New base issue 1192 special 31 july 2018 energy news 2

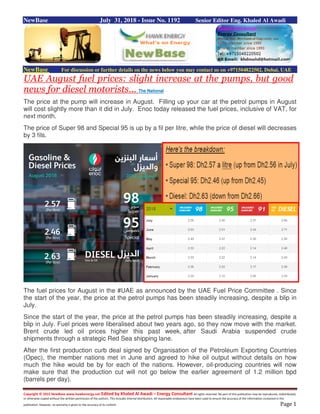

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase July 31, 2018 - Issue No. 1192 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE August fuel prices: slight increase at the pumps, but good news for diesel motorists... The National The price at the pump will increase in August. Filling up your car at the petrol pumps in August will cost slightly more than it did in July. Enoc today released the fuel prices, inclusive of VAT, for next month. The price of Super 98 and Special 95 is up by a fil per litre, while the price of diesel will decreases by 3 fils. The fuel prices for August in the #UAE as announced by the UAE Fuel Price Committee . Since the start of the year, the price at the petrol pumps has been steadily increasing, despite a blip in July. Since the start of the year, the price at the petrol pumps has been steadily increasing, despite a blip in July. Fuel prices were liberalised about two years ago, so they now move with the market. Brent crude led oil prices higher this past week, after Saudi Arabia suspended crude shipments through a strategic Red Sea shipping lane. After the first production curb deal signed by Organisation of the Petroleum Exporting Countries (Opec), the member nations met in June and agreed to hike oil output without details on how much the hike would be by for each of the nations. However, oil-producing countries will now make sure that the production cut will not go below the earlier agreement of 1.2 million bpd (barrels per day).

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Iraq: DNO passes Peshkabir production target Source: DNO DNO, the Norwegian oil and gas operator, has announced that a fourth well has been put on production at the Peshkabir field in the Kurdistan region of Iraq pushing total output past the previously published target of 30,000 barrels of oil per day (bopd). The Peshkabir-5 well is currently producing around 8,000 bopd from three Cretaceous and two Jurassic zones through temporary test facilities and the oil trucked to Fish Khabur for export. Seven Cretaceous zones and two Jurassic zones were flow tested, with individual zones ranging between 3,600 bopd and 7,200 bopd. 'At around 35,000 bopd, Peshkabir has now leapfrogged into second place after Tawke among the Kurdistan fields operated by the international oil companies,' said Bijan Mossavar-Rahmani, DNO's Executive Chairman. 'We are setting our sights on higher production and accelerating field development,' he added. The Peshkabir-5 well was designed to appraise the western extension of the field and drilled to a measured depth of 2,918 meters in 57 days at a cost of USD 12.1 million. DNO operates and has a 75 percent interest in the Tawke license, which contains the Tawke and Peshkabir fields . Two other wells, Peshkabir-6 and Peshkabir-7, have now reached target depth of 4,250 meters and 3,750 meters, respectively, and will commence production testing in August. The Peshkabir field was brought on production in 2017 and the two drilled wells last year, Peshkabir-2 and Peshkabir-3, have produced at a constant combined rate of around 15,000 bopd. The Peshkabir-4 well, completed in July, is currently producing around 12,000 bopd. DNO operates and has a 75 percent interest in the Tawke license, which contains the Tawke and Peshkabir fields, with partner Genel Energy holding the remainder.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 NewBase 29 June 2018 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices drop on oversupply concerns as OPEC output increases Reuters + NewBase+ Bloomberg Oil prices fell on Tuesday, with Brent futures set for their biggest monthly loss in two years, as oversupply concerns rose after a Reuters survey showed OPEC output rose in July to its highest for 2018. September Brent crude futures fell 25 cents, or 0.3 percent, to $74.72 a barrel by 0654 GMT after rising nearly 1 percent on Monday. The September contract expires later on Tuesday and the more-active October contract was down 0.3 percent at $75.35. U.S. West Texas Intermediate crude futures (WTI) were down 24 cents, or 0.3 percent, at $69.88 a barrel, after rising more than 2 percent in the previous session. For the month, Brent futures are set to drop about 6 percent, the most since July 2016, while WTI futures set to decline 5.8 percent, the biggest monthly drop since October 2017. Oil price special coverage

