New base energy news 17 october 2020 issue no. 1382 by senior editor khaled alawadi-compressed

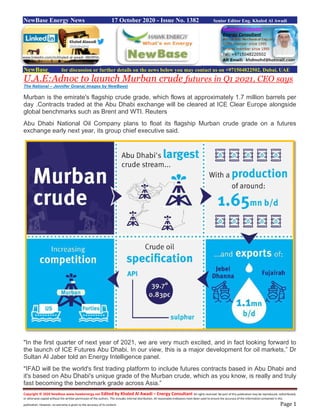

- 1. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 17 October 2020 - Issue No. 1382 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE U.A.E:Adnoc to launch Murban crude futures in Q1 2021, CEO says The National – Jennifer Gnana( images by NewBase) Murban is the emirate's flagship crude grade, which flows at approximately 1.7 million barrels per day .Contracts traded at the Abu Dhabi exchange will be cleared at ICE Clear Europe alongside global benchmarks such as Brent and WTI. Reuters Abu Dhabi National Oil Company plans to float its flagship Murban crude grade on a futures exchange early next year, its group chief executive said. "In the first quarter of next year of 2021, we are very much excited, and in fact looking forward to the launch of ICE Futures Abu Dhabi. In our view, this is a major development for oil markets,” Dr Sultan Al Jaber told an Energy Intelligence panel. "IFAD will be the world's first trading platform to include futures contracts based in Abu Dhabi and it's based on Abu Dhabi's unique grade of the Murban crude, which as you know, is really and truly fast becoming the benchmark grade across Asia.” www.linkedin.com/in/khaled-al-awadi-38b995b

- 2. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Intercontinental Exchange, which operates global exchanges, said on Monday it will float Murban crude futures in the first quarter of 2021. The ICE Futures Abu Dhabi will begin trading next year, subject to the completion of regulatory approvals. A more specific date for the launch of trading will be announced in due course, ICE said. Adnoc's Murban crude to be listed on futures exchange in 'historic' step-change for Abu Dhabi's oil pricing Oil majors and Asian energy companies partner with Adnoc on international crude futures exchange Murban is Abu Dhabi's flagship crude grade, which flows at approximately 1.7 million barrels per day. The company currently uses a retroactive pricing mechanism for its crude. The new Murban Crude forward pricing mechanism will use a market-driven futures contract as its price marker, enabling customers and the market to better price, trade, and manage their crude requirements. "ICE Murban Futures will be a physically delivered contract with delivery at Fujairah in the UAE on a free on board (FOB) basis,” the exchange operator said. The futures will be complemented with a range of cash settled derivatives, which will be launched on the first day of trading. Contracts traded at the Abu Dhabi exchange will be cleared at ICE Clear Europe alongside global benchmarks such as Brent, WTI, ICE Platts Dubai and ICE Low Sulphur Gasoil. Last year, oil majors including BP and Total, trading house Vitol and Asian energy companies partnered with Adnoc to set up the international futures exchange for Murban. Intercontinental Exchange Abu Dhabi will be based at the Abu Dhabi Global Market, the capital’s international financial centre. Companies that signed the partnership include Thailand’s PTT, Japan’s JXTG and Inpex, BP, France’s Total, South Korea’s GS Caltex, PetroChina, Anglo-Dutch major Shell and Vitol. The Supreme Petroleum Council also lifted restrictions on destinations for the sale of Murban. Brent is the most widely-used benchmark for crude and is based on production from the North Sea, which is currently in decline. Around two-thirds of all crude contracts globally reference to Brent. In the Middle East, Saudi Arabia – the world’s largest oil exporter – uses the Oman crude price quoted on the Dubai Mercantile Exchange. Dr Al Jaber also remained optimistic over the long-term demand for oil and cited Opec's recent estimate for overall demand to reach 109m bpd over the next 20 to 25 years. He added that the UAE was "keeping a close eye" on the potential impact of new Covid-19 restrictions that were enforced following a second wave of infections. The UAE, which is part of the Opec+ alliance to cut production, remained "100 per cent compliant" to output curbs agreed by the alliance, he said. The group, led by Saudi Arabia and Russia, is cutting back 7.7m bpd from the markets and will convene their technical and monitoring committee meetings on Thursday and on October 19, respectively.

