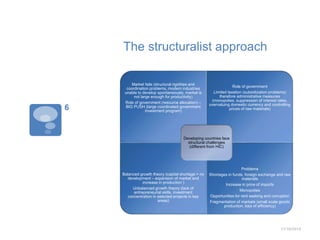

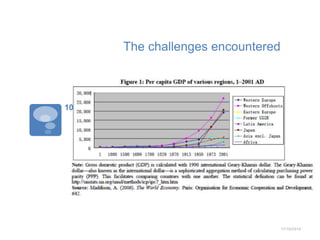

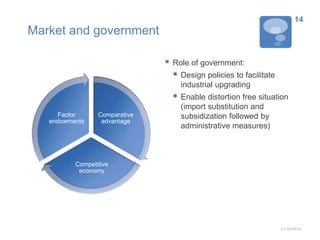

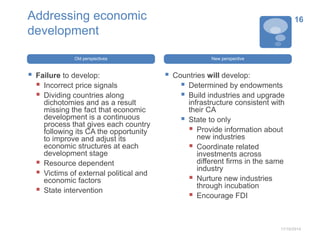

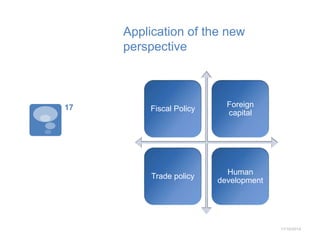

This document provides an overview and comparison of old and new perspectives on economic development, as presented by Justin Lin in his "New Structural Economics". The old perspectives, including laissez-faire, structuralism, and trade theories, focused on government intervention and import substitution. The new perspective emphasizes the role of comparative advantage, facilitating industrial upgrading based on a country's factor endowments, and allowing the market to allocate resources. This new perspective provides a more continuous view of development and a greater role for the private sector compared to the old perspectives.