New base special 18 july 2014

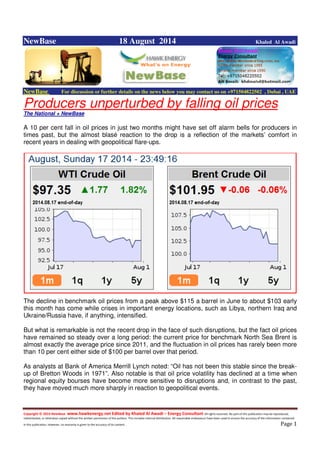

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 18 August 2014 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Producers unperturbed by falling oil prices The National + NewBase A 10 per cent fall in oil prices in just two months might have set off alarm bells for producers in times past, but the almost blasé reaction to the drop is a reflection of the markets’ comfort in recent years in dealing with geopolitical flare-ups. The decline in benchmark oil prices from a peak above $115 a barrel in June to about $103 early this month has come while crises in important energy locations, such as Libya, northern Iraq and Ukraine/Russia have, if anything, intensified. But what is remarkable is not the recent drop in the face of such disruptions, but the fact oil prices have remained so steady over a long period: the current price for benchmark North Sea Brent is almost exactly the average price since 2011, and the fluctuation in oil prices has rarely been more than 10 per cent either side of $100 per barrel over that period. As analysts at Bank of America Merrill Lynch noted: “Oil has not been this stable since the break- up of Bretton Woods in 1971”. Also notable is that oil price volatility has declined at a time when regional equity bourses have become more sensitive to disruptions and, in contrast to the past, they have moved much more sharply in reaction to geopolitical events.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 As the EFG Hermes analyst Mohamed Al Hajj, points out, regional bourses have shown a sharp decline in the wake of disruptions, for example, last August’s news about potential US air strikes in Syria, while oil prices remained more steady. This year has been a similar story, with much greater volatility in the regional equity markets than in oil prices (see chart). There are complex factors behind the relative steadiness of oil. The most important consistent factor driving oil prices is the world economy. “We do not expect oil price volatility to rise sharply as demand weakness in Europe and emerging markets will be balanced by regional instability,” said Mr Al Hajj. That is a view shared by the International Energy Agency, the consuming countries’ think tank, as reported last week. Bank of America Merrill Lynch also reckons that apart from macro-economic facts, the breakdown in the old Opec quota system in 2011 has been a major factor in stabilising markets. This has meant that, “In effect, key swing producers (Saudi, UAE and Kuwait) were handed a 5+ (million barrel a day) band to help balance” the world oil market, something that they have managed to do effectively. As the key producing countries have become more adroit at anticipating and managing the supply-demand balance, they have been able to keep a comfortable cushion for oil prices in relation to their national budget breakeven oil prices (which for the UAE is about $74 a barrel, according to the IMF). Another factor that is likely to be reducing volatility is that banks, such as Goldman Sachs, have retreated from the markets in the wake of the 2008 financial crises. The subsequent heightened scrutiny and cost of leverage put on such risky sectors has pushed them to sell up their physical oil assets and reduce sharply their related hedging activities.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 UAE: NDC inaugurates new UAE-built land rig WAM+ NewBase Abu Dhabi: The National Drilling Company (NDC), has inaugurated a new land rig, as part of the company’s fleet expansion programme which, covers offshore, onshore and land rigs to serve the oil and gas industry in Abu Dhabi, the company announced on Sunday. NDC says the new rig will help the company keep abreast of the long term plans of its clients, such as Abu Dhabi Company for Onshore Oil Operations (Adco), and step-up its ability to perform specific drilling operations that require the availability of rigs of various horsepower capabilities. NDC Chief Executive Officer, Abdullah Saeed Al Suwaidi, said that NDC has doubled the number of its rigs in the last four years from 28 in 2009 to 58 rigs owned by the company so far.