New base 18 june 2018 energy news issue 1181 by khaled al awadi-compressed

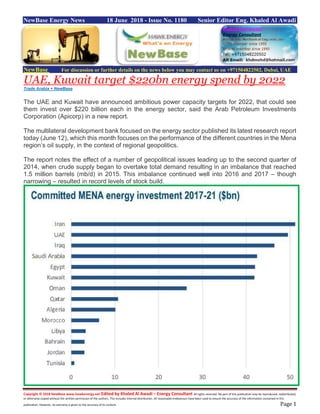

- 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 18 June 2018 - Issue No. 1180 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE, Kuwait target $220bn energy spend by 2022 Trade Arabia + NewBase The UAE and Kuwait have announced ambitious power capacity targets for 2022, that could see them invest over $220 billion each in the energy sector, said the Arab Petroleum Investments Corporation (Apicorp) in a new report. The multilateral development bank focused on the energy sector published its latest research report today (June 12), which this month focuses on the performance of the different countries in the Mena region’s oil supply, in the context of regional geopolitics. The report notes the effect of a number of geopolitical issues leading up to the second quarter of 2014, when crude supply began to overtake total demand resulting in an imbalance that reached 1.5 million barrels (mb/d) in 2015. This imbalance continued well into 2016 and 2017 – though narrowing – resulted in record levels of stock build.

- 2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Following the Arab spring that began in December 2010, supply in several Mena countries was severely disrupted, and coupled with Iranian sanctions, led to substantial losses from the region that contributed to a rise in oil prices. In Syria and Yemen, exports dropped to zero, whilst in Libya, output fell from above 1.5mb/d in 2011 to as little as 220kb/d by mid-2014. But high prices inevitably led to strong supply response, mainly from the US. With a contraction in global demand growth, the market became out of balance, leading to a steep decline in oil prices that saw Brent dip below $30 a barrel in January 2016. The Organisation for Economic Co-operation and Development (OECD) commercial stocks increased from around 2,640mb/d in May 2014, to a peak of 3,110mb/d by July 2016. This caused prices to plunge and new measures to be implemented by Opec to rebalance the market, while different oil-based economy countries from across the region looked to invest more heavily in energy sources to overcome the oversupply. In November 2017, the UAE announced plans to invest $109 billion in the sector until 2022. Kuwait also followed suit by announcing similar plans earlier this year to invest $112 billion in the next five years to boost production in hope of increasing oil capacity from 3.2mb/d at the start of this year to around 4mb/d by 2020. In other parts of the region, investors have been more cautious. In the case of Libya, the improving production profile is not backed by a strong historical trend, having had an inconsistent production profile due to regular production outages caused by different factors including civil unrest and geopolitical tensions. While different operations in the country were hit, net output has improved after restarting the 330kb/d Shahara fields, with further increases expected following its $450 million acquisition of Marathon’s 16.3 per cent stake in the 300kb/d Waha consortium.

- 3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 The report also finds that Iraq managed to continue increasing production even whilst battling so- called Islamic State, while Iranian output recovered following the lifting of sanctions, and Libyan production returned to 1mb/d this year for the first time since 2013. Earlier this year, Iraq announced a revised capacity target with the aim of reaching 6.5mb/d by 2022. In the first quarter of 2018, the country’s rig count reached 58, 17 higher than the same period last year and has been the main contributor to Mena’s overall rig count. Iran has a unique set of challenges to overcome, following the US’s decision to re-impose secondary sanctions. However, during the brief period when the sanctions were lifted, Iran managed to surprise by increasing output from 2.9mb/d in 2015 to 3.8mb/d today, surpassing pre-sanction levels of 3.6mb/d. The report also finds that while the Opec+ production cut agreement has indeed benefited the market by stabilising it, the main concern has been outside Mena, particularly Venezuela and to a lesser extent Angola whose fields are maturing and nearing depletion. In Venezuela – now widely seen as the highest risk to the oil market - production has not recovered since the end of 2014 when it stood at 2.4mb/d and has shrunk to reach 1.4mb/d as recently as Q1 2018, with the downward trend expected to continue. Production in the country is at a 30-year low. With high debt, rising inflation and deteriorating equipment and labour shortages, Venezuela’s production could see further output losses by year-end.

