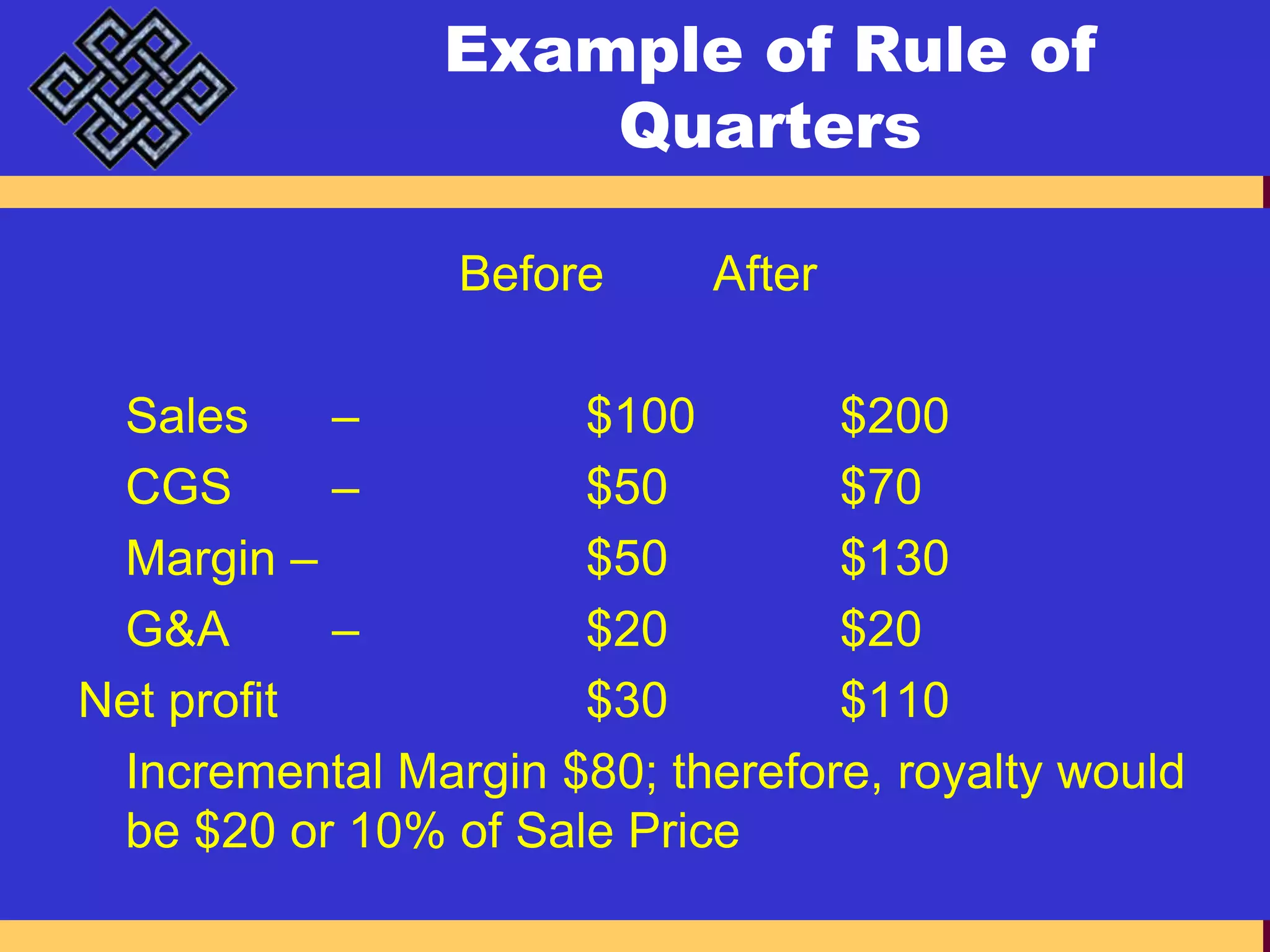

The document outlines the technology transfer (TT) process, detailing the roles of patent agents and considerations for licensing agreements essential for start-ups. It discusses the importance of intellectual property protections, assessing ownership rights, and drafting claims while addressing the complexities of licensing arrangements and valuation issues. It also emphasizes communication among inventors, commercialization managers, and patent agents throughout the process to ensure effective patent management and licensing strategies.