India, UAE to build strategic energy partnership

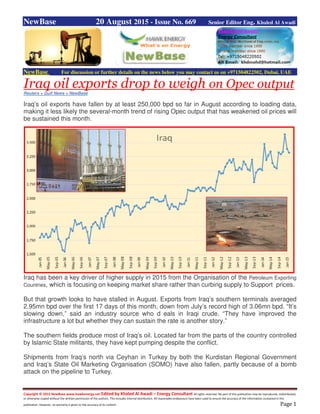

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 20 August 2015 - Issue No. 669 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Iraq oil exports drop to weigh on Opec output Reuters + Gulf News + NewBase Iraq’s oil exports have fallen by at least 250,000 bpd so far in August according to loading data, making it less likely the several-month trend of rising Opec output that has weakened oil prices will be sustained this month. Iraq has been a key driver of higher supply in 2015 from the Organisation of the Petroleum Exporting Countries, which is focusing on keeping market share rather than curbing supply to Support prices. But that growth looks to have stalled in August. Exports from Iraq’s southern terminals averaged 2.95mn bpd over the first 17 days of this month, down from July’s record high of 3.06mn bpd. “It’s slowing down,” said an industry source who d eals in Iraqi crude. “They have improved the infrastructure a lot but whether they can sustain the rate is another story.” The southern fields produce most of Iraq’s oil. Located far from the parts of the country controlled by Islamic State militants, they have kept pumping despite the conflict. Shipments from Iraq’s north via Ceyhan in Turkey by both the Kurdistan Regional Government and Iraq’s State Oil Marketing Organisation (SOMO) have also fallen, partly because of a bomb attack on the pipeline to Turkey.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Independent KRG exports averaged about 200,000 bpd in the first 17 days of August, according to loading data, while SOMO exported a few pipeline shipments at an average of 45,000 bpd, according to loading data and an industry source. Taken together, this means Iraq’s total northern shipments so far in August are less than half of the 517,000 bpd that the KRG said was exported in July. Reuters estimated July northern exports averaged 540,000 bpd. To be sure, Iraq’s output could recover in the rest of August and a rise from other Opec members, notably Saudi Arabia, could in theory offset weaker Iraqi volumes. “Lower Opec output in August compared to July is a possibility,” said a consultant who tracks supply from the group. “But much will depend on what the Saudis do - they surprised by lowering output in July from June and they could reverse course in August.” Another industry source familiar with the issue said Iraq’s southern exports could rise to around 3.0mn bpd in August as the pumping rate had increased this week. And average exports from the north will probably increase if there are no renewed interruptions on the northern pipeline, which the first industry source said is operating again. Iraqi exports were held back by decades of war and sanctions. The growth follows investment by Western oil companies and an easing of export bottlenecks. Iraq PM visits oilfield where locals harass Lukoil Source: Reuters Iraq's Prime Minister Haider al-Abadi visited the supergiant West Qurna-2 oilfield on Tuesday after the state-run South Oil Company warned output could be affected unless protests by locals demanding jobs were defused. The SOC last week sent a report to the oil ministry asking it to defuse protests by villagers and residents of areas near some of the southern fields where most of Iraq's crude is produced, including West Qurna-2. Hundreds of locals recently blocked some entrance to Iraq's giant southern West Qurna-2 oilfield, operated by Russia's Lukoil, demanding jobs in a sign of the growing challenges facing foreign firms operating in the south. 'We explained in the report that if such undesired harassments to the foreign operators continue, oil production will definitely be affected,' said a senior SOC source on condition of anonymity. After visiting West Qurna, Abadi toured the surrounding villages that have been a source of the protests. Local communities and tribes in Iraq, where foreign oil companies are developing the

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 OPEC nation's vast energy reserves, periodically protest to squeeze companies for jobs and other work benefits. A Lukoil official based in the oil hub of Basra told Reuters operations were continuing as normal with a steady output of 450,000 barrels per day (bpd), but said production was at risk if the situation was not resolved. 'Recent pressure from villagers and nearby residents making demands could force us to consider halting operation if they keep extorting us,' he said. Protests started last year, but intensified in recent weeks as Iraqis take to the streets in a show of anger against corruption and mismanagement that has prompted Abadi to unveil a reform plan. 'Despite Lukoil's ongoing initiatives to hire more laborers from nearby areas, things have got out of control,' said the senior SOC official. 'Someone who is asking for a job as a cleaner one day comes back asking for a thousand dollar-contract the next.'