- 3. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Libya’s Oil Output Reaches 500,000 Barrels a Day After Truce Bloomberg - Salma El Wardany Libya’s daily oil production has risen to around 500,000 barrels, according to people familiar with the situation, as the war-battered nation restarts its energy industry after a truce. Sharara, the country’s biggest oil field, is pumping roughly 110,000 barrels a day, according to two people with knowledge of the situation, who asked not to be identified because they’re not authorized to speak to media. The southwestern deposit, which has a capacity of 300,000 barrels daily, restarted on Sunday. Brent crude fell following the news but later pared some losses. The international benchmark was 0.6% lower late Thursday at $43.06 a barrel. The halt in Libya’s civil war led to many fields and ports in the east reopening last month, after an almost total shutdown of energy facilities since January. Before then, Libya was producing 1.2 million barrels a day. Libya is home to Africa’s largest crude reserves and the return of its barrels is weighing on oil prices just as tighter virus restrictions in many countries sap demand for energy. The North African nation is an OPEC+ member, though it’s exempt from supply curbs the cartel initiated in May to boost oil prices, which are down around 35% this year. Libya’s Oil Network OPEC nation has Africa’s biggest crude reserves

- 4. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 JPMorgan Chase & Co. forecasts that Libyan output could hit 1 million barrels a day by March, though that will depend on the truce holding. Libya’s oil exports averaged 385,000 barrels daily in the first two weeks of this month, up from 213,000 barrels a day for all of September, according to tanker-tracking data monitored by Bloomberg. Many of those shipments are from storage tanks at ports, rather than freshly-pumped crude. Here’s a breakdown of production: Arabian Gulf Oil Co., or Agoco, was producing 257,000 barrels a day as of Thursday from its eastern fields, according to a separate person Sirte Oil Co. which operates fields supplying Brega port, is pumping 76,000 barrels a day, another person said Fields run by Mellitah Oil Co. are producing 100,000 barrels a day El Feel, which is close to Sharara and needs electricity from its bigger neighbor to operate, has not restarted; but the 70,000-barrel-a-day field normally follows Sharara’s shutdowns and is expected to resume soon Here’s the latest on ports: Zawiya port, which handles Sharara’s crude, is set to load 630,000 barrels this month on to the tanker Aegean Nobility, according to an initial loading plan; the exports will be the first from the port since January The two eastern oil ports of Es Sider and Ras Lanuf, the country’s largest and third-biggest respectively, are still closed Brega is set to export three cargoes next month

- 5. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Oman’s sovereign rating was cut for the 2nd time in 2020 by S&P - Abeer Abu Omar Oman’s sovereign rating was cut for the second time in 2020 by S&P Global Ratings as lower crude revenue and the virus pandemic take a heavy toll on the country’s finances. S&P took Oman a notch lower to B+, four levels into its non-investment grade scale, according to a statement Friday. The outlook on the rating is stable. The Gulf nation had already been downgraded twice this year by both Moody’s Investors Service and Fitch Ratings. S&P’s rating is now one level lower than both Moody’s and Fitch. “Oman’s public sector finances, as indicated by the net debt level, will materially weaken over the next three years, notwithstanding the implementation of measures to reduce fiscal deficits, S&P said. “This is partly driven by our assumptions of restrained oil price growth and slow economic recovery from the Covid-19 pandemic.” The sultanate’s finances were in trouble even before the breakout of the pandemic and a crash in oil prices. It is now on course to rack up the steepest budget deficit since 2016 at nearly 19% of gross domestic product, according to the International Monetary Fund. The economy is seen contracting 10%, the most among Arab Gulf nations, the fund estimated in its latest outlook.

- 6. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 S&P estimates Oman’s gross government debt will rise to about 84% of GDP by end-2020 from 60% in 2019, while government-related enterprises debt will reach 43% of GDP from 30% during the same period. The real GDP will contract in 2020 by 5% due to oil production limits under the OPEC+ agreement and the blow dealt by the Covid-19 to domestic demand and investment, it said. The IMF now expects Oman’s debt ratio to rise by 18 percentage points this year, on par with junk- rated Ecuador. According to Bloomberg Barclays indexes, Oman’s dollar bonds have underperformed all Gulf Arab peers this year. Oman’s economy has been struggling since the earlier oil price crisis in 2014, and it has been forced to tap international debt markets to plug budget deficits. It was slower than its neighbors in implementing fiscal reforms despite dwindling reserves, though this month it announced plans for a 5% value-added tax next year, a step economists said was welcome but not enough. “The incremental revenues from VAT would be offset to a large extent by incremental interest expenditure,” Morgan Stanley’s Jaiparan Khurana wrote in an Oct. 15 note. The largest oil exporter outside of OPEC, Oman reportedly discussed receiving financial aid from wealthier neighbors earlier this year to help it weather cheaper crude and the pandemic. Preliminarily figures showed the fiscal deficit widened 25% during the first half of 2020 on a yearly basis.

