New base energy news issue 915 dated 25 august 2016

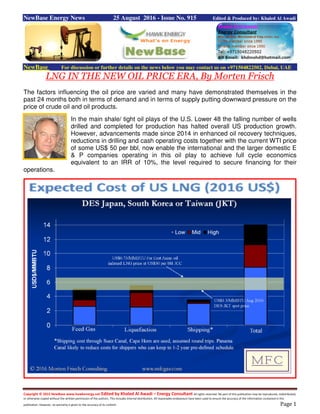

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 25 August 2016 - Issue No. 915 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE LNG IN THE NEW OIL PRICE ERA, By Morten Frisch The factors influencing the oil price are varied and many have demonstrated themselves in the past 24 months both in terms of demand and in terms of supply putting downward pressure on the price of crude oil and oil products. In the main shale/ tight oil plays of the U.S. Lower 48 the falling number of wells drilled and completed for production has halted overall US production growth. However, advancements made since 2014 in enhanced oil recovery techniques, reductions in drilling and cash operating costs together with the current WTI price of some US$ 50 per bbl, now enable the international and the larger domestic E & P companies operating in this oil play to achieve full cycle economics equivalent to an IRR of 10%, the level required to secure financing for their operations.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 A high number of drilled but uncompleted wells are likely to allow U.S. shale/ tight oil production to resume at the current WTI price levels, but a fast revival of the E&P industry is under question when the dispersion of high pressure pumping crews used for hydraulic fracturing and completion of wells is taken into account. The oil price outlook is likely to be impacted by supply side and demand side wild cards. Although this is the case and when assuming no further major deterioration of geopolitical situations, the oil price could fluctuate between US$45 and US$60 in the short to medium term. Gas production and, therefore, the price of gas will be influenced by oil market economics, as increases in oil – related E&P activities likely will pull E&P resources away from gas in North America. A price increase to US$ 3-3.5 MMBtu is likely to be required for the gas market in the U.S. Lower 48 states to balance in the medium term. This price level could ease after 2018 as most drilled, but uncompleted gas wells or gas DUCs are concentrated in areas of pipeline capacity shortages, and these shortages are due to be removed in 2018 and beyond. US delivered ex ship or DES LNG cargos bound for Asia can currently not be delivered above the short run marginal cost of production, when compared to ICIS Heren East Asia Index for LNG pricing. LNG produced in the U.S. is already uncompetitive, despite the current low level of Henry Hub gas prices. Should Henry Hub prices rise in the future as predicted, U.S. LNG will become even less competitive in Asian markets and Europe is likely to be an alternative destination of “last –resort” for flexible LNG cargoes. US LNG projects under construction will be adding substantially to the current total global LNG oversupply, particularly in the 2018 - 2020 period. Floating Storage Re-gasification Units or FSRU technology appears to be an innovative solution for both buyers and LNG developers, as it creates additional LNG demand in smaller, newer markets. But oversupply will remain a problem for years to come, also beyond 2020, putting further pressure on LNG supply chain costs and helping buyers command new, unprecedented allowances in long term LNG agreements. Click here to read LNG in the New Oil Price Era by Morten Frisch in full. http://www.naturalgaseurope.com/pdfs/Morten%20Frisch%20- %20LNG%20in%20the%20New%20Oil%20Price%20Era%20Final%206%20July%20%202016.pdf

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Arabia Holds China Market Share Lead on Record Oil Output Bloomberg - Anthony Dipaola Saudi Arabia kept its spot as China’s biggest oil supplier for the first seven months this year after pumping record output in July, even as Russia threatens to overtake the kingdom in their contest for sales to the world’s largest energy consumer. The biggest crude exporter shipped an average of 1.05 million barrels a day to China in the year through July 31, giving it a market share of 14 percent, according to Bloomberg calculations based on data that China’s General Administration of Customs published Wednesday. Russia’s share was 13.6 percent, the data show. Russia has gained ground in China this year, exceeding imports from Saudi Arabia in three months. “There’s a market-share battle going on mainly among the Middle East producers and Russia,” Olivier Jakob, managing director of Petromatrix, said by phone from Zug, Switzerland. “Rivals are making a big push into China.” Oil climbed more than 20 percent to enter a bull market last week amid speculation that supplier talks in September in Algiers may lead to action to stabilize the market. The world’s biggest producers are fighting for market share as prices are still at half the level of two years ago. Saudi Arabia pumped 10.67 million barrels a day on average in July, while Russia’s output was 11.01 million barrels a day, according to the Organization of Petroleum Exporting Countries. China bought more oil from Russia than from Saudi Arabia from March through May, according to the customs data. For all of last year, Russia’s share was 12.6 percent against Saudi Arabia’s 15.1 percent. Russia has gained ground on Saudi Arabia, in part, by selling crude on a spot basis to refineries not owned by China’s state oil companies, Jakob said. Those smaller refiners, known as teapots, have been allowed to import their own supplies in the past year. Russia sold 1.02 million barrels a day in the first seven months, the data show. Saudi Arabia, which has historically sold most of its crude under long-term contracts to large refiners, may try to sell more oil on a spot basis to win buyers in Asia, Jakob said.