Coal India Q1FY15: Revenues stable on steady volumes and healthy realizations, buy - HDFC Sec

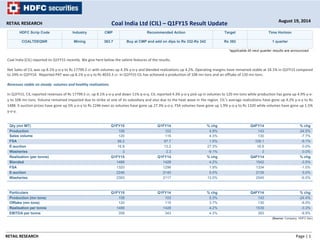

- 1. RETAIL RESEARCH Page | 1 HDFC Scrip Code Industry CMP Recommended Action Target Time Horizon COALTDEQNR Mining 363.7 Buy at CMP and add on dips to Rs 332-Rs 342 Rs 392 1 quarter *applicable till next quarter results are announced Coal India (CIL) reported its Q1FY15 recently. We give here below the salient features of the results. Net Sales of CIL was up 8.1% y‐o‐y to Rs 17799.5 cr with volumes up 4.3% y‐o‐y and blended realizations up 4.2%. Operating margins have remained stable at 24.1% in Q1FY15 compared to 24% in Q1FY14. Reported PAT was up 8.1% y‐o‐y to Rs 4033.3 cr. In Q1FY15 CIL has achieved a production of 108 mn tons and an offtake of 120 mn tons. Revenues stable on steady volumes and healthy realizations In Q1FY15, CIL reported revenues of Rs 17799.5 cr, up 8.1% y‐o‐y and down 11% q‐o‐q. CIL reported 4.3% y‐o‐y pick up in volumes to 120 mn tons while production has gone up 4.9% y‐o‐ y to 108 mn tons. Volume remained impacted due to strike at one of its subsidiary and also due to the heat wave in the region. CIL’s average realizations have gone up 4.2% y‐o‐y to Rs 1488. E‐auction prices have gone up 5% y‐o‐y to Rs 2246 even as volumes have gone up 27.3% y‐o‐y. FSA volumes have gone up 1.9% y‐o‐y to Rs 1320 while volumes have gone up 1.5% y‐o‐y. Qty (mn MT) Q1FY15 Q1FY14 % chg Q4FY14 % chg Production 108 103 4.9% 143 -24.5% Sales volume 120 115 4.3% 130 -7.7% FSA 99.2 97.7 1.5% 109.1 -9.1% E-auction 16.8 13.2 27.3% 16.8 0.0% Washeries 3 3.3 -9.1% 3 0.0% Realisation (per tonne) Q1FY15 Q1FY14 % chg Q4FY14 % chg Blended 1488 1428 4.2% 1542 -3.5% FSA 1320 1296 1.9% 1334 -1.0% E-auction 2246 2140 5.0% 2139 5.0% Washeries 2393 2117 13.0% 2545 -6.0% Particulars Q1FY15 Q1FY14 % chg Q4FY14 % chg Production (mn tons) 108 103 5.3% 143 -24.4% Offtake (mn tons) 120 115 3.7% 130 -8.0% Realisation per tonne 1488 1428 4.2% 1539 -3.3% EBITDA per tonne 358 343 4.3% 393 -8.9% (Source: Company, HDFC Sec) RETAIL RESEARCH August 19, 2014 Coal India Ltd (CIL) – Q1FY15 Result Update

