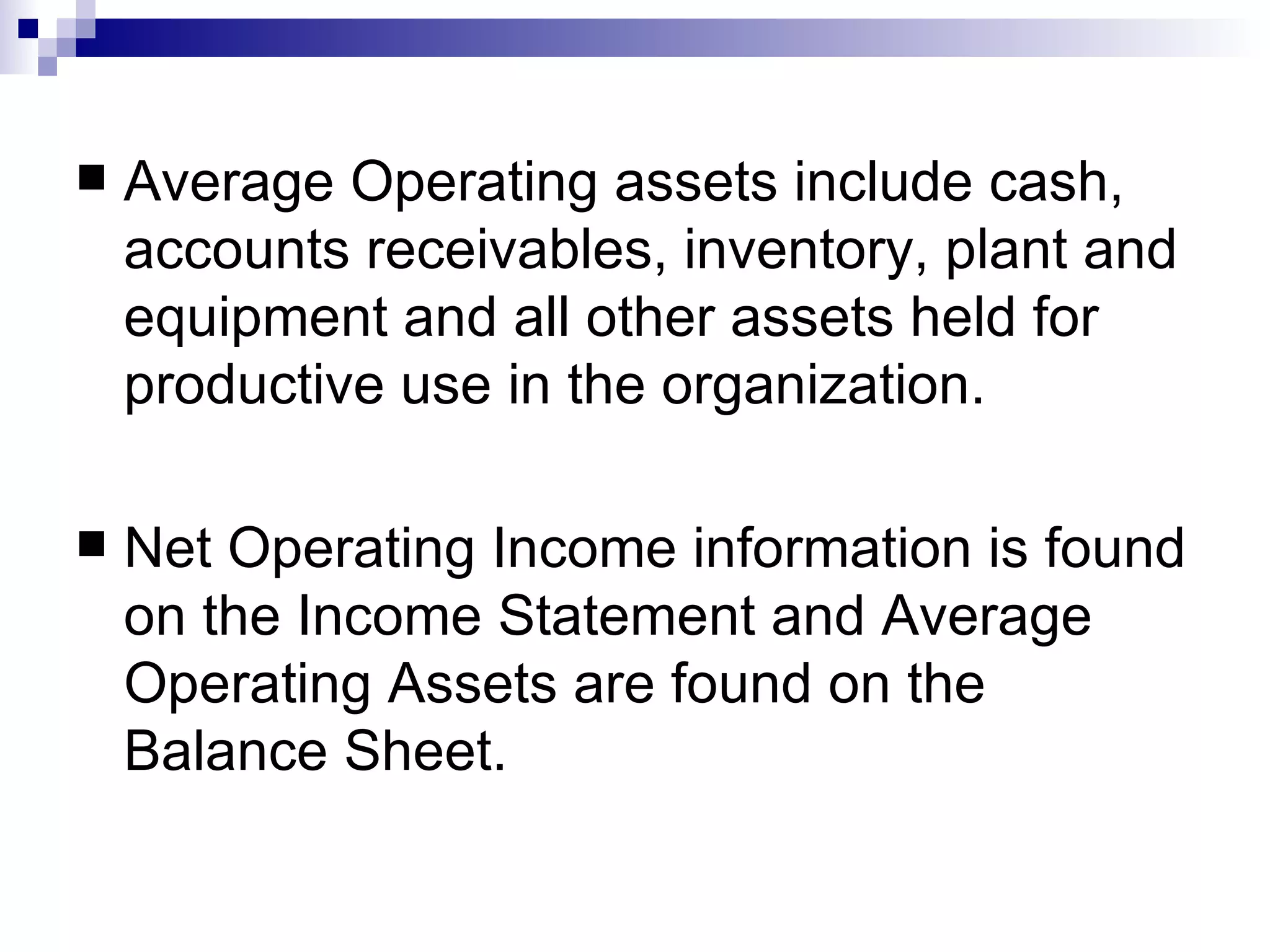

