Mahindra Financial result update: 4QFY15 PAT up 7% YoY and 144% QoQ

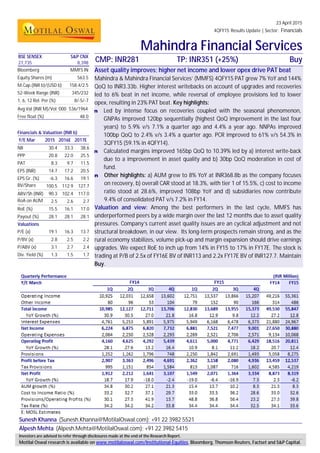

- 1. 23 April 2015 4QFY15 Results Update | Sector: Financials Mahindra Financial Services Sunesh Khanna (Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521 Alpesh Mehta (Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415 BSE SENSEX S&P CNX CMP: INR281 TP: INR351 (+25%) Buy27,735 8,398 Bloomberg MMFS IN Equity Shares (m) 563.5 M.Cap.(INR b)/(USD b) 158.4/2.5 52-Week Range (INR) 345/232 1, 6, 12 Rel. Per (%) 8/-5/-7 Avg Val (INR M)/Vol ‘000 536/1964 Free float (%) 48.0 Financials & Valuation (INR b) Y/E Mar 2015 2016E 2017E NII 30.4 33.3 38.6 PPP 20.8 22.0 25.5 PAT 8.3 9.7 11.5 EPS (INR) 14.7 17.2 20.5 EPS Gr. (%) -6.3 16.6 19.1 BV/Share ( ) 100.5 112.9 127.7 ABV/Sh (INR) 90.3 102.4 117.0 RoA on AUM (%) 2.5 2.6 2.7 RoE (%) 15.5 16.1 17.0 Payout (%) 28.1 28.1 28.1 Valuations P/E (x) 19.1 16.3 13.7 P/BV (x) 2.8 2.5 2.2 P/ABV (x) 3.1 2.7 2.4 Div. Yield (%) 1.3 1.5 1.7 Asset quality improves; higher net income and lower opex drive PAT beat Mahindra & Mahindra Financial Services’ (MMFS) 4QFY15 PAT grew 7% YoY and 144% QoQ to INR3.33b. Higher interest writebacks on account of upgrades and recoveries led to 6% beat in net income, while reversal of employee provisions led to lower opex, resulting in 23% PAT beat. Key highlights: n Led by intense focus on recoveries coupled with the seasonal phenomenon, GNPAs improved 120bp sequentially (highest QoQ improvement in the last four years) to 5.9% v/s 7.1% a quarter ago and 4.4% a year ago. NNPAs improved 100bp QoQ to 2.4% v/s 3.4% a quarter ago. PCR improved to 61% v/s 54.3% in 3QFY15 (59.1% in 4QFY14). n Calculated margins improved 165bp QoQ to 10.39% led by a) interest write-back due to a improvement in asset quality and b) 30bp QoQ moderation in cost of fund. n Other highlights: a) AUM grew to 8% YoY at INR368.8b as the company focuses on recovery, b) overall CAR stood at 18.3%, with tier 1 of 15.5%, c) cost to income ratio stood at 28.6%, improved 108bp YoY and d) subsidiaries now contribute 9.4% of consolidated PAT v/s 7.2% in FY14. Valuation and view: Among the best performers in the last cycle, MMFS has underperformed peers by a wide margin over the last 12 months due to asset quality pressures. Company’s current asset quality issues are an cyclical adjustment and not structural breakdown, in our view. Its long-term prospects remain strong, and as the rural economy stabilizes, volume pick-up and margin expansion should drive earnings upgrades. We expect RoE to inch up from 14% in FY15 to 17% in FY17E. The stock is trading at P/B of 2.5x of FY16E BV of INR113 and 2.2x FY17E BV of INR127.7. Maintain Buy. Investors are advised to refer through disclosures made at the end of the Research Report. Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