- 4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Mustafa Ansari, senior economist, said: “The situation that the market has found itself in is an interesting one. It has become apparent that the market is increasingly affected by a broader range of factors, and that the US shale industry cannot rebalance the market alone. “As demand growth continues to outpace supply, we could see further stock withdrawals. And with Opec spare capacity expected to decline, especially if production cuts are eased, then the market will have a small buffer within which it can cushion itself against supply disruptions, leading to price hikes and higher volatility. Ghassan Al-Akwaa, Energy Sector specialist at Apicorp, said: “Our report shows that supply from the Organization of the Petroleum Exporting Countries (Opec) increased by 3.85mb/d between the second quarter of 2014 and the end of 2016, with output only falling following the Opec+ agreement. “This can mean only one thing: the oil industry is still thriving, and this is shown through different exporting countries – like Iraq and Iran – bouncing back from their different set of challenges stronger than any other time.” – The UAE has done impressive work to stay on track with the renewable energy targets and with phases 3 and 4 of the Dubai Solar Park to begin commissioning by the end of 2020, and is placed at the forefront of renewable energy development in the region, according to a research published by the Arab Petroleum Investments Corporation, APICORP, on the regional renewable energy sector.

- 5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Iraq moves to create its own oil tanker fleet & Expand loaders © Jean-Paul Pelissier / Reuters OPEC’s second-largest producer Iraq has taken steps toward selling its crude oil on a delivered basis after it is looking to build its own tanker fleet. At present, most of Iraq’s crude oil and oil products are being sold on a so-called ‘free on board’ basis, in which the seller pays for transportation of the goods to the port of shipment, plus loading costs. With a tanker fleet of its own, Iraq could sell crude oil on a delivered basis and manage the shipping of the oil to customers. Other Gulf oil producers sell their oil on an ex-ship basis—which requires the seller to deliver goods to a customer at an agreed port of arrival. Iraq is now looking to have its own fleet after decades without its own vessels. The state-held Iraq Oil Tanker Company (IOTC) has struck agreements with Iraqi shipping company Al-Iraqia Shipping Services & Oil Trading (AISSOT) to help build the fleet and train staff, IOTC’s general manager Hussein Allawi told Platts on Thursday. AISSOT is a joint venture company set up by IOTC and Arab Maritime Petroleum Transport Company (AMPTC) to meet the growing needs of the Government and industry in Iraq. AISSOT is mandated to invest in the creation of world-class strategic infrastructure for oil and gas, shipping logistics, and trading operations, according to its website. “They [AISSOT] are promoting their crude export and own transportation volume, so that more will be handled by their national shipping arm,” a shipping executive at a North Asian refiner told Platts, commenting on the Iraqi efforts to manage their own fleet and exports. According to the executive, the Iraqi company plans to buy secondhand tankers and order new-builds, possibly buying as many as 40-50 very large crude carriers (VLCCs). AISSOT currently owns two VLCCs, shipping sources told Platts.

- 6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6

- 7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Egypt: SDX Energy spuds SRM-3 appraisal well at South Ramadan Source: SDX Energy SDX Energy, the North Africa focused oil and gas company, has announced that it has spud its SRM-3 appraisal well at South Ramadan, Egypt (SDX 12.75% working interest and non- operator). The SRM-3 well is the last remaining commitment well on the South Ramadan concession. The well is anticipated to take up to 90 days to drill and complete. Based upon the results of this well the Company will decide how best to optimise its position in the licence. About SDX SDX is an international oil and gas exploration, production and development company, headquartered in London, England, UK, with a principal focus on North Africa. In Egypt, SDX has a working interest in two producing assets (50% North West Gemsa & 50% Meseda) located onshore in the Eastern Desert, adjacent to the Gulf of Suez and a 55% interest in the South Disouq appraisal and development project in the Nile Delta. In Morocco, SDX has a 75% working interest in the Sebou concession situated in the Rharb Basin. These producing assets are characterised by exceptionally low operating costs making them particularly resilient in a low oil price environment. SDX's portfolio also includes high impact exploration opportunities in both Egypt and Morocco.

- 8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 World Aviation Transport Faces Turbulence as Slowest Changes Its Fuel ©2018 Bloomberg L.P. -- Alex Longley From the window of a jet plane, it can be hard to see ships crawling across the seas. Yet what’s burning in those engines thousands of feet below may determine the fate of airline profits in the next few years. In about 18 months’ time, the world’s oil refineries are going to have to supply shipping companies with better-quality fuel to comply with international regulations agreed back in 2016 in a nondescript building on the banks of the River Thames in London. While the regulators’ target was to lower sulfur emissions from ship fuel, it’s becoming increasingly clear there will be an accompanying -- and significant -- impact on the supply of jet fuel, the aviation industry’s single biggest expense. The trouble is, there’s profound disagreement about whether the result will be a glut or a shortage of the fuel. “These rules are going to impact airlines,” said Mark Maclean, managing director at Commodities Trading Corporation Ltd., which advises on hedging strategies. “The impacts will not be isolated only within the shipping industry, these changes will affect the entire oil and middle-distillate complex,” the part of refining that includes jet fuel and diesel. From Jan. 1, 2020, the world’s ships will need to consume fuels containing less sulfur under the 2016 rules set out by the International Maritime Organization, part of the United Nations. Oil refineries are likely to face an initial demand surge from shippers for diesel-type products when the rules kick in. Diesel is critical in determining the cost of normally more-expensive jet fuel, so if that historic price relationship holds, then the aviation industry’s fuel bill could surge as well.

- 9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Refining Puzzle How it plays out in practice hinges on the way refineries make jet fuel and -- critically -- how much flexibility they’ll have to adjust their output once the new rules enter into force. Jet fuel is made in one simple refining process, meaning that if more crude gets distilled to make diesel, then there will be an unavoidable surge in jet fuel supplies too. Several traders say that could result in a surplus. But not everybody agrees. For one thing, increased amounts of jet fuel will be blended into fuel oil to meet the more stringent sulfur specifications, according to Jan-Jacob Verschoor, a director at Oil Analytics and a chemical engineer by training who previously worked at Royal Dutch Shell Plc. Refineries will also have some flexibility to maximize diesel production to the detriment of jet fuel output, more than negating any ramp-up in overall crude processing, he said. Airlines Un-Hedged So far, most airlines seem relaxed about the situation. Of 26 carriers monitored by Bloomberg in Europe, the U.S. and Asia, only Southwest Airlines Co. has reported hedged fuel prices into the next decade. The company has 38 percent of 2020 buying covered, up from 36 percent a year ago for 2019. It’s already hedging all the way into 2022. “New developments like IMO 2020 regulations are certainly one of the many items we monitor on an ongoing basis to determine their impact on the energy markets, and ultimately the price of jet fuel, and we incorporate such information into our robust planning processes,” Southwest said by email in response to questions about its hedges. Big Question Prices for jet fuel for mid-2020 have risen by more than 40 percent since the middle of last year, tracing gains in both crude and diesel. Rising profit margins for diesel, one of the fuels that airlines reference when hedging their costs, are a sign of the impact the new shipping rules already are having on the market, London-based Maclean said. The ICE gasoil crack, or premium to Brent, for June 2020 has gained about 60 percent since last July. The fallout from the shipping rule change is an important quandary for airlines already suffering from a more than 50 percent increase in crude prices over the past year. The crude-price surge may force some weaker operators out of business, Ryanair Holdings Plc Chief Executive Officer Michael O’Leary said last month. Willie Walsh, CEO of British Airways parent IAG SA, said last week that the price of fuel “is having an impact because it’s much higher than we expected.” Rising fuel costs were a factor that prompted the International Air Transport Association to cut its profit target for global aviation. Hedging Strategy While those higher crude prices may be preoccupying airline executives for now, the looming changes for shipping are starting to register. Robert Isom, president of American Airlines Group Inc., said in a call last month that his company too is looking at the issue without having a clear strategy yet. At a recent industry conference, the CEOs of Kenya Airways Plc and LOT Polish Airlines SA said they were aware of the issue and that, if anything, it may lower costs as more jet fuel gets produced. Virgin Australia’s CEO also said it would likely influence pricing. “Our fuel guys are going through everything to understand what the impact could be on us,” Isom said. “So, we are in the process of working through that. I don’t have an answer on that yet at all.”