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 GCC on right track toward ‘sustainable development’ Saudi Gazette The use of technology in the public sector, the increasing appetite for alternative investments, achieving capital efficiencies and cost savings in the workplace and measuring national performance via non-traditional indicators are all issues that are being widely talked about in the Middle East, as businesses struggle to strive amid unstable climates, Deloitte said in the latest quarterly publication of its Middle East Point of View (ME PoV) which includes a special insert on the Social Progress Index. The index is one of the most recent and noteworthy measurements of a country’s development. Rashid Bashir, head of Strategy Consulting at Deloitte Middle East and Steve Almond, global chairman of Deloitte Touche Tohmatsu Limited, provide in-depth analyses of the SPI and its implications for the Middle East North Africa region. The most commonly used measures of development and national performance in an economy have traditionally been gross domestic product (GDP) and associated indicators. The Social Progress Index (SPI) consists of a comprehensive measurement framework for the social and environmental performance of a nation. Published by the non-profit Social Progress Imperative in collaboration with Deloitte, and released at the Skoll World Forum on Social Entrepreneurship, this year’s SPI studies 132 countries, of which 8 from the MENA region, ranked as follows: UAE 37th, followed by Kuwait in the 40th position, Saudi Arabia 65th, Jordan 75th, Lebanon 83rd, Egypt 84th, Iraq 118th and Yemen 125th. In MENA, GCC countries have made significant strides for the region in providing basic needs such as housing, education, housing and utilities. However, for the Middle Eastern countries included in the SPI, the greatest challenges observed are in providing social opportunity for citizens and residents. A number of factors weigh in on this dimension, such as the unique political, religious and cultural characteristics which influence some of the outcomes measured such as Personal Freedom. Ecosystem sustainability is also an area of concern in the GCC where fresh water and biodiversity are more scarce, and high emissions are a by-product of extensive industrial development.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Indian Delegation to Visit Pakistan for LNG Supply Talks Dawn + NewBase A high-level Indian delegation is expected to visit Pakistan within a week to finalise a deal on sale of 200 mmcfd of LNG to Pakistan, government officials have told Business Recorder newspaper. The two countries have finalised all modalities except price, the newspaper reported on Sunday. During earlier rounds of talks in New Delhi in March and April it was decided that officials from Gail India would visit Pakistan in the second week of August. Gail India will source LNG from international suppliers, which will then be regasified at the LNG terminal at Dahej in Gujarat, for supply to Pakistan. The pipeline to be used to supply gas to Pakistan would start from western Indian state of Gujarat, would be built by Gail India. Pakistan has been facing acute shortage of natural gas to feed its power plants and has intensified efforts to source the fuel. Meanwhile, another Pakistani newspaper Dawn reported on Saturday that Economic Coordination Committee (ECC) of the cabinet approved on Friday formation of a nine-member price negotiations committee to hold talks with Qatar Gas for import of LNG. The committee will hold negotiations with Qatar Gas for a government-to-government deal on gas import and examine the results of LNG import price to be offered by bidders, reported Dawn. Spain’s Iberdrola Has over 400 MW of Wind Power in Latin America

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 Spain’s Iberdrola Has over 400 MW of Wind Power in Latin America http://www.laht.com/article.asp?ArticleId=2347937&CategoryId=12394 Spain’s Iberdrola passed the 400 MW wind power generating capacity level in the first half of this year in Latin America, a region where the company has another 150 MW of generating capacity close to going online and plans to build wind farms with another 450 MW of capacity, company spokesmen told Efe. Iberdrola’s current 418 MW of generating capacity in Latin America are concentrated in Mexico, with 231 MW, and Brazil, with 187 MW. The company operates the La Venta III, La Ventosa and Bee Nee Stipa plants in Oaxaca, a state in southern Mexico. Iberdrola has broken ground on the $120 million (about 90 million euros) Pier II wind farm, which will have 66 MW of generating capacity. The Spanish company has put 11 wind farms online in Brazil, where it began operating in 2006, providing 187 MW of electric power to the market. Iberdrola’s oldest wind farm is in Rio Grande do Norte and it developed the other 10 alternative power plants with Neoenergia via the Força Eolica do Brasil, or FEB, company. FEB has built and placed online the Calango project, which has five wind farms; the Caetite complex, which has three plants; Mel 2; and Arizona 1. FEB has won the rights to build three new wind farms in Brazil over the next 30 months, adding 84 MW of generating capacity to the South American country’s electricity grid. The new projects will cost around $200 million (150 million euros), company representatives said.