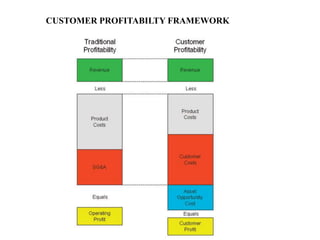

1) A customer profitability analysis evaluates the costs and revenues assigned to segments of a company's customer base. It focuses on determining which customers are profitable versus unprofitable.

2) The general approach involves segmenting customers, calculating the revenue and costs attributable to each segment using activity-based costing, and then analyzing the profitable versus unprofitable segments.

3) A case study showed an insurance company used customer profitability analysis to identify that recently retired customers were unprofitable for a certain policy, so it adjusted agent commissions to discourage selling to that segment.