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 The Reuters survey showed OPEC increased production 70,000 barrels per day (bpd) to 32.64 million bpd in July, the most this year. The group has pledged to offset the loss of Iranian supply as looming sanctions have already started to cut exports from OPEC's third-largest producer. U.S. President Donald Trump appeared to soften his approach to Iran, saying on Monday he would meet with President Hassan Rouhani without any preconditions. This was only a week after he threatened on Twitter to unleash severe consequences on the country. The United States has indicated that it wants Iranian exports cut to zero under the sanctions it pledged to reintroduce in May and that would go fully into effect in November. While prices were softer on Tuesday, there are bullish signs in the refined products market, said Virendra Chauhan, an oil analyst at Energy Aspects in Singapore. Six analysts polled ahead of reports from the American Petroleum Institute (API), an industry group, and the U.S. Department of Energy's Energy Information Administration (EIA) estimated, on average, that crude stocks fell about 3.2 million barrels in the week ended July 27. Oil Rises Most in a Month Amid Heightened Worldwide Supply Risks Crude rose by the most in a month as traders focus on supply risks from Canada to the Middle East. Futures in New York advanced as much as 3.5 percent in New York amid speculation that a Canadian oil-sands facility that supplies U.S. refineries won’t return to full production as quickly as expected. Threats elsewhere included an imminent labor strike in North Sea oil fields and Saudi Arabia’s suspension of shipments through a key Red Sea transit route. “The Saudis said they were going to avoid the area with their shipping interests, and if that is occurring, that’s obviously supportive,” said John Kilduff, a partner at New York-based hedge fund Again Capital LLC. “Apparently the Syncrude situation is not going very well.” Although trade tensions between the U.S. and China pushed oil lower for much of this month, Barclays Plc warned of “significant upside risk” for prices in the fourth quarter as sanctions begin