- 7. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 U.S. shale oil output to drop 123,000 bpd to 7.69MBPD in November Reuters + EIA U.S. shale oil output is expected to decline by 123,000 barrels per day (bpd) in November, the biggest drop since May, to about 7.69 million bpd, the U.S. Energy Information Administration (EIA) said in a monthly forecast on Tuesday. Overall output is expected to drop for the third straight month and is expected to decline in most of the seven major shale formations in November. The biggest decline is forecast in the Eagle Ford basin of South Texas, where production is estimated to drop by about 34,000 bpd to about 1 million bpd, the lowest since May 2013, the data showed. U.S. oil and gas producers have slashed spending and curbed output this year as the global oil market grapples with a plunge in demand due to the coronavirus outbreak. Still, U.S. energy firms last week added oil and natural gas rigs for a fourth week in a row for the first time since June 2018 as producers start drilling again with crude prices CLc1 holding around $40 a barrel over the past few months. In the Permian basin of Texas and New Mexico, the biggest shale oil basin in the country, output is expected to drop by 17,000 bpd to about 4.4 million bpd. Separately, the EIA projected U.S. natural gas output would decline for a third month in a row to 81.8 billion cubic feet per day (bcfd) in November. That would be down over 0.6 bcfd from its forecast for October. Output from the big shale fields hit a monthly all-time high of 86.9 bcfd in November. Output in Appalachia, the biggest U.S. shale gas formation, was set to slip for a third month in a row in November to 33.6 bcfd, down over 0.1 bcfd from October.

- 8. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 India: Vestas expands footprint in India, introduces new turbine Vistas + NewBase The global demand for sustainable energy solutions in low and ultra-low wind areas continues to grow as renewable technology improves in efficiency and cost. This trend is especially prominent in India, the world’s fourth largest wind energy market, where the energy demand is expected to double and the government intends to add around 100 GW wind power in the predominantly low-wind market by 2030. While the new turbine is globally applicable, it initially targets low and ultra-low wind condition projects in India and the US. It increases the turbine swept area by 67 per cent in comparison to V120-2.2 MW, and with a large rotor to rating ratio, it significantly improves the partial load production in low-wind conditions. “With the introduction of the V155-3.3 MW wind turbine, Vestas is connecting our proven 4 MW platform technology with customised solutions to improve our customers’ business case in low and ultra-low wind conditions,” says Thomas Scarinci, Senior Vice President of Product Management Vestas. “With this product designed specifically to optimise energy production in low and ultra-low wind conditions, we are confident that we can bring enhanced value to our customers and partners in India and other suited markets”. As the turbine will be predominantly locally manufactured and sourced in India, it reinforces Vestas’ existing commitment to the country’s growing renewable energy industry. The V155-3.3 MW improves the annual energy production (AEP) by more than three percent for a 300 MW wind park with 46 fewer turbines, creating an improved level of business case certainty

- 9. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Vestas will increase its already prominent manufacturing footprint in India by establishing a new converter factory in Chennai and expanding its current blade factory in Ahmedabad. These investments follow Vestas’ previously announced new nacelle and hub factory in Chennai, which is currently under construction. The production ramp-up will add around 1,000 new jobs within the next year to the approximately 2,600 people currently working for Vestas in India. While the expanded production setup in India will serve the growing wind market in the region, it will also act as a strategic export hub. “We have installed close to 4 GW of wind turbines in India over the last two decades and established a large production footprint, and we’re excited to leverage this as we support the government’s ambitions for renewable energy. With the introduction of the V155-3.3 MW turbine, we are able to offer improved energy production and business case certainty for our customers in India’s growing wind market,” says Clive Turton, President of Vestas Asia Pacific. “With the production ramp up in India, we anticipate increased employment across our existing hubs, underlining our commitment to better support our customers and drive the country’s renewable energy transition.” With an optimised blade design and market specific towers up to 140 m hub height, the turbine is designed to meet local transportation requirements. Built on the globally proven 4 MW platform, the V155-3.3 MW features a full-scale converter delivering excellent grid compliance, faster active and reactive power during dynamic frequency and voltage events. With 35 GW of 4 MW platform turbines installed in 47 countries, the V155-3.3 MW has been developed within Vestas’ leading standards within design, testing and manufacturing, ensuring customer’s business case certainty. Prototype installation is planned for the third quarter 2021, while serial production is expected by the first quarter of 2022.

- 10. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Global liquid fuels production outages have increased in 2020 Source: U.S. Energy Information Administration, October 2020 Short-Term Energy Outlook Disruptions to crude oil and condensate production from members of the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC countries have risen considerably since last year. These outages have contributed to reduced liquid fuel supply and, along with crude oil production declines agreed to among OPEC and partner countries (OPEC+), have contributed to global liquid fuels inventory draws since June. Note: Non-OPEC production outages include crude oil and condensate. OPEC production outages are for crude oil only. So far in 2020, monthly oil supply disruptions have averaged 4.6 million barrels per day (b/d) and reached 5.2 million b/d in June, the highest monthly levels since at least 2011, when the U.S. Energy Information Administration (EIA) began tracking monthly liquids production outages. Global oil supply disruptions averaged 3.1 million b/d in 2019, and rising outages in Iran have been the main drivers of the year-on-year increase. EIA does not include field closures for economic reasons or oil demand declines in its accounting of supply disruptions. Libya, Venezuela, and Iran (the OPEC countries exempt from the latest OPEC+ agreement) were the main contributors to these outages. Domestic political instability in Libya has removed about 1.2 million b/d from oil production since February 2020. The Libyan National Army, the warring faction in eastern Libya, blockaded five of the country’s oil export terminals and shut in oil production from major fields in the southwestern region in January 2020, causing Libya’s production to fall to less than 100,000 b/d by April.

- 11. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 U.S. sanctions have led to production outages in Venezuela and Iran. U.S. sanctions placed on oil- trading companies and shipping companies that facilitated exports of Venezuela’s crude oil in the first half of 2020 removed 500,000 b/d of crude oil production from global markets by August. Ongoing U.S. sanctions on Iran’s crude oil and condensate exports have kept Iran’s disruption levels elevated through 2020, and disruptions there have increased by another 100,000 b/d since January. Non-OPEC oil supply disruptions, mostly from the United States and Canada, rose to nearly 800,000 b/d in August. Disruptions in Canada occurred when operators ordered nonessential staff to stop work because of coronavirus outbreaks at production sites. In the United States, hurricane-related disruptions and unplanned maintenance affected oil production this summer. Other non-OPEC countries experienced temporary field closures for various reasons such as coronavirus outbreaks among workers, logistical issues moving workers or equipment during the pandemic, fires at field operations in Canada, or other natural disasters. EIA publishes historical unplanned production outage estimates in its Short-Term Energy Outlook (STEO). In its estimates of outages, EIA differentiates among declines in production resulting from unplanned production outages, permanent losses of production capacity, and voluntary production cutbacks. EIA’s estimates of unplanned production outages are calculated as the difference between estimated effective production capacity (the level of supply that could be available within one year) and estimated production.

- 12. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 EIA’s International Energy Outlook analyzes electricity markets in India, Africa, and Asia…. source: U.S. EIA, International Energy Outlook 2020 (IEO2020) Countries that are not members of the Organization for Economic Cooperation and Development (OECD) in Asia, including China and India, and in Africa are home to more than two-thirds of the world population. Note: OECD=Organization for Economic Cooperation and Development. These regions accounted for 44% of primary energy consumed by the electric sector in 2019, and the U.S. Energy Information Administration (EIA) projected they will reach 56% by 2050 in the Reference case in the International Energy Outlook 2019 (IEO2019). Changes in these economies significantly affect global energy markets. Today, EIA is releasing its International Energy Outlook 2020 (IEO2020), which analyzes generating technology, fuel price, and infrastructure uncertainty in the electricity markets of Africa, Asia, and India. A related webcast p resentation will begin this morning at 9:00 a.m. Eastern Time from the Center for Strategic and International Studies.

- 13. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 IEO2020 focuses on the electricity sector, which consumes a growing share of the world’s primary energy. The makeup of the electricity sector is changing rapidly. The use of cost-efficient wind and solar technologies is increasing, and, in many regions of the world, use of lower-cost liquefied natural gas is also increasing. In IEO2019, EIA projected renewables to rise from about 20% of total energy consumed for electricity generation in 2010 to the largest single energy source by 2050. The following are some key findings of IEO2020: As energy use grows in Asia, some cases indicate more than 50% of electricity could be generated from renewables by 2050. IEO2020 features cases that consider differing natural gas prices and renewable energy capital costs in Asia, showing how these costs could shift the fuel mix for generating electricity in the region either further toward fossil fuels or toward renewables. Africa could meet its electricity growth needs in different ways depending on whether development comes as an expansion of the central grid or as off-grid systems. Falling costs for solar photovoltaic installations and increased use of off-grid distribution systems have opened up technology options for the development of electricity infrastructure in Africa. Africa’s power generation mix could shift away from current coal-fired and natural gas-fired technologies used in the existing central grid toward off-grid resources, including extensive use of non-hydroelectric renewable generation sources. Transmission infrastructure affects options available to change the future fuel mix for electricity generation in India. IEO2020 cases demonstrate the ways that electricity grid interconnections influence fuel choices for electricity generation in India. In cases where India relies more on a unified grid that can transmit electricity across regions, the share of renewables significantly increases and the share of coal decreases between 2019 and 2050. More limited movement of electricity favors existing in-region generation, which is mostly fossil fuels.

- 14. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 IEO2020 builds on the Reference case presented in IEO2019. The models, economic assumptions, and input oil prices from the IEO2019 Reference case largely remained unchanged, but EIA adjusted specific elements or assumptions to explore areas of uncertainty such as the rapid growth of renewable energy. Because IEO2020 is based on the IEO2019 modeling platform and because it focuses on long-term electricity market dynamics, it does not include the impacts of COVID-19 and related mitigation efforts. The Annual Energy Outlook 2021 (AEO2021) and IEO2021 will both feature analyses of the impact of COVID-19 mitigation efforts on energy markets. Asia (China) infographic With the IEO2020 release, EIA is publishing new Plain Language documentation of EIA’s World Energy Projection System (WEPS), the modeling system that EIA uses to produce IEO projections. EIA’s new Handbook of Energy Modeling Methods includes sections on most WEPS components, and EIA will release more sections in the coming months.

- 15. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase October 17-2020 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil Ekes Out Weekly Gain Even as Resurgence Threatens Demand Bloomberg +Reuters + NewBase Oil posted a small weekly gain on tentative signs that demand is picking up even as a new wave of coronavirus cases casts a shadow ove r the market. Futures in New York edged lower on Friday, but still managed to record an advance of 0.7% this week on shrinking U.S. crude stockpiles and signs of improving demand in China and India. Gains were capped by record new virus cases from Germany to Portugal and the biggest surge in U.S. daily infections in two months. Brent crude futures LCOc1 fell 23 cents to settle at $42.93 a barrel, and U.S. West Texas Intermediate (WTI) crude futures dropped 8 cents to settle at $40.88 a barrel. Brent rose 0.2% for the week, while WTI was on track to gain 0.7%. Oil price special coverage

- 16. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 “We had some bright spots, but the outlook remains really challenged in terms of demand and the rising Covid cases,” said John Kilduff, a partner at Again Capital LLC. “We keep getting these dueling inputs where we get some hopefulness about things picking up and then get knocked back down.” Crude futures in New York have clung close to the $40-a-barrel mark since September amid uncertainty around a demand recovery as the virus rages. Meanwhile, OPEC producers and allies see a risk of an oil surplus next year if Libya’s production rises and demand remains depressed. At the same time, the market’s structure continues to strengthen, with the spread between Brent’s nearest contracts at its narrowest since late July. For West Texas Intermediate futures, the prompt spread rallied to its tightest contango in a month. Prices pared earlier losses on Friday after American retail sales and consumer sentiment indicators topped estimates. “We’re having a much stronger consumer than we anticipated, despite a good part of the country struggling to find work,” said Edward Moya, a senior market analyst at Oanda Corp. “Everyone is going to be still consuming a wide variety of goods going into these coming months, and that’s going to be positive for crude.” The Organization of Petroleum Exporting Countries and its allies are facing pressure to postpone their plans for tapering output cuts. Given the uncertainty over the oil demand outlook, the right course of action is to wait for now, JPMorgan analysts including Natasha Kaneva wrote in a report. The move to add another 2 million barrels of day onto the market in January could be postponed by a quarter, the report said. OPEC+ is also contending with the unexpected return of Libyan oil output, which hit 500,000 barrels a day this week. The group forecasts that global oil supplies could increase by 200,000 barrels a day next year if Libya manages to revive supply and the pandemic hits demand harder than expected, according to a document seen by Bloomberg. U.S. oil and gas rig count rises by most since January: Baker Hughes U.S. energy firms this week added the most oil and natural gas rigs since January as producers return to the wellpad with crude prices holding around $40 a barrel over the past several months. The oil and gas rig count, an early indicator of future output, rose for the fifth week in a row, increasing 13 to 282 in the week to Oct. 16, energy services firm Baker Hughes Co BKR.N said in its closely followed report on Friday.