- 2. 23 April 2015 2 Mahindra Financial Services Exhibit 1: Quarterly performance v/s expectations and deviations for the same Y/E March 4QFY15A 4QFY15E Var (%) Comments Income from ops 15,207 15,323 -1 Interest Expense 6,373 6,988 -9 Other Income 166 134 24 Net Income 9,001 8,469 6 Interest write-back led to +160bp QoQ margin expansions % Change (Y-o-Y) 16 10 Operating Expenses 2,571 2,813 -9 INR 200m Write-back on employee expenses led to lower opex Operating Profit 6,429 5,656 14 % Change (Y-o-Y) 18 4 Other Provisions 1,493 1,496 0 Provisions in-line Profit before Tax 4,936 4,160 19 Tax Provisions 1,602 1,441 11 Net Profit 3,334 2,719 23 Better than expected net income and lower opex led to PAT beat % Change (Y-o-Y) 7 -12 Source: MOSL, Company Asset quality improves 120bp – GNPA at 5.9% n Intense focus on recoveries and high collection efforts coupled with seasonal phenomena resulted in GNPA decline. n GNPAs declined 120bps to 5.9% vs 7.1% a quarter ago and 4.4% a year ago. The GNPA improvement is the highest sequential improvement in asset quality in last 4 years. NNPA also improved to 2.4% vs 3.4% a quarter ago. n Credit cost was at 1.72% vs 0.94% in 4QFY14; PCR improved to 61% v/s 54.3% in 3QFY15 (59.1% in 4QFY14). Higher net income and lower opex drives PAT beat n Easing wholesale rates and coupled with higher yield on loans (led by interest recovery) led to improvement in net income which grew +16% YoY and +20% QoQ to INR9b. n Calculated margins improved by 165bp QoQ to 10.39%, led by a) interest recovery due to improvement in asset quality b) 30bp QoQ moderation in cost of fund Cost of fund to 9.72%. n Further, opex declined 5% QoQ led by INR200m reversal of employee expenses; Cost income for the quarter improved to 28.6% AUM growth moderate to 8%; focus on recovery n Moderating demand and focus on recoveries led to AUM growth falling to single digits at 8% YoY and 1% QoQ to INR 369b. n Consolidation of CV/CE book (-6% YoY and 0.4% QoQ) led to its share in overall AUM decline to 13% v/s +15% in 4QFY14. Incremental AUM growth YoY is driven by M&M auto/utility vehicles (50% of incremental AUM). Healthy performance by subsidiaries continues n In 4QFY15 disbursements of MRHFL grew 48.8% YoY to INR3.6b. PAT grew 71.4% YoY to INR216m. O/s book stood at ~INR21b (up 55% YoY). FY15 PAT grew +63% to INR442m n MIBL Total income grew +9.5% YoY. Net premium grew by 28.5% YoY to INR3b. n Subsidiaries now contribute 9.4% of consol PAT v/s 7.2% in FY14

