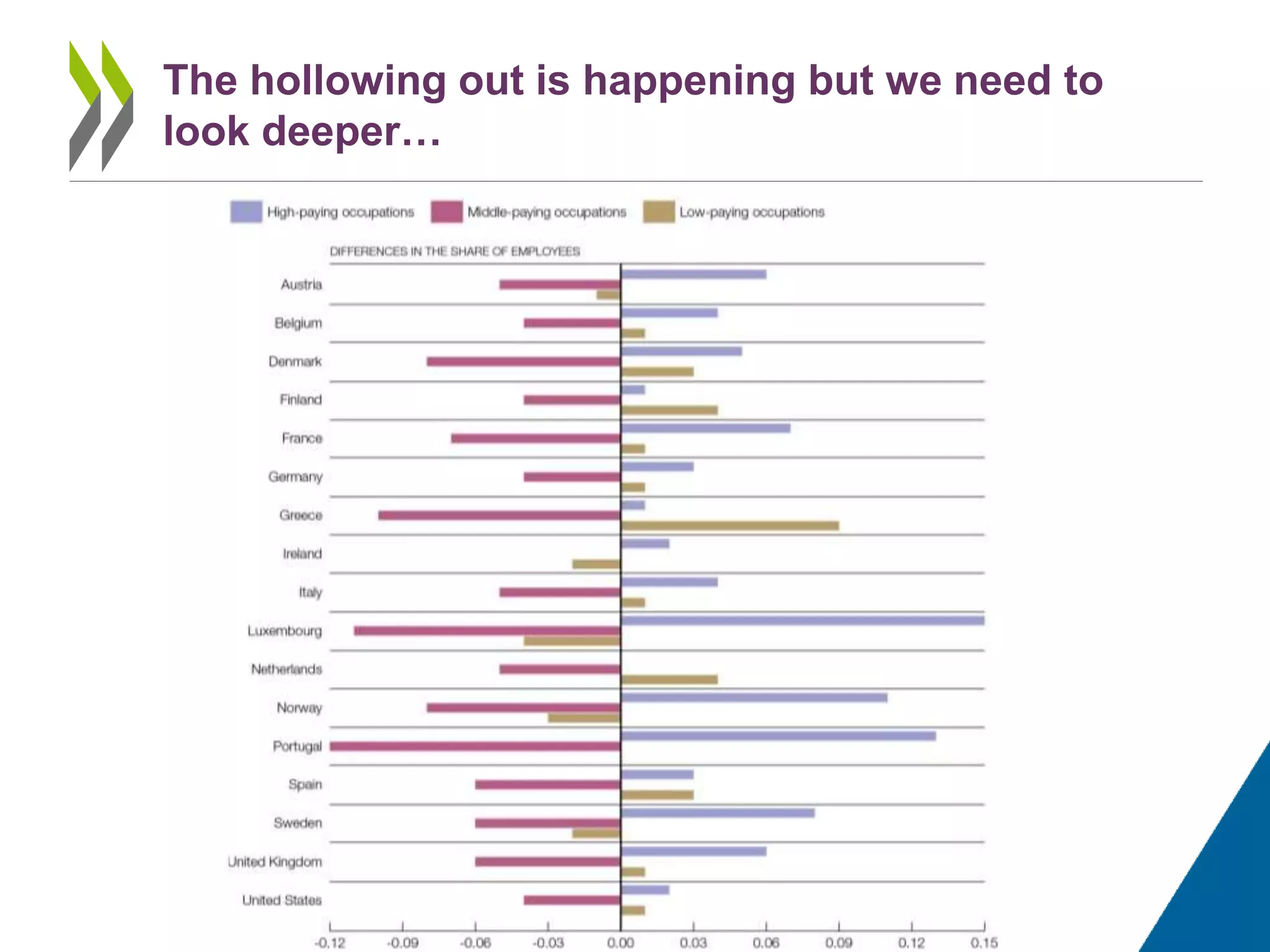

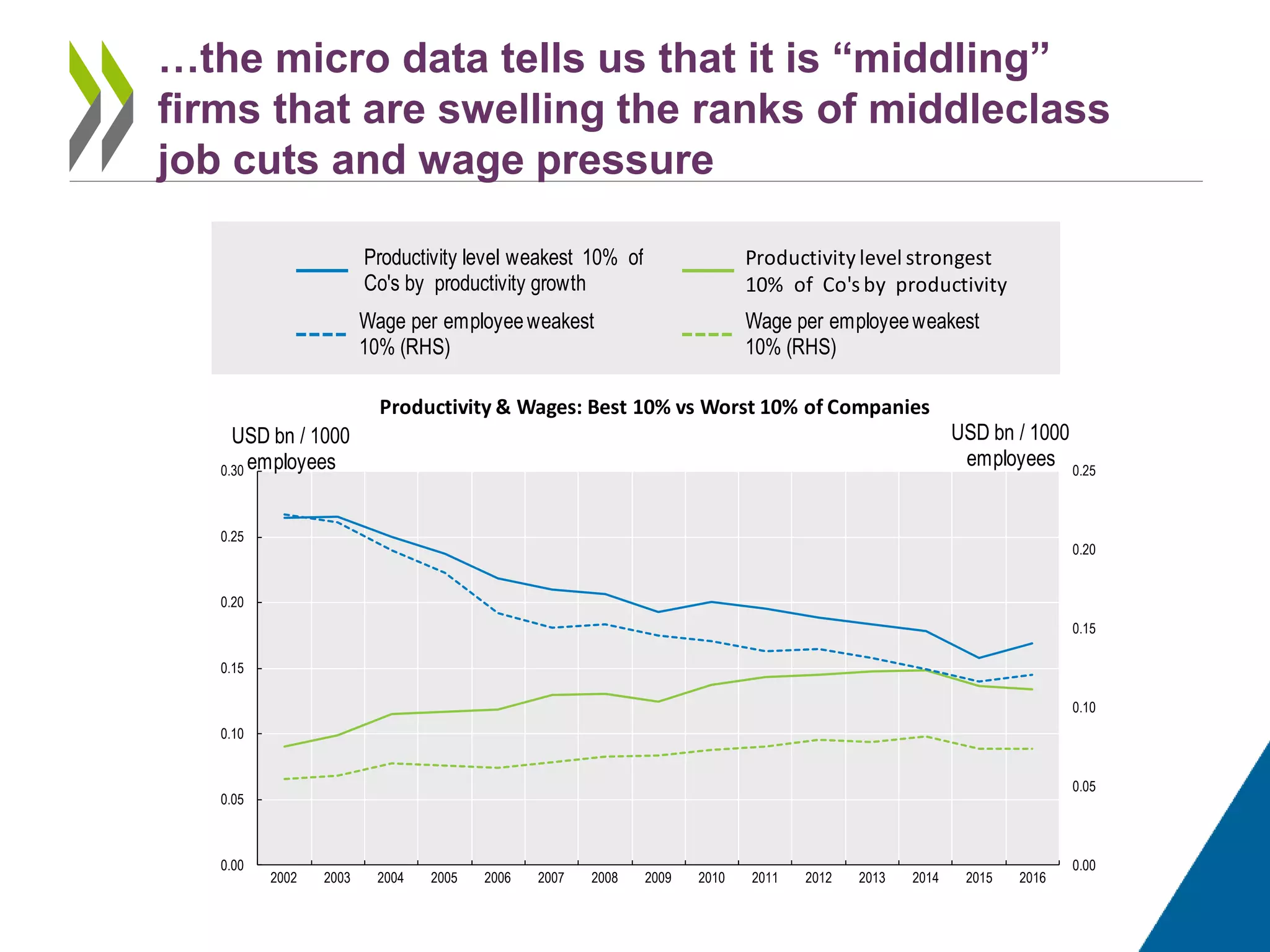

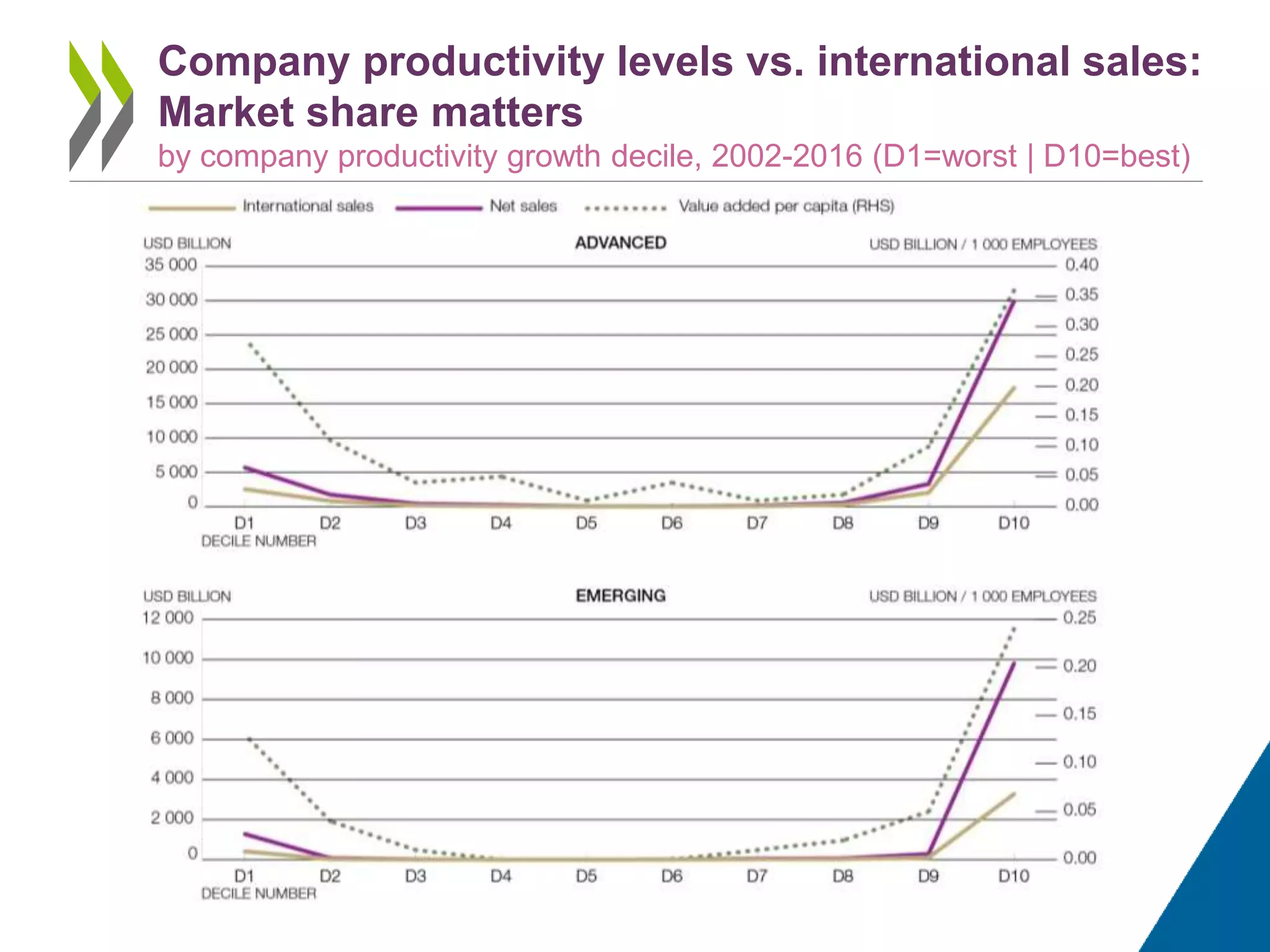