- 17. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 The total rig count fell to a record low of 244 rigs during the week ended Aug. 14, while oil rigs alone fell to a 15-year low at 172 in the same week, according to Baker Hughes data going back to 1940. U.S. oil rigs this week also posted their biggest build since January, rising 12 to 205 this week, their highest since June. Gas rigs rose one to 74, according to Baker Hughes data. Most of the rigs added were in Texas, which gained seven. At least three of those units were in the Eagle Ford shale in South Texas, according to the data. Even though U.S. oil prices are still down about 34% since the start of the year due to coronavirus demand destruction, U.S. crude futures CLc1 have gained 116% over the past six months to about $41 a barrel on Friday mostly on hopes global economies and energy demand will return as governments lift more lockdowns. Analysts said those higher oil prices have encouraged some energy firms to start drilling again. “The horizontal activity trough is now indeed behind us, and we continue to expect to see further modest gains into year end 2020,” analysts at Tudor, Pickering, Holt & Co said this week.

- 18. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Energy Demand to Receive a Work-From-Home Boost This Winter (Bloomberg) -- “Get yours before they go,” says the headline on a home improvement article dedicated to the hottest housing trends. The must-have item? A patio heater. With winter in the northern hemisphere fast approaching, the Covid-19 pandemic is prompting families to buy outdoor heaters. Restaurants and bars are also snapping them up to provide al fresco dining and drinking, while Google searches for “patio heating” have jumped to a record high. These heaters rely on electricity or liquefied petroleum gas, like propane. Residential energy demand is set to increase in the coming months as millions of people in Europe, Asia and North America spend more time at home -- either working, studying or relaxing on their patios. With many offices still open, commercial use should remain steady, creating a so-called ‘double-heating effect’ that could lead to more use of everything from kerosene to natural gas. Commodity traders are also beginning to bet on a colder-than-normal winter, due to the formation of a La Nina weather pattern in the Pacific Ocean. That -- combined with the impact of the coronavirus -- may mean that demand for some energy products could be surprisingly strong. “Weather agencies are forecasting a cold start to the 2020–21 winter,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. in London. “Demand for LPG, kerosene, heating oil and low-sulfur fuel oil could all be boosted by varying degrees.” The likelihood of higher-than-usual demand has already started to filter through to the market: U.S. spot propane prices rose to the highest level this year last week The price of natural gas, used to heat homes or produce electricity, has jumped in Asia and Europe to the highest since before the virus Double heating could add 5% to gas demand for Europe, said James Huckstepp, manager for EMEA gas analytics at S&P Global PlattsMeanwhile, the U.S. Henry Hub gas benchmark rallied to a 19-month high earlier this week amid optimism for colder

- 19. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 temperaturesAsian kerosene margins have recovered to $1 a barrel from as low as minus $2 in early September amid an uptick in demand from Japan, where the fuel is used for heating householdsThe Organization of the Petroleum Exporting Countries said it expects an increase in U.S. heating oil consumption The La Nina pattern is expected to bring below-average temperatures to North Asia, which is home to the biggest LNG importers, along with western Canada, parts of the northern U.S. and southern Europe, according to Todd Crawford, chief meteorologist at the Weather Company. Total winter natural gas demand rose by a third from the previous year due to the last major La Nina in 2010-2011, Australia & New Zealand Banking Group Ltd. said in a note this month. A colder winter will also likely boost thermal coal consumption in China, while traders say that Japanese buyers have been stockpiling kerosene. It still isn’t clear, however, whether double heating will be enough to overcome the virus-induced drop in demand from major industrial users, which are generally the biggest consumers of electricity, natural gas and some oil products. This has forced analysts to rethink how they forecast winter demand. Some of the biggest buyers of liquefied natural gas -- including Korea Gas Corp. and China National Offshore Oil Corp. -- have scrapped their usual winter demand models, according to traders, and are rebuilding them from the ground up as they evaluate how the pandemic is upending energy consumption patterns. And while European and Asian natural gas prices have rallied they’re still at the lowest seasonal level in over a decade, indicating a degree of anxiety over how consumption will play out this winter.