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 Orion orders semi-submersible rig from Honghua Offshore Press Release, August 18, 2014 China’s Honghua Offshore Oil&Gas Equipment(Jiangsu) CO.,Ltd. has received a Letter of Award with with Orion Engineering and Management Limited (“Orion”), for the construction of one semi-submersible drilling rig. Orion plans to buy the rig for a total consideration of approximately US$320 million, excluding owner- furnished equipment. According to the LOA, the Sales and Purchase Agreement (the “Agreement”) is expected to be executed within 60 days. At the same time, Orion has the option to purchase an additional 3 units of the same specification from Honghua Offshore under the same conditions at six-month intervals. The rig and Option Units under the LOA will be equipped with Honghua Offshore’s in-house design and manufacture drilling package. Meanwhile, Orion will contract a subsidiary of Opus Offshore Ltd. (“Opus Offshore”) to supervise the construction of the rig. Zhang Mi, Chairman of Honghua commented, “We have always been emphasizing that Honghua must be innovative and develop its self-developed core equipment in offshore engineering sector. Signing the LOA symbolised that the Company has started a new chapter of its manufacturing business, and entered the offshore drilling equipment market. “We believe that it demonstrates client and the market’s recognition on the Company’s equipment design and construction capability. Meanwhile, the construction of a series of semi-submersible drilling rigs will capitalize on the strengths of the extraordinary capability of Honghai Crane to fully achieve the innovative concept of ‘onshore manufacturing of offshore equipment’, thus reducing construction cost and production cycle time.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Indonesia: Salamander reports small discovery offshore Press Release Salamander Energy plc announces that drilling operations on the North Kendang-2 exploration well (“NK-2″) in its operated South East Sangatta PSC have now been concluded. The well, located offshore Kalimantan, Indonesia, reached a total depth of 2,569 metres true vertical depth subsea and encountered two hydrocarbon bearing intervals, one of which was the primary objective zone of high pressure encountered in the North Kendang-1 (“NK-1″) well. This was successfully penetrated in NK-2 and comprised a 2.5m gas condensate bearing sand. In addition, a 10.5m gas bearing sand with oil shows was encountered at a shallower depth. This sand is at the same stratigraphic interval that flowed 6,000 bopd on test in the South Kecapi-1 DIR/ST well in the Bontang PSC.Salamander said that the volume of hydrocarbons encountered is considered to be sub-commercial and the NK-2 well has been plugged and abandoned. This well concluded Salamander’s drilling programme in the North Kutei and the Ocean General rig has now been released.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 UK oil and gas forecasts 'incredibly pessimistic', says Scotland http://www.theguardian.com/business/2014/aug/18/oil-gas-forecasts-north-sea-pessimistic-scotland Among N-56's recommendations is that a more competitive tax regime is established for the North Sea. Photograph: Andy Buchanan/PA .Forecasts of future revenues from North Sea oil and gas by an economics watchdog have been described as "incredibly pessimistic" and could be six times lower than the actual levels, according to a report. The Scottish and UK governments have repeatedly clashed over the future of the industry, particularly around forecasts from the UK Office for Budget Responsibility on the amount of cash it expects to be raised from the North Sea. The Scottish government argues the OBR forecasts are based on a "very low estimate of future total production", while its own figures have been criticised by opponents who claim they are overly optimistic. In July, the OBR chairman, Robert Chote, revealed the body was now forecasting that revenues of £61.6bn would be raised between 2013-14 and 2040-41, down from £82.2bn. A report by the thinktank N-56 said the figure could be as high as £365bn if a series of recommendations were implemented. Among its recommendations, some of which were highlighted by the Wood Review earlier this year, are the establishment of a more competitive tax regime for the North Sea; moving all policy and decision makers responsible for taxation and regulation of the industry to Aberdeen regardless of the referendum result; and the creation of a hydrocarbon investment bank to boost investment and a host of technological schemes between industry to boost oil recovery.