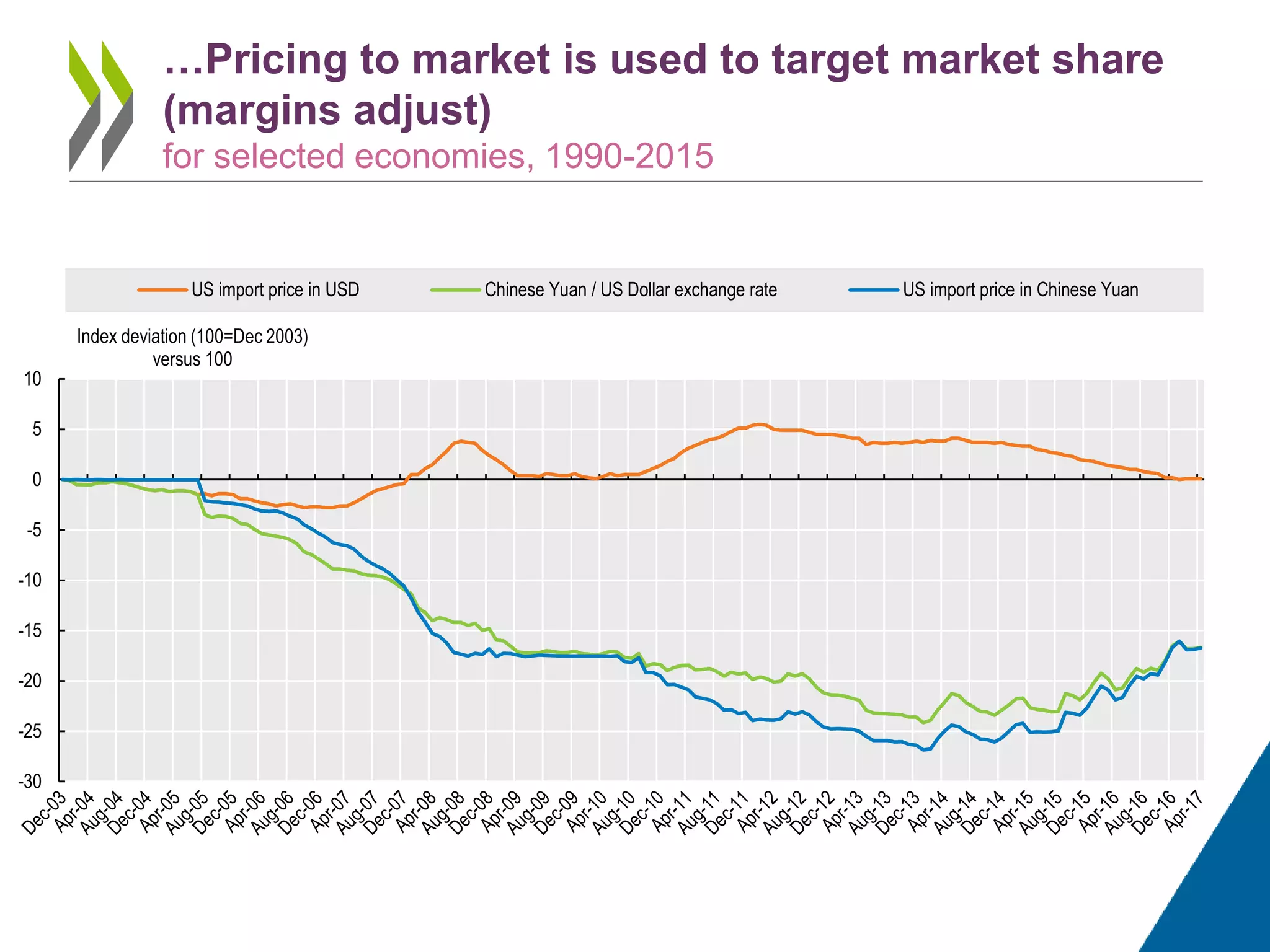

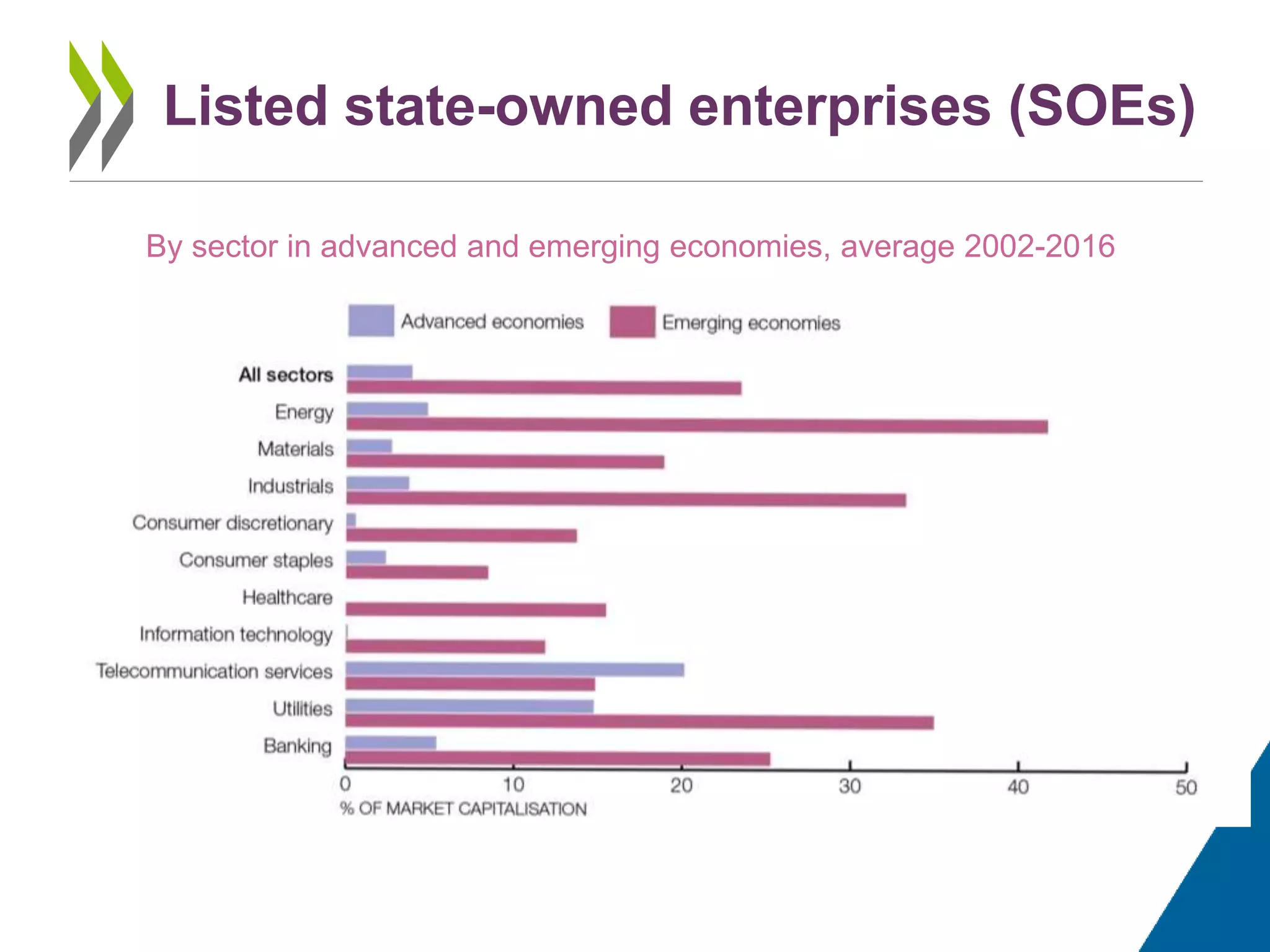

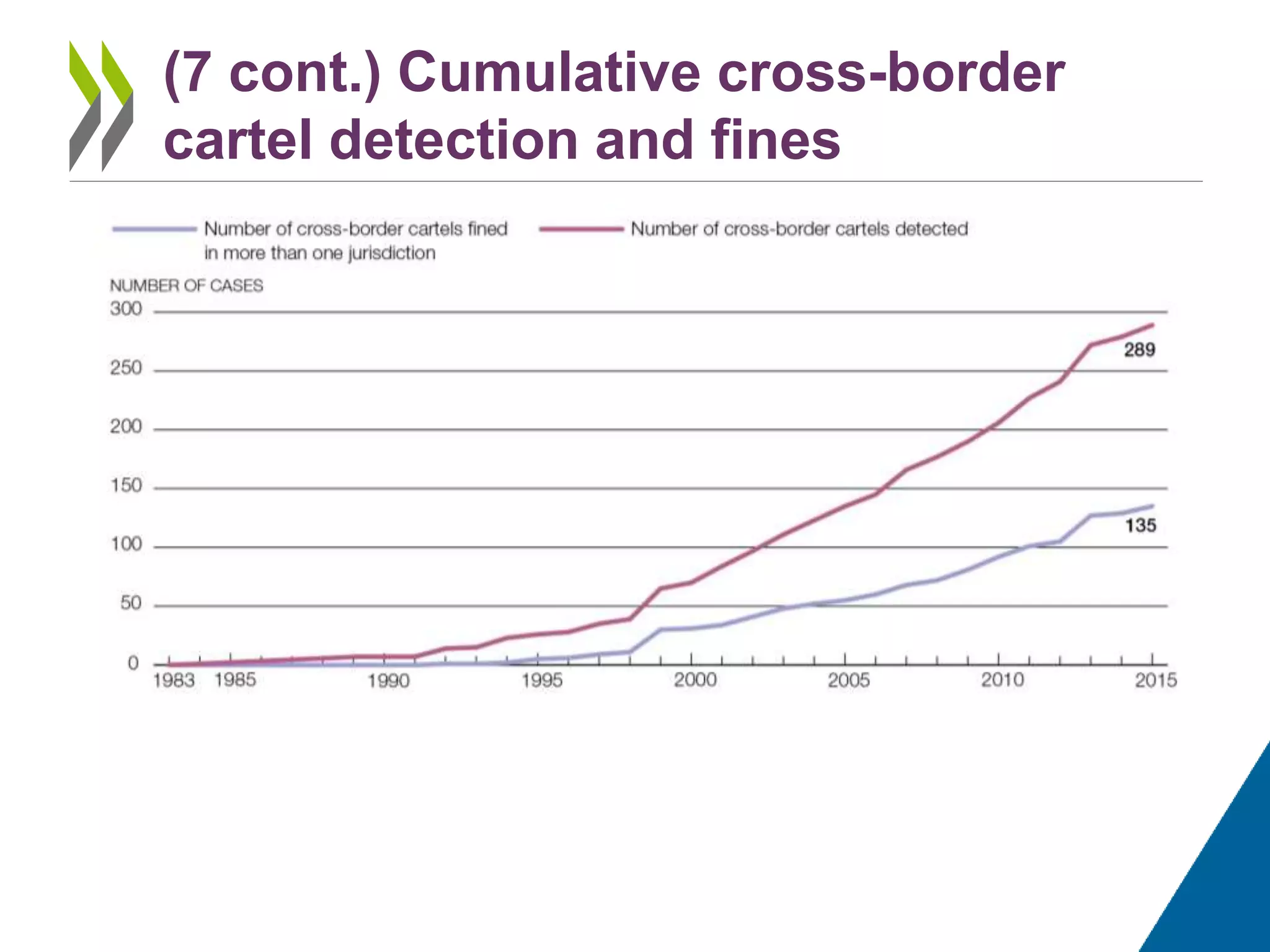

