Indoco ru2 qfy2011-251010

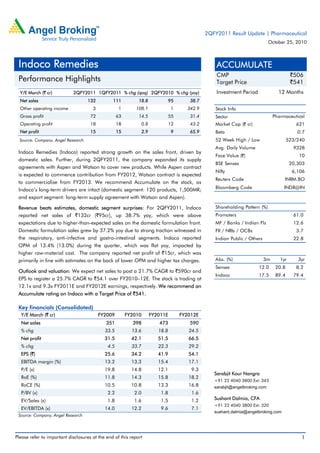

- 1. Please refer to important disclosures at the end of this report 1 Y/E March (` cr) 2QFY2011 1QFY2011 % chg (qoq) 2QFY2010 % chg (yoy) Net sales 132 111 18.8 95 38.7 Other operating income 3 1 108.1 1 342.9 Gross profit 72 63 14.5 55 31.4 Operating profit 18 18 0.8 12 43.2 Net profit 15 15 2.9 9 65.9 Source: Company, Angel Research Indoco Remedies (Indoco) reported strong growth on the sales front, driven by domestic sales. Further, during 2QFY2011, the company expanded its supply agreements with Aspen and Watson to cover new products. While Aspen contract is expected to commence contribution from FY2012, Watson contract is expected to commercialise from FY2013. We recommend Accumulate on the stock, as Indoco’s long-term drivers are intact (domestic segment: 120 products, 1,500MR; and export segment: long-term supply agreement with Watson and Aspen). Revenue beats estimates, domestic segment surprises: For 2QFY2011, Indoco reported net sales of `132cr (`95cr), up 38.7% yoy, which were above expectations due to higher-than-expected sales on the domestic formulation front. Domestic formulation sales grew by 37.2% yoy due to strong traction witnessed in the respiratory, anti-infective and gastro-intestinal segments. Indoco reported OPM of 13.4% (13.0%) during the quarter, which was flat yoy, impacted by higher raw-material cost. The company reported net profit of `15cr, which was primarily in line with estimates on the back of lower OPM and higher tax charges. Outlook and valuation: We expect net sales to post a 21.7% CAGR to `590cr and EPS to register a 25.7% CAGR to `54.1 over FY2010–12E. The stock is trading at 12.1x and 9.3x FY2011E and FY2012E earnings, respectively. We recommend an Accumulate rating on Indoco with a Target Price of `541. Key financials (Consolidated) Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E Net sales 351 398 473 590 % chg 33.5 13.6 18.8 24.5 Net profit 31.5 42.1 51.5 66.5 % chg 4.5 33.7 22.3 29.2 EPS (`) 25.6 34.2 41.9 54.1 EBITDA margin (%) 13.2 13.3 15.4 17.1 P/E (x) 19.8 14.8 12.1 9.3 RoE (%) 11.8 14.3 15.8 18.2 RoCE (%) 10.5 10.8 13.3 16.8 P/BV (x) 2.2 2.0 1.8 1.6 EV/Sales (x) 1.8 1.6 1.5 1.2 EV/EBITDA (x) 14.0 12.2 9.6 7.1 Source: Company, Angel Research ACCUMULATE CMP `506 Target Price `541 Investment Period 12 Months Stock Info Sector Bloomberg Code INDR@IN Shareholding Pattern (%) Promoters 61.0 MF / Banks / Indian Fls 12.6 FII / NRIs / OCBs 3.7 Indian Public / Others 22.8 Abs. (%) 3m 1yr 3yr Sensex 12.0 20.8 8.2 Indoco 17.5 89.4 79.4 Face Value (`) BSE Sensex Nifty Reuters Code Pharmaceutical Avg. Daily Volume Market Cap (` cr) Beta 52 Week High / Low 10 20,303 6,106 INRM.BO 621 0.7 523/240 9328 Sarabjit Kour Nangra +91 22 4040 3800 Ext: 343 sarabjit@angelbroking.com Sushant Dalmia, CFA +91 22 4040 3800 Ext: 320 sushant.dalmia@angelbroking.com Indoco Remedies Performance Highlights 2QFY2011 Result Update | Pharmaceutical October 25, 2010