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 An oil fund should also be established to ensure fiscal stability, N-56 said. Graeme Blackett, of N-56, said: "Since 1970 over £1tn in oil and gas revenues have been produced by the North Sea and at least as much value remains to be produced as already has been, presenting a tremendous opportunity for the sector and for Scotland's public finances. "Scotland is a net contributor to the UK public finances, in part due to our geographic share of oil and gas revenues, and this ensures that our finances are typically healthier than the UK public finances as whole. "The OBR puts forward incredibly pessimistic forecasts on both barrel price and reserves, largely discredited by industry experts. "What is clear is these natural resources can be maximised through implementing the recommendations put forward both by ourselves and the Wood Review, delivering considerable surpluses that we would recommend are used to invest in an oil fund to benefit future generations." The report comes as it was announced that potential oil and gas discoveries off the west coast of Scotland are to be examined in a partnership between the Scottish government, industry and academics. Areas including the Solway Firth, the Firth of Clyde, the North Channel (between Scotland and Ireland) and the Sea of the Hebrides will be the focus of the study. Only about 20 exploration wells have been drilled off the west coast of the mainland, compared with the thousands drilled in the north and north-east of the country. The N-56 report was welcomed by the first minister, Alex Salmond. Salmond said: "This substantial new report from a leading business organisation blows another huge hole in the credibility of the OBR's oil forecasts, especially as it comes just days after esteemed Scottish economist, Professor Sir Donald MacKay, said the OBR's calculations were 'precisely wrong' and 'hopelessly at sea'. "The report also endorses the Scottish government's plans to set up an energy fund – something Westminster have consistently failed to do to the great detriment of current and future generations. "Instead of continuing to talk down Scotland's oil and gas sector, the No campaign should acknowledge that the sector has a bright future ahead of it.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 "With a yes vote in September, we will be able to ensure that the sector benefits from a more stable taxation regime instead of being subject to surprise Treasury tax grabs – maximising the jobs that the industry creates and revenue for the long-term, and ensuring that Scotland's resources are used to the full benefit of the people of Scotland." A Treasury spokesman said: "As part of the UK, every man, woman and child in Scotland is £1,400 better off. The Scottish government's claim that Scotland's public finances will be boosted by separation are based on inflated oil and gas forecasts. Every independent expert agrees that North Sea oil and gas revenues are volatile and will ultimately decline. The Scottish government's own stats show that over the past two years, North Sea tax revenues were around £5bn less than the Scottish government's lowest estimate. "The North Sea is a maturing basin and it needs valuable incentives from the Exchequer to sustain investment, which the UK, with its broad and diverse tax base, is able to provide. "An independent Scotland would have to invest almost £3,800 per head – over 10 times more than when the costs are spread across the whole UK – to match the estimated £20bn the UK government has guaranteed to provide on decommissioning relief in the North Sea. This report takes no account of these costs. "It is not credible for the Scottish government to say they would sustain current tax incentives for the oil industry and set up an oil fund, while cutting corporation tax below the UK level and increasing welfare benefits. "How would they fund all these tax cuts, ensure increase public spending and put money aside for an oil fund?" A Better Together spokesman said: "It's not surprising that a report by an organisation founded by an adviser to Yes Scotland has reached this conclusion. "All independent experts make clear that the tax we can expect to get from oil is declining and volatile. The broad shoulders of the UK mean we can make the most of the oil that is left without putting the money for our schools and hospitals at the mercy of volatile oil prices. "By saying No Thanks to separation we can have the best of both worlds for Scotland – a strong Scottish parliament, with more powers guaranteed, backed up by the strength security and stability of the United Kingdom, which will protect funding for our public services."