- 10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase June 18 - 2018 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices fall on expectation Russia, Saudi will raise output Reuters + Bloomberg + NewBase Brent crude futures, the international benchmark for oil prices, were at $73.05 per barrel at 0036 GMT, down 39 cents, or 0.5 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $64.24 a barrel, down 82 cents, or 1.3 percent, from their last settlement. The drops came after crude futures fell around 3 percent on Friday, hurt by concerns about rising output and a U.S.-China trade row. "Oil prices tanked... after Russia and Saudi Arabia all but confirmed a production increase," said Stephen Innes, head of trading for Asia/Pacific at futures brokerage OANDA. The producer cartel of the Organization of the Petroleum Exporting Countries (OPEC), which is de- facto led by Saudi Arabia, and some allies including Russia have been withholding output with since the start of 2017. Producers will meet in Vienna on June 22 to decide forward production policy. Oil price special coverage

- 11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 "Most industry observers are expecting a production rise," said Innes, although he added that "the magnitude and timing of the boost remain uncertain." Also looming over markets was a threat by China to slap a duty on U.S. oil imports in response to announcements by Washington of new import sanctions on China, in what many analysts say could be a serious trade stand-off between the world's biggest two economies. WTI Oil Price Slumps Below $65 Oil fell below $65 a barrel as Saudi Arabia and Russia prepared for a clash with allied crude producers over whether to lift output and as China and the U.S. exchanged trade threats. Futures in New York dropped as much as 1.8 percent, on course for the lowest close since April 9, after a 2.7 percent decline Friday. Iran says Venezuela and Iraq will join it in blocking a proposal to increase production that’s backed by Saudi Arabia and Russia when OPEC and its allies meet in Vienna this week. China said it would impose tariffs on a variety of U.S. goods, including crude and gasoline, in response to President Donald Trump’s $50 billion levy on Chinese imports. Crude has dropped more than 10 percent from late May amid signs Saudi Arabia and Russia are seeking to lift output curbs that have eliminated a global surplus and boosted prices. Meanwhile, traders are trying to digest the impact from both the U.S. and China issuing tariffs on goods and the threat of a broader trade war between the world’s two largest economies. OPEC Highlights Demand Uncertainty Before Crucial Meeting OPEC emphasized the deep uncertainty over the strength of demand for its oil just a week before contentious talks on whether to raise production. There’s a “wide forecast range” for how much crude the Organization of Petroleum Exporting Countries needs to pump in the second half of the year, its research department said in a monthly

- 12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 report. With a range of of 1.7 million barrels a day between the upper and lower estimates, demand could either be significantly higher, or slightly below, than OPEC’s current output. “Looking at various sources, considerable uncertainty as to world oil demand and non-OPEC supply prevails,” according to the report, published by OPEC’s secretariat in Vienna. “This outlook for the second half of 2018 warrants close monitoring.” OPEC and its allies are headed for a fractious meeting in Vienna next week as Saudi Arabia, under pressure from President Donald Trump, seeks to revive halted output to prevent higher prices. While Russia also favors an increase, there’s growing resistance from countries that have little scope to raise production, including Iraq, Iran and Venezuela. Tuesday’s report could give ammunition those nations, putting them on a collision course with other members who seem determined to pump more. Glut Gone The Saudis and Russia have been leading a 24-nation coalition of oil producers, drawn from OPEC and beyond, since early 2017. Their supply cuts have already cleared a global glut, with oil inventories falling below their five-year average for the first time since 2014, according to the report. Under the current terms of the supply deal, production curbs are set to continue until the end of 2018. The cartel’s main forecast, mostly unchanged from last month’s report, indicates that more OPEC crude would be needed to fully satisfy global demand. However, the group also gave unusual emphasis to the uncertainty in this estimate.

- 13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 An average of 33.34 million barrels a day is required from the group’s 14 members in the second half of 2018, considerably higher than the 31.87 million they pumped last month, the report showed. Output from Venezuela continues to slump amid an economic crisis, slipping to 1.39 million barrels a day in May. Growing Risks Yet the report also said that “downside risks might limit” the demand outlook as economic growth slows in major economies, fuel subsidies are withdrawn and consumers switch from oil to natural gas. It also highlighted the potential for even faster output growth from rival producers including the U.S., Canada and Brazil. OPEC uses the top end of the forecast range for its base-case estimate, the report showed. If demand for its crude turns out to be at the lower end, OPEC’s current output would already be slightly higher than the market requires. Despite the uncertainties, Saudi Arabia and Russia appear to already be in the process of increasing production, unwinding almost 18 months of supply restraint. Saudi Arabia told the organization it had raised output above 10 million barrels a day last month for the first time since October, the report showed. Russia boosted crude supply to the highest in 14 months in the first week of June as some companies breached their caps, said a person with knowledge of the matter. Iran Says Three OPEC Members to Veto Saudi-Proposed Supply Boost Iran says Venezuela and Iraq will join it in blocking a proposal to increase oil production that’s backed by Saudi Arabia and Russia when OPEC and its allies meet in Vienna this week.

- 14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 “Three OPEC founders are going to stop it,” Iran’s representative to the bloc Hossein Kazempour Ardebili said in comments to Bloomberg on Sunday. “If the Kingdom of Saudi Arabia and Russia want to increase production, this requires unanimity. If the two want to act alone, that’s a breach of the cooperation agreement.” Iran’s comments show that OPEC members are set to clash when they meet later this week in Vienna to discuss the proposal to end global output cuts. The historic 24-nation pact has succeeded in its goals of balancing oil markets and lifting crude prices, and the two biggest producers want a relaxation of quotas as soon as next month. But while Saudi Arabia and Russia are pumping below capacity, many countries in OPEC including Iran and Venezuela would struggle to raise output even if their quotas were increased. OPEC and its allies could consider a production increase of as much as 1.5 million barrels a day, Russian Energy Minister Alexander Novak said on Thursday. That would be enough to offset the supply losses from Venezuela and Iran foreseen by the International Energy Agency. Saudi Arabia has been discussing different scenarios that would raise production by between 500,000 and 1 million barrels a day, according to people familiar with the matter.

- 15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 EIA expects Brent crude prices will average $71 per barrel in 2018, $68 per barrel in 2019 Source: U.S. Energy Information Administration, Short-Term Energy Outlook In the June 2018 update of its Short-Term Energy Outlook (STEO), EIA forecasts Brent crude oil prices will average $71 per barrel (b) in 2018 and $68/b in 2019. The updated 2019 forecast price is $2/b higher than in the May STEO. Brent crude oil spot prices averaged $77/b in May, an increase of $5/b from April and the highest monthly average price since November 2014. West Texas Intermediate (WTI) prices are forecast to average almost $7/b lower than Brent prices in 2018 and $6/b lower in 2019. Crude oil prices have reached high levels as global oil inventories have generally declined from January 2017 through April 2018. Even though the 2019 oil price forecast is higher than it was in the May STEO, EIA expects oil prices to decline in the coming months because global oil inventories are expected to rise slightly during the second half of 2018 and in 2019. Expected inventory growth results from forecast oil supply growth outpacing forecast oil demand growth in 2019. EIA currently forecasts global petroleum and other liquids inventories will increase by 210,000 barrels per day (b/d) next year, a factor that, all else being equal, typically puts downward pressure on oil prices. Most of the growth in global oil production in the coming months is expected to come from the United States. EIA projects that U.S. crude oil production will average 10.8 million b/d for full-year 2018, up from 9.4 million b/d in 2017, and will average 11.8 million b/d in 2019. If the 2018 and 2019 forecast annual averages materialize, they would be the highest levels of production on record, surpassing the previous record set in 1970.

- 16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Tight oil production in the Permian region of West Texas and New Mexico is the main driver of rising U.S. production. Among other countries outside of the Organization of the Petroleum Exporting Countries (OPEC), Canada and Brazil are also expected to experience significant growth in oil production in 2019. EIA expects that OPEC crude oil production will average 32.0 million b/d in 2018, a decrease of about 0.4 million b/d from the 2017 level. Total OPEC crude oil output is expected to increase slightly in 2019 to an average of 32.1 million b/d. The 2018 and 2019 levels are 0.2 million b/d and 0.3 million b/d lower, respectively, than forecast in the May STEO, reflecting revised expectations of crude oil production in Venezuela and Iran. The lower OPEC forecast is one of the main reasons EIA expects oil prices to be slightly higher in 2019 compared with last month’s forecast. OPEC, Russia, and other non-OPEC countries will meet on June 22 to assess current oil market conditionsassociated with their existing crude oil production reductions. Current reductions are scheduled to continue through the end of 2018. Oil ministers from Saudi Arabia and Russia have announced that they will re-evaluate the production reduction agreement given accelerated output declines from Venezuela and uncertainty surrounding Iran’s production levels. In the June STEO, EIA assumes declining Venezuelan and Iranian crude oil production in 2019 will be offset by increasing production from Persian Gulf producers, primarily Saudi Arabia. Depending on the outcome of the June 22 meeting, however, the magnitude of any supply response is uncertain. Overall, EIA expects global oil production to increase by almost 2.0 million b/d in 2019 compared with forecast oil demand growth of 1.7 million b/d.

