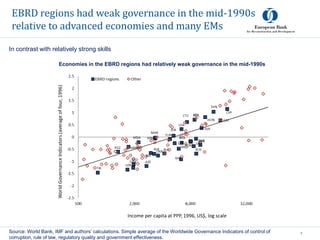

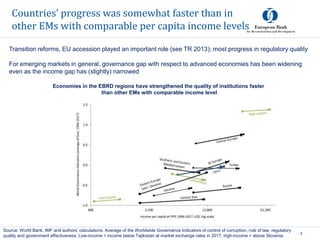

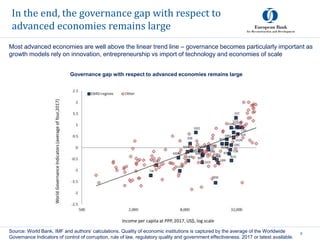

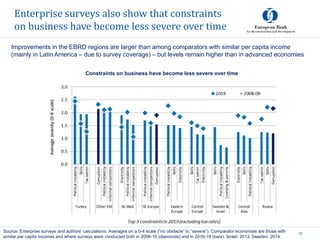

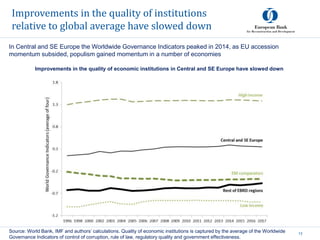

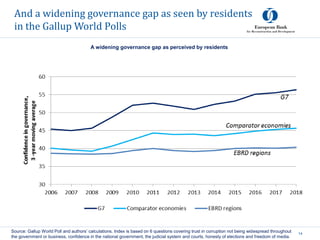

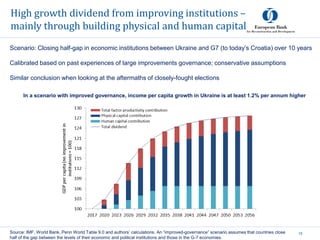

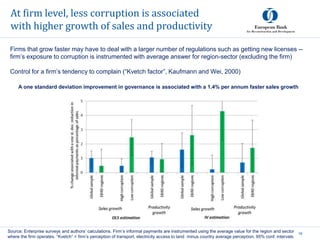

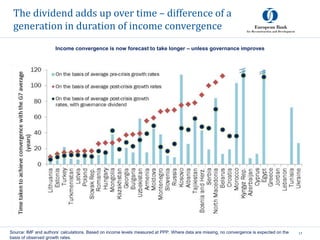

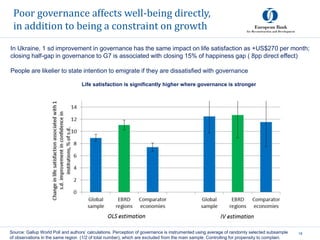

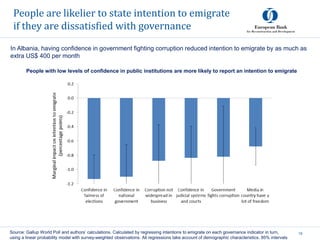

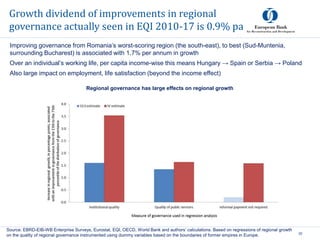

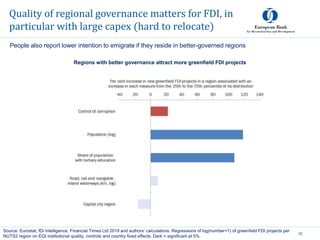

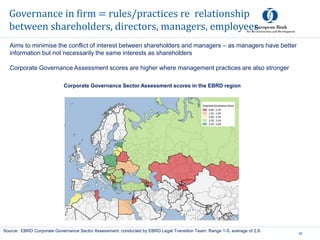

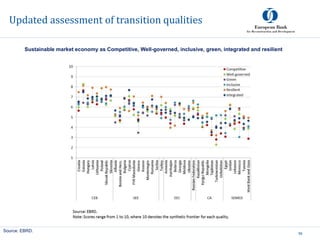

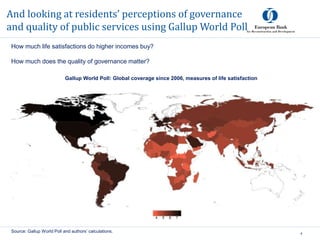

This document discusses the importance of good governance for economic growth and well-being. It summarizes research finding that improving governance can significantly increase GDP growth rates over time by enabling greater physical and human capital accumulation. At the firm level, less corruption is associated with higher sales growth and productivity gains. The document also finds that better governance has a direct, positive impact on life satisfaction, above and beyond its effects on income levels. Residents in countries with weaker governance are also more likely to express an intention to emigrate. While governance has strengthened over time in many regions, significant gaps remain compared to advanced economies.

![Use Worldwide Governance Indicators

to measure country-level governance

5Source: World Bank, IMF and authors’ calculations. Simple average of the Worldwide Governance Indicators of control of

corruption, rule of law, regulatory quality and government effectiveness.

Worldwide governance indicators at a glance, 2017

Control of corruption, rule of law, regulatory quality and government effectiveness scaled -2.5 to 2.5

[also voice and accountability and political stability and absence of violence]

Results are similar for other measures as shown in TR 2013](https://image.slidesharecdn.com/plekhanovgovernanceandeconomicdevelopmentv1-191126151003/85/Governance-and-Economic-Development-5-320.jpg)