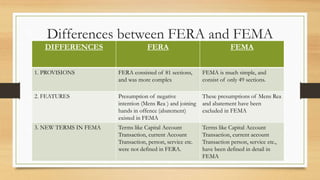

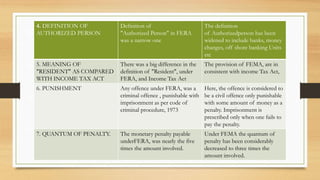

The document discusses the nature of the economic environment, focusing on how economic systems—capitalism, socialism, and mixed economies—affect business operations and strategies. It highlights the advantages and disadvantages of each system, detailing aspects such as income inequality, efficiency, government regulation, and social welfare. Additionally, it addresses the roles of monetary policy and industrial policy, along with regulations like the Foreign Exchange Management Act (FEMA) and the Workmen's Compensation Act.