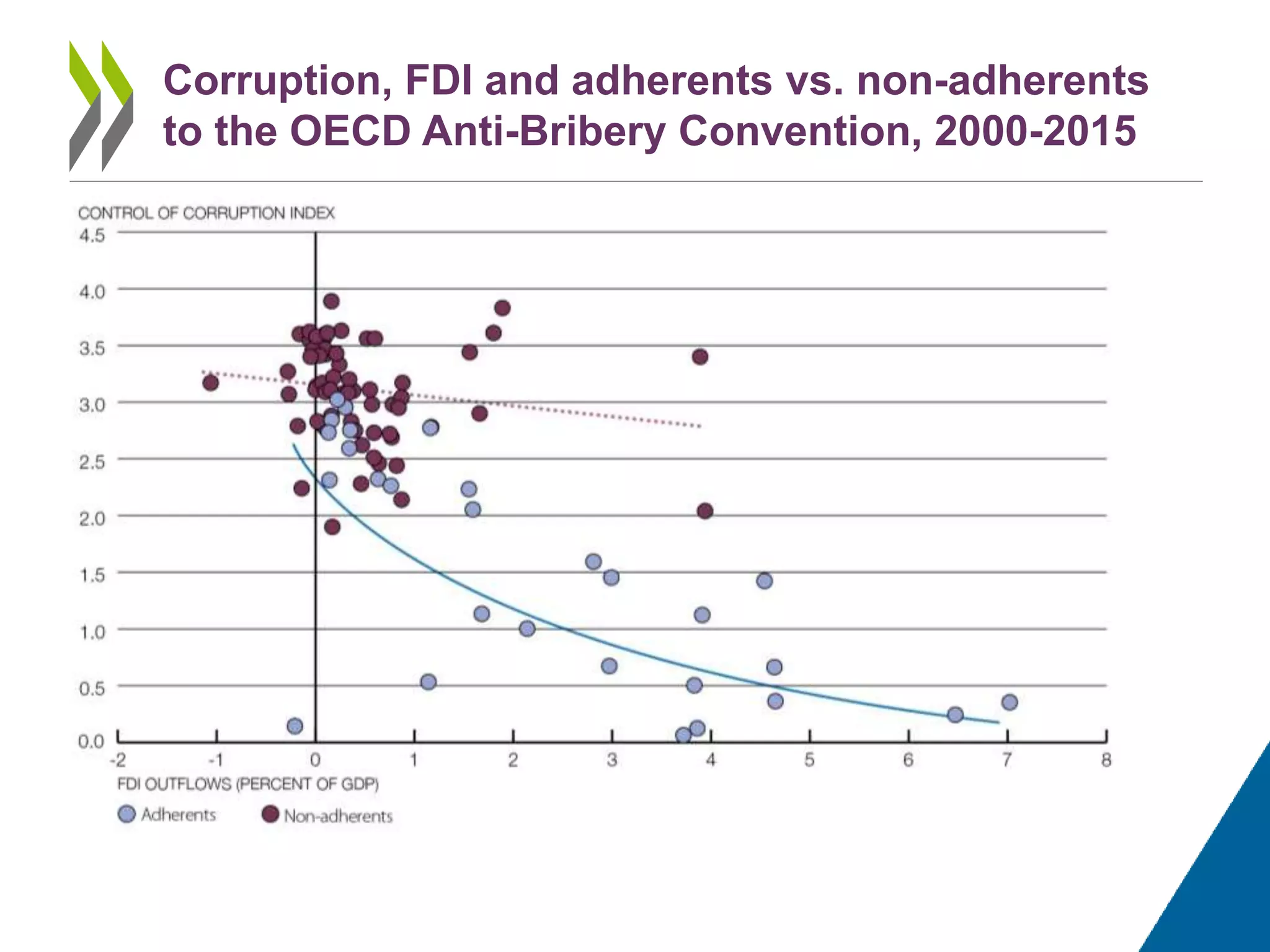

The document summarizes key findings from the 2017 OECD Business and Finance Outlook report. It addresses 8 questions on issues related to globalization and the impact of technology and trade on middle-income jobs. The summary discusses how openness and a level global playing field are important for companies to innovate and gain productivity. However, some countries use subsidies, exchange rate management and pricing strategies to gain unfair export advantages over competitors. Overall, the document argues that non-transparent practices like these undermine open markets and fair global competition.