data ownership, access rights and confidentiality. UNCTAD is now revamping the initiative with an emphasis on strengthening the capacity of countries to manage their wealth of data. The new initiative could assist mineral-rich countries in Africa and elsewhere to create their own natural resource data banks to capture the untapped value from geosciences information to optimize natural resource development and management. These data banks would include a range of digitalized historical mineral data, such as: Old maps and information on rock formations, mineral composition and geological structures. Exploration data comprising drilling results, geophysical surveys and geochemical analysis. Production data detailing quantities extracted, grades of ore and production methods. Environmental data such as water quality assessment, air quality monitoring and biodiversity surveys. The initiative would enable developing countries to harness the power of technology to compile and analyse vast amounts of data, empowering them to make informed decisions about their mineral reserves responsibly and inclusively. Inclusive approach UNCTAD advocates for a collaborative and inclusive approach involving governments, companies and institutions with geoscientific archives working together to develop natural resources data banks.

- 5. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 It will support beneficiary countries in developing their capacity to digitalize and organize their historical mineral data. The initiative would facilitate easy access, search and retrieval of archived information through digital databases and artificial intelligence as demonstrated in recent efforts in Zambia. It will also enhance the efficiency of data governance by providing more comprehensive and precise datasets. This could improve decision-making among policymakers, government agencies and industry stakeholders regarding resource allocation. Furthermore, developing countries can bolster their capacity to attract investments, which could spur economic growth and contribute to meeting the global demand for critical energy transition minerals in a sustainable manner. According to UNCTAD, it’s also essential to ensure the soaring demand for critical energy transition minerals doesn’t further entrench countries’ dependence on commodities for their export earnings. Such dependence leaves countries vulnerable to market price fluctuations and global economic shocks. It’s also linked to lower socioeconomic development.

- 6. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Japan’s Jera Looks to Invest in Middle East Hydrogen Projects Bloomberg + NewBase Japan’s biggest utility, Jera Co., is looking to invest in low-carbon hydrogen and ammonia projects in the Middle East, in addition to buying their output. Jera has established a division for investing in such plants. Tsuyoshi Oyama, who heads the unit’s Australia and Middle East activities, said facilities that can produce around 1 million tons a year of “blue” ammonia are attractive targets, as well as smaller “green” hydrogen projects. Some of the world’s biggest planned blue ammonia plants, which capture carbon dioxide emitted in the production process, are located in the Middle East. The hydrocarbon-dependent region hopes that sequestering emissions will mean it can continue to produce fuels from oil and gas despite growing demand for cleaner fuels. The Japanese firm signed preliminary agreements with Saudi Arabia’s Public Investment Fund and Abu Dhabi National Oil Co. to work together on clean ammonia and hydrogen. It recently agreed to work with CF Industries Holdings on an ammonia plant in Louisiana. Japan is expected to be one of the biggest buyers of clean hydrogen and ammonia. Jera is testing the use of ammonia as a substitute for coal in its Hekinan power station in an effort to reduce its greenhouse gas emissions. JERA signs deal with CF Industries to develop 1.4 mil mt/year US ammonia project by 2028 Energy transition highlights: Our editors and analysts bring you the biggest stories from the industry this week, from renewables to storage to carbon prices. Japan is testing the use of ammonia as power plant feedstock Firm will jointly develop a low- carbon ammonia plant in the M.E, India & US

- 7. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Japan's largest power generation company, JERA has agreed with US-based CF Industries to explore the development of a 1.4 million mt/year low-carbon ammonia project at the latter's Blue Point Complex in Louisiana, with the plan to start production in 2028. Under a joint development agreement, JERA is considering taking a 48% stake in the project as well as procuring more than 500,000 mt/year of ammonia to meet low-carbon fuel demand in Japan. JERA and CF Industries aim to make a final investment decision "within a year" for the project, which will capture CO2 from production and use it for carbon capture and storage, according to a JERA spokesperson. JERA has pledged to commercialize its ammonia co-firing power generation by 2030 as part of its aim to start using 100% ammonia as fuel in the 2040s for its 2050 carbon neutrality target.