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 China Oil Giants Unmoved by Bull Rally After Worst-Ever Earnings Aibing Guo After posting their worst-ever half-year results, two of China’s oil giants aren’t getting carried away by crude’s return to a bull market, forecasting a rocky path ahead. PetroChina Co., the country’s biggest oil and gas company, and Cnooc Ltd., China’s main offshore explorer, reported the weakest earnings since they were both publicly listed. About a week after oil capped a 22 percent gain from its previous low, the two producers that together account for about 70 percent of the country’s crude output both struck a cautious note about the outlook for prices in the coming months. “Looking ahead to the second half of the year, uncertainties still remain in both the international and domestic macro environment,” Cnooc Chairman Yang Hua said in the company’s filing on Wednesday. “Further recovery of international oil prices faces headwinds.” Oil has whipsawed this year, flipping five times between bear and bull markets, as output from nations outside the Organization of Petroleum Exporting Countries, including China and the U.S., declines in the wake of a price crash that began in 2014. The latest surge was driven by speculation that informal discussions among OPEC members next month may lead to action to stabilize the market. Weak Recovery PetroChina’s net income dropped 98 percent to 531 million yuan ($80 million), the state-run explorer said in a statement to the Hong Kong stock exchange on Wednesday. The company was saved from a loss by the 24.5 billion yuan gain it booked from the sale of Trans-Asia Gas Pipeline Co., which it announced in November.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 “In the second half of 2016, the recovery of the global economy will remain weak and financial markets will tend to be unstable due to significant political events including Brexit,” PetroChina’s Chairman Wang Yilin said in the company’s earnings release. “The overall supply in the international oil market will continue to be sufficient and the global oil price is likely to keep fluctuating at a low level.” Brent crude has lost more than 50 percent in the past two years. The global benchmark was trading at $49.62 a barrel at 9:47 a.m. in New York. Citigroup Inc. this week cut its forecast by $2 for the last two quarters of the year to $47 and $50 a barrel, respectively. Positive Payout Cnooc swung to a 7.74 billion yuan loss, compared with a net income of 14.7 billion yuan a year earlier. It booked a 10.4 billion yuan impairment on its assets. Most of the charge was related to its Canadian oil sands operations, Yang said Wednesday in Hong Kong. Despite the loss, Cnooc decided to pay out a HK$0.12 interim dividend. PetroChina announced a special dividend of 0.02 yuan per share on top of its usual dividend distribution of 45 percent of profit. “The positive here is the willingness to pay beyond its 45 percent payout policy” by PetroChina, Aditya Suresh, an analyst at Macquarie Capital Ltd., said in a research note. High production costs, aging fields and low prices have resulted in a decline in China’s domestic crude output, helping drive imports by the world’s second-biggest consumer to a record. The country’s crude production in July tumbled to the lowest since October 2011 and has slipped 5.1 percent in the first seven months of the year, according to data from the National Bureau of Statistics. PetroChina’s capital expenditures in the first half of the year fell 17.5 percent to 50.9 billion yuan. Cnooc’s spending for the period dropped 33 percent to 22 billion yuan. The offshore producer will attempt to control capital spending within the previously announced 60 billion yuan target through 2016, President Yuan Guangyu said Wednesday in Hong Kong.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Norway's Oil Investments To Fall Again In 2017 by Reuters Investment in Norway's oil and gas sector, a cornerstone of the economy, will drop next year as weak crude prices push energy companies to rein in their budgets, a national statistics agency survey showed on Wednesday. Norway's offshore sector generates a fifth of gross domestic product and a fall in crude prices has forced energy firms to delay or cancel projects and lay off staff. Oil and gas investments will reach 150.5 billion crowns ($18.4 billion) next year, down from a May estimate of 153.2 billion crowns, Statistics Norway said. This year they will reach 163.5 billion crowns, down from a May estimate of 165.9 billion. Next year's drop is mainly due to firms, which have been on a cost-saving review for the past two years, mothballing projects to decommission ageing installations at offshore oil and gas fields, it said. "Almost the entire decrease from the last survey is due to lower estimates in shutdown and removal (of platforms)," the agency said in a statement. The estimate for those costs had dropped 25 per cent since May. An economist said the numbers pointed to a lower rate path for the central bank.