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 INDIAN, UAE TO BUILD STRATEGIC PARTNERSHIP ON ENERGY By Fareed Rahman, Senior Business Reporter – Gulf News There is likely to be an increased cooperation in the energy sector after the visit of Indian Prime Minister Narendra Modi to the UAE this week. In a joint statement, the two countries decided to promote a strategic partnership in the energy sector, including through UAE’s participation in India in the development of strategic petroleum reserves, upstream and downstream petroleum sectors, and collaboration in third countries. India is a major importer of crude oil from the UAE. It imports about 270,000 of crude oil per day from the UAE with the country being the sixth largest supplier of the commodity to India. Veerendra Chauhan, an oil analyst at the London-based Energy Aspects, told Gulf News over phone that the cooperation between the two countries is set to increase after Modi’s visit. “India is putting a lot of emphasis on infrastructure and economic development. It needs secure supply of energy in the coming years and latest collaboration between India and the UAE will be important for the country.” He said there will be investment opportunities for UAE based companies in the energy sector. We will see increased cooperation between the two countries as the economy of India grows. The UAE will be an important partner.”

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 The UAE Minister of Economy Sultan Saeed Al Mansouri told this week that the UAE is open to meet any demand for oil from India. “The issue of energy is quite a challenge for India. It is a growing nation and the economy is growing 6 to 7 per cent and the demand for oil is there,” he told Gulf News on the sidelines of an investors meet attended by Modi. According to Make In India website of the Indian government there are plenty of investment opportunities in the oil and gas sector specially in exploration and production, refining sector, pipeline transportation etc. Gary Dugan, Chief Investment Officer at National Bank of Abu Dhabi said India is turning to alternative energy sources to supplement the ongoing development of more conventional sources of energy. “India has a chronic energy shortage that holds back its economic growth and development. It is likely to make available several large contracts for the development of its power industry in the future. In June for example the government announced tenders for 500 megawatts to 1,000 megawatt of solar power.” “It is understood that India needs to spend close to $100 billion to end blackouts.” Demand for primary energy in India is to increase threefold by 2035 to 1.516 billion tonnes of oil equivalent from 563 million tonnes of oil equivalent in 2012. It is the fourth largest consumer of crude oil and petroleum products in the world.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Tunisia:Circle Oil announces extension of permit for Mahdia Licence Source: Circle Oil AIM-listed Circle Oil has announced that the Tunisian Authority has approved the application to renew the exploration permit on its Mahdia block. The Permit is being extended for three years until 19 January 2018 and Circle Oil, as operator, currently has a 100% working interest in the Permit. The Mahdia permit offshore Tunisia covers an area of 3,024km2, and contains the El Mediouni structure which was drilled by Circle's EMD-1 wellin August 2014. As announced on 26 August 2014, the well encountered notable oil shows in the Ketatna (Oligo- Miocene) carbonates. While mud losses prevented log data acquisition, Circle considers the shows to indicate a significant resource from the structure. The Permit also contains a number of similar prospects which the Company look forward to exploring in further detail. The extension of the licence carries with it a one exploration well and one appraisal well commitment and a requirement to acquire 300km2 of 3D seismic. Circle outlined its strategy for the Mahdia licence at its recent AGM. Given its material working interestthe Company intends to select suitable partners with whom it can evaluate and develop the El Mediouni structure and other prospects on the permit. Circle has already had initial expressions of interest from a number of oil and gas companies with the financial strength and industry experience to make them suitable joint venture partners. The confirmation of this extension of the Permit will give interested parties greater certainty in making a formal approach and should greatly assist the Company in concluding an agreement. This farm out strategy will minimise Circle's financial commitment, reduce risk, and still allow the Company to benefit from the potential of the discovery. This approach is fully consistent with Circle's strategy to grow the Company in a sustainable manner and deliver value to shareholders in a low oil-price environment. Mitch Flegg, CEO Circle Oil comments: 'Circle Oil wishes to place on record our thanks to the Tunisian Consultative Committee on Hydrocarbons. We look forward to continuing to work with them with the aim of delivering a project which would bring considerable benefit to the people of Tunisia and to Circle. We will now move forward with the process of identifying a suitable partner or partners to work with us to realise the value of this exciting discovery.'

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Algeria: Petroceltic International provides update on Ain Tsila development project Source: Petroceltic International AIM-listed Petroceltic International has announced the launch of an invitation to tender for the provision of Engineering, Procurement and Construction ('EPC') services in respect of the Ain Tsila gas and condensate development in Algeria. Groupement Isarene, the joint operating organisation responsible for executing theAin Tsila field development plan established by Sonatrach (the National Oil and Gas Company of Algeria), Petroceltic and Enel, has completed a pre- qualification process to select a short list of EPC contractors with Algerian experience which would be capable of delivering the Central Gas Processing Facility and associated works envisaged for the Ain Tsila development. Following completion of that process, four companies (or consortia) have been invited by Groupement Isarene to tender for the Ain Tsila EPC contract: • Daewoo Engineering & Construction Co., Ltd • GS Engineering Corporation and Dodsal Engineering & Construction PTE Ltd (acting as a consortium) • JGC Corporation and JGC Algeria S.p.A (acting as a consortium) • Tecnidas Reunidas SA and Bonatti S.p.A (acting as a consortium)

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The scope of work for the EPC contract comprises a central processing facility, an industrial base, an administration/ accommodation base, well gathering system, and product export system. This scope of work is based on the Front End Engineering and Design ('FEED') outputs being generated by Chicago Bridge and Iron ('CBI') Company on behalf of the Groupement. The surface facilities have been designed to process up to 420 million standard cubic feet/day of wet gas, and transport the resultant product streams of dry gas, liquefied petroleum gas ('LPG') and condensate to existing tie-in points in the Algerian national hydrocarbon export infrastructure. Following a technical and commercial evaluation of the offers, it is anticipated that the EPC tender process will complete with an award recommendation targeted for year end 2015, with first Ain Tsila gas export scheduled for 2018. The approved Ain Tsila plan of development envisages the production of gross reserves of 2.1 Trillion Cubic Feet of sales gas, 67 million barrels of condensate and 108 million barrels of LPG extracted from an annual average wet gas plateau rate of 355 million standard cubic feet/ day. Development drilling is due to start in Q4 2015 with a newly built rig, contracted from Sinopec, which is currently en route to Algeria. U p to 24 new wells will be drilled and 6 existing wells recompleted prior to first gas, with a production plateau of 14 years maintained by further drilling. Petroceltic holds a 38.25% interest, Sonatrach a 43.375% interest, and Enel an 18.375% interest in the Isarene PSC. Petroceltic continues to benefit from a carry of its development costs in respect of Ain Tsila following the completion of the sale of an 18.375% interest to Sonatrach in July 2014. Commenting on the update, Brian O'Cathain, CEO of Petroceltic said: 'We are delighted to see the continued solid progress of the Ain Tsila project towards the EPC contract award, and onwards towards first gas in 2018. The anticipated award of the EPC to an EPC contractor with significant Algeria experience will be a major milestone in de-risking that schedule.'

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Congo (Brazzaville): Aquatic awarded multi-million pound Moho Nord subsea project contract.. Aquatic Engineering and Construction Aquatic Engineering and Construction, an Acteon company, has been awarded a multi- million pound contract on the $10 billion Moho Nord subsea project, off the coast of the Republic of Congo, West Africa. The contract was awarded by a UK-based subcontractor working for Total E&P Congo. Aquatic's ten-month campaign portion will mobilise in October 2015. Aquatic, the global partner for complete flex-lay solutions, will supply reel drive systems, together with a team of supervisors and technicians. They will provide the technical expertise and support to operate the equipment hired for the duration of the operation. Aquatic will be instrumental in the installation of 23 km of subsea flexible pipes and 50 km of umbilicals. The Moho Nord subsea deepwater offshore project is located approx. 75 km off the coast of Pointe Noire and is the latest project being developed in the Moho- Bilondo License. Since 2013, three other Acteon companies (2H Offshore, SRP and UTEC Survey) have been awarded work on the Moho Nord subsea project. Each Acteon group operating company functions as a discrete business, while complementing sister companies to add value for the customer. Martin Charles, Aquatic’s managing director, said, 'This project is the most significant for Aquatic to date, and affords us the opportunity to forge a closer relationship with our customer in a new geographical location, while levering support from other Acteon Group operating companies. Our people and equipment will work in close partnership with our customer to deliver the project safely and on time, where output is expected to achieve 140,000 barrels of oil equivalent per day by 2017.'

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Lehman to Build a $12 Billion Solar Empire in US,Africa & Asia Bloomberg Alexander Longley Seven years ago, Kerry Adler watched as the disaster at Lehman Brothers Holdings Inc. scuttled his vision of renewable-power riches. Today, he has reassembled assets from the collapsed investment bank, laying the foundation for a green-energy colossus. Adler’s SkyPower Ltd. has lined up deals to build utility-scale solar farms in North America, Asia and Africa worth more than $12 billion — though how the projects will be financed remains a mystery. To date, SkyPower has completed 23 projects totaling 300 megawatts, ranking it just 34th among solar developers worldwide, according to Bloomberg New Energy Finance. But if Adler is successful in fulfilling all of his signed contracts, he will have more renewable power capacity than any operator currently has. SkyPower aims to “kickstart this market in the hope of bringing power to people that really deserve it,” Adler, 50, said by phone from Kenya as he wrapped up his second major deal this year. That was a $2.2 billion pact for 1 gigawatt of solar — about the capacity of a typical nuclear reactor, and massive for renewables — that will take years Fort William First Nation site, Fort William, Ontario, Canada

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 to build. SkyPower has also begun a joint venture in Mexico, and within two months expects two more deals in the Middle East and Africa, each about as big as the Kenya contract. SkyPower has projects with a total capacity of about 25 gigawatts in the works, and Adler says he can build 7 gigawatts within five years. Even that would make it far larger than the biggest developers of commissioned solar projects: China’s Huanghe Hydropower Development Co Ltd., which has 2 gigawatts, and Arizona-based First Solar Inc., with 1.2 gigawatts, according to Bloomberg data. In terms of projects in the pipeline, only Missouri-based SunEdison Inc. is bigger, with deals representing 53 gigawatts on the table. Lehman Collapse “The next question is what is your probability rating — how likely is it that those projects will get built,” said Michael Morosi, a solar-industry analyst at Avondale Partners LLC in Nashville, Tennessee. He called SkyPower’s ambitions “a stretch goal.” Adler founded SkyPower in 2003 after a stint as chairman of outsourcing firm Sitel Canada. Lehman bought a majority stake in SkyPower in 2007. Lehman’s collapse the following year choked off credit to SkyPower, which itself sought protection from creditors in 2009. An affidavit Adler filed to an Ontario court said SkyPower was in “dire financial straits,” with C$214 million in debt ($165 million). The SkyPower name and fledgling solar business were sold a few months later to a new majority shareholder, CIM Group, a Los Angeles private equity fund with $20 billion of assets in real estate and infrastructure. Adler was kept on as CEO, and he retains a stake in the business. He declined to reveal his ownership share or provide revenue or profits for the closely held company. Thunder Bay Airport, Thunder Bay, Ontario, Canada

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 With the backing of CIM, SkyPower sold stakes in 16 projects totaling 200 megawatts to panel maker Canadian Solar Inc. for C$185 million. Then it started bidding for bigger deals, and in May 2014 Adler won a $5 billion contract to provide 3 gigawatts of solar to Nigeria. Since then, Adler has wrapped up Kenya and other contracts with a total potential value of $7.2 billion. In Egypt, he has promised to build 3 gigawatts, and in India SkyPower has deals to provide 350 megawatts. SkyPower offered “a very good rate, and we are hopeful that they will fulfil the contract,” said Manu Srivastava, commissioner for clean energy in Madhya Pradesh, one of two Indian states where Adler has deals. Financing Questions Despite Adler’s success in getting contracts, it’s unclear whether he’ll secure financing, said Jenny Chase, solar analyst at Bloomberg New Energy Finance. Many such agreements have scant repercussions for companies that fail to get financial backing and build the promised installations, she said. “Developers go around signing deals with countries and anyone else who might buy power from them,” Chase said. “A lot of those deals won’t come off.” First Light project, Napanee, Ontario, Canada SkyPower says it has worked with “leading bankers to the renewable industry,” though Adler declined to name them. He wouldn’t say whether there are any penalties in his contracts, but he insists SkyPower can line up the financial backing it needs. “We wouldn’t spend the time, money and effort pursuing a market,” Adler said, “if we did not believe that we have the capability to finance the project.” This story has been corrected to show SunEdison's pipeline in gigawatts.