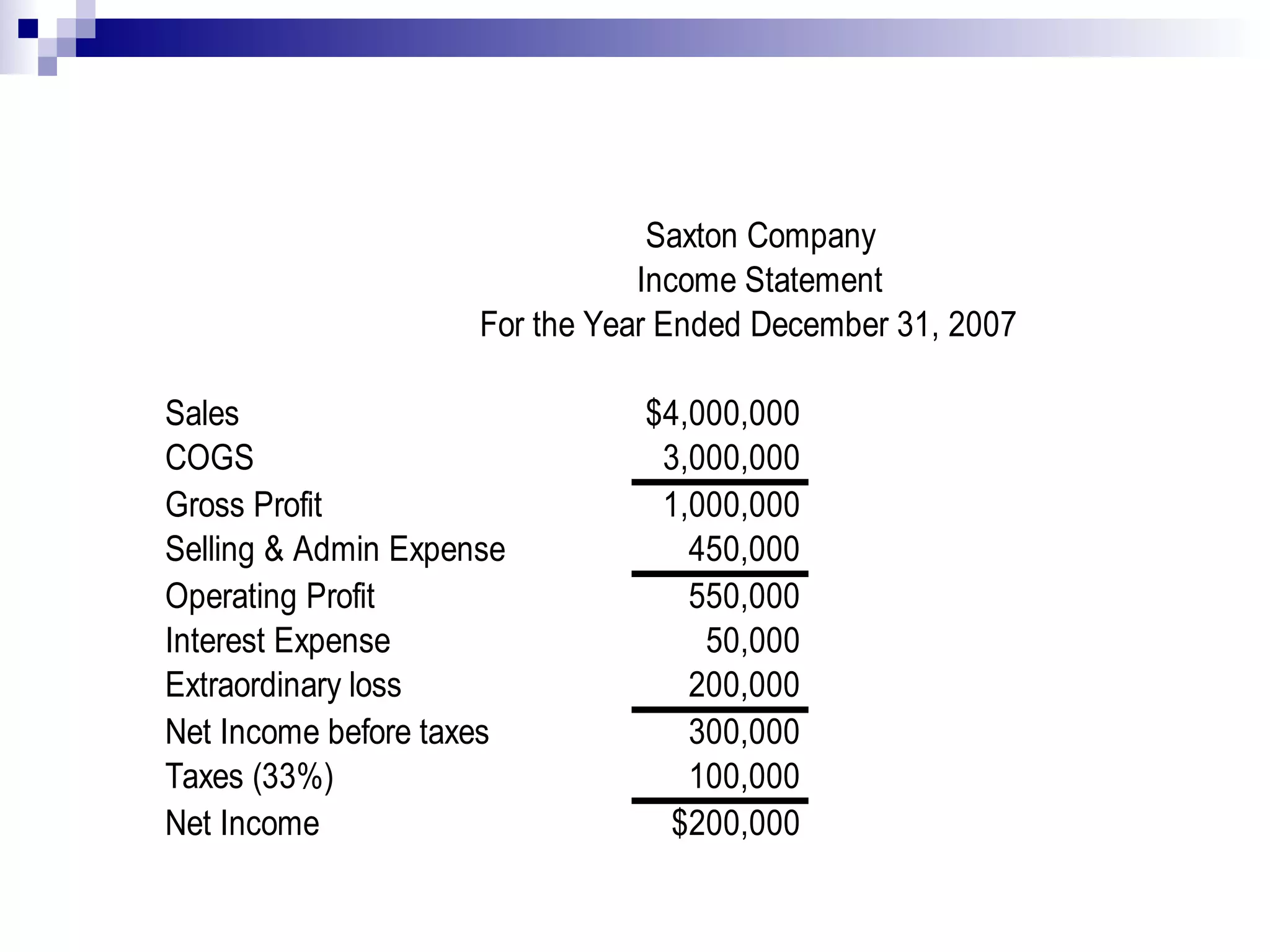