- 17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase Special Coverage News Agencies News Release June 18-2018 BP Statistical Review of World Energy 2018: Two steps forward, one step back Source: BP Global energy demand growth above its 10-year average Natural gas was the largest source of energy growth, boosted by coal-to-gas switching in China, and renewables continue to grow For the first time, the BP Statistical Review of World Energy includes data on the fuel mix in the power sector, which strikingly is unchanged from 20 years ago, and key materials (eg, lithium and cobalt) for the changing energy world. Introducing the 2018 edition of the BP Statistical Review of World Energy, Bob Dudley, BP group chief executive, said: '2017 was a year where structural forces in the energy market continued to push forward the transition to a lower carbon economy, but where cyclical factors have reversed or slowed some of the gains from prior years. These factors, combined with rising demand for energy, has resulted in a material increase in carbon emissions following three years of little or no growth.' Fuel consumption by region 2017

- 18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Percentage Data published in the Review – the 67th annual edition – show that: growth in energy demand increased, led by growing demand for natural gas and renewables, gains in energy efficiency slowed as industrial activity in the OECD accelerated and output from China’s most energy-intensive sectors returned to growth, coal consumption increased for the first time in four years, led by growing demand in India and China, and carbon emissions are estimated to have increased after three years of little to no growth. In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity. Demand for oil grew by 1.8% while growth in production was below average for the second consecutive year. Production from OPEC and the 10 other countries that agreed cuts decreased, while producing countries outside of that group, particularly the US driven by tight oil, saw increases. Consumption exceeded production for much of 2017 and as a result OECD inventories fell back to more normal levels. 2017 was a strong year for natural gas with consumption up 3% and production up 4% – the fastest growth rates since immediately following the global financial crisis. The single biggest factor fueling global gas consumption was the surge in Chinese gas demand, where consumption increased by over 15%, driven by government environmental policies encouraging coal-to-gas switching. Renewables grew strongly in 2017, with wind and solar leading the way. Coal consumption was also up, growing for the first time since 2013. Oil reserves-to-production (R/P) ratios Years

- 19. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Oil production/consumption by region Million barrels daily Production by region Consumption by region

- 20. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Crude oil prices 1861-2017 US dollars per barrel, world events BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Regional refining margins US dollars per barrel

- 21. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Gas reserves-to-production (R/P) ratios Years 2017 by region History BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Gas production/consumption by region Billion cubic metres Consumption by regionProduction by region

- 22. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Gas prices $/mmBtu BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Source: Includes data from FGE MENAgas service, IHS. Major gas trade movements 2017 Trade flows worldwide (billion cubic metres)

- 23. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Coal reserves-to-production (R/P) ratios Years 2017 by region History BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Coal prices US dollars per tonne

- 24. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Nuclear energy consumption by region Million tonnes oil equivalent BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Hydroelectricity consumption by region Million tonnes oil equivalent

- 25. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25 BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Renewable energy consumption/share of power by region Other renewables consumption by region Million tonnes oil equivalent Other renewables share of power generation by region Percentage Biofuels production by region Million tonnes oil equivalent World biofuels production BP Statistical Review of World Energy 2018 © BP p.l.c. 2018

- 26. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26 Regional electricity generation by fuel 2017 Percentage BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Share of global electricity generation by fuel Percentage BP Statistical Review of World Energy 2018 © BP p.l.c. 2018

- 27. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 27 Bob Dudley commented: 'This year’s Review looks at the energy mix within the power sector, for the first time, which astonishingly shows that the share of coal in the sector is unchanged from 20 years ago. 'As we have said in our Energy Outlook, our Technology Outlook and now our Statistical Review, the power system must decarbonize. We continue to believe that gains in the power sector are the most efficient way to drive down carbon emissions in coming decades.' The BP Statistical Review of World Energy and other material is available online at: www.bp.com/statisticalreview BP Statistical Review of World Energy 2018 © BP p.l.c. 2018 Key materials prices Cobalt prices Thousands of US dollars per tonne Lithium carbonate prices Thousands of US dollars per tonne

- 28. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 28 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase June 2018 K. Al Awadi

- 29. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 29 Thank you for sharing with us your comments and thoughts on the above issue, similarly we would like to share with our daily publications on Energy news via own NewBase Energy News – https://www.slideshare.net/khdmohd/ne-base-27-april-2018-energy-news-issue-1165-by-khaled-al-awadi Call us for details khdmohd@hawkenergy.net Your Energy Consultant for the GCC area Khaled Al Awadi

- 30. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 30 For Your Recruitments needs and Top Talents, please seek our approved agents below