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase 20 August- 2015 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices dip further after U.S. stock-build, Saudi export rise REUTERS + NEWBASE Oil markets opened up weak on Thursday following sharp falls the previous session, with U.S. contracts hovering slightly above $40 per barrel, levels not seen since the credit crunch of 2009, and globally traded Brent tested support at $47. U.S. West Texas Intermediate (WTI) crude oil slumped over 4 percent on Wednesday to hit a 6-1/2- year low as a huge unexpected stockpile build in the United States reinforced concerns about a growing global oil glut. U.S. crude inventories rose 2.6 million barrels last week to 456.21 million barrels, the government's Energy Information Administration said. And markets opened up weak again on Thursday. U.S. crude futures CLc1 were trading at $40.69 per barrel at 0024 GMT, levels not seen since the peak of the global financial crisis of 2008/2009. Brent LCOc1 was down 11 cents at $47.05 a barrel. "WTI prices plunged to the lowest level in more than six years after an EIA report showed that U.S. crude stockpiles unexpectedly rose 2.6 million barrels against market expectations for a small decline," ANZ bank said on Thursday. "Despite the weak price environment, the biggest OPEC producer, Saudi Arabia, boosted its oil exports," it added. Saudi Arabia exported 7.365 million barrels per day (bpd) in June, up from 6.935 million bpd in May, figures published by the Joint Organisations Data Initiative (JODI) showed. The bearish sentiment is also visible in the long-term derivatives market. Contracts for delivery of crude oil in the future on the big commodities markets such as the New York Mercantile Exchange (CME.O) and the InterContinental Exchange (ICE.N) show the price of oil for delivery in five years' time has collapsed in recent months, implying that traders do not expect a price recovery any time soon. U.S. crude prices for delivery in 2020 cost only about $20 more than they do now, a price difference that falls further when adjusted to expected inflation and interest rates. Oil price special coverage

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Three Reasons Oil Will Surge Past $70 By the End of the Year Bloomberg - Julie Verhage Oil has been demolished over the past year, falling from $100 a barrel to the low 40s. But one oil expert says things are about to turn the corner once again, and Brent crude is going to surge to $71 a barrel by the end of the year. Credit Suisse energy economist Jan Stuart spoke on Bloomberg TV yesterday, giving the reasons behind his big target. I admit, my target looks very ambitious. The thinking behind it is that production is rolling already. We know that it's higher than we thought it was going to be at this stage, but it is rolling. The question is going to be how fast, how far. We think United States crude oil production ends the year below 9 million barrels a day from the 9.6 high...Number two, demand is growing...Emerging market demand not great, but not bad either. It's still growing, the consumer in China especially. Thirdly, Europe is not a headwind. That's the first time in five years. So without that headwind, my demand is going to be quite alright. And then, the next big shoe to drop that hasn't really dropped is that we need to see decline rates outside America kick in. If the industry spends this much less and if you know that the underlying decline rate everywhere is about four percent per annum, we need somehow to add four million barrels a day outside America, outside OPEC just to stand still. That is not going to continue to happen at these prices. He went on to talk about how prices need to rise for the industry to fund itself, particular for the upstream, or exploration and production portion. Also important in his forecast is that emerging market demand remains positive, even if it is at historically low levels. In terms of the biggest concerns for his target, tailwinds from a slowdown in China and a recession in emerging markets are chief among them. To watch the full interview, go here.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage Iran shopping list disputed in US debate over deal Bloomberg/Washington The US debate over the Iran nuclear accord is turning in part on conflicting assessments of the Islamic Republic’s likely shopping list. While President Barack Obama contends Iran will fund urgent domestic needs with most of the money it obtains once frozen assets are released, his Republican opponents say they expect the newly flush country to binge on weapons support for regional terrorism. As lobbying intensifies ahead of a vote of disapproval in Congress next month, Israeli Prime Minister Benjamin Netanyahu and other opponents say the deal to curb Iran’s nuclear programme would give it a flood of funds that leaders of the state could funnel to military or regional proxies. “Iran will receive $150bn that it will surely use to murder innocent men, women and children,” Jewish groups said in a newspaper ad over the weekend pressing Democratic Senator Cory Booker of New Jersey to oppose the deal. Yet claims of a terror windfall are overstated, according to analyses by the US government and specialists on Iran’s economy. “The amount is small and the opponents tend to exaggerate that because they want to argue that the agreement