- 2. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 2 Exhibit 1: 2QFY2011 performance Y/E March (` cr) 2QFY2011 1QFY2011 % chg (qoq) 2QFY2010 % chg (yoy) 1HFY2011 1HFY2010 % chg Net sales 132 111 18.8 95 38.7 244 194 25.8 Other income 3 1 108.1 1 342.9 5 3 0.5 Total income 135 113 20.0 96 248 197 26.2 Gross profit 72 63 14.5 55 31.4 135 113 19.4 Gross margins (%) 54.2 56.3 57.3 55.2 58.2 Operating profit 18 18 0.8 12 43.2 35 31 13.9 OPM (%) 13.4 15.8 13.0 14.5 16.0 Interest 1 1 (18.5) 1 (19.7) 1 2 (25.8) Dep. & amortisation 3 3 4.4 3 15.9 7 6 15.5 PBT 14 14 0.9 9 56.9 32 27 20.0 Provision for taxation 1.7 0.4 335.9 0.3 400.0 2.1 0.7 182.4 Reported net profit 15 15 2.9 9 65.9 30 26 15.4 Less : Exceptional items 0 0 - 0 0 0 PAT after exceptional items 15 15 2.9 9 65.9 30 26 15.4 EPS (`) 12.4 12.1 7.5 24.5 21.2 Source: Company, Angel Research Exhibit 2: 2QFY2011 – Actual v/s Angel estimates ` cr Actual Estimate Variation (%) Net sales 132 113 17.1 Other operating income 3 2 55.0 Operating profit 18 18 0.6 Tax 2 1 240.0 Net profit 15 14 6.6 Source: Company, Angel Research Revenue beats estimates, domestic segment surprises: For 2QFY2011, Indoco reported net sales of `132cr (`95cr), up 38.7% yoy, which were above expectations due to higher-than-expected sales on the domestic formulation front. Domestic formulation sales grew by 37.2% yoy to `88cr (`66cr) on the back of strong traction witnessed in the respiratory, anti-infective and gastro-intestinal segments. The company witnessed strong growth across key brands Cyclopam, Febrex plus and Sensodent-K.

- 3. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 3 Exhibit 3: Domestic formulation sales trend Source: Company, Angel Research On the export front, the company’s sales grew by strong 39.0% yoy to `40cr (`29cr), driven by the semi-regulated formulation and API segments. The semi-regulated formulation segment grew by 140.4% yoy to `8cr (`3cr), driven by African and Latin American markets; while the regulated formulation segment grew by 19.7% yoy to `27cr (`23cr), driven by the UK market. On the API front, sales grew by 69.6% yoy to `5cr (`3cr). Exhibit 4: Export sales trend Source: Company, Angel Research OPM impacted by higher raw-material cost: Indoco reported OPM of 13.4% (13.0%) during the quarter, which was flat yoy, impacted by higher raw-material cost. Gross margin during the quarter contracted by 301bp yoy to 54.2% (57.3%), while employee expenses increased by 28.2% yoy to `19cr (`15cr). 66 67 72 73 88 50 60 70 80 90 100 2QFY2010 3QFY2010 4QFY2010 1QFY2011 2QFY2011 (`cr) 29 27 34 36 40 0 5 10 15 20 25 30 35 40 45 2QFY2010 3QFY2010 4QFY2010 1QFY2011 2QFY2011 `cr

- 4. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 4 Exhibit 5: OPM trend Source: Company, Angel Research Net profit in line with estimates: Indoco reported net profit of `15cr, which was primarily in line with our estimates on the back of lower OPM and higher tax charges. Indoco has stopped availing full MAT credit, as the company would be utilising it in future as 1) contribution from non- tax free zone Goa and Waluj plant starts increasing and 2) the Baddi plant would come out of 100% tax exemption in FY2011 and will be under 30% exemption. Exhibit 6: Net profit trend Source: Company, Angel Research 13.0 12.9 10.1 13.4 13.4 0.0 4.0 8.0 12.0 16.0 2QFY2010 3QFY2010 4QFY2010 1QFY2011 2QFY2011 % 9 8 8 15 15 0 5 10 15 20 2QFY2010 3QFY2010 4QFY2010 1QFY2011 2QFY2011 (`cr)

- 5. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 5 Concall takeaways For FY2011, management reiterated guidance on the domestic formulation business of 20–25% growth, while exports are expected to register 30–35% yoy growth, which would result in composite top-line growth of 21–26%, with OPM in the range of 18–19%. During the quarter, the company extended its supply agreements with Aspen and Watson. The Aspen contract, in addition to ophthalmic products covered earlier, now extends to a number of products to cater to Latin America and African markets. The company expects supply under the contract to begin in FY2012. On the Watson front, the supply agreement has been extended by four more products to 10 products now, having a market size of US $1.5bn. The Watson contract is expected to contribute meaningfully from FY2013. Indoco has invested `48cr in Goa facility and expects trial production to begin from 4QFY2011. Through this facility, the company’s tablet production capacity would increase by 40% to 10bn tablets per annum. Indoco has been able to reduce its domestic debtor days from 82 days in FY2010 to 78 days as of September 2010.

- 6. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 6 Recommendation rationale Domestic formulations back on the growth trajectory: Indoco has a strong brand portfolio of 120 products and a base of 1,500MR. The company operates in various therapeutic segments, including anti-infective, anti-diabetic, CVS, ophthalmic, dental care, pain management and respiratory. Indoco’s prominent brands include Cyclopam, Vepan, Febrex plus, ATM, Sensodent-K and Sensoform. The company’s top 10 brands contribute 60% to domestic sales. Post the restructuring of the domestic business in FY2009, which resulted in an improved working capital cycle, Indoco is back on the growth trajectory with its domestic formulation business outpacing the industry’s growth rate in the last two quarters. Indoco has witnessed strong growth across the respiratory, anti-infective, ophthalmic and alimentary therapeutic segments. Further, management plans to increase its sales force by 200MR in FY2011 to expand its penetration in tier- II/rural markets. Scaling-up on the export front: Indoco has also started focusing on regulated markets by entering into long-term supply contracts. The company is currently executing several contract manufacturing projects covering a number of products for its clients in the UK, Germany and Slovenia. Management plans to incur capex of `95cr (34% of FY2010 GFA) for building formulation facilities in Goa and Waluj funded through debt and internal accruals to cater to higher export demand. Watson and Aspen contracts to provide long-term growth: Indoco has entered into supply agreements for ophthalmic products with Watson (US market) and Aspen Pharma (emerging markets). We expect milestone payments from the contracts to commence from FY2011 on successful regulatory filings and substantial revenue flow from the deal to commence from FY2013. Outlook and valuation: We have revised our estimates for FY2011 and FY2012 to factor in higher growth on the domestic and export (Aspen contract contribution) fronts and higher tax charges. We expect net sales to post a 21.7% CAGR to `590cr and EPS to register a 25.7% CAGR to `54.1 over FY2010–12E. The stock is trading at 12.1x and 9.3x FY2011E and FY2012E earnings, respectively. We recommend an Accumulate rating on Indoco, as the company’s long-term drivers are intact (domestic segment: 120 products, 1,500MR; and export segment: long-term supply agreement with Watson and Aspen), with a Target Price of `541.

- 7. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 7 Exhibit 7: Key assumptions Earlier estimates Revised estimates FY2011E FY2012E FY2011E FY2012E Domestic sales growth (%) 14.5 12.9 19.5 18.5 Export sales growth (%) 25.3 29.4 29.6 38.3 Growth in employee expenses (%) 12.9 13.8 17.4 15.6 Operating margins (%) 15.4 16.6 15.4 17.1 Capex (` cr) 80.0 50.0 80.0 59.0 Source: Company, Angel Research Exhibit 8: Change in estimates Particulars (` cr) FY2011 FY2012 Earlier estimates Revised estimates % chg Earlier estimates Revised estimates % chg Sales 455 473 4.0 543 590 8.6 Operating profit 70 73 4.1 89 101 13.5 Prov. for tax 5 6 28.8 3 16 423.6 Net profit 49 51 5.0 67 67 (0.7) Source: Company, Angel Research Exhibit 9: One-year forward PE band Source: Company, Angel Research - 100 200 300 400 500 600 Apr-05 Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 12x 3x 9x 6x (`)