- 2. RETAIL RESEARCH Page | 2 OPMs steady at 24.1% OPMs of the company stood at 24.1% compared to 24% in Q1FY14 but down from 25.5%. Operating Profits were higher by 8.2% y‐o‐y to Rs 4281 cr. The outperformance was impacted by provisioning of Rs 427.6 cr related to dues from NTPC. In Q4FY14 on settlement with NTPC, CIL has made a provision/woff of Rs 876.5 cr during the quarter. Contractual expenses as a percentage cost to sales stood at 10.1% compared to 9% in Q1FY14. EBIDTA/ton for the quarter stood at Rs358/ton. Costs as a % of sales Q1FY15 Q1FY14 Q4FY14 Material consumed 11.9% 10.6% 6.8% Employee exp 39.6% 41.4% 35.0% Power & Fuel 3.1% 3.2% 2.9% Welfare expenses 0.5% 1.0% 1.2% Repairs 1.1% 1.0% 1.9% Contractual exp 10.1% 9.0% 10.7% Other exp 3.4% 4.1% 3.8% Prov/write off 0.0% 0.0% 0.0% Overburden Removal Adj (OBR) 2.4% 2.1% 4.6% (Source: Company, HDFC Sec) Interest costs have come down from Rs 7.4 cr to Rs 1.1 cr y‐o‐y. Other income has come down 1.8% y‐o‐y to Rs 2180.5 cr. Depreciation costs are up 9% y‐o‐y to Rs 518.3 cr. PBT has gone up 4.7% y‐o‐y to Rs 5957.8 cr. PAT is up 8.1% y‐o‐y to Rs 4033.3 cr. Other Developments / Takeaways • CIL has said it will formally oppose the proposed 25MT cap on e‐auction volumes within the next two weeks. The main reason for this move is strong opposition from non‐power consumers, mainly small/medium sized players, which are currently availing coal through this route, as imported coal is not a viable option for them. The board feels this will lead to lower production as storage is not possible beyond a limit Concerns • Impact of Naxalite movement & Illegal mining • Stringent environment norms & Land acquisition issues • Infrastructure bottlenecks & Wagon availability leading to high inventory • Quality of Coal and disputes with buyers on that count • Government intervention & stringent labour regulation • Profit Sharing and other amendments under proposed New Mining Policy • High Wage Hike • Recovery of Dues from power companies and utilities could pose concerns • Competition from private sector • Penalty structure for failure to supply coal could impact profits in case of shortfall • Restricted ability to raise prices • Increase in costs without immediate increase in prices • Pullback of FSA prices.

- 3. RETAIL RESEARCH Page | 3 • Lower‐than‐expected production growth due to delays in environmental clearance, • Diversion of e‐auction coal to the power sector with a regulated price increase could have a negative impact on earnings. Conclusion CIL is the largest coal producing company in the world with raw coal production of 462 mn tones in FY14. It also has the largest reserves of coal of around 65bn tonnes of which 22bn tonnes are extractable reserves. CIL’s coal production accounts for 80%+ of the total coal produced in India. Coal consumption in India is expected to remain strong and a surge in power generation capacities would continue the trend in the coming years. Despite its massive production capacity, it may still be unable to meet up the domestic demand, which may result in high imports. Net Sales of CIL was up 8.1% y‐o‐y to Rs 17799.5 cr with volumes up 4.3% y‐o‐y and blended realizations up 4.2%. Operating margins have remained stable at 24.1% in Q1FY15 compared to 24% in Q1FY14. Reported PAT was up 8.1% y‐o‐y to Rs 4033.3 cr. In Q1FY15 CIL has achieved a production of 108 mn tons and an offtake of 120 mn tons. We are maintaining our FY15 estimates and introducing FY16 estimates. The overhang of Government’s Follow on Public Offer (FPO), the Presidential directive to sign FSAs with power producers and lower market linked prices have resulted in Coal India underperforming the indices over the last one year. With the special interim dividend from the company, the overhang of the FPO has vanished. Realisations under e‐auction sales and washed coal sales are near their bottom, and any increase in global coal prices would lead to higher realisations for CIL. Earnings are expected to improve FY15 onwards on the back of higher volumes, marginal increase in e‐auction prices and price hikes taken by the company during the year. High dividend yield on a large liquid profit making company is a safety margin for the stock. While the government has directed CIL to reduce E‐Auction proportion from 10% to 7%, unavailability of evacuation facilities to power plants has been the key reason for an actual increase in proportion of E‐Auction in FY14 as company resorted to E‐Auction sales for coal where evacuation facilities were a bottleneck. The bid to cap e‐auction sales at 25 mn tons and make the same available for power plants continues to pose a risk to earnings of CIL. E‐auction contributed ~18% of overall sales in FY14. CIL would be a major beneficiary of the new Government’s focus on fuel security. The paucity of supplies for the power sector will likely make ramp‐up of domestic volumes a priority area for the new government. CIL’s volume trajectory has been tepid over the past five years (3% CAGR) with the exception of FY13 that witnessed a 7% growth in volumes. The Government is strongly ensuring a smooth Centre‐State administrative coordination to facilitate time‐bound project clearances (environment/forest clearances). It is also planning to setup key rail projects (particularly the trunk rail lines in Chhattisgarh, Jharkhand and Odisha) for transportation of coal. CIL has managed to get 16 out of the total 20 projects pending with the Ministry of Environment and Forests for environment clearance as on December 30, 2013. The capacity addition would add 160mn tons to the company’s annual capacity. The above would boost volume‐led earnings growth prospects and bolster a longer term investment case in CIL. In our Q4FY14 results update dated June 04, 2014 we recommended investors to buy the stock on dips to Rs 344 – Rs 353 (13.5x ‐14x FY15E core EPS + cash per share of Rs 110) and (5.5x‐5.7x FY15E EV/EBITDA) for a target price of Rs 405 (17x FY15E core EPS + cash per share of Rs 110) & (~6.9x FY15 EV/EBITDA) in the next 1 quarter. Post the update; the stock touched a high of Rs 423.7 on 11th June 2014 and a low of Rs 347.1 on 13th August 2014. We feel investors could look to buy the stock at CMP and add on dips to Rs 332 – Rs 342 (10.5x ‐11x FY16E core EPS + cash per share of Rs 123) and (4.3x‐4.5x FY16E EV/EBITDA) for a target price of Rs 392 (13.5x FY16E core EPS + cash per share of Rs 123) & (5.5x FY16 EV/EBITDA) in the next 1 quarter. Financials Particulars (Rs in cr) FY10 FY11 FY12 FY13 FY14 FY15E FY16E Net Sales 44615.3 50233.6 62415.4 68302.7 68810.0 74766.3 81495.3 Core EBITDA 10516.5 13409.1 15667.8 18083.6 15963.2 17517.7 19909.3 EBITDA (%) 23.60% 26.70% 25.1% 26.5% 23.2% 23.4% 24.4% Profit after Tax 9603 10867 14788 17356.3 15112 17453 20646