- 8. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Egypt: TAG Oil commences flow back of BED4-T100 horizontal well Source: TAG Oil TAG Oil has successfully pumped all twelve planned stages of its multistage hydraulic frac on its BED4-T100 well location within the Badr Oil Field ('BED-1'). Stages one through three, which are located across the heavily fractured and more permeable section of the well, received a concentrated acid stimulation while stages four through twelve were mechanically fracture stimulated with proppant. At least 50 tonnes of sand were used per stage in the mechanically propped fracture stages with over 1,000,000 pounds successfully pumped across the 308-metre lateral section. The fracture equipment has been moved off location, and a coiled tubing unit is in the process of drilling out the ball seats used to separate the fracture stages that will be followed with the flow back operations in the next several days. TAG Oil’s technical team is assuming approximately 7-10 days of flow back before it expects to see consistent clean oil flows. Stabilized flow rates are expected approximately 10 days after consistent oil rates are achieved. Accordingly, the Company expects to be able to release flow rates on the T100 well at some point during the month of May. A further update will be provided in due course on the well tie-in and facilities configuration after production volumes have been established.

- 9. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Ukraine Endures Missile Barrage, Strikes Russian Refinery Bloomberg News Ukraine sustained a heavy Russian missile barrage overnight aimed at gas infrastructure and other targets, while striking back a Russian oil refinery with drones. Moscow reported a Ukrainian drone attack on the Slavyansk oil refinery in the Krasnodar region, the first such strike since early this month. The state-run news agency Tass said the strike caused a fire, which partially suspended refinery operations. The plant was hit by 10 drones, Tass said, citing the refinery’s representative. Russia’s defense ministry said 66 drones were intercepted and downed over the Krasnodar region. UAVs from the Security Service of Ukraine targeted the Kushchevsk military airfield and the Slavyansk and Ilsky refineries in the Krasnodar region, according to a person with knowledge of the operation who wasn’t authorized to speak publicly. Russian officials and media haven’t referred to the Ilsky facility. The Slavyansk refinery is capable of processing 4 million tons of oil a year and is one of the closest facilities to war zone in eastern Ukraine. It was previously hit by drones in March along with many other large Russian refineries. Some of the affected facilities are still processing less than before the attacks. US warned Ukraine that attacks on Russian oil refineries were impacting global energy markets and urged Kyiv to focus on military targets. The most recent drone attack on a Russian oil refinery happened on April 2. Russia’s defense ministry said in a statement that recent strikes, including the overnight barrage, had targeted energy and defense facilities and railway infrastructure in response to Kyiv’s attempts to “damage Russian energy and industrial facilities.” Targets fired at by Kremlin troops included energy facilities in the Lviv and Ivano-Frankivsk regions in the west, and the Dnipropetrovsk region in central Ukraine, the national grid operator Ukrenergo said in statement on Facebook. State-run Naftogaz said gas infrastructure facilities came under attack but that service to clients and to Ukrainian consumers weren’t interrupted. “Hits on power plants in Kryvyi Rih, Dnipro, Lviv and Ivano-Frankivsk put thousands of Ukrainians in the dark,” Bridget Brink, the US ambassador to Ukraine, said on X. “Other cities were hit as well, including damage to a Kharkiv hospital.”

- 10. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Exxon and Chevron Output Booms in World’s Hottest Oil Patches Bloomberg If you want to understand why the two largest US oil companies are together spending in excess of $100 billion on acquisitions right now, look no further than the amount of crude they’re extracting from the two hottest oil fields on the planet. Exxon Mobil Corp. and Chevron Corp., which reported earnings Friday, are both predicting their production in the Permian Basin — the US region that already supplies more oil than Iraq — will increase by 10% this year. Exxon also revealed that production from its massive oil development in Guyana in the first quarter surged 70% from a year earlier. That’s enough to supply almost a fifth of the global demand growth this year that’s forecast by the International Energy Agency. Guyana and the Permian stand out for relentless levels of production growth in a industry that has otherwise struggled to find new, low-cost resources in recent years. Now Exxon and Chevron are racing to cement their positions, outpacing their biggest European peers in the process. Exxon is set to become the Permian’s biggest producer once it closes its $64 billion acquisition of Pioneer Natural Resources Co. while Chevron is spending $52 billion on Hess Corp. to gain a 30% share of Guyana’s prolific Stabroek Block. The Permian and Guyana “are big growth drivers at both companies,” said Neal Dingmann, an analyst at Truist Securities. “There are definitely fears on US inventory and shortages worldwide because of lack of investment in the group over several years now.” After years of reduced investment in oil and gas as fossil-fuel companies focused on returns and reducing emissions, crude supplies are once again starting to look tight. Brent oil earlier this month traded above $90 a barrel for the first time since the fall, with tensions in the Middle East threatening

- 11. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 to send prices even higher. For all the efforts to transition to greener sources of energy, oil demand is forecast by the IEA to grow by about 1.3 million barrels a day this year to a new record. European supermajors Shell Plc and BP Plc, who are set to report over the next two weeks, are in a very different position. Shell walked away from Guyana months before Exxon drilled its first discovery in 2015, and sold its Permian position to ConocoPhillips in 2021. BP’s presence in the Permian is much smaller than either of the US majors. Furthermore, Shell and BP had in recent years sought to push into renewables. They’re now pivoting back toward bolstering oil and gas production. But that’s easier said than done, and both have anemic growth profiles out to 2030 compared with their US rivals — assuming the Pioneer and Hess deals are completed. For Exxon and Chevron, both of committed to fossil fuels during the initial wave of ESG investing, targeting the Permian and Guyana will not just grow production but also lower their overall cost of supply. Both regions can produce oil at a profit for less than $35 a barrel. While sitting on two big growth engines, the two companies must be mindful on spending because investors still see capital discipline and a strong balance sheet as a “top priority,” according to Nick Hummel, an analyst at Edward D. Jones & Co. That’s because OPEC still has 5 million barrels a day “sitting on the sidelines” that could come back into the market at some point, he said. For now, both Exxon and Chevron are stuck in a holding pattern, waiting to close the acquisitions of Pioneer and Hess. The former is waiting approval from the Federal Trade Commission while the latter is tied up in arbitration because Exxon claims it has a right of first refusal over Hess’s 30% stake in Guyana. Even so, both say they expect to complete their respective deals by the end of the year. “These are big deals that will definitely impact the overall growth trajectory for both companies,” Hummel said. “The focus will be on execution over the next few quarters.”

- 12. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 South Africa's renewable energy transition with an intensive construction programme .. EDF is building 1.2GW of renewables across SA Staff Writer, Bizcommunity.com EDF Renewables is driving South Africa's renewable energy transition with an intensive construction programme. The company is building nearly 1.2GW of low-carbon power capacity, including wind, solar, and battery storage, across eight sites in the Northern and Eastern Cape. "Our projects will contribute towards meeting the energy needs of South Africans, both through government programmes and through private channels for Anglo American mines via our joint trader Envusa Energy," said Tristan de Drouas, CEO of EDF Renewables. "These constructions will have a visible impact on the current power shortage, which is very good news for the country, and a source of pride for the teams. They are a tangible illustration of the EDF Group's capabilities to deliver low-carbon energy solutions in South Africa." This massive program, developed with key partners, reached financial agreements between November 2022 and February 2024. EDF Renewables' projects are rapidly moving forward to help ease South Africa's crippling energy deficit. Koruson 1: A cluster of three wind farms (Phezukomoya, San Kraal, and Coleskop) with a total capacity of 420MW, developed in partnership with H1 Holdings, GIBB-Crede, and a local community trust.

- 13. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Koruson 2: A collaboration with Anglo American via their joint venture Envusa Energy. This project includes wind and solar farms with 520MW total generation capacity, with investments from Pele Green Energy and a local community trust. Umoyilanga Hybrid Power Plant: A partnership with Perpetua Holdings. This innovative "virtual power plant" will combine 115MW solar, 63MW wind, and 75MW battery storage over two geographically separate sites delivering 75MW of dispatchable power. Accelerating energy progress The combined investment across these projects totals R34bn. This influx of resources has quickly mobilised construction, targeting commercial operation between 2024 and 2026. Once complete, these power plants are expected to provide close to 4TWh of low-carbon power to the national grid annually. For context, Eskom, South Africa's power utility, reported a 14.4TWh energy shortage in 2023. This new renewable capacity demonstrates a significant acceleration of renewable energy deployment after less than 1GW of utility-scale projects were commissioned since 2020. These projects directly create jobs, stimulate small businesses, and utilise South African goods and services where possible. They also reserve a portion of revenue to fund socio-economic development in nearby communities.

- 14. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 U.S. natural gas-fired electricity generation consistently increased in 2022 and 2023 .. U.S. Energy Information Administration, Hourly Electric Grid Monito Electricity generation from units that primarily consume natural gas in the U.S. Lower 48 states has increased for all hours of the day since 2021, according to data reported on Form EIA-930, Hourly and Daily Balancing Authority Operations Report. Increased electricity generation from natural gas was due mostly to coal retirements, increases in natural gas-fired electricity generating capacity, and low natural gas prices in 2023. Off-peak natural gas-fired generation rose about 22% between 2021 and 2023, according to our data, displacing coal-fired units as an overnight source of electricity. Note: The chart series reflect the average electricity generation for a given hour across an entire year; they are reported in 24-hour increments for the U.S. Lower 48 states, based on local time. Note: The chart series reflect the average electricity generation for a given hour across an entire year; they are reported in 24-hour increments for the U.S. Lower 48 states, based on local time. Balancing authorities, the organizations responsible for maintaining the U.S. electric grid, report the volume of electricity from electric generators by primary fuel source on Form EIA-930. Balancing authorities may not know actual fuel consumption. We collect actual fuel consumption for electricity generation on other EIA surveys and report these data in the Electric Power Monthly, with a longer data lag and by month.

- 15. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase April 29 -2024 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil Declines as US Steps Up Efforts to Secure a Truce in Gaza Oil slipped as the US pushed to broker a peace deal between Israel and Hamas that would reduce geopolitical tensions in the Middle East. Oil prices fell in early Asian trading on Monday, erasing gains from Friday as Israel-Hamas peace talks in Cairo eased fears of a wider conflict in the Middle East and U.S. inflation data further dimmed the prospects of interest rate cuts anytime soon. Stepped-up efforts to mediate a ceasefire between Israel and Hamas moderated geopolitical tensions and contributed to the weak opening on Monday, IG market analyst Tony Sycamore said. A Hamas delegation will visit Cairo on Monday for peace talks, a Hamas official told Reuters. Israel's foreign minister said on Saturday a planned incursion into Rafah, where more than one million displaced Palestinians are sheltering, could be put off in the event of a deal that involves the release of Israeli hostages. Oil price special coverage Brent crude futures fell by as much as $1, or 1.1% to $88.50 a barrel before ticking back up to $88.75 at 0649 GMT. West Texas Intermediate (WTI) futures were down 67 cents, or 0.8%, at $83.18 a barrel.

- 16. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 A White House spokesperson said Israel had agreed to listen to U.S. concerns about the humanitarian effects of the potential invasion. Markets are also on watch for the U.S. Federal Reserve's May 1 policy review. "Also playing a part are some nerves ahead of this week’s Federal Open Market Committee meeting which is expected to come with a more hawkish tone," Sycamore said. U.S. inflation rose 2.7% in the 12 months through March, data on Friday showed, above the Fed's target of 2%. Lower inflation would have increased the likelihood of interest rate cuts, which would stimulate economic growth and oil demand. "The sticky U.S. inflation sparks concerns for 'higher-for-longer' interest rates", leading to a stronger U.S. dollar and putting pressure on commodity prices, independent market analyst Tina Teng said. The dollar strengthened on the prospect of higher-for-longer interest rates. A stronger dollar makes oil more expensive for those holding other currencies. Further weighing on the outlook for oil demand, China's industrial profit growth slowed down in March, official data showed on Saturday, in the latest sign of frail domestic demand in the world's second largest economy. The market brushed aside potential supply disruptions stemming from Ukranian drone strikes on the Ilsky and Slavyansk oil refineries in Russia's Krasnodar region over the weekend. The Slavyansk refinery had to suspend some operations after the attack, a plant executive said. Brent crude traded below $89 a barrel after gaining 2.5% last week, while West Texas Intermediate dropped toward $83. US Secretary of State Antony Blinken will step up efforts to secure a truce in Gaza during a visit to the region. The White House said Israel has agreed to hear out its concerns and hold off invading Rafah until meeting with the Americans. Crude has risen this year on OPEC+ supply cuts and heightened tensions in the Middle East — the source of about a third of the world’s oil. Meanwhile, shifting expectations for US monetary policy

- 17. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 are weighing on the demand outlook, and traders will look to a Federal Reserve meeting on Wednesday to gauge the prospects for rate cuts this year. Despite the uncertain outlook, timespreads continue to signal bullishness. The gap between the two nearest Brent contracts was still more than $1 a barrel in backwardation. While the figure has come off slightly from last week’s highs, it’s still more than double what it was a month ago. “Geopolitical risks have eased considerably,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. While the bank still expects a “deep deficit” this quarter, “the outlook for the second half of the year is less clear with it largely depending on OPEC+ policy,” he said. Russia attacked Ukraine over the weekend with a heavy missile barrage aimed at natural gas infrastructure and other targets. Kyiv struck back with drones targeting an oil refinery in the Krasnodar region, with state-run news agency Tass reporting that the Slavyansk plant had partially suspended operations because of a fire. US Shale Drilling-Rig Usage Plunges by Most in Five Months The US shale-oil sector experienced the biggest plunge in drilling activity in more than five months as explorers keep a tight hold on spending. The number of US rigs drilling for oil fell by five to 506, marking the biggest slide since Nov. 3, according to data released by Baker Hughes Co. on Friday. This week’s move reverses last week’s five-rig increase. After better-than-expected output from fewer rigs in 2023, US shale executives now are in the midst of slowing down amid a shrinking inventory of top-tier drilling locations, weak natural gas prices, and industry consolidation. Total spending by North American explorers is forecast to Hawk Energy Sees Oil at $85-$100 This Year With Strong Demand Growth That’s a ‘ foreseeable & sensible range,’ Hawk Energy CEO M. Al Shihabi says Demand set to grow to 104 MBD up by 2.0 MBD, in 2024: Al Awadhi says

- 18. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase Specual Coverage The Energy world –April 29 -2024 CLEAN ENERGY Taiwan: Ørsted inaugurates the Asia-Pacific region’s largest offshore wind farms Source: Ørsted Ørsted is proud to announce the inauguration of the Greater Changhua 1 and 2a offshore wind farms in Taiwan. Inauguration of the Greater Changhua 1 & 2a offshore wind farms. From the left: 1. Kuo Tsi-san, Deputy Director of Economic and Renewable Energy Development Department. Changhua County 2. Christy Wang, Chair of Ørsted Taiwan 3. Lee Chun-li, Deputy Director General, Energy Administration, Ministry of Economic Affairs 4. Per Mejnert Kristensen, CEO of Region APAC at Ørsted 5. Wang Mei-hua, Minister of Economic Affairs 6. Mads Nipper, Group President and Chief Executive Officer of Ørsted 7. Taiwan President Tsai Ing-wen 8. Patrick Harnett, Chief Operating Officer at Ørsted 9. Shen Jong- chin, Senior Advisor to the President 10. John Faye, Chair of Mercury Taiwan Holdings Limited 11. Lee Chang-ken, President, Cathay Financial Holdings 12. Jeff Chang, Chair of Cathay PE 13. Chou Yu-hsin, Deputy Director General of Industrial Development Administration, Ministry of Economic Affairs With a total installed capacity of 900 MW, the two offshore wind farms are in operation and fully connected to the grid, making them the largest of their kind in Taiwan and in the Asia-Pacific region.