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Special Report Iraq Key projects and Business Highlights 2014 NewBase Archives After the licenses rounds in 2009 and 2010 to award the development of the major oil and gas fields in Iraq all the winning companies such as BP, ExxonMobil, Shell, Petronas, Gazprom, Lukoil, China National Petroleum Company (CNPC or PetroChina), Sinopec,TPAO or Total spent a couple of years to carry out the front end engineering and design (FEED) work of these $ multi-billion capital expenditure projects. In doing so most of them realized that the basis of the Technical Engineering Services (TES) agreement they signed with Bagdad Government should return a poor remuneration in compensation of their investments. In addition, it also appears that the national oil companies (NOCs) such as Midland Oil Company (Midland Oil), South Oil Company (SOC) met some delays in developing the infrastructures required to export the oil and gas that should be produced by the international oil company (IOCs) in respect with their TES agreement. In this context, most of these IOCs put on hold their investments and started to renegotiate the remuneration fees of their TES contract. At the end of 2013 most of these TES agreements has been revised giving the signal to trigger series of major oil and gas projects upstream and midstream. 1- TPAO and Kuwait Energy to award Iraq Mansuriya The Houston-based engineering company KBR is currently completing the front end engineering and design (FEED) for the gas treatment facilities to be built at the Mansuriya gas field in the Diyala region of East Iraq by a joint venture led by Turkish Petroleum Corporation (TPAO), through its subsidiary Turkish Petroleum Overseas Company (TPOC), in partnership with the local Midland Oil Company (Midland Oil), Kuwait Energy Corporation (KEC), the Korean Gas Corporation (Kogas). Located 110 kilometers northeast of Baghdad near the Iran boarder, the Mansuriya gas field is the second largest non-associated gas field in the Diyala Region. Covering 110 square kilometers, Mansuriya is estimated to hold 4.5 trillion cubic meters of non-associated gas and condensate. Discovered in 1978, the Mansuriya gas field has been left undeveloped since then and up to the bidding round organized by the Iraq Government for the Energy Development program.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Before the wars and even more after the wars, Iraq has been over producing gas country wise compared to its domestic needs. But of the gas produced was generated as associated gas and concentrated in the south and the north of Iraq. Because of the lack of transportation infrastructures, this gas could not be exported from one region to another so that most of it was just flared in-place. Large programs are on going to gather and monetize the flared gas, but in the meantime the regions in the center, east and west of Iraq still need gas to feed power generation and economical development; KBR completes FEED on Mansuriya gas plant project. In October 2010, TPAO and its partners Midland Oil, KEC and Kogas were awarded the Mansuriya gas field during the Third Bidding Round proposed by Iraq Government. As a result, TPAO and its partners signed a Development and Production Service Agreement for a period of 20 years on Mansuriya. In Mansuriya, TPAO is sharing the working interests as following: - TPAO 37.5% is the operator - KEC 22.5% - Kogas 15% - Midland Oil 25% During the twenty years of Service Agreement, TPAO and its partners are planning to extract from Mansuriya: - 47.6 billion cubic meters of gas - 143.6 million barrels of condensate As part of Iraq Energy Development program the gas will supply a power plant and the condensate the local industries. In December 2012, TPAO and its partners KEC, Kogas and Midland Oil, awarded the FEED contract for the Mansuriya gas field development project. In addition to the FEED contract KBR will provide Quality Control Support Services (QCSS) during the engineering, procurement and construction (EPC) phase of the project; Based on the FEED proposed by KBR, the Mansuriya project should include: - Gas gathering system - Gas and condensate separation - Gas sweetening and regeneration unit - Gas dehydration and regeneration unit

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 KBR designed the Mansuriya gas treatment facilities with a capacity of 110 million cubic feet per day (cf/d) of gas. As KBR is completing the FEED, TPAO and its partners Kuwait Energy, Midland Oil and Kogas are expected the award the EPC contract for the Mansuriya gas central processing plant on the second quarter 2014 for a first production in 2016. 2-SOC Common Seawater Supply Project at bidding stage The state-owned South Oil Company (SOC) is currently evaluating the offers for the giant Common Seawater Supply Project (CSSP) to be built in the south of Iraq to provide all the water required by the exploration and production of the oil and gas fields in the Basra Province. The south of Iraq is well-known for its concentration of oil and gas fields classified among the largest in the world. Because of wars and ban these fields have remained underdeveloped during decades, but since the licences round organized in 2009 by Baghdad Government all these fields are subject to $ multi billion development programs let by major companies such as BP, Eni, ExxonMobil, Lukoil, Petronas, Shell, Total. Until 2012 all these projects were moving slowly because of the poor commercial conditions of the Technical Services Contracts (TSC) signed with