will destabilise the region,” says Nader Habibi, an economics professor at Brandeis University, who says any additional Iranian military spending probably will be “marginal.” The division of any unfrozen funds may pit President Hassan Rouhani’s pledges to improve the nation’s battered economy against the military aspirations of the hard-line Islamic Revolutionary Guard Corps. While lifting sanctions designed to bring Iran to the bargaining table would allow fresh investment from abroad, the first flow of funds potentially would come from Iranian accounts that were immobilised during the stand-off over the nuclear programme. Among the assets involved are proceeds of Iranian oil sales to countries including China, India and Japan; stranded foreign deposits by Iranian banks, individuals and companies; and Central Bank of Iran loans for Iranian energy projects. The value of the affected assets fluctuates and detailed estimates are difficult to obtain, in part because none of the funds are in the US. Bijan Khajepour, managing director of Atieh International, a Vienna-based consulting firm, pegs the total at about $102bn, while Habibi puts it at $89.6bn. Treasury Secretary Jacob J Lew told the House Foreign Affairs Committee last month that $115bn was “theoretically” available. “There’s a lot of counting issues and a bit of an art and a science associated with it,” says Adam Smith, a former senior adviser to the Treasury Department office that implemented the Iran sanctions. Under the nuclear agreement, the Iranian government will regain access to its stranded overseas funds once it scraps most of its nuclear infrastructure. “We think it will take six to 12 months,” Colin Kahl, national security adviser to the vice president, told an audience at the Center for Strategic and International Studies in Washington on August 13. But much of the $115bn that Treasury has identified won’t be available to Iranian leaders, as Lew has emphasised.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 More than $22bn is tied up in contracts Iran has signed with Chinese companies. Another $25bn belongs to Iranian individuals and banks and $25bn represents funds that Iran deposited overseas to finance projects of the Naftiran Intertrade Co, its global oil-trading arm, according to Khajepour and Habibi. Funds that have accumulated in accounts at the Bank of China illustrate how the sanctions have worked and the limits on the money Iran eventually will have at its disposal. Under the restrictions, Iran was isolated from global financial networks though it could still sell oil to countries such as China. With most trade to Europe and the US shut off, Iran used the sale proceeds to import Chinese consumer goods and to hire Chinese construction firms for large infrastructure projects including highways and refineries. Of the various pots of frozen money, the amount that probably would be immediately available is $29bn in central bank and government funds, Khajepour and Habibi say. Treasury’s estimate of potentially available funds is $56bn. Even at that, US officials say Iran probably won’t choose to repatriate all of the money that becomes available. Iran will need to keep overseas a portion of the funds - which Treasury says represents the country’s entire foreign exchange stockpile - to avoid a sharp increase in the value of its currency and to facilitate foreign trade. The International Monetary Fund calls for countries to retain sufficient reserves to pay for three to six months of imports, which in Iran’s case would amount to $20bn to $40bn. The US anticipates that the vast majority of the unfrozen funds would remain overseas, according to a Treasury official who spoke on condition of anonymity. Some of the funds are likely to be transferred from accounts in Asia to Europe, where Iran expects to see trade return to higher pre-sanctions levels, the official said. “As a matter of financial reality, Iran can’t simply spend the usable resources as they will likely be needed to meet international payment obligations such as financing for imports and external debt,” Lew said on July 28. Even after the deal is implemented, sanctions will remain in effect preventing most US companies from dealing with Iran. The prohibitions that will be suspended, which bar companies in other countries from Iranian trade, are known as “secondary sanctions.” Most date from 2010 and used the threat of losing access to the US market to discourage third-country companies, especially financial institutions, from doing business with the Islamic Republic. “The sophistication and complexity of the Iranian sanctions are really something unique,” says Smith, the former Treasury official who’s now an attorney with Gibson, Dunn & Crutcher in Washington. “There are a lot of moving parts here.” In an August 5 speech, Obama said any financial windfall Iran receives will be dwarfed by the country’s overdue bills and investment needs. The Iranian economy shrank by 9% in the two years ending March 2014, and the government faces at least $500bn in unpaid debts to Iranian contractors as well as pent-up investment demands, according to the Treasury Department. The oil and gas sector needs $145bn by 2020 just to keep production from falling, according to the Congressional Research Service. Rouhani was elected Iran’s president in 2013 after promising to end its isolation, boost living standards and create jobs. In recent weeks, he has instructed government departments to prioritise domestic needs in advance of parliamentary elections scheduled for February and his own re-election bid in 2017.