- 3. 23 April 2015 3 Mahindra Financial Services Valuations and view n MMFS has underperformed peers by a wide margin over the last 12 months due to asset quality pressures. While it’s reported NPLs are likely to remain at ~6% till 2HFY16, we view this as a cyclical adjustment and not a structural breakdown. n Long-term prospects remain exciting, and as the rural economy stabilizes, MMFS should once again be in a pole position to capture the upturn. The management targets AUM of INR900b by 2020, implying 20% CAGR over the next six years. n We expect RoEs to inch up from 14% in FY15 to 17% in FY17. Asset quality stabilization, volume growth pick-up, and margin expansion should drive earnings upgrades. The stock is currently trading at P/BV of 2.5x of FY16E BV of INR113 and 2.2x FY17E BV of INR127.7. We value the stock at 2.75x FY17 P/B. Maintain Buy. Exhibit 2: DuPont Analysis Y/E MARCH 2007 2008 2009 2010 2011 2012 2013 2014 2015E 2016E 2017E Interest Income 15.01 18.15 19.30 18.90 18.23 18.23 18.03 17.99 17.39 17.24 17.02 Interest Expended 6.27 7.54 7.81 6.75 6.49 7.71 8.05 8.36 8.13 8.14 7.81 Net Interest Income 8.73 10.62 11.49 12.16 11.74 10.52 9.98 9.63 9.26 9.10 9.21 Income from Securitisation 1.04 1.77 1.60 1.69 0.89 0.64 1.07 0.82 0.64 0.74 0.92 Net operating income 9.77 12.39 13.09 13.84 12.63 11.16 11.05 10.44 9.90 9.84 10.13 Other Income 0.30 0.35 0.30 0.51 0.32 0.36 0.27 0.12 0.16 0.15 0.15 Net Income 10.07 12.74 13.39 14.35 12.95 11.52 11.31 10.56 10.06 9.98 10.27 Operating Expenses 3.78 4.17 4.08 4.37 4.70 4.07 3.69 3.49 3.28 3.49 3.60 Operating Income 6.29 8.57 9.31 9.98 8.24 7.44 7.62 7.07 6.78 6.49 6.68 Provisions/write offs 2.37 4.07 4.32 2.98 1.34 1.08 1.41 1.93 2.70 2.12 2.05 PBT 3.92 4.50 4.98 7.00 6.90 6.36 6.22 5.14 4.08 4.37 4.62 Tax 1.35 1.57 1.70 2.37 2.35 2.10 1.91 1.75 1.37 1.51 1.60 Reported PAT 2.57 2.93 3.28 4.63 4.55 4.27 4.31 3.39 2.71 2.86 3.03 Leverage 7.07 5.78 4.69 4.65 4.82 5.34 5.43 5.48 5.70 5.63 5.62 RoE 18.19 16.92 15.41 21.54 21.96 22.79 23.42 18.58 15.46 16.12 17.02 Source: MOSL, Company

- 4. 23 April 2015 4 Mahindra Financial Services Exhibit 3: Quarterly Snapshot FY13 FY14 FY15 Variation (%) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q QoQ YoY Profit and Loss (INR m) Net Income 4,916 5,394 5,665 6,784 6,224 6,875 6,820 7,732 6,881 7,521 7,477 9,001 20 16 Operating Expenses 1,667 1,768 1,872 2,112 2,064 2,250 2,528 2,293 2,269 2,521 2,706 2,571 -5 12 Employee 584 589 522 539 592 701 671 1,008 1,084 1,174 1,183 1,149 -3 14 Others 1,084 1,179 1,350 1,572 1,472 1,548 1,857 1,285 1,185 