- 8. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 8 Exhibit 10: Recommendation summary Company Reco CMP Tgt Price Upside FY2012E FY10-12E FY2012E (`) (`) % PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE ROE Alembic Neutral 73 - - 11.5 0.9 7.7 46.4 14.8 18.5 Aurobindo Pharma Accumulate 1,208 1,330 10.1 11.1 1.9 9.1 4.7 15.5 24.1 Aventis* Under review 1,830 - - 19.9 2.8 15.4 16.1 18.0 18.9 Cadila Healthcare Neutral 715 - - 18.0 2.9 14.0 26.6 26.0 34.7 Cipla Neutral 353 - - 20.6 4.0 18.7 12.8 16.0 18.9 Dr Reddy's Neutral 1,638 - - 21.0 2.6 13.6 99.8 23.8 25.5 Dishman Pharma Buy 183 279 52.3 8.5 1.6 6.2 21.7 12.5 16.8 GSK Pharma* Under review 2,354 - - 31.9 7.3 20.7 11.0 38.7 28.9 Indoco Remedies Accumulate 506 541 6.9 9.3 1.2 7.1 25.7 16.8 18.2 Ipca labs Neutral 304 - - 13.2 1.9 9.1 18.7 23.3 25.1 Lupin Neutral 455 - - 19.5 3.1 16.1 23.2 23.9 31.2 Orchid Chemicals Neutral 332 - - 19.4 2.2 12.0 - 7.0 13.0 Piramal Healthcare Neutral 495 - - 14.6 2.3 10.8 21.1 25.4 32.7 Ranbaxy* Neutral 612 - - 21.3 2.6 13.4 102.0 18.8 20.2 Sun Pharma Neutral 2,139 - - 25.2 7.0 20.8 14.0 16.4 17.7 Source: Company, Angel Research; * December ending

- 9. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 9 Profit & Loss Statement (Consolidated) Y/E March (`) FY2007 *FY2008 FY2009 FY2010 FY2011E FY2012E Gross sales 344 272 355 402 480 597 Less: Excise duty 18 9 5 4 6 8 Net Sales 326 263 351 398 473 590 Other operating income 1 1 2 5 4 6 Total operating income 326 264 352 403 478 596 % chg 34.1 (19.2) 33.6 14.4 18.5 24.8 Total Expenditure 267 220 304 345 400 489 Net Raw Materials 143 113 150 174 204 252 Other Mfg costs 22 26 38 46 28 35 Personnel 34 32 48 56 66 77 Other 67 49 68 69 101 124 EBITDA 59 43 46 53 73 101 % chg 23.1 (27.6) 8.1 14.9 37.2 38.5 (% of Net Sales) 18.1 16.3 13.2 13.3 15.4 17.1 Depreciation& Amortisation 9 8 11 12 16 18 EBIT 50 35 35 41 57 83 % chg (63.2) (30.1) 0.3 16.9 39.3 44.6 (% of Net Sales) 15.4 13.3 10.0 10.3 12.1 14.0 Interest & other Charges 5 4 6 3 6 9 Other Income 2 2 2 0 2 2 (% of PBT) 4.6 4.4 7.0 0.4 3.5 2.4 Recurring PBT 48 34 33 43 58 82 % chg 235.0 (29.3) (2.1) 29.9 34.3 42.0 Extraordinary Expense/(Inc.) 1.6 1.8 - - - - PBT (reported) 46 32 33 43 58 82 Tax 5 2 2 1 6 16 (% of PBT) 9.9 6.1 5.1 2.4 11.1 19.1 PAT (reported) 42 30 31 42 51 67 PAT after MI (reported) 42 30 31 42 51 67 ADJ. PAT 43 32 31 42 51 67 % chg 28.5 (26.3) (1.4) 33.7 22.3 29.2 (% of Net Sales) 12.8 11.5 9.0 10.6 10.9 11.3 Basic EPS (`) 35.6 24.5 25.6 34.2 41.9 54.1 Fully Diluted EPS (`) 35.6 24.5 25.6 34.2 41.9 54.1 % chg 29.3 (31.1) 4.4 33.8 22.3 29.2

