NTPC Ltd.Q2FY Result Update

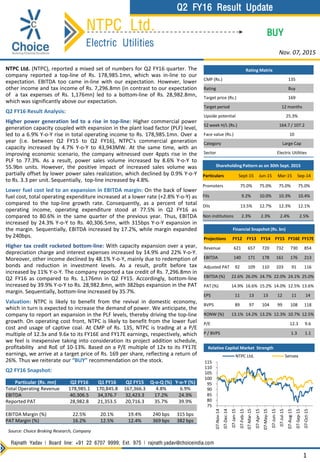

- 1. NTPC Ltd. Electric Utilities BUY Relative Capital Market Strength NTPC Ltd. (NTPC), reported a mixed set of numbers for Q2 FY16 quarter. The company reported a top-line of Rs. 178,985.1mn, which was in-line to our expectation. EBITDA too came in-line with our expectation. However, lower other income and tax income of Rs. 7,296.8mn (in contrast to our expectation of a tax expenses of Rs. 1,176mn) led to a bottom-line of Rs. 28,982.8mn, which was significantly above our expectation. Q2 FY16 Result Analysis: Higher power generation led to a rise in top-line: Higher commercial power generation capacity coupled with expansion in the plant load factor (PLF) level, led to a 6.9% Y-o-Y rise in total operating income to Rs. 178,985.1mn. Over a year (i.e. between Q2 FY15 to Q2 FY16), NTPC’s commercial generation capacity increased by 4.7% Y-o-Y to 43,943MW. At the same time, with an improving economic scenario, the company witnessed over 4ppts rise in the PLF to 77.3%. As a result, power sales volume increased by 8.6% Y-o-Y to 55.9bn units. However, the positive impact of increased sales volume was partially offset by lower power sales realization, which declined by 0.9% Y-o-Y to Rs. 3.3 per unit. Sequentially, top-line increased by 4.8%. Lower fuel cost led to an expansion in EBITDA margin: On the back of lower fuel cost, total operating expenditure increased at a lower rate (+2.8% Y-o-Y) as compared to the top-line growth rate. Consequently, as a percent of total operating income, operating expenditure stood at 77.5% in Q2 FY16 as compared to 80.6% in the same quarter of the previous year. Thus, EBITDA increased by 24.3% Y-o-Y to Rs. 40,306.5mn, with 315bps Y-o-Y expansion in the margin. Sequentially, EBITDA increased by 17.2%, while margin expanded by 240bps. Higher tax credit rocketed bottom-line: With capacity expansion over a year, depreciation charge and interest expenses increased by 14.9% and 22% Y-o-Y. Moreover, other income declined by 48.1% Y-o-Y, mainly due to redemption of bonds and reduction in investment levels. As a result, profit before tax increased by 11% Y-o-Y. The company reported a tax credit of Rs. 7,296.8mn in Q2 FY16 as compared to Rs. 1,176mn in Q2 FY15. Accordingly, bottom-line increased by 39.9% Y-o-Y to Rs. 28,982.8mn, with 382bps expansion in the PAT margin. Sequentially, bottom-line increased by 35.7%. Valuation: NTPC is likely to benefit from the revival in domestic economy, which in turn is expected to increase the demand of power. We anticipate, the company to report an expansion in the PLF levels, thereby driving the top-line growth. On operating cost front, NTPC is likely to benefit from the lower fuel cost and usage of captive coal. At CMP of Rs. 135, NTPC is trading at a P/E multiple of 12.3x and 9.6x to its FY16E and FY17E earnings, respectively, which we feel is inexpensive taking into consideration its project addition schedule, profitability and RoE of 10-13%. Based on a P/E multiple of 12x to its FY17E earnings, we arrive at a target price of Rs. 169 per share, reflecting a return of 26%. Thus we reiterate our “BUY” recommendation on the stock. Q2 FY16 Snapshot: Rajnath Yadav | Board line: +91 22 6707 9999; Ext. 975 | rajnath.yadav@choiceindia.com 1 Nov. 07, 2015 Rating Matrix CMP (Rs.) 135 Rating Buy Target price (Rs.) 169 Target period 12 months Upside potential 25.3% 52 week H/L (Rs.) 164.7 / 107.2 Face value (Rs.) 10 Category Large Cap Sector Electric Utilities Shareholding Pattern as on 30th Sept. 2015 Particulars Sept-15 Jun-15 Mar-15 Sep-14 Promoters 75.0% 75.0% 75.0% 75.0% FIIs 9.2% 10.0% 10.3% 10.4% DIIs 13.5% 12.7% 12.3% 12.1% Non institutions 2.3% 2.3% 2.4% 2.5% Q2 FY16 Result Update Financial Snapshot (Rs. bn) Projections FY12 FY13 FY14 FY15 FY16E FY17E Revenue 621 657 720 732 730 854 EBITDA 140 171 178 161 176 213 Adjusted PAT 92 109 110 103 91 116 EBITDA (%) 22.6% 26.0% 24.7% 22.0% 24.1% 25.0% PAT (%) 14.9% 16.6% 15.2% 14.0% 12.5% 13.6% EPS 11 13 13 12 11 14 BVPS 89 97 104 99 108 118 RONW (%) 13.1% 14.2% 13.2% 12.3% 10.7% 12.5% P/E 12.3 9.6 P / BVPS 1.3 1.1 Source: Choice Broking Research, Company 75 80 85 90 95 100 105 110 115 07-Nov-14 07-Dec-14 07-Jan-15 07-Feb-15 07-Mar-15 07-Apr-15 07-May-15 07-Jun-15 07-Jul-15 07-Aug-15 07-Sep-15 07-Oct-15 NTPC Ltd. Sensex Particular (Rs. mn) Q2 FY16 Q1 FY16 Q2 FY15 Q-o-Q (%) Y-o-Y (%) Total Operating Revenue 178,985.1 170,845.8 167,366.3 4.8% 6.9% EBITDA 40,306.5 34,376.7 32,423.3 17.2% 24.3% Reported PAT 28,982.8 21,353.5 20,716.3 35.7% 39.9% EBITDA Margin (%) 22.5% 20.1% 19.4% 240 bps 315 bps PAT Margin (%) 16.2% 12.5% 12.4% 369 bps 382 bps

- 2. BUY 2 Q2 FY16 Quarter Performance: Source: Choice Broking Research, Company Q2 FY16 Segmental Details: Source: Choice Broking Research, Company NTPC Ltd. Electric Utilities Nov. 07, 2015 Q2 FY16 Result Update Particulars (Rs. mn) Q2 FY16 Q1 FY16 Q2 FY15 Q-o-Q (%) Y-o-Y (%) Total Operating Income 178,985.1 170,845.8 167,366.3 4.8% 6.9% Total Operating Expenditure (138,678.6) (136,469.1) (134,943.0) 1.6% 2.8% EBITDA 40,306.5 34,376.7 32,423.3 17.2% 24.3% Depreciation (13,229.1) (12,379.5) (11,515.8) 6.9% 14.9% EBIT 27,077.4 21,997.2 20,907.5 23.1% 29.5% Interest Expenses (8,145.3) (7,308.8) (6,674.1) 11.4% 22.0% Other Income 2,753.9 2,387.2 5,306.9 15.4% -48.1% Profit Before Tax (PBT) 21,686.0 17,075.6 19,540.3 27.0% 11.0% Tax Expenses 7,296.8 4,277.9 1,176.0 70.6% 520.5% Adjusted PAT 28,982.8 21,353.5 20,716.3 35.7% 39.9% Basic EPS (Rs.) 3.5 2.6 2.5 35.5% 39.8% Diluted EPS (Rs.) 3.5 2.6 2.5 35.5% 39.8% EBITDA Margin (%) 22.5% 20.1% 19.4% 240 bps 315 bps Reported PAT Margin (%) 16.2% 12.5% 12.4% 369 bps 382 bps Q2 FY16 Q1 FY16 Q2 FY15 Q-o-Q (%) Y-o-Y (%) Segmental Revenue (Rs. mn) Generation 179,502.8 171,173.1 167,828.7 4.9% 7.0% Others 270.1 237.1 228.6 13.9% 18.2% Total Revenue 179,772.9 171,410.2 168,057.3 4.9% 7.0% Segmental EBIT Break-up (Rs. mn) Generation 31,093.0 25,249.6 24,240.5 23.1% 28.3% Others (270.2) (20.7) 36.7 1205.3% -836.2% Total EBIT 30,822.8 25,228.9 24,277.2 22.2% 27.0%

- 3. BUY 3 Q1 FY16 Other Operating Parameters: Source: Choice Broking Research, Company NTPC Ltd. Electric Utilities Nov. 07, 2015 Q2 FY16 Result Update Other Operating Parameters Particular (Rs. mn) Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Q-o-Q (%) Y-o-Y (%) Group Installed Capacity (MW) 43,128 43,143 44,398 45,048 45,548 1.1% 5.6% NTPC Commercial Capacity (MW) 36,467 37,142 37,142 37,142 37,942 2.2% 4.0% Group Commercial Capacity (MW) 41,968 42,643 43,143 43,143 43,943 1.9% 4.7% NTPC Coal PLF (%) 73.2% 80.8% 82.7% 77.6% 77.3% (31) bps 407 bps NTPC Gas PLF (%) 33.4% 31.8% 26.7% 28.5% 25.7% (274) bps (765) bps NTPC Coal PAF (%) 76.8% 91.0% 97.2% 91.6% 88.1% (352) bps 1,130 bps NTPC Gas PAF (%) 89.1% 93.2% 96.5% 96.6% 97.6% 100 bps 851 bps Gross Generation (mn Units) 55,421 61,310 61,313 58,696 60,159 2.5% 8.5% Commercial Generation (mn Units) 55,252 61,139 61,313 58,482 59,847 2.3% 8.3% Energy Sent Out (mn Units) 51,465 57,216 57,385 54,475 55,891 2.6% 8.6% Domestic Coal Supply (mn tonnes) 33.92 39.61 41.06 38.39 34.62 -9.8% 2.1% Imported Coal Supply (mn tonnes) 2.88 4.93 4.89 3.86 2.56 -33.7% -11.1% Total Coal Consumption (mn tonnes) 36.80 44.54 45.95 42.25 37.18 -12.0% 1.0% Gas Consumption (mmscmd) 6.68 6.12 5.62 5.88 5.13 -12.8% -23.2% Average Tariff (Rs. per Unit) 3.32 3.26 3.34 3.26 3.29 0.9% -0.9% Average Fuel Cost (Rs. Per unit) 2.22 2.12 2.18 2.11 2.06 -2.3% -7.1% Regulated Equity (Rs. mn) 352,075 366,177 369,163 369,000 389,120 5.5% 10.5% Conference Call Highlights: • During the quarter, NTPC commercialized 800MW of its hydro power generation capacity and operated it at 83.3% PLF level. Moreover, in Oct. 2015, the company commercialized 500MW generation capacity at Vindhyachal Super Thermal Power Station. This thermal power plant is entitled to earn additional return on equity of 0.5% (i.e. 16%), as it was synchronized and commissioned well before the commercial date of operations. • In Sept. 2015, the company appointed M/s. Thriveni- Sainik JV as mine developer cum operator for Pakri Barwadih Coal Mining Project for a period of 27 years. Peak annual production from the mine is likely to be 15mn tonnes. Commercial mining operations is expected to start in current fiscal. • Adjusted profit for the quarter increased by 24.2% Y-o-Y to Rs. 22,165.2mn as against Rs. 17844mn in Q2 FY15. • Regulated equity during the quarter stood at Rs. 3,89,120mn. NTPC has raised the standalone capex guidance for FY16 from Rs. 230bn to Rs. 250bn.

- 4. 4 Financial Statement Source: Choice Broking Research Source: Choice Broking Research BUYNTPC Ltd. Electric Utilities Profit and Loss Statement Projections (Rs. mn) FY12 FY13 FY14 FY15 FY16E FY17E Total Operating Income 620,522 656,916 720,193 732,461 729,972 853,692 Revenue Growth Rate (%) 9.0% 5.9% 9.6% 1.7% -0.3% 16.9% Total Expenditure (480,124) (485,947) (542,275) (571,605) (554,122) (640,249) EBITDA 140,399 170,969 177,918 160,856 175,851 213,442 EBITDA Growth Rate (%) 2.9% 21.8% 4.1% -9.6% 9.3% 21.4% EBITDA Margin (%) 22.6% 26.0% 24.7% 22.0% 24.1% 25.0% Depreciation (27,917) (33,968) (41,422) (49,117) (54,417) (61,787) EBIT 112,482 137,001 136,496 111,740 121,434 151,656 Interest (17,116) (19,244) (24,066) (27,436) (29,432) (32,547) Other Income 27,897 31,188 26,620 21,163 19,809 20,360 Exceptional Item 0 16,841 0 0 0 0 PBT 123,262 165,786 139,050 105,467 111,811 139,469 Income Tax Expenses (31,024) (39,592) (29,299) (2,558) (20,794) (23,061) PAT 92,237 126,194 109,751 102,909 91,018 116,408 PAT Growth Rate (%) 1.3% 18.6% 0.4% -6.2% -11.6% 27.9% PAT Margin (%) 14.9% 16.6% 15.2% 14.0% 12.5% 13.6% Balance Sheet Projections (Rs. mn) FY12 FY13 FY14 FY15 FY16E FY17E Share Capital 82,455 82,455 82,455 82,455 82,455 82,455 Reserves And Surplus 650,457 721,421 775,699 734,119 804,203 893,837 Deferred Revenue 14,301 12,441 16,099 13,942 13,942 13,942 Long-Term Borrowings 459,083 532,537 624,058 785,323 820,470 869,711 Deferred Tax Liabilities (Net) 6,369 9,153 10,516 9,791 8,163 9,547 Other Long-Term Liabilities 17,291 19,698 25,125 28,866 28,866 28,866 Long-Term Provisions 6,037 7,399 8,794 11,157 8,512 9,955 Short-Term Borrowings 0 0 0 0 141,772 165,800 Trade Payables 44,607 51,324 64,296 59,532 37,747 44,385 Other Current Liabilities 95,372 104,693 115,476 168,076 122,522 143,287 Short-Term Provisions 32,337 70,045 73,026 77,588 76,392 89,340 Total Liabilities 1,408,307 1,611,165 1,795,542 1,970,847 2,145,042 2,351,124 Tangilble Assets 450,445 626,874 718,659 742,393 993,055 1,222,216 Intangible Assets 2,119 2,487 2,450 46,097 0 0 CWIP 418,278 371,094 448,867 564,935 488,447 410,844 Intangible Assets Under Development 0 0 19 0 0 0 Non-Current Investments 95,839 91,376 81,209 71,541 71,541 71,541 Long Term Loans And Advances 53,944 96,334 127,773 155,279 155,279 155,279 Other Non Current Assets 13,719 14,912 17,868 16,968 16,968 16,968 Current Investments 16,225 16,225 16,370 18,781 18,781 18,781 Inventories 37,029 40,572 53,734 74,530 69,997 77,183 Trade Receivables 58,325 53,650 52,201 76,044 77,997 86,539 Cash And Bank Balances 161,418 168,677 153,114 128,788 141,772 165,800 Short-Term Loans And Advances 15,433 17,456 31,160 24,076 24,076 24,076 Other Current Assets 85,534 111,508 92,120 51,416 87,131 101,898 Total Assets 1,408,307 1,611,165 1,795,542 1,970,847 2,145,042 2,351,124 Nov. 07, 2015 Q2 FY16 Result Update

- 5. 5 Financial Statement (Contd…) Source: Choice Broking Research Source: Choice Broking Research BUYNTPC Ltd. Electric Utilities Cash Flow Statement Projections (Rs. mn) FY12 FY13 FY14 FY15 FY16E FY17E Profit Before Tax 123,262 165,786 139,050 105,467 111,811 139,469 Depreciation and Amortization 27,917 33,968 41,422 49,117 54,417 61,787 Other Adjustments (11,286) (9,875) 5,335 14,629 12,869 15,937 Change in Working Capital (22,071) (5,971) (2,919) (7,665) (105,942) 12,683 Income Tax Paid (10,723) (28,956) (25,563) (19,199) (20,794) (23,061) Cash Flow from Operating Activities 107,099 154,952 157,325 142,347 52,362 206,815 CAPEX (107,944) (162,967) (167,397) (171,283) (182,493) (213,423) Change in Investments 18,039 16,225 16,225 16,370 0 0 Others 11,100 6,573 11,375 9,287 16,563 16,563 Cash Flow from Investing Activities (78,805) (140,169) (139,797) (145,626) (165,930) (196,860) Net Change in Borrowings 52,135 72,624 73,732 186,092 176,918 73,270 Interest Expenses (38,851) (38,315) (47,414) (55,863) (29,432) (32,547) Dividend & Dividend Tax (41,146) (40,688) (57,881) (147,968) (20,934) (26,774) Others (829) (1,146) (1,527) (1,042) 0 124 Cash Flow from Financing Activities (28,691) (7,524) (33,090) (18,781) 126,552 14,073 Net Cash Inflow / Outflow (398) 7,259 (15,562) (22,060) 12,984 24,028 Opening Cash & Cash Equivalents 161,853 161,418 168,677 153,114 128,788 141,772 Closing Cash & Cash Equivalent 161,455 168,677 153,115 131,054 141,772 165,800 Financial Ratios Particulars FY12 FY13 FY14 FY15 FY16E FY17E Profitability & Return Ratios EBITDA Margin (%) 22.6% 26.0% 24.7% 22.0% 24.1% 25.0% PAT Margin (%) 14.9% 16.6% 15.2% 14.0% 12.5% 13.6% RONW (%) 13.1% 14.2% 13.2% 12.3% 10.7% 12.5% RoCE (%) 9.6% 10.5% 9.3% 7.0% 6.8% 7.6% Working Capital & Liquidity Ratios Payables (Days) 26.6 29.1 32.8 29.9 29.1 29.5 Inventory (Days) 22.1 23.0 27.4 37.5 35.0 33.0 Receivables (Days) 34.8 30.4 26.6 38.2 39.0 37.0 Current Ratio (X) 2.1 1.7 1.5 1.2 1.7 1.6 Turnover & Leverage Ratios Fixed Asset Turnover (X) 0.8 0.7 0.7 0.6 0.5 0.5 Total Asset Turnover (X) 0.5 0.4 0.4 0.4 0.4 0.4 Debt Equity Ratio (X) 0.6 0.7 0.7 1 1.1 1.1 Dividend Pay Out Ratio 38.4% 32.0% 45.1% 120.2% 20.0% 20.0% DuPont Analysis 13.1% 16.4% 13.2% 12.3% 10.7% 12.5% Tax Burden (PAT / PBT) 0.7 0.8 0.8 1.0 0.8 0.8 Interest Burden (PBT / PBIT) 1.1 1.2 1.0 0.9 0.9 0.9 EBIT Margin 18.1% 20.9% 19.0% 15.3 16.6% 17.8% Total Asset Turnover Ratio (Net Sales / Total Asset) 0.5 0.4 0.4 0.4 0.4 0.4 Leverage Ratio (Total Asset / Total Equity) 1.9 2.0 2.0 2.2 2.4 2.4 Valuation Ratios DPS (Rs.) 4.3 4.2 6.0 15.0 2.2 2.8 BVPS (Rs.) 88.9 97.5 104.1 99.0 107.5 118.4 EPS (Rs. Cr) 11.2 13.3 13.3 12.5 11.0 14.1 P / E (X) 12.1 10.2 10.2 10.8 12.3 9.6 P / BVPS (X) 1.5 1.4 1.3 1.4 1.3 1.1 Nov. 07, 2015 Q2 FY16 Result Update

- 6. e 6 Disclaimer This is solely for information of clients of Choice Broking and does not construe to be an investment advice. It is also not intended as an offer or solicitation for the purchase and sale of any financial instruments. Any action taken by you on the basis of the information contained herein is your responsibility alone and Choice Broking its subsidiaries or its employees or associates will not be liable in any manner for the consequences of such action taken by you. We have exercised due diligence in checking the correctness and authenticity of the information contained in this recommendation, but Choice Broking or any of its subsidiaries or associates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this recommendation or any action taken on basis of this information. This report is based on the fundamental analysis with a view to forecast future price. The Research analysts for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Choice Broking has based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Choice Broking makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. The opinions contained within the report are based upon publicly available information at the time of publication and are subject to change without notice. The information and any disclosures provided herein are in summary form and have been prepared for informational purposes. The recommendations and suggested price levels are intended purely for stock market investment purposes. The recommendations are valid for the day of the report and will remain valid till the target period. The information and any disclosures provided herein may be considered confidential. Any use, distribution, modification, copying, forwarding or disclosure by any person is strictly prohibited. The information and any disclosures provided herein do not constitute a solicitation or offer to purchase or sell any security or other financial product or instrument. The current performance may be unaudited. Past performance does not guarantee future returns. There can be no assurance that investments will achieve any targeted rates of return, and there is no guarantee against the loss of your entire investment. POTENTIAL CONFLICT OF INTEREST DISCLOSURE (as on date of report) Disclosure of interest statement – • Analyst interest of the stock /Instrument(s): - No. • Firm interest of the stock / Instrument (s): - No. Choice’s Rating Rationale The price target for a large cap stock represents the value the analyst expects the stock to reach over next 12 months. For a stock to be classified as Outperform, the expected return must exceed the local risk free return by at least 5% over the next 12 months. For a stock to be classified as Underperform, the stock return must be below the local risk free return by at least 5% over the next 12 months. Stocks between these bands are classified as Neutral. Choice Equity Broking Pvt. Ltd. Choice House, Shree Shakambhari Corporate Park, Plt No: -156-158, J.B. Nagar, Andheri (East), Mumbai - 400 099. +91-022-6707 9999 +91-022-6707 9959 www.choiceindia.com Q2 FY16 Result Update Rating Legend Rating Upside BUY Absolute Return >15% Accumulate Absolute Return Between 10-15% Hold Absolute Return Between 0-10% Reduce Absolute Return 0 To Negative 10% Sell Absolute Return > Negative 10% Institutional Equity Team Name Designation Email id Contact No. Ajay Kejriwal President ajay@choiceindia.com 022- 6707 9850 Sumeet Bagadia Head of Research sumeet.bagadia@choiceindia.com 022 - 6707 9830 Amit Singh VP - Institutional Sales amit.singh@choiceindia.com 022 - 6707 9852 Devendra Gaikwad Sr. Manager - Institutional Sales devendra.gaikwad@choiceindia.com 022 - 6707 9877 Rajnath Yadav Research Analyst rajnath.yadav@choiceindia.com 022 - 6707 9975 Satish Kumar Research Analyst satish.kumar@choiceindia.com 022 - 6707 9974 Kunal Parmar Research Associate kunal.parmar@choiceindia.com 022 - 6707 9982 Amit Pathania Research Associate amit.pathania@choiceindia.com 022 - 6707 9979 Vikas Chaudhari Research Associate vikas.chaudhari@choiceindia.com 022 - 6707 9988 Trirashmi Ghoderao Research Advisor trirashmi.ghoderao@choiceindia.com 022 - 6707 9972 Neeraj Yadav Research Advisor Neeraj.yadav@choiceindia.com 022 - 6707 9988 NTPC Ltd. Date Recommendation CMP (Rs.) Target Price (Rs.) 07-Nov-2015 BUY 135 169 01-Aug-2015 BUY 135 169 23-Jul-2015 BUY 137 169