1,347 1,523 1,422 -7 11 Operating Profits 3,248 3,626 3,793 4,673 4,160 4,625 4,292 5,439 4,611 5,000 4,771 6,429 35 18 Provisions 854 836 815 329 1,252 1,262 1,796 748 2,250 1,842 2,691 1,493 -45 100 PBT 2,395 2,790 2,977 4,344 2,907 3,363 2,496 4,691 2,362 3,158 2,080 4,936 137 5 Taxes 784 914 975 1,160 995 1,151 854 1,584 813 1,087 716 1,602 124 1 PAT (before EO) 1,610 1,876 2,002 3,184 1,912 2,212 1,641 3,107 1,549 2,071 1,364 3,334 144 7 Asset Quality GNPA (INR m) 7,639 8,734 10,001 7,630 11,555 12,223 15,153 14,057 20,278 21,314 24,991 20,997 -16 49 NNPA (INR m) 2,275 3,270 3,841 2,600 5,062 5,541 6,739 5,756 10,954 10,126 11,426 8,182 -28 42 %GNPAs to total assets (%) 3.8 3.9 4.1 3.0 4.2 4.1 4.8 4.4 6.2 6.3 7.1 5.9 %NNPAs to total assets (%) 1.2 1.5 1.6 1.0 1.9 1.9 2.2 1.9 3.0 3.1 3.4 2.4 PCR (Calc., %) 70.2 62.6 61.6 65.9 56.2 54.7 55.5 59.1 46.0 52.5 54.3 61.0 Ratios (%) Cost to Income 33.9 32.8 33.1 31.1 33.2 32.7 37.1 29.7 33.0 33.5 36.2 28.6 Tax Rate 32.8 32.7 32.8 26.7 34.2 34.2 34.2 33.8 34.4 34.4 34.4 32.5 CAR 17.4 16.5 19.8 19.7 19.6 19.1 18.6 18.0 18.1 17.9 18.1 18.3 Tier I 14.7 14.0 17.3 17.0 16.4 16.1 15.7 15.5 15.6 15.5 15.6 15.5 RoA - calculated 3.3 3.6 3.4 5.4 2.9 3.1 2.2 3.9 1.9 2.5 1.6 3.8 140 -3 RoE - calculated 21.2 23.4 20.9 30.3 16.8 18.6 13.3 24.5 12.0 15.5 9.9 23.7 140 -4 Key Details (INR b) AUM (Reported) 217 238 256 279 295 311 329 341 343 357 365 369 1 8 AUM (Adjusted) 209 229 247 265 282 298 314 321 325 339 346 347 0 8 On book Loans 191 213 234 240 262 281 300 296 305 319 329 329 0 11 Off book Loans 18 16 13 24 20 17 13 25 20 20 17 18 8 -27 Borrowings 170 190 197 215 226 242 257 265 262 276 280 280 0 6 On book Borrowings 149 172 182 189 204 224 243 239 240 255 262 263 0 10 Off book (Securitisation) 20 17 15 26 22 18 15 26 22 21 18 18 -4 -32 AUM Mix (%) Auto/Utility vehicles 28 29 29 28 28 27 28 29 30 29 30 31 Tractors 20 19 19 19 19 19 19 19 19 18 19 18 Cars 32 32 32 24 24 24 23 24 23 23 23 23 Commercial Vehicles 13 13 13 17 17 16 16 15 14 14 13 13 Refinance & others 7 7 7 12 12 14 14 13 14 16 15 15 Value of assets fin mix. (%) Auto/Utility vehicles 27 29 30 31 30 30 31 32 33 32 33 33 Tractors 19 18 19 19 21 20 21 20 20 18 19 18 Cars 27 26 25 24 23 23 22 22 22 22 21 22 Commercial Vehicles 15 15 14 14 13 13 11 11 9 10 9 9 Refinance & others 12 12 12 12 13 14 15 15 16 18 18 18 Total Borrowing Mix (%) Bank Term loans 48 45 47 51 42 50 49 54 50 49 46 43 Bonds/NCDs 22 25 26 25 28 22 21 22 21 19 21 22 Securitization 12 9 7 12 10 7 6 10 8 8 7 6 Fixed deposits 9 9 10 11 12 13 13 14 15 16 16 17 Commercial Papers 9 11 8 0 8 9 11 0 6 9 9 12 Other Details Branches (Nos.) 615 628 639 657 675 687 710 893 998 1,055 1,088 1,108 Employees (Nos.) 4,255 4,296 4,272 4,214 4,229 4,464 4,429 9,349 12,741 13,648 13,899 14,197 Source: MOSL, Company

- 5. 23 April 2015 5 Mahindra Financial Services Story in charts Exhibit 4: AUM growth +8% YoY and 1% QoQ 187 196 209 229 247 265 282 298 314 321 325 339 346 347 42 41 39 36 32 35 35 30 27 21 15 14 10 8 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 Adj. AUM(INR b) YoY Gr. (%) Exhibit 5: AUM Mix remain stable QoQ (%) 30 30 28 29 29 28 28 27 28 29 30 29 30 31 20 20 20 19 19 19 19 19 19 19 19 18 19 18 31 31 32 32 32 24 24 24 23 24 23 23 23 23 12 12 13 13 13 17 17 16 16 15 14 14 13 13 7 7 7 7 7 12 12 14 14 13 14 16 15 15 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 Auto/Uvs Tractors Cars CVs UsedCV & others Exhibit 6: Borrowing mix shifts away from bank funding (%) 49 55 48 45 47 51 42 50 49 54 50 49 46 43 21 22 22 25 26 25 28 22 21 22 21 19 21 22 12 14 12 9 7 12 10 7 6 10 8 8 7 6 8 9 9 10 11 12 13 13 14 15 16 16 17 11 0 9 11 8 0 8 9 11 0 6 9 9 12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 BankTerm Loans Bonds / NCDs Securitiz. FD CP Exhibit 7: Cof improves 30bp QoQ 10.2 10.7 10.3 10.3 10.1 10.6 9.7 9.7 9.5 9.9 8.7 8.9 8.9 9.4 6.7 7.0 7.3 7.3 7.4 7.4 7.2 7.4 7.6 7.8 7.6 7.6 7.6 7.7 9MFY12 FY12 1QFY13 1HFY13 9MFY13 FY13 1QFY14 1HFY14 9MFY14 FY14 1QFY15 1HFY15 9MFY15 FY15 Gross Spread(%) Cost of Funds (%) Exhibit 8: Sequential improvement of120bp QoQ 140 110 140 230 160 110 110 40 120 4QFY07 4QFY08 4QFY09 4QFY10 4QFY11 4QFY12 4QFY13 4QFY14 4QFY15 Improvement in GNPA in 4Q (bp) Source: Company, MOSL Exhibit 9: Provision coverage increase 675bp QoQ 18 4 26 23 21 7 30 27 42 14 49 37 56 23 74 78 70 63 62 66 56 55 56 59 46 52 54 61 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 Prov as % of Op Profit PCR (%) Source: Company, MOSL

- 6. 23 April 2015 6 Mahindra Financial Services Exhibit 10: Financials: Valuation metrics 62.34 Rating CMP Mcap EPS (INR) P/E (x) BV (INR) P/BV (x) RoA (%) RoE (%) (INR) (USDb) FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17 ICICIBC* Buy 312 28.9 23.0 27.1 10.7 8.7 131 150 1.89 1.58 1.63 1.64 15.8 16.4 HDFCB Buy 1,014 40.7 52.0 63.1 19.5 16.1 287 336 3.53 3.02 2.00 1.99 19.5 20.3 AXSB Buy 538 20.3 37.5 44.0 14.4 12.2 219 255 2.46 2.11 1.79 1.75 18.4 18.5 KMB* Neutral 1,377 17.0 49.2 60.4 28.0 22.8 371 427 3.72 3.22 1.86 1.86 14.3 15.0 YES Buy 851 5.7 60.9 76.4 14.0 11.1 332 393 2.56 2.17 1.68 1.70 19.9 21.1 IIB Buy 857 7.3 43.2 54.6 19.8 15.7 227 274 3.77 3.13 1.90 1.97 20.7 21.8 DCBB Buy 119 0.5 7.3 9.5 16.5 12.6 63 72 1.90 1.65 1.12 1.17 12.3 14.1 FB Buy 129 1.8 13.0 15.6 9.9 8.3 100 112 1.29 1.15 1.20 1.19 13.7 14.7 JKBK Neutral 100 0.8 13.6 18.1 7.3 5.5 137 151 0.73 0.66 0.81 0.95 10.4 12.6 SIB Buy 25 0.5 3.7 4.7 6.8 5.4 29 33 0.86 0.77 0.78 0.86 13.3 15.2 Private Aggregate 123.6 17.2 14.3 2.78 2.41 SBIN (cons)* Buy 277 33.2 29.0 36.2 9.2 7.3 231 260 1.15 1.01 0.77 0.84 12.8 14.5 PNB Buy 160 4.6 26.8 36.2 6.0 4.4 231 263 0.69 0.61 0.77 0.91 12.2 14.6 BOI Neutral 218 2.3 50.3 64.3 4.3 3.4 455 511 0.48 0.43 0.46 0.49 11.6 13.3 BOB Neutral 179 1.2 24.1 30.8 7.5 5.8 184 208 0.97 0.86 0.70 0.78 13.7 15.7 UNBK Buy 153 1.6 36.6 47.1 4.2 3.2 320 359 0.48 0.43 0.57 0.64 12.0 13.9 INBK Buy 158 1.2 28.7 33.5 5.5 4.7 287 313 0.55 0.50 0.63 0.63 10.4 11.2 CRPBK Neutral 57 0.2 16.5 21.9 3.5 2.6 141 158 0.41 0.36 0.54 0.64 12.3 14.7 ANDB Buy 77 0.7 17.9 22.5 4.3 3.4 169 185 0.46 0.42 0.55 0.60 11.0 12.7 IDBI Neutral 79 2.0 14.4 19.7 5.4 4.0 157 173 0.50 0.45 0.58 0.69 9.5 11.9 DBNK Neutral 50 0.4 9.7 13.6 5.2 3.7 130 141 0.39 0.36 0.36 0.44 7.7 10.0 Public Aggregate 47.4 7.7 6.0 0.83 0.75 HDFC* Buy 1,276 31.9 38 46 21.6 16.4 165 192 5.03 3.93 2.53 2.53 23.8 24.9 LICHF Buy 443 3.6 33 39 13.5 11.3 198 229 2.24 1.93 1.43 1.42 17.8 18.3 IHFL Buy 561 3.3 64 79 8.7 7.1 215 246 2.61 2.28 4.23 4.29 32.4 34.3 IDFC Buy 169 4.3 13 14 13.4 11.8 109 120 1.29 1.16 2.20 2.19 11.5 12.0 RECL Buy 323 5.1 66 75 4.9 4.3 300 358 1.08 0.90 3.50 3.36 24.2 22.8 POWF Buy 276 5.8 55 63 5.0 4.4 288 334 0.96 0.83 3.18 3.11 20.6 20.1 SHTF Buy 1,031 3.8 78 92 13.2 11.3 494 573 2.09 1.80 2.27 2.44 16.3 17.7 MMFS Neutral 281 2.5 18 21 16.0 13.1 113 128 2.49 2.19 2.61 2.76 16.5 17.7 BAF Buy 4,281 3.4 219 267 19.5 16.1 1,137 1,360 3.77 3.15 2.94 2.88 21.0 21.4 NBFC Aggregate 63.8 14.8 12.8 2.74 2.38 *Multiples adj. for value of key ventures/Investments; For ICICI Bank and HDFC Ltd BV is adjusted for investments in subsidiaries

- 7. 23 April 2015 7 Mahindra Financial Services Financials and valuations Income Statement (INR Million) Y/E March 2010 2011 2012 2013 2014 2015 2016E 2017E Interest Income 14,054 18,545 26,500 36,268 47,079 53,388 58,408 64,888 Interest Expended 5,017 6,602 11,203 16,188 21,880 24,967 27,586 29,778 Net Interest Income 9,037 11,943 15,297 20,080 25,199 28,420 30,822 35,110 Change (%) 20.4 32.2 28.1 31.3 25.5 12.8 8.4 13.9 Income from Securitisation 1,254 906 925 2,145 2,137 1,973 2,508 3,504 Other Income 380 324 521 533 314 486 497 561 Net Income 10,671 13,173 16,743 22,759 27,650 30,880 33,827 39,175 Change (%) 22.0 23.4 27.1 35.9 21.5 11.7 9.5 15.8 Operating Expenses 3,250 4,783 5,920 7,420 9,134 10,068 11,832 13,713 Operating Income 7,421 8,390 10,823 15,339 18,516 20,811 21,996 25,462 Change (%) 22.1 13.1 29.0 41.7 20.7 12.4 5.7 15.8 Provisions and W/Offs 2,215 1,365 1,570 2,833 5,058 8,275 7,186 7,831 PBT 5,206 7,024 9,253 12,506 13,458 12,536 14,809 17,632 Tax 1,762 2,393 3,051 3,833 4,585 4,219 5,109 6,083 Tax Rate (%) 33.8 34.1 33.0 30.7 34.1 33.7 34.5 34.5 PAT 3,444 4,631 6,201 8,673 8,872 8,318 9,700 11,549 Change (%) 60.5 34.5 33.9 39.9 2.3 -6.2 16.6 19.1 Proposed Dividend (Incl Tax) 850 1,213 1,682 2,389 2,717 2,326 2,712 3,229 Balance Sheet (INR Million) Y/E March 2010 2011 2012 2013 2014 2015 2016E 2017E Equity Share Capital 960 1,025 1,027 1,126 1,127 1,128 1,128 1,128 Reserves & Surplus 16,326 23,876 28,483 43,420 49,815 55,566 62,554 70,874 Net Worth 17,286 24,901 29,510 44,546 50,942 56,694 63,682 72,002 Borrowings 64,577 96,750 139,611 188,723 239,293 266,994 290,305 336,592 Change (%) 23.9 49.8 44.3 35.2 26.8 11.6 8.7 15.9 Total Liabilities 81,863 121,651 169,121 233,269 290,235 323,688 353,987 408,594 Investments 2,159 6,746 5,025 7,315 8,692 10,856 11,942 13,136 Change (%) 96.8 212.4 -25.5 45.6 18.8 24.9 10.0 10.0 Loans and Advances 86,414 122,673 173,449 236,483 296,172 329,298 354,031 405,532 Change (%) 27.0 42.0 41.4 36.3 25.2 11.2 7.5 14.5 Net Fixed Assets 476 818 989 1,068 1,195 1,100 1,302 1,253 Net Current Assets -7,186 -8,586 -10,342 -11,597 -15,824 -17,566 -13,288 -11,328 Total Assets 81,863 121,651 169,121 233,269 290,235 323,688 353,987 408,594 E: MOSL Estimates

- 8. 23 April 2015 8 Mahindra Financial Services Financials and valuations Ratios Y/E March 2010 2011 2012 2013 2014 2015E 2016E 2017E Spreads Analysis (%) Yield on Portfolio 18.1 17.7 18.0 17.7 17.6 17.0 17.0 17.0 Cost of Borrowings 8.6 8.2 9.5 9.9 10.2 9.9 9.9 9.5 Interest Spread 9.5 9.5 8.5 7.8 7.4 7.1 7.1 7.5 Net Interest Margin (on AUMs) 11.5 10.8 9.7 9.6 9.3 9.0 8.9 9.1 Profitability Ratios (%) RoE 21.5 22.0 22.8 23.4 18.6 15.5 16.1 17.0 RoA (on balance sheet) 4.6 4.6 4.3 4.3 3.4 2.7 2.9 3.0 RoA on AUM 4.0 4.0 3.8 3.9 3.1 2.5 2.6 2.7 Average Leverage (x) 4.6 4.8 5.3 5.4 5.5 5.7 5.6 5.6 Average leverage on AUM (x) 5.4 5.4 6.0 6.1 6.0 6.2 6.2 6.3 Efficiency Ratios (%) Int. Expended/Int.Earned 35.7 35.6 42.3 44.6 46.5 46.8 47.2 45.9 Op. Exps./Net Income 30.5 36.3 35.4 32.6 33.0 32.6 35.0 35.0 Empl. Cost/Op. Exps. 39.4 31.7 33.7 30.1 32.6 45.6 44.6 44.3 Secur. Inc./Net Income 11.7 6.9 5.5 9.4 7.7 6.4 7.4 8.9 Asset-Liability Profile (%) Loans/Borrowings Ratio 133.8 126.8 124.2 125.3 123.8 123.3 122.0 120.5 Net NPAs to Adv. 1.0 0.6 0.7 1.1 1.9 2.7 2.6 2.3 Valuation Book Value (INR) 36.0 48.6 57.5 79.1 90.4 100.5 112.9 127.7 BV Growth (%) 17.3 34.9 18.3 37.7 14.3 11.2 12.3 13.1 Price-BV (x) 