TCS: Status quo, on track for revenue acceleration; maintain neutral - Motilal Oswal

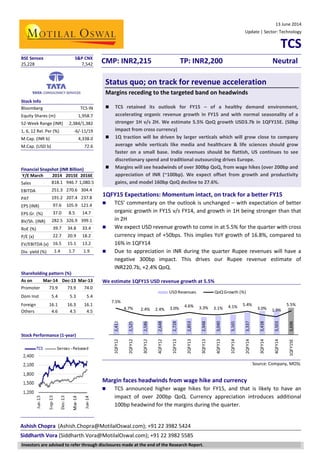

- 1. Ashish Chopra (Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424 Siddharth Vora (Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585 13 June 2014 Update | Sector: Technology TCS CMP: INR2,215 TP: INR2,200 Neutral Status quo; on track for revenue acceleration Margins receding to the targeted band on headwinds TCS retained its outlook for FY15 – of a healthy demand environment, accelerating organic revenue growth in FY15 and with normal seasonality of a stronger 1H v/s 2H. We estimate 5.5% QoQ growth USD3.7b in 1QFY15E. (50bp impact from cross currency) 1Q traction will be driven by larger verticals which will grow close to company average while verticals like media and healthcare & life sciences should grow faster on a small base. India revenues should be flattish, US continues to see discretionary spend and traditional outsourcing drives Europe. Margins will see headwinds of over 300bp QoQ, from wage hikes (over 200bp and appreciation of INR (~100bp). We expect offset from growth and productivity gains, and model 160bp QoQ decline to 27.6%. 1QFY15 Expectations: Momentum intact, on track for a better FY15 TCS’ commentary on the outlook is unchanged – with expectation of better organic growth in FY15 v/s FY14, and growth in 1H being stronger than that in 2H We expect USD revenue growth to come in at 5.5% for the quarter with cross currency impact of +50bps. This implies YoY growth of 16.8%, compared to 16% in 1QFY14 Due to appreciation in INR during the quarter Rupee revenues will have a negative 300bp impact. This drives our Rupee revenue estimate of INR220.7b, +2.4% QoQ. We estimate 1QFY15 USD revenue growth at 5.5% Source: Company, MOSL Margin faces headwinds from wage hike and currency TCS announced higher wage hikes for FY15, and that is likely to have an impact of over 200bp QoQ. Currency appreciation introduces additional 100bp headwind for the margins during the quarter. 2,412 2,525 2,586 2,648 2,728 2,853 2,948 3,040 3,165 3,337 3,438 3,503 3,696 7.5% 4.7% 2.4% 2.4% 3.0% 4.6% 3.3% 3.1% 4.1% 5.4% 3.0% 1.9% 5.5% 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15EUSDRevenues QoQ Growth (%) Investors are advised to refer through disclosures made at the end of the Research Report. BSE Sensex S&P CNX 25,228 7,542 Stock Info Bloomberg TCS IN Equity Shares (m) 1,958.7 52-Week Range (INR) 2,384/1,382 1, 6, 12 Rel. Per (%) -6/-11/19 M.Cap. (INR b) 4,338.0 M.Cap. (USD b) 72.6 Financial Snapshot (INR Billion) Y/E March 2014 2015E 2016E Sales 818.1 946.7 1,080.5 EBITDA 251.3 270.6 304.4 PAT 191.2 207.4 237.8 EPS (INR) 97.6 105.9 121.4 EPS Gr. (%) 37.0 8.5 14.7 BV/Sh. (INR) 282.5 326.9 399.1 RoE (%) 39.7 34.8 33.4 P/E (x) 22.7 20.9 18.2 EV/EBITDA (x) 16.5 15.1 13.2 Div. yield (%) 1.4 1.7 1.9 Shareholding pattern (%) As on Mar-14 Dec-13 Mar-13 Promoter 73.9 73.9 74.0 Dom Inst 5.4 5.3 5.4 Foreign 16.1 16.3 16.1 Others 4.6 4.5 4.5 Stock Performance (1-year)

- 2. TCS 13 June 2014 2 Impact from a high growth rate and contribution from productivity improvement should help partially offset the impact from headwinds, and we expect the decline to be limited to 160bp, implying EBIT margin of 27.6% in 1QFY15. We estimate margins to decline by 160bps to 27.6% Source: Company, MOSL TCS continues to maintain its target band for margins as 26-28% going forward and may tweak the rate of investments going forward in the event of additional headwinds like appreciation of INR. Our PAT estimate for the quarter stands at INR49.5b, down 6.6%, on account of appreciation in INR, lower operating margin, and little impact from forex hedges compared to gains worth INR2b in 4QFY14. Segmental traction Growth will be broad based across verticals with large verticals growing close to company average and smaller verticals like healthcare & life sciences and media are expected to grow above company average. Vertical performance in 4QFY14 Verticals Contr. to overall rev (%) QoQ Gr. (%) Contr. to incr rev (%) 4 Quarter CQGR BFSI 42.9 2.4 53.5 3.2 Mfg 8.6 (0.4) (2.0) 3.9 Telecom 9.3 (1.3) (6.6) 3.6 LS & Healthcare 6.1 5.3 16.7 8.4 Retail & Distr 13.5 (0.3) (2.4) 3.8 Transportation 3.5 1.9 3.5 4.4 Energy and Utilities 3.8 1.9 3.8 3.6 Media & Entmnt 2.6 15.2 18.5 9.3 Hi-Tech 5.3 1.9 5.3 1.7 Others 4.4 4.3 9.7 (0.6) Source: MOSL, Company In terms of geography, revenue momentum in US continues – with greater project based or discretionary demand. Europe is seeing sustained momentum of traditional outsourcing spend picking up. Growth will be driven by developed geographies while India revenues are expected to be flattish during the quarter.

- 3. TCS 13 June 2014 3 Geography performance in 4QFY14 Geographies Contr. to overall rev (%) QoQ Gr. (%) Contr. to incr rev (%) 4 Quarter CQGR North America 52.2 0.9 25.8 3.1 Latin America 2.2 (2.5) (3.1) 1.4 UK 17.8 3.6 33.7 5.1 Continental Europe 12.1 6.3 38.5 10.4 India 6.2 0.3 0.9 (5.1) APAC 7.4 1.9 7.4 4.0 MEA 2.1 (2.7) (3.2) 3.6 Source: MOSL, Company In terms of services, growth continues to be broad-based across the offerings. TCS’ proprietary cloud offering iON remains work in progress, still small in terms of revenue size to impact overall company performance, Change in depreciation policy in line with the revised Companies Act To be in accordance with the Companies Act 2013, TCS effected change in its depreciation policy. The company has taken the opportunity to further rationalize the policies for depreciation – bringing different policies across subsidiary companies under one standard. TCS will be following straight-line depreciation with lower asset life from the previously followed WDV method. This will result in: [1] a one-time impact in Indian GAAP of write back of 4-5% of net Fixed Assets as an exceptional item and [2] one time impact in IFRS of additional charge of ~2% of Fixed Asset added to normal depreciation. We will factor the same into our estimates as clarity on the exact impact of the same emerges in 1QFY 15 financials. Valuation and view Our estimates remain largely unchanged after the management’s latest outlook. Over the past four years, TCS has led the incremental revenues as well as operating profits not just domestically, but also in the global arena (compared to peers multiple times its size); and its market cap is second only to IBM. At 18.8% USD revenue CAGR over FY14-16E, we expect TCS to continue leading the industry growth with excellent execution. At 20.9x FY15E and 18.2x FY16E EPS, we remain Neutral on valuations. We would treat any corrections as an entry opportunity.

- 4. TCS 13 June 2014 4 Story in charts TCS continues to lead industry growth… Source: Company, MOSL …but India headwinds cripple outperformance Source: Company, MOSL Revenue growth finally getting delinked to headcount... Source: Company, MOSL ...as competitive intensity gradually pulls down pricing Source: Company, MOSL Operating at peak efficiency, reflected in utilization... Source: Company, MOSL ...Expect margins to settle lower and EPS to lag rev. growth Source: Company, MOSL

- 5. TCS 13 June 2014 5 Operating Metrics 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 Service Lines (%) ADM 43.4 43.1 42.4 42.4 42.3 41.7 41.4 41.0 Engineering and Industrial Services 4.6 4.6 4.7 4.6 4.7 4.7 4.6 4.8 Infrastructure Services 10.6 11.4 11.7 12.1 11.9 11.8 12.0 12.0 Enterprise Solutions 15.2 14.9 15.1 15.5 15.1 15.4 15.7 15.7 Global Consulting 2.8 3.0 3.2 3.1 3.5 3.3 3.4 3.4 Asset Leverage Solutions 2.8 2.7 2.8 2.5 2.5 2.7 2.3 2.6 Assurance Services 7.6 7.7 7.7 7.8 8.1 8.5 8.5 8.4 BPO 13.0 12.6 12.4 12.0 11.9 11.9 12.1 12.1 Industry Verticals (%) BFSI 43.0 42.8 43.0 43.5 43.0 43.1 42.7 42.9 Manufacturing 7.9 8.2 8.5 8.5 8.4 8.4 8.8 8.6 Telecom 10.3 10.3 9.5 9.3 9.6 9.3 9.6 9.3 Life Sciences & Healthcare 5.3 5.2 5.2 5.1 5.5 5.7 5.9 6.1 Retail & Distribution 13.2 13.4 13.4 13.4 14.0 13.9 13.8 13.5 Transportation 3.7 3.6 3.6 3.4 3.4 3.4 3.5 3.5 Energy and Utilities 3.6 3.6 3.8 3.8 3.7 3.8 3.8 3.8 Media & Entertainment 2.2 2.2 2.1 2.1 2.1 2.2 2.3 2.6 Hi-Tech 6.0 5.9 5.8 5.7 5.5 5.4 5.3 5.3 Others 4.8 4.8 5.1 5.2 4.8 4.8 4.3 4.4 Geographies (%) America 53.5 52.8 52.6 53.2 54.1 53.2 52.7 52.2 UK 17.0 17.1 17.5 16.8 17.0 17.3 17.5 17.8 Rest of Europe 9.6 9.5 9.1 9.4 9.9 11.2 11.6 12.1 Europe 26.6 26.6 26.6 26.2 26.9 28.5 29.1 29.9 India 7.1 7.5 7.6 8.8 7.6 6.9 6.3 6.2 APAC 7.4 7.6 7.5 7.3 6.9 7.1 7.4 7.4 Latin America 3.3 3.4 3.6 2.4 2.4 2.3 2.3 2.2 MEA 2.1 2.1 2.1 2.1 2.1 2.0 2.2 2.1 Others 12.8 13.1 13.2 11.8 11.4 11.4 11.9 11.7 Revenue Mix (%) Offshore 50.5 49.1 49.4 48.3 48.5 48.1 47.8 47.4 Onsite 44.7 45.8 45.6 46.5 46.3 46.5 46.8 47.0 GDC 4.8 5.1 5.0 5.2 5.2 5.4 5.4 5.6 Utilization Excluding Trainees 81.3 81.6 81.7 82.0 82.7 83.4 84.3 83.8 Including Trainees 72.3 72.8 72.1 72.2 72.5 75.0 77.5 77.9 Source: MOSL, Company

- 6. TCS 13 June 2014 6 Operating Metrics 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 QoQ growth (%) Service Lines ADM 0.7 3.8 1.7 3.1 3.9 3.9 2.3 0.9 Engineering and Industrial Services 3.0 4.6 5.6 0.9 6.4 5.4 0.8 6.3 Infrastructure Services 5.0 12.5 6.1 6.7 2.4 4.6 4.8 1.9 Enterprise Solutions 3.0 2.5 4.7 5.9 1.4 7.5 5.0 1.9 Global Consulting 6.8 12.0 10.2 -0.1 17.5 -0.6 6.1 1.9 Asset Leverage Solutions -26.0 0.8 7.2 -7.9 4.1 13.9 -12.2 15.2 Assurance Services 7.3 5.9 3.3 4.5 8.1 10.7 3.0 0.7 BPO 16.5 1.3 1.7 -0.2 3.2 5.4 4.8 1.9 Industry Verticals BFSI 5.0 4.1 3.8 4.3 2.9 5.7 2.1 2.4 Manufacturing 3.0 8.5 7.1 3.1 2.9 5.4 7.9 -0.4 Telecom 6.1 4.6 -4.7 1.0 7.5 2.1 6.4 -1.3 Life Sciences & Healthcare 3.0 2.6 3.3 1.1 12.3 9.3 6.6 5.3 Retail & Distribution 8.8 6.2 3.3 3.1 8.8 4.7 2.3 -0.3 Transportation 3.0 1.7 3.3 -2.6 4.1 5.4 6.1 1.9 Energy and Utilities -2.4 4.6 9.1 3.1 1.4 8.3 3.0 1.9 Media & Entertainment 3.0 4.6 -1.4 3.1 4.1 10.5 7.7 15.2 Hi-Tech 3.0 2.8 1.6 1.3 0.4 3.5 1.1 1.9 Others -22.7 4.6 9.8 5.1 -3.9 5.4 -7.7 4.3 Geographies America 2.8 3.2 2.9 4.3 5.9 3.7 2.1 0.9 UK 15.2 5.2 5.8 -1.0 5.3 7.3 4.2 3.6 Rest of Europe 0.9 3.5 -1.0 6.5 9.6 19.3 6.7 6.3 Europe 9.6 4.6 3.3 1.6 6.9 11.7 5.2 4.7 India -13.9 10.5 4.7 19.4 -10.1 -4.3 -5.9 0.3 APAC -1.0 7.4 2.0 0.4 -1.6 8.5 7.4 1.9 Latin America 9.7 7.7 9.4 -31.2 4.1 1.1 3.0 -2.5 MEA 3.0 4.6 3.3 3.1 4.1 0.4 13.3 -2.7 Others 2.2 7.0 4.1 -7.8 0.6 5.4 7.5 0.2 Offshore 5.0 1.2 3.9 -0.5 5.9 5.4 3.0 1.1 Onsite 3.4 6.7 2.8 3.8 5.0 6.7 4.4 2.4 GDC 11.6 10.6 1.2 5.8 5.5 10.3 3.7 5.8 Overall International business 4.6 4.1 3.2 1.8 5.5 6.3 3.7 2.0 Domestic Business -13.9 10.5 4.6 19.6 -10.1 -4.4 -5.8 0.4 Source: MOSL, Company

- 7. TCS 13 June 2014 7 Financials and valuations Income statement (INR Million) Y/E March 2011 2012 2013 2014 2015E 2016E Sales 373,245 488,938 629,895 818,094 946,723 1,080,484 Change (%) 24.3 31.0 28.8 29.9 15.7 14.1 Cost of Services 198,505 258,773 332,545 422,065 513,543 598,835 SG&A Expenses 62,848 85,988 116,480 144,707 162,539 177,260 EBITDA 111,892 144,177 180,870 251,322 270,642 304,388 % of Net Sales 30.0 29.5 28.7 30.7 28.6 28.2 Depreciation 7,990 9,036 10,792 13,243 15,206 17,242 Other Income 5,247 4,041 11,174 15,891 20,203 28,504 PBT 109,149 139,182 181,252 253,969 275,639 315,650 Tax 21,203 31,688 40,344 60,712 66,153 75,756 Rate (%) 19.4 22.8 22.3 23.9 24.0 24.0 Minority Interest 1,116 1,110 1,494 2,089 2,080 2,080 PAT 86,827 106,384 139,413 191,168 207,406 237,814 Change (%) 26.3 22.5 31.0 37.1 8.5 14.7 Balance sheet (INR Million) Y/E March 2011 2012 2013 2014 2015E 2016E Share Capital 1,957 1,957 1,957 1,959 1,959 1,959 Reserves 250,432 323,276 407,524 551,393 638,273 779,840 Net Worth 252,389 325,233 409,481 553,352 640,232 781,798 Preference shares 1,000 1,000 1,000 0 0 0 Minority Interest 4,663 5,276 6,561 6,905 6,905 6,905 Loans 10,718 12,306 10,894 12,561 14,307 16,133 Capital Employed 268,771 343,815 427,936 572,817 661,443 804,836 Gross Block 86,156 107,400 135,587 170,530 204,717 236,907 Less : Depreciation 33,816 42,852 53,644 66,887 82,092 99,334 Net Block 52,340 64,548 81,944 103,644 122,625 137,573 Other LT Assets 89,929 110,269 88,815 118,105 141,657 160,298 Investments 18,390 0 33,765 37,673 37,673 37,673 Curr. Assets 171,948 237,173 315,022 429,703 562,793 689,659 Debtors 95,479 137,469 172,366 222,360 272,704 310,917 Cash & Bank Balance 47,401 34,617 79,035 156,495 231,377 311,803 Other Current Assets 29,068 65,087 63,621 50,848 58,712 66,939 Current Liab. & Prov 63,837 68,175 91,609 116,308 203,305 220,368 Current Liabilities 63,837 68,175 91,609 116,308 203,305 220,368 Net Current Assets 108,111 168,998 223,413 313,395 359,488 469,291 Application of Funds 268,771 343,815 427,936 572,817 661,443 804,836 E: MOSL Estimates

- 8. TCS 13 June 2014 8 Financials and valuation Ratios Y/E March 2011 2012 2013 2014 2015E 2016E Basic (INR) EPS 44.4 54.4 71.2 97.6 105.9 121.4 Cash EPS 48.4 59.0 76.7 104.4 113.7 130.2 Book Value 129.5 166.7 209.7 282.5 326.9 399.1 DPS 14.0 25.0 22.0 32.0 37.0 42.0 Payout % 31.6 46.0 30.9 32.8 34.9 34.6 Valuation (x) P/E 49.9 40.7 31.1 22.7 20.9 18.2 Cash P/E 45.7 37.6 28.9 21.2 19.5 17.0 EV/EBITDA 38.2 29.9 23.4 16.5 15.1 13.2 EV/Sales 11.5 8.8 6.7 5.1 4.3 3.7 Price/Book Value 17.1 13.3 10.6 7.8 6.8 5.5 Dividend Yield (%) 0.6 1.1 1.0 1.4 1.7 1.9 Profitability Ratios (%) RoE 37.4 36.7 37.8 39.7 34.8 RoCE 42.2 44.1 44.1 47.6 41.4 Turnover Ratios Debtors (Days) 81 87 90 88 95 99 Fixed Asset Turnover (x) 7.9 8.4 8.6 8.8 8.4 8.3 Cash flow statement (INR Million) Y/E March 2011 2012 2013 2014 2015E 2016E CF from Operations 94,817 115,419 150,205 204,411 222,611 255,056 Cash for Working Capital 18,165 -73,671 -9,997 -12,522 28,789 -29,377 Net Operating CF 112,982 41,747 140,208 191,890 251,401 225,679 Net Purchase of FA -53,633 -41,584 -6,733 -64,233 -57,739 -50,831 Net Purchase of Invest. 19,409 18,390 -33,765 -3,909 0 0 Net Cash from Invest. -34,224 -23,193 -40,498 -68,142 -57,739 -50,831 Proc. from equity issues -11,155 24,319 -3,504 25,371 -35,736 0 Proceeds from LTB/STB 1,608 1,588 -1,412 1,666 1,746 1,826 Dividend Payments -32,058 -57,246 -50,377 -73,325 -84,790 -96,248 Cash Flow from Fin. -41,604 -31,339 -55,292 -46,287 -118,780 -94,421 Free Cash Flow 59,349 164 133,475 127,656 193,662 174,847 Net Cash Flow 37,153 -12,785 44,418 77,461 74,882 80,426 Opening Cash Bal. 10,249 47,402 34,617 79,035 156,495 231,377 Add: Net Cash 37,153 -12,785 44,418 77,461 74,882 80,426 Closing Cash Bal. 47,402 34,617 79,035 156,495 231,377 311,803 E: MOSL Estimates

- 9. TCS 13 June 2014 9 N O T E S

- 10. TCS 13 June 2014 10 Disclosures This report is for personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Disclosure of Interest Statement TATA CONSULTANCY SVCS LTD 1. Analyst ownership of the stock No 2. Group/Directors ownership of the stock No 3. Broking relationship with company covered No 4. Investment Banking relationship with company covered No Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues. Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.K. This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity to which this document relates is only available to investment professionals and will be engaged in only with such persons. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker- dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email:anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact(+65)68189232 Contact: (+65) 68189233 / 65249115 Office Address:21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com