- 10. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 10 Balance Sheet (Consolidated) Y/E March (`) FY2007 *FY2008 FY2009 FY2010 FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 12 12 12 12 12 12 Reserves& Surplus 221 242 266 298 329 379 Shareholders’ Funds 233 254 278 310 341 392 Total Loans 36 34 56 66 86 101 Deferred Tax Liability 21 22 23 24 30 33 Total Liabilities 289 310 357 400 456 525 APPLICATION OF FUNDS Gross Block 207 219 234 268 353 412 Less: Acc. Depreciation 40 47 58 70 86 104 Net Block 167 172 176 197 267 307 Capital Work-in-Progress 2 2 16 31 26 26 Investments 0.0 0.0 0.0 0.2 0.2 0.2 Current Assets 178 199 223 251 247 307 Cash 15 16 29 38 10 9 Loans & Advances 21 31 42 53 57 71 Other 142 152 153 160 180 227 Current liabilities 58 63 59 78 83 114 Net Current Assets 120 137 165 172 164 192 Mis. Exp. not written off 1 0 0 0 0 0 Total Assets 289 310 357 400 456 525 Cash Flow Statement (Consolidated) Y/E March (`) FY2007 *FY2008 FY2009 FY2010 FY2011E FY2012E Profit before tax 48 34 33 43 58 82 Depreciation 9 8 11 12 16 18 (Inc)/Dec in Working Capital (48) (8) (5) 1 (19) (29) Less: Other income 2 2 2 0 2 2 Direct taxes paid 4 7 5 8 10 12 Cash Flow from Operations 3 26 32 48 42 57 (Inc.)/Dec.in Fixed Assets (15) (15) (30) (48) (80) (59) (Inc.)/Dec. in Investments (2) (0) - - - 0 Other income 2 2 2 0 2 2 Cash Flow from Investing (15) (14) (28) (48) (78) (57) Issue of Equity - - - - - - Inc./(Dec.) in loans 5 (1) 21 13 20 15 Dividend Paid (Incl. Tax) (8) (9) (12) (3) (12) (16) Others 1 (1) (1) (2) - - Cash Flow from Financing (2) (11) 8 8 8 (1) Inc./(Dec.) in Cash (14) 1 13 9 (28) (0) Opening Cash balances 30 15 16 29 38 10 Closing Cash balances 15 16 29 38 10 9

- 11. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 11 Key Ratios Y/E March FY2007 *FY2008 FY2009 FY2010 FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 14.2 20.6 19.8 14.8 12.1 9.3 P/CEPS 11.8 16.4 14.6 11.5 9.2 7.3 P/BV 2.6 2.4 2.2 2.0 1.8 1.6 Dividend yield (%) 1.3 1.0 1.0 1.4 1.7 2.1 EV/Sales 1.9 2.4 1.8 1.6 1.5 1.2 EV/EBITDA 10.5 15.0 14.0 12.2 9.6 7.1 EV / Total Assets 2.1 2.1 1.8 1.6 1.5 1.4 Per Share Data (`) EPS (Basic) 35.6 24.5 25.6 34.2 41.9 54.1 EPS (fully diluted) 35.6 24.5 25.6 34.2 41.9 54.1 Cash EPS 43.0 30.8 34.7 44.1 54.7 69.1 DPS 6.8 5.0 5.1 7.0 8.4 10.8 Book Value 197.1 206.9 226.6 252.7 277.5 318.7 DuPont Analysis EBIT margin 15.4 13.3 10.0 10.3 12.1 14.0 Tax retention ratio 90.1 93.9 94.9 97.6 88.9 80.9 Asset turnover (x) 1.5 0.9 1.1 1.2 1.2 1.2 ROIC (Post-tax) 20.2 11.6 10.7 11.7 12.7 14.0 Cost of Debt (Post Tax) 12.8 9.7 12.4 4.7 6.6 7.6 Leverage (x) 0.6 0.1 0.1 0.1 0.2 0.2 Operating ROE 24.3 11.8 10.6 12.4 13.6 15.5 Returns (%) ROCE (Pre-tax) 20.5 11.7 10.5 10.8 13.3 16.8 Angel ROIC (Pre-tax) 22.7 12.4 11.6 12.7 15.2 18.1 ROE 20.1 13.1 11.8 14.3 15.8 18.2 Turnover ratios (x) Asset Turnover (Gross Block) 1.9 1.2 1.6 1.6 1.5 1.6 Inventory / Sales (days) 41 57 50 55 54 50 Receivables (days) 105 110 108 86 76 75 Payables (days) 50 56 41 39 40 40 WC cycle (ex-cash) (days) 134 156 133 122 110 103 Solvency ratios (x) Net debt to equity 0.1 0.1 0.1 0.1 0.2 0.2 Net debt to EBITDA 0.3 0.4 0.6 0.5 1.0 0.9 Interest Coverage (EBIT / Int.) 9.8 9.7 6.0 14.1 10.2 9.4 Note: *For Nine months ended March 31st 2008

- 12. Indoco Remedies | 2QFY2011 Result Update October 25, 2010 12 Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Indoco Remedies 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors. Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%)