- 20. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 “In the short term, estimates for winter demand will need to grapple with the depth and duration of lockdown measures, and figure out what impact this will have on both total demand and intraday profiles,” said James Whistler, the global head of energy derivatives at Simpson Spence Young, an international commodity and ship broker. “The risks of continued restrictions and second waves are high, and companies should expect demand to be volatile.” The spread of the virus and the extent to which major economies are forced to impose more restrictions will be key. Europe is already struggling with a fresh wave of infections and there’s a risk the same phenomenon will happen in the U.S. The picture in North Asia looks better, although more people are working from home than usual. Energy consumption will be highest where there’s an inconsistent and unpredictable division between working at home and the office, said Liam O’Brien, an associate professor at Carleton University’s Architectural Conservation and Sustainability Engineering program in Ottawa. A lot will depend on whether commercial buildings are operated based on occupancy and if the ventilation rate is increased to reduce Covid-19 transmission, he said. High numbers of people working from home could intensify power demand when there are sudden cold blasts, but by how much is uncertain. The lack of clarity is spurring more swings in energy markets. Implied volatility in the Henry Hub gas benchmark in the U.S. is at the highest in at least a decade, suggesting the market expects more dramatic price moves. Grid operators usually rely on large industrial facilities to anchor their demand forecasts and help with reactive power support, IHS Markit said in a note. But with some of these plants halted amid an uncertain economic outlook, operators are in uncharted territory. “The double-heating effect will likely have a bigger impact on peak demand rather than overall energy demand,” said James Taverner, an IHS analyst in London. “This is something transmission system operators will be watching very closely.”

- 21. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase Special Coverage The Energy world – October 16- September -2020 Coronavirus response can ‘reshape the future of energy,’ IEA says in annual report KEY POINTS The world’s response to Covid-19 can “reshape the future of energy” for years to come, the International Energy Agency said Tuesday in its annual World Energy Outlook report. “It is too soon to say whether today’s crisis represents a setback for efforts to bring about a more secure and sustainable energy system, or a catalyst that accelerates the path of change,” the report said. IEA envisions oil demand hitting a plateau in 2030 and declining from there, while solar could become the “new king of the world’s electricity markets.” The world’s response to Covid-19 can “reshape the future of energy” for years to come, the International Energy Agency said Tuesday in its annual World Energy Outlook report. The IEA report underscored that most important of all is how the crisis will ultimately affect the transition to clean energy. The report noted that while the clean energy transition continues to gain momentum, faster and bolder structural changes are needed if the world is to reach net-zero carbon emissions. “The Covid-19 crisis has caused more disruption than any other event in recent history, leaving scars that will last for years to come,” the Paris-based agency said in a statement. “Covid-19 unleased a crisis of exceptional ferocity on countries around the world ...The crisis is still unfolding today — and its consequences for the world’s energy future remain highly uncertain.” Despite a record drop in global emissions this year, the world is far from doing enough to put them into decisive decline. Dr Fatih Birol, IEA Executive Director

- 22. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Going forward, IEA believes that renewables will take “starring roles,” and solar will take “center stage,” driven by supportive government policies and declining costs. “I see solar becoming the new king of the world’s electricity markets,” said Fatih Birol, IEA’s executive director. “Based on today’s policy settings, it is on track to set new records for deployment every year after 2022.” On the other hand, IEA forecasts that coal demand will not return to pre-coronavirus levels, and that it will account for less than 20% of energy consumption by 2040, for the first time since the Industrial Revolution. Oil will remain “vulnerable to the major economic uncertainties resulting from the pandemic,” with demand starting to decline after 2030, the agency said. Due to the ongoing impacts of Covid-19, the IEA expects global energy demand to fall by 5% in 2020, with oil and coal consumption falling 8% and 7%, respectively. Natural gas demand is expected to decline by 3% this year — the largest decline since it became a major source of fuel in the 1930s — but the agency sees an uptick in demand over the next decade driven by growth from emerging economies. The outlook has been revised slightly since April, when the agency predicted energy demand could drop 6% in 2020. Key estimated energy demand, CO2 missions and investment indicators, 2020 relative to 2019