Baghdad and also because of the lack of infrastructures to support such massive capital expenditure programs. But in 2013, the companies and Baghdad Authorities aligned on these issues and redefined more realistic targets for the plateau production to be reached in the respective fields. Since then all the projects are moving actively forward including the infrastructures projects driven by the Oil Ministry of Iraq through the national oil companies (NOCs) such as SOC. Power generation, export pipelines and this Common Seawater Supply Project are on the top of the list as to enable the international oil companies (IOCs) to implement their own plans. To be developed in phases the CSSP is expected to provide the companies with the required water to boost the oil and gas production. Using the enhanced oil recovery (EOR) techniques, the companies are targeting recovery rates above 50% from Iraq oil fields. These EOR techniques suppose to inject large quantities of water in the reservoirs in order to maintain the pressure and flush the crude oil from all the pockets. South Oil awarded CSSP PMC contract to CH2M Hill In 2012, South Oil awarded the project management consultancy (PMC) contract for the Common Seawater Supply Project to the US-based company CH2M Hill with the mission to prepare: - Pre-front end engineering and design (pre-FEED) - Environmental and safety assessment

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 - Front end engineering and design (FEED) contract - Engineering, procurement and construction (EPC) contracts for the different packages of the project. From this preliminary work the Common Seawater Supply Project should include: - Power generation - Pumping stations - Water treatment facilities - Pipelines network Designed to supply the giant fields of West Qurna-1, West Qurna-2, Zubair, Majoon, Missan, Rumaila, Halfaya, Gharraf and other normal fields of the south of Iraq, the CSSP should have a capacity of 12.5 million barrels of water per day. Overall South Oil is planning to invest $10 billion capital expenditure in the Common Seawater Supply Project. Because of the progressive exploration – production of the oil and gas fields, SOC is planning to phase up the development of CSSP. For CSSP Phase-1, South Oil is targeting to treat, transport and distribute 5.2 million barrels per day of seawater for an estimated $3.5 billion capital expenditure. South Oil qualified five engineering companies. The technical offers were submitted in February 2014 and the commercial offers are expected on second quarter. Even if CSSP suffered from delays, South Oil is targeting to award the FEED contract in 2014 in order to sanction the different EPC packages in 2015 for the first operations of the Common Seawater Supply Project Phase-1 by 2017. 3- Shell and Petronas gear up in Majnoon Full Field Field The international oil company (IOC) Royal Dutch-Shell (Shell) and its partners, the Malaysia national oil company (NOC) Petronas and the local South Oil Company (SOC or

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 South Oil)) are making major decision to gear up from the previous start-up phase to the full field development (FFD) of the giant Majnoon oil and gas field in the south of Iraq. Located 70 kilometers north of Basra and covering a surface of 60 kilometers long by 15 kilometers wide, Majnoon is listed among the largest oil and gas fields in the world with estimated in-place reserves of 38 billion barrels. Although Majnoon had been discovered in 1975 by the Brazilian company Braspetro, today Petrobras International. Since that time the Majnoon oil and gas field has never got a chance to be developed according to its potential because of it geographical position along the Iran boarder. Number of companies attempted to invest in Majnoon and the succession of wars prevented sustainable exploration and production program. Transformed in battle field with explosives and land mines all over, Majnoon oil and gas reserves remained nearly untouched until it was awarded to the joint venture of Shell, Petronas and South Oil in 2009 as the result of the second licence round. In signing a technical services contract (TSC) with Baghdad Government, Shell and its partners accepted only $1.39 per barrel as remuneration fees on the production with a targeted plateau production of 1 million barrels per day (b/d) by 2017. This technical services contract is signed for 20 years during which Shell and its partners have planned to spend $50 billion capital expenditure with the working interests distributed as following: - Shell 45% is the operator - Petronas 30% - South Oil 25% Until 2012, Shell and its partners invested more than $2 billion capital expenditure to secure and clean up Majnoon and convert it into a safe exploration and production area. Majnoon Oil Field Commercial Production project to go In 2013, Shell, Petronas and SOC managed to ramp-up the production that reached 200,000 b/d of crude oil on last December with the support of: - Petrofac in charge of the engineering, procurement and construction (EPC) contract - Wood and CCC consortium to provide start-up services Through this start-up phase, Shell, Petronas and SOC acquired a deep knowledge of the reservoir and have decided to gear up their program in launching the Majnoon Full Field Development project. In that perspective the Swiss-based Foster Wheeler and the Irish engineering company Kentz formed the joint venture Foster Wheeler Kentz Energy Services DMMC to win the Majnoon Oil Field Commercial Production Project engineering contract.