- 19. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Today’s inauguration is a major milestone, as the Greater Changhua 1 and 2a offshore wind farms have not only doubled Taiwan’s offshore wind capacity; they have also successfully catalysed Taiwan’s offshore wind ecosystem. President Tsai Ing-wen thanked Ørsted for investing in Taiwan and bringing renewable technologies to Taiwan. She recalled that eight years ago, she went to see the first two demonstration wind turbines at Formosa 1, which is located off the coast of Miaoli County. Soon after that, Ørsted came to Taiwan and started further development of Formosa 1 and the 128 MW project, which was inaugurated in 2019 as Taiwan’s first commercial-scale offshore wind farm. Today, she congratulated Ørsted once again for completing the 900 MW Greater Changhua 1 and 2a offshore wind farms with the support of its investors, CDPQ and Cathay PE. This is currently the largest offshore wind project in the Asia-Pacific region. President Tsai Ing-wen says: 'It took us eight years to turn the words 'energy transition' in our policy papers into actual wind farms in operation. Taiwan now has Asia-Pacific's largest offshore wind farm and our own offshore wind supply chain.' Mads Nipper, Group President and CEO of Ørsted, says: 'With today’s inauguration, we’re celebrating a landmark achievement for Ørsted and for Taiwan. Greater Changhua 1 and 2a are our first gigawatt-scale offshore wind farms outside of Europe. They’re also Taiwan’s first utility-scale far-shore wind farms and the largest of their kind in APAC, reaffirming Taiwan as the frontrunner in the region. In 2024, Ørsted has a record 7.6 GW of offshore wind projects under construction worldwide, including our next big project in Taiwan, the 920 MW Greater Changhua 2b and 4. We’re committed to creating a world that runs entirely on green energy and enabling long-term benefits to the economies and societies where we operate.' Per Mejnert Kristensen, CEO of Region APAC at Ørsted, says: 'Greater Changhua 1 and 2a is a flagship project of historic significance. This project has spearheaded the establishment of the local offshore wind industry as well as contributed significantly to Taiwan’s energy transition and net-zero goals. I’d like to express gratitude to the relentless efforts of our team and to the support from the authorities and our partners, suppliers, and contractors. We’ve built a strong talent pool, including our industry-first operations and maintenance ‘Taiwan team’, dedicated to ensuring a stable energy output for decades to come. Together, we look forward to delivering more world-class wind farms in Taiwan.'

- 20. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Ørsted began offshore construction in March 2021 and recently announced the successful installation of all 111 Siemens Gamesa SG 8.0-167 DD wind turbines, which are now supplying renewable energy to Taiwan’s electricity grid. The 605.2 MW offshore wind farm Greater Changhua 1 is co-owned by Ørsted (50 %) and Mercury Taiwan Holdings, a consortium of CDPQ, a global investment group, and Cathay PE, with a combined ownership stake of 50 %. The 294.8 MW Greater Changhua 2a is 100 % owned by Ørsted. Emmanuel Jaclot, Executive Vice-President and Head of Infrastructure at CDPQ, says: 'Today’s inauguration of the Greater Changhua 1 Offshore Wind Farm marks a significant milestone for Taiwan and for our collaboration with Ørsted and Cathay PE. CDPQ is committed to advancing the energy transition in Asia Pacific, and we continue to explore investment opportunities in renewables and transition assets across the region.' Jeff Chang, Chair of Cathay PE, says: 'Today’s event is of great significance to Taiwan’s energy transition, and Cathay PE is glad to be part of the achievement, contributing to Taiwan’s low-carbon future.' The 900 MW wind farms inaugurated today are part of Ørsted’s Greater Changhua offshore wind zone, which also comprises Greater Changhua 2b, Greater Changhua 3, and Greater Changhua 4. The zone has a combined capacity of approximately 2.4 GW.