- 23. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 It is too soon to say whether today’s crisis represents a setback for efforts to bring about a more secure and sustainable energy system, or a catalyst that accelerates the path of change. IEA’s World Energy Outlook report As is customary, the report outlined the impacts of several different scenarios rather than just one given the number of variables in flux. But in a departure from recent years, the IEA chose to focus more heavily on the pivotal next 10 years. Under the “Stated Policies Scenario,” Covid-19 will be brought under control in 2021 and energy demand will rebound to its pre-crisis level in 2023, while the “Delayed Recovery Scenario” models a slower economic recovery from the pandemic, with energy demand not rebounding until 2025. The other two — the “Sustainable Development Scenario” and “Net Zero Emissions by 2050″ — outline the necessary steps to reach stated climate goals. In the former scenario, net-zero emissions are achieved by 2070, while in the latter, aggressive policies mean the goal is met by 2050. “It is too soon to say whether today’s crisis represents a setback for efforts to bring about a more secure and sustainable energy system, or a catalyst that accelerates the path of change,” the report said. Solar is the ‘new king’ The only energy source expected to grow this year is renewables. Much of the growth is generated from solar, and that’s set to continue in the years to come as prices decline, making solar a cheaper power source than new coal and gas-fired plants. Under the stated policies scenario, renewables are on track to meet 80% of the growth in electricity demand over the next 10 years. By 2025, renewables will overtake coal as the primary means of producing electricity. If more aggressive policies are adopted, renewables will play an even larger part in the next five or so years, according to the report. Who is leading in renewable energy? However, one obstacle stands in the way of renewables-generated power: the outdated electrical grid. “Without enough investment, grids will prove to be a weak link in the transformation of the power sector, with implications for the reliability and security of electricity supply,” IEA said. Oil demand reaches a ‘plateau’ The coronavirus pandemic hit the oil industry hard earlier this year as shelter-in-place orders led to a drop-off in fuel demand. Ultimately, coronavirus erased “almost a decade of growth in a single year.” Demand for 2020 as a whole is expected to be 8 million barrels per day less than in 2019, although the agency expects demand to climb again in 2023. The agency expects an uptick through 2030, at which point “oil demand reaches a plateau.” Much of the return to growth will stem from emerging and developing economies, most notably India. In the delayed recovery scenario, however, oil demand won’t recover until 2027. IEA noted that while some of the coronavirus-induced changes are negative for oil demand — including working from home and travel restrictions — some side effects are supportive, such as an aversion to public transportation and the continued popularity of SUVs, among other things.

- 24. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 While declining demand sent oil prices tumbling earlier this year and has kept them lower for longer, a lack of investment in the industry could lead to future fluctuations in prices. The report noted the steep economic consequences for countries that rely on oil production. “Now, more than ever, fundamental efforts to diversify and reform the economies of some major oil and gas exporters look unavoidable,” IEA said. The agency pointed to large oil companies writing down the value of their assets as a “palpable expression of a shift in perceptions about the future.” Global coordination needed Global energy-related emissions are on track to drop 7% this year as economies around the world shut down to slow the spread of the virus. But the IEA noted that this approach will not lead to long- term declines, since the shutdowns are in response to a one-off event rather than a structural change. “The economic downturn has temporarily suppressed emissions, but low economic growth is not a low-emissions strategy — it is a strategy that would only serve to further impoverish the world’s most vulnerable populations,” noted Birol. “Governments have the capacity and the responsibility to take decisive actions to accelerate clean energy transitions and put the world on a path to reaching our climate goals,” he added. The report emphasized that simply reducing emissions is not enough. Instead, existing infrastructure needs to be updated or retired, and significant investments must be made in areas like carbon capture. Some countries, including Canada and New Zealand, as well as the European Union, have announced climate plans in line with IEA’s sustainable development scenario. But if the world is to reduce emissions at the rate required, IEA stresses that there needs to be global coordination.

- 25. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25 NewBase Energy News 17 October 2020 - Issue No. 1382 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC area via Hawk Energy Service, as the UAE operations base. Khaled is the Founder of NewBase Energy, and an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste- to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor- in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above. NewBase: For discussion or further details on the news above you may contact us on +971504822502, Dubai, UAE NewBase 2020 K. Al Awadi

- 26. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26

- 27. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 27

- 28. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 28 For Your Recruitments needs and Top Talents, please seek our approved agents below