- 4. RETAIL RESEARCH Page | 4 PATM (%) 21.50% 21.60% 23.7% 25.4% 22.0% 23.3% 25.3% EPS 15.2 17.2 23.4 27.48 23.9 27.6 32.7 EV/ EBITDA 12.6 9.4 6.6 5.4 7.0 5.2 4.9 Cash per share 61.9 72.6 92.1 98.5 83 110 123 Core EPS 9.9 12.1 15.1 17.9 14.5 17.3 20.0 Equity capital 6316.4 6316.4 6316.4 6316.4 6316.4 6316.4 6316.4 (E: Estimates, RE = Revised Estimates, A=Actuals Source: Company, HDFC Sec) Financials : Consolidated (Rs cr) Q1FY15 Q1FY14 % chg Q4FY14 % chg Net Sales 17799.5 16472.4 8.1% 19998.0 -11.0% Total Expenditure 13518.6 12514.5 8.0% 14890.4 -9.2% Material consumed 1570.7 1376.8 14.1% 2210.5 -28.9% Inc/Dec in Stock 556.1 374.9 48.4% -849.3 -165.5% Employee exp 7046.6 6812.8 3.4% 7002.7 0.6% Power & Fuel 543.5 522.7 4.0% 572.9 -5.1% Welfare expenses 89.7 159.3 -43.7% 238.9 -62.4% Repairs 193.2 164.9 17.2% 388.4 -50.2% Contractual exp 1798.9 1484.2 21.2% 2148.2 -16.3% Other exp 612.3 675.4 -9.3% 751.4 -18.5% Prov/write off 427.6 346.4 23.4% 917.3 -53.4% Overburden Removal Adj 680.1 597.1 13.9% 1509.4 -54.9% EBIDTA 4281.0 3958.0 8.2% 5107.6 -16.2% Other Income 2180.5 2219.6 -1.8% 2384.4 -8.5% Interest 1.1 7.4 -84.7% 33.0 -96.5% PBDT 6460.4 6170.1 4.7% 7459.0 -13.4% Depreciation 518.3 475.7 9.0% 584.1 -11.3% Exceptional Item -15.8 5.0 -413.7% -26.7 -41.0% PBT 5957.8 5689.5 4.7% 6901.6 -13.7% Tax 1924.6 1958.5 -1.7% 2467.4 -22.0% PAT 4033.2 3731.0 8.1% 4434.2 -9.0% Less Minority Interest -0.06 -0.04 NA 0 #DIV/0! Reported PAT 4033.3 3731.0 8.1% 4434.2 -9.0% EPS 6.4 5.9 8.1% 7.0 -9.0% Equity 6316.4 6316.4 6316.4 OPM % 24.1% 24.0% 25.5% NPM % 22.7% 22.7% 22.2%

- 5. RETAIL RESEARCH Page | 5 Analyst: Siji A Philip – Banks, Capital Goods, Power & Midcaps ( email ID: siji.philip@hdfcsec.com) RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients