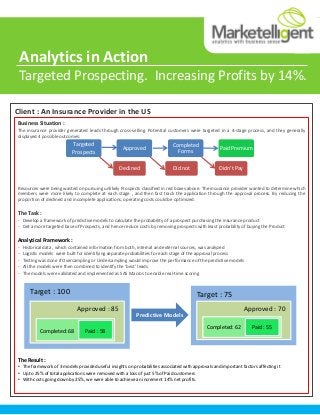

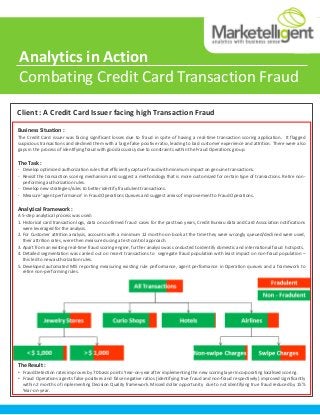

The document discusses how analytics can be used to solve business problems in the retail banking industry. It describes how analytics can be applied to various areas of a bank's profit and loss statement, including acquiring new customers, reducing customer attrition, improving account activation rates, and maximizing revenue from interest, fees, and cross-selling. It also discusses how strategic reporting, marketing analytics, and data-driven insights can be used for segmentation, customer lifetime value analysis, profitability and loyalty analysis, cross-selling strategies, and customer retention programs. The overall aim is to provide a top-down analytical approach to optimize all areas of a bank's operations and financial performance.