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Housing, energy, telecommunications, aviation and the environment all will be competing for the available funds. “The mentioned projects plus the government debts have the potential to absorb everything,” Khajepour said in an e-mail. “But how the government will use them is still unclear.” Opponents of the deal argue that it would be problematic for the US even if Iran devotes only a sliver of the freed-up assets to further support Syria, Hezbollah or Hamas. The US wants Syrian President Bashar al- Assad to step down and considers Hezbollah and Hamas terrorist organisations. Along with expanding its military and further promoting terrorism, Iran also is likely to become more prosperous once the end of sanctions allows it to do business again with much of the world, says Mark Dubowitz, executive director of the Foundation for Defense of Democracies. If Iran were to cheat on the nuclear deal, thus requiring the imposition of fresh sanctions, it could prove more difficult to punish the Iranian economy. “You could see a situation where Iran is a much tougher target,” says Dubowitz, who advised Congress in the formulation of the existing sanctions. US officials concede that Iran may devote some of its new funds to supporting terrorism. But they say any increase could be matched by more military spending by the US, Israel or Gulf states, who already outspend Iran almost 10-to-1. The US already has begun discussions with the Gulf States on ways to better interdict Iranian funds flowing to groups such as Hezbollah. Obama says there’s no chance that “sanctions relief turns Iran into the region’s dominant power.” Whatever threat the Islamic Republic poses, he says, would only be worse if it had nuclear weapons.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Japan, Iran to discuss investment pact after sanctions end --Reuters Japan and Iran will start negotiations on an investment accord once sanctions are lifted following last month's landmark international deal on Tehran's nuclear programme, the Nikkei reported, citing Japanese government sources. Initial talks are being held between the two countries to prepare for the lifting of sanctions and begin formal negotiations, the business daily said, without identifying the sources. Japan is keen to boost ties with Iran and invest in resource projects in the country, as well as return imports of Iranian oil to about 10 per cent of the total from 5 percent now after sanctions forced Japanese refiners to cut purchases, it said. Earlier this month, Daishiro Yamagiwa, vice-minister of Japan's Ministry of Economy, Trade and Industry (METI), visited Tehran and met top government officials, accompanied by executives from the oil, gas and other industries. Yamagiwa did not discuss an investment agreement, Shigetoshi Ikeyama, a director in METI's Middle East and Africa division, said when contacted by Reuters about the Nikkei report. "Knowing that Japanese companies are interested in boosting economic ties in future, state minister Yamagiwa had general discussions on streamlining the environment for that, but did not discuss an investment pact in particular," Ikeyama said, adding that the Ministry of Foreign Affairs would take the lead on any discussions on specific agreements. "Another reason for Yamagiwa's visit was to avoid being beaten by European and U.S. companies," Ikeyama said.Officials at the foreign ministry were not immediately available for comment. Inpex, Japan's biggest energy explorer, JGC Corp, an engineering company, and trading houses Mitsubishi Corp, Mitsui & Co and Itochu Corp joined Yamagiwa on the visit, the Nikkei said. A spokesman at Inpex, which in 2010 was forced to give up a stake in Iran's Azadegan oil field because of the sanctions, confirmed some of its officials had accompanied Yamagiwa and said the explorer was monitoring the situation.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Itochu and JGC also confirmed they were in the delegation but Mitsui did not respond immediately to a query on the matter. A Mitsubishi official had said earlier that it planned to send an official along with Yamagiwa. Senior government ministers from Italy, France, Germany and Serbia have been among those making the trek since the July 14 accord, which raised the prospect of banking and trade sanctions on Iran being lifted, possibly by the end of this year. Last month Iran outlined plans to rebuild its main industries and trade relations following the nuclear agreement with world powers, saying it was targeting oil and gas projects worth $185 billion by 2020.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 18 August 2015 K. Al Awadi