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 According to the terms of the contract, Foster Wheeler and Kentz will provide engineering services for the: - Conceptual study - Front end engineering and design (FEED) - Detailed design - Engineering, procurement and construction (EPC) This engineering services contract covers the: - Revamping and upgrade of the existing facilities - Construction of the new facilities Shell, Petronas and South Oil sanctioned the Majnoon FEED and EPC services contract to Foster Wheeler and Kentz for a two years period with the option for a third year extension. In doing so, Shell, Petronas and South Oil confirm their investment program in the Majnoon Oil Field Commercial Production project in the perspective of 2017 with the support of the Foster Wheeler and Kentz joint venture. 4- Qaiwan tenders Iraq Bazian Refinery Expansion Phase-3 The Dubai-based Qaiwan Global Energy DMCC (Qaiwan) Group has sent the call for bid (CFB) regarding the engineering, procurement and construction (EPC) contract for its Bazian Refinery Expansion Project Phase-3 (BREP3) in the Kurdistan Province of Iraq. Qaiwan and Bezhan Petrochemical Corporation (BezhanPet) operate in Bazian one of the two refineries in the Kurdistan Province. Bazian is located 25 kilometers northwest from Sulaymaniyah in direction of Kirkuk at the southeast of Kurdistan. With a capacity of 34,000 barrels per day (b/d) the Bazian Refinery is producing transportation fuels such as diesel, gasoline, kerosene, and feedstock for the petrochemical industry such as naphtha and fuel oil. Originally designed to accept only 47° API gravity crude, Qaiwan and BezhanPet decided in 2009 to proceed top a first upgrading operation to process 20,000 b/d of 32° API crude oil. This first Bazian Refinery expansion project was completed in 2010. In following Qaiwan engaged the second phase of Bazian Expansion to ramp up the refining capacities to 34,000 b/d. Qaiwan completed this Bazian Refinery Phase-2 project in 2012. Despite these refinery expansions, Kurdistan remains in deficit of refined products while it becomes a significant crude oil and gas exporter. In this context, Erbil Regional Government and

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 Qaiwan have decided to undertake the Bazian Refinery Expansion Project Phase-3 (BREP3) in selecting the French engineering company Technip to perform the feasibility study. Technip at FEED work to double Bazian Refinery With the third expansion of the Bazian Refinery, Qaiwan is planning to add 50,000 b/d capacity to reach 84,000 b/d total. The Bazian Refinery Expansion Project Phase-3 will also include the construction of a 110 kilometers inlet pipeline to transport the crude oil from the southern Kurdistan oil and gas fields to Bazian. This pipeline will have a capacity of 125,000 b/d which indicates that Qaiwan is already considering 40,000 b/d expansion in further phases to come after BREP3. In respect with the unbalance between the export of crude oil and the import of refined products, the Erbil Local Government awarded the front end engineering and design (FEED) work for the BREP3 to Technip. According to the first conclusions of the ongoing FEED work in Technip, the Bazian Refinery Expansion Phase 3 should include: - Crude distillation unit (CDU) of 50,000 b/d capacity - Naphtha hydro-treating unit of 33,500 b/d capacity - Continuous catalytic reformer (CCR) of 22,500 b/d capacity - Isomerization unit of 10,500 b/d capacity - Kerosene hydro-treating unit of 13,500 b/d capacity - Amine regeneration unit - Sulfur recovery unit - Waste water treatment unit - Offsites and utilities In respect with the current progress of the FEED work carried out by Technip, Qaiwan expects to award the engineering, procurement and construction (EPC)contract for the Bazian Refinery Expansion Project Phase-3 on second half 2014 in targeting a completion of the BREP3 by 2017.

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Energy Services & Consultants Mobile : +97150-4822502 khalid_malallah@emarat.ae khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. Currently working asOil & Gas sector. Currently working asOil & Gas sector. Currently working asOil & Gas sector. Currently working as Technical AffTechnical AffTechnical AffTechnical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operationsthe GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operationsthe GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operationsthe GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat ,Manager in Emarat ,Manager in Emarat ,Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developedresponsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developedresponsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developedresponsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructinggreat experiences in the designing & constructinggreat experiences in the designing & constructinggreat experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs forOUs forOUs forOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andthe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy progrEnergy progrEnergy progrEnergy program broadcastedam broadcastedam broadcastedam broadcasted internationally , via GCC leading satellite Channels .internationally , via GCC leading satellite Channels .internationally , via GCC leading satellite Channels .internationally , via GCC leading satellite Channels . NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 18 August 2014 K. Al Awadi