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 "The numbers are slightly weaker than expected," said Kari Due-Andresen, chief economist at Handelsbanken. "It looks like it is weaker than the central bank's own forecasts." She said she did not expect Norges Bank to reduce rates at its next policy meeting on Sept. 22, but sees further cuts later. The central bank was until recently widely expected to cut rates from the current 0.50 percent, but recent data including stronger-than-expected inflation for July suggested it might hold rates this time. Brent crude oil currently trades at around $49 per barrel. The price has risen since the start of the year but is still down around 57 percent since June 2014.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Kenya: Work Begins on 2D Seismic Survey in Wajir Kenya by Rigzone Staff Essel Group Middle East (EGME) and Simba Energy Inc. confirmed Wednesday that work has commenced on the 2D seismic survey of Block 2A in Wajir, Kenya. The testing will cover an area of approximately 332 miles and roughly 248 miles has already been cleared in preparation for shooting. Survey production has been completed on over half of the testing area and the technical team has started shooting, according to EGME. This survey is being carried out by AGS Oilfield Services Ltd and will identify and evaluate areas with hydrocarbon potential in Block 2A. The two specific aims for the seismic survey are to pinpoint the optimum locations for drilling and to estimate depths and volumes for primary and secondary targets. In addition to the latest seismic news, EGME also revealed that it has entered into a definitive agreement to acquire a new skid mounted drilling rig. The AC-VFD rig will be used by the company during its oil exploration activity on Block 2A. “The work on the seismic survey and the acquisition of this drilling rig is further evidence of the progress we are making in developing our portfolio of oil assets,” said Gagan Goel, managing director of EGME and chairman of Simba Energy. “The testing is ongoing and we remain extremely confident in the prospects for Block 2A. We look forward to working with DNV GL on bringing the rig into operation.”

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Kenya: First Kenyan Oil Due by March 2017; Exports to Follow Bloomberg - Helen Nyambura-Mwaura Tullow Oil Plc will put Kenya on the map of oil producers by the first quarter of 2017 and drill eight additional exploration wells in the African nation’s North Lokichar region, President Uhuru Kenyatta said. Exports will commence three months later, with the crude being transported by road to the Indian Ocean port city of Mombasa, Kenyatta said in an e-mailed statement after he met with Tullow’s chief operating officer, Paul McDade. Kenya’s recoverable resources are estimated at 750 million barrels. Tullow will sink more wells to increase that figure to over a billion barrels, according to the statement. Initial production will be 2,000 barrels per day, with road transport to Mombasa a stopgap measure until Kenya constructs a pipeline. Kenya’s government has signed an agreement to develop that conduit with Tullow, Africa Oil Corp. and Maersk Oil Gas AS, according to the statement. The pipeline will link fields in the northwestern Lokichar region to a planned port in the coastal town of Lamu. East Africa’s biggest economy is racing ahead with production plans after neighboring Uganda spurned it as host of a pipeline to transport that country’s own estimated 1.7 billion barrels of resources. Kenyan authorities in June said they would begin work on a 865-kilometer (538- mile) pipeline in 2018.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 25 August 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices fall as market focus returns to global supply overhang Reuters + NewBase Crude prices edged lower on Thursday as brimming U.S. and Asian fuel inventories returned investors' attention to a large global supply overhang, cutting short a price rally and restricting Brent crude futures to below the $50 a barrel mark. International benchmark Brent crude oil futures were trading at $48.95 per barrel at 0132 GMT in early Asian trade, down 10 cents, after closing down 1.8 percent previously. U.S. West Texas Intermediate (WTI) crude futures were at $46.68 a barrel, down 9 cents, after falling 2.8 percent on Wednesday. Traders said price falls this week had truncated a rally that pushed crude up by more than 20 percent earlier in August on talk of a potential deal by oil producers to freeze output in an effort to rein in oversupply. Hopes of a deal were dampened by record output from theOrganization of the Petroleum Exporting Countries (OPEC) and little