7.8 5.8 4.9 3.6 3.1 2.8 2.5 2.2 Adjusted BV (INR) 34.9 47.6 55.9 76.1 83.8 90.3 102.4 117.0 Price-ABV (x) 8.1 5.9 5.0 3.7 3.4 3.1 2.7 2.4 OPS (INR) 15.5 16.4 21.1 27.2 32.9 36.9 39.0 45.1 OPS Growth (%) 21.7 5.9 28.7 29.3 20.6 12.3 5.7 15.8 Price-OP (x) 18.2 17.2 13.3 10.3 8.6 7.6 7.2 6.2 EPS (INR) 7.2 9.0 12.1 15.7 15.7 14.7 17.2 20.5 EPS Growth (%) 60.1 26.0 33.6 29.8 0.4 -6.3 16.6 19.1 Price-Earnings (x) 39.2 31.1 23.3 17.9 17.8 19.1 16.3 13.7 Dividend 1.4 2.0 2.8 3.6 4.0 3.5 4.1 4.9 Dividend Yield (%) 0.5 0.7 1.0 1.3 1.4 1.3 1.5 1.7 E: MOSL Estimates

- 9. 23 April 2015 9 Mahindra Financial Services Corporate profile Exhibit 12: Shareholding pattern (%) Mar-15 Dec-14 Mar-14 Promoter 52.0 52.0 52.1 DII 4.0 1.7 1.3 FII 38.2 41.6 41.4 Others 5.9 4.6 5.1 Note: FII Includes depository receipts Exhibit 13: Top holders Holder Name % Holding Aranda Investments (Mauritius) Pte Ltd 3.8 Franklin Templeton Investment Funds 2.6 Fidelity Funds Emerging Markets Fund 1.3 JP Morgan Sicav Investment Company 1.1 Exhibit 14: Top management Name Designation Bharat N Doshi Chairman Ramesh Iyer Managing Director V Ravi CFO Exhibit 15: Board of director Name Name Bharat N Doshi Manohar G Bhide* Ramesh Iyer Dhananjay Mungale* Piyush Mankad* Pawan Kumar Goenka Uday Y Phadke Chandrashekhar Bhave* Rama Bijapurkar* V S Parthasarathy *Independent Exhibit 17: Auditors Name Type B K Khare & Co Statutory Exhibit 18: MOSL forecast v/s consensus EPS (INR) MOSL forecast Consensus forecast Variation (%) FY16 17.2 17.8 -3.4 FY17 20.5 21.8 -6.0 Company description Mahindra and Mahindra Financial Services (MMFS) is a subsidiary of India conglomerate Mahindra & Mahindra (M&M). MMFS was set up two decades ago, with the objective of financing the vehicles sold by parent M&M. Over last decade MMFS has transformed itself from a captive lender to the largest semi-urban and rural focused diversified NBFC. MMFS as a branch network of 1108 branches, ~14000 employees, 1.8m customers and asset under management of INR368b. MMFS has two subsidiaries viz. Mahindra rural housing finance and Mahindra insurance brokers. Exhibit 11: Sensex rebased

- 10. 23 April 2015 10 Mahindra Financial Services Disclosures This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Motilal Oswal Securities Limited is under the process of seeking registration under SEBI (Research Analyst) Regulations, 2014. There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues Disclosure of Interest Statement MAHINDRA & MAHINDRA FIN SECS § Analyst ownership of the stock No § Served as an officer, director or employee No Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com