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 to bite Iranian exports. The bank estimated U.S. measures against the Islamic Republic will crimp Iranian exports by about 700,000 barrels a day. The dollar weakened ahead of crucial meetings by central bankers later this week, boosting the appeal of commodities priced in the U.S. currency. West Texas Intermediate crude for September delivery rose $1.72 to $70.41 a barrel at 9:52 a.m. on the New York Mercantile Exchange. Total volume traded was about 23 percent below the 100- day average. Brent for September settlement added 97 cents to $75.26 a barrel on the London-based ICE Futures Europe exchange. The global benchmark traded at a $4.85 premium to WTI. Suncor Energy Inc. lowered the top end of its full-year production range as it works to bring the Syncrude oil-sands facility back online after a power outage brought the 350,000-barrel-a-day plant down last month. Output this year will be 740,000 to 750,000 barrels of oil equivalent a day, the Calgary-based company said last week. “Geopolitical risk rose last week from left and right of the Arab Peninsula,” with the Saudi tanker attack and growing U.S.-Iran tension, said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. “An escalation of either of the conflicts would have a devastating impact on global oil supply.” Troubled Waters From ship tracking to geopolitics, there’s plenty to keep an eye on in the oil market this week. There’ll be the first full month of tanker tracking since the Organization of Petroleum Exporting Countries and its allies agreed to ramp up output in June. Bloomberg will also release its monthly output estimate for the group. OPEC’s biggest producer, Saudi Arabia, said that its July exports would be “roughly equal” to June, but expect to see some increases from its allies. We’ll also be watching developments in the Bab el-MandebStrait after Saudi Arabia said that it was halting shipments via that choke point after two tankers came under attack from Houthi militia.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Look for signals of whether flows from other nations will continue and what the Saudis’ next moves will be. Oil Bulls Get Back in the Game as Supply Risks Rattle Market Oil bulls are venturing back into the market as global conflict sparks concern that supply disruptions will leave buyers scrambling for barrels. Money managers boosted their net-long position -- the difference between bets on rising prices and wagers on a decline -- in Brent crude by 4.1 percent after cutting them the most since 2016 a week earlier. Geopolitical tensions have roiled the crude market, sending Brent prices higher since mid-July as global supplies tighten. U.S. plans to reimpose sanctions on Iran may sharply curtail the nation’s oil exports, stoking concern that OPEC won’t have enough spare capacity to meet rising demand. Saudi Arabia, meanwhile, temporarily halted shipments via a key Red Sea shipping lane after it said two tankers were attached by Yemen’s Houthi militia. “The risk premium for Brent is definitely on right now given the war of words we’ve seen against Iran -- in general, political instability,” said Ashley Petersen, lead oil analyst at Stratas Advisors in New York. “I don’t think markets are expecting that to get any better anytime soon.” Iran has renewed threats to block the Strait of Hormuz since the U.S. announced its plan to reinstate sanctions and cut shipments from OPEC’s third-largest producer to zero from about 2.5 million barrels a day now. U.S. efforts to cut Iran’s oil exports are expected to contribute to global oil price volatility in the short term, according to the International Energy Agency. And concern 'Oil prices continued to increase, averaging 74 $/b in the second quarter, supported notably by inventory reductions and geopolitical tensions.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 persists that there won’t be enough spare OPEC capacity to make up for losses from producers like Venezuela. The Brent net-long position rose to 367,640 contracts, the first gain in three weeks, ICE Futures Europe data show. “It lines up with our call to buy the dip in July,” said Chris Kettenmann, chief energy strategist at Macro Risk Advisors LLC. “We’ve been pretty vocal about adding to length through the July sell-off.” Oil’s Bull Trend Goldman Sachs Group Inc. said while U.S. policies may weigh on crude prices in the near term, prices are poised to re-test $80 a barrel later this year. “OPEC could bring back 1 million barrels a day, but any barrels brought back by Saudi, Russia, Kuwait, those might just offset barrels lost from Iranian sanctions,” said Noah Barrett, an energy research analyst at Janus Henderson Investors. Due to bottlenecks in the Permian Basin, “U.S. production will continue to grow, but it probably won’t exceed expectations. It’s more likely it will disappoint to the downside.” Though a shortage of pipelines persists in the Permian Basin of West Texas and New Mexico, domestic crude production is hovering near a record 11 million barrels a day, according to the latest Energy Information Administration data. Hedge funds’ net-long position in West Texas Intermediate crude fell 2.4 percent to 392,147 futures and options during the week ended July 24, according to the U.S. Commodity Futures Trading Commission. Longs fell and shorts rose. “There’s just kind of an acknowledgment that there is still a lot of supply in Texas, so it’s not clear sailing for prices,” Petersen said. Total positioning on the U.S. benchmark and Brent slid to the lowest level since 2016. The reduction in participation shows that “the summer-time doldrums are here and there’s not a lot of direction for this market at the moment,” said John Kilduff, a partner at New York-based hedge fund Again Capital LLC.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 NewBase Special Coverage News Agencies News Release 31 July 2018 BP announces second quarter 2018 results Source: BP Strong earnings, strategic momentum, increased dividend Bob Dudley, Group chief executive, said: 'We continue to make steady progress against our strategy and plans, delivering another quarter of strong operational and financial performance. We brought two more major projects online, high- graded our portfolio through acquisitions such as BHP’s US onshore assets and invested in a low- carbon future with the creation of BP Chargemaster. Given this momentum and the strength of our financial frame, we are increasing our dividend for the first time in almost four years. This reflects not just our commitment to growing distributions to shareholders but our confidence in the future.' • Underlying replacement cost profit* for the second quarter of 2018 was $2.8 billion – four times that reported for the same period in 2017 – including significantly higher earnings from the Upstream and Rosneft. • Operating cash flow excluding Gulf of Mexico oil spill payments* was $7.0 billion in the second quarter – which included a $1.3 billion working capital* release (after adjusting for inventory holding gains*) – and $12.4 billion in the first half, including a $0.4 billion working capital build. • Dividend was increased 2.5% to 10.25 cents a share, the first rise since the third quarter of 2014. • Upstream reported the strongest quarter since the third quarter of 2014 on both a replacement cost and underlying basis. • Oil and gas production: reported production in the quarter was 3.6 million barrels of oil equivalent a day. Upstream production, excluding Rosneft, was 1.4% higher than a year earlier and up 9.6% when adjusted for portfolio changes and pricing effects, driven by rising output from new major projects* and strong plant reliability*. • Major projects: with start-ups in Azerbaijan, Russia and Egypt, three of the six new projects expected to start in 2018 are now online. • Strategic portfolio management: agreed to buy world-class US onshore oil and gas assets from BHP, a $10.5 billion acquisition that will transform BP’s US Lower 48 business. BP also agreed to increase its stake in the Clair oilfield in the UK while exiting the Greater Kuparuk Area in Alaska. • Downstream reported strong first half refining performance, with record levels of crude processed at Whiting refinery in US; further expansion in fuels marketing, with more than 1,200 convenience partnership sites now across our retail network. • Advancing the energy transition: acquisition of UK's largest electric vehicle charging company Chargemaster and investment in innovative battery technology firm StoreDot move forward BP’s approach to advanced mobility.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 • Gulf of Mexico oil spill payments in the quarter were $0.7 billion on a post-tax basis. • Net debt* reduced in the quarter by $0.7 billion to $39.3 billion. • BP's share buyback programme continued with 29 million ordinary shares bought back in the first half at a cost of $200 million. * See definitions in the Glossary on page 34 of the full announcement. RC profit (loss), underlying RC profit, operating cash flow excluding Gulf of Mexico oil spill payments, working capital after adjusting for inventory holding gains, net debt and organic capital expenditure are non-GAAP measures.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 27 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase K. Al Awadi August 2017 Please contact; marilyn@ppc-inc.com Please contact; marilyn@ppc-inc.com