prospect of voluntary restrictions. "Brent also came under pressure after (OPEC- member) Iraq said it still isn't producing as much oil as it should be, raising concerns that OPEC supply will continue to increase," ANZ bank said on Thursday. With output high, not just from OPEC but also other top producers like Russia, and the demand outlook shaky, analysts said there was little prospect of an end to the glut, which has pulled down crude prices from over $100 a barrel to their current sub-$50 levels since 2014. "Ample inventories were due to weaker demand in Asia, but more generally were driven by excess supply generated by refiners maximizing runs, notably to produce gasoline in the U.S.," BNP Paribas said. "In Asia, China's July economic statistics confirmed loss of growth momentum," it added. The French bank said that the "lacklustre demand prospects (and) the augmented capacity of the global refining system ... suggest (that) a distillate supply overhang will persist." Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase Special Coverage News Agencies News Release 25 August 2016 As Japan and South Korea import less LNG, other Asian countries begin to import more Source: U.S. EIA, compiled from several countries' statistical departments Japan, South Korea, and China are the three largest importers of liquefied natural gas (LNG) in the world, accounting for more than half of global LNG imports in 2015. Combined LNG imports in these countries averaged 18.2 billion cubic feet per day (Bcf/d) in 2015, a 5% (0.9 Bcf/d) decline from 2014 levels and the first annual decline in these countries' combined LNG imports since the global economic downturn in 2009. Declines in LNG imports in these countries were partially offset by increasing LNG imports elsewhere in Asia. Imports in India and Taiwan, the fourth- and fifth-largest LNG importers, respectively, increased slightly in 2015. However, most of the increase in LNG imports came from emerging Asian LNG markets, such as Malaysia, Singapore, Thailand, and Pakistan. Although LNG demand growth prospects are limited in the more mature markets of Japan and South Korea, LNG demand in China, India, Taiwan, and emerging Asian markets is expected to grow in the future. In Japan, South Korea, and China, reduced demand for natural gas in the power sector, driven by slower economic growth and lower-priced competing fuels, resulted in reduced LNG consumption in 2015. Cooler-than-usual temperatures as a result of effects from El Niño also contributed to lower electricity consumption andreduced LNG imports in those countries.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Potential for LNG demand growth in both Japan and South Korea may be limited. Japan's total electricity consumption has fallen for five consecutive years, and nuclear generation is gradually returning to service, likely reducing natural gas use for electricity generation. In South Korea, government policies that favor the use of coal and nuclear over natural gas for electricity generation led to a greater use of coal-fired and nuclear power plants. In China, the lower prices of competing fuels and the slowdown in the growth of the Chinese economy drove the 2015 decline in LNG imports. Natural gas use in China may increase for several reasons: the implementation of environmental policies promoting use of natural gas in the power, industrial, and transportation sectors; the availability of imported global LNG supply at relatively low prices; and growing capacity of LNG regasification. Emerging Asian LNG import markets, including Thailand, Malaysia, Singapore, and Pakistan, currently account for a small share of total Asian LNG imports, but they may have the potential to increase their LNG imports soon. LNG import growth in these countries is driven primarily by the increased use of natural gas for power generation. In Thailand, the combined effects of declining domestic natural gas production near consuming centers and strong growth in natural gas demand are driving LNG import growth. Although LNG imports provide a relatively small share of natural gas supply in Thailand, the country's LNG imports are projected to increase because of limited growth potential for domestic production and for pipeline imports from Myanmar, its two main supply sources. Malaysia began importing LNG in 2013. The country's LNG imports are projected to grow moderately, limited by competition from lower-priced coal and domestic natural gas prices. Prospects for LNG demand growth in Singapore depend on the country becoming an LNG trading hub in the region. Singapore is increasing regasification capacity and launched the SGX LNG index in an effort to establish a regional Asian LNG hub. Pakistan began importing LNG in March 2015. Pakistan's LNG imports are projected to double in the next two years. Declining domestic production and rapidly growing natural gas demand in the power generation and industrial sectors, results in increases in LNG imports.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 26 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 25 August 2016 K. Al Awadi

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14