- 21. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 Greater Changhua 1 and 2a alone can produce enough renewable energy to power one million Taiwanese households a year, equivalent to 1.75 million tonnes of carbon dioxide reductions annually. Ørsted is dedicated to delivering stable and large-scale renewable energy in Taiwan. The company is currently constructing its next large-scale project, the 920 MW Greater Changhua 2b and 4 offshore wind farms. Together with Taiwan’s first commercial offshore wind farm, Formosa 1 (128 MW), Ørsted is operating and constructing nearly 2 GW of offshore wind capacity in Taiwan. The day before the inauguration Ørsted announced its ’Green energy for Taiwan, powered by people‘ case study on the Greater Changhua 1 and 2a offshore wind farms, which analyses the economic value for Taiwan as well as the long-term social and environmental benefits. About Ørsted in Taiwan and the Greater Changhua 1 and 2a offshore wind farms: Key milestones for the Greater Changhua 1 and 2a offshore wind farms: April 2018: Ørsted awarded 900 MW grid capacity for offshore wind April 2019: Ørsted took final investment decision on Changhua 1 and 2a offshore wind farms December 2020: Ørsted brought in investors, CDPQ and Cathay PE, for Greater Changhua 1 Offshore Wind Farm March 2021: Ørsted kicked off offshore installation February 2022: Onshore substations switched on April 2022: First power generated by Greater Changhua 1 and 2a August 2022: Inaugurated largest operations and maintenance hub in APAC August 2022: Completed foundation installation April 2024: First power from all 111 wind turbines 25 April 2024: Inauguration of Greater Changhua 1 and 2a offshore wind farms Operational wind farms in Taiwan Formosa 1 Ørsted is the biggest shareholder and co-owner of Taiwan’s first commercial-scale offshore wind project, Formosa 1, which was extended from a capacity of 8 MW to 128 MW in 2019. Greater Changhua 1 and 2a The Greater Changhua 1 and 2a offshore wind farms are located 35-60 km off the coast of Changhua County, have a capacity of approx. 900 MW, and can provide renewable energy to one million households. The 605 MW Greater Changhua 1 is co-owned by Ørsted (50 %) and Caisse de dépôt et placement du Québec (CDPQ) and Cathay PE, with a combined ownership stake of 50 %. Greater Changhua 1 hosts the world-first pilot ReCoral by ØrstedTM, a project that sets out to discover whether offshore wind turbine foundations could provide an additional new home where corals have the potential to flourish.

- 22. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Wind farms under construction Greater Changhua 2b and 4 Ørsted was awarded the 920 MW Greater Changhua 2b and 4 offshore wind farms in June 2018. A corporate power purchase agreement was signed with Taiwan Semiconductor Manufacturing Company Limited (TSMC) in July 2020. The Greater Changhua 2b and 4 offshore wind farms are expected to be completed by the end of 2025. Development projects Ørsted is developing a leading portfolio of offshore wind sites and has secured approvals of environmental impact assessments for them that can compete in future tenders in Taiwan. The development projects include the Xu Feng and Greater Changhua 3 projects located off the coast of Changhua County as well as the Wo Neng projects situated off the coast of Taichung. As the world leader in offshore wind, Ørsted has installed more than 1,900 offshore wind turbines at sea. By the end of 2023, Ørsted had 8.9 GW of offshore wind capacity installed, 6.7 GW of capacity under construction, and a further 3.7 GW of capacity awarded, resulting in a firm capacity of 19.2 GW. This aligns with the company’s ambition of reaching 35-38 GW in installed renewable energy capacity by the end of 2030.

- 23. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 NewBase Energy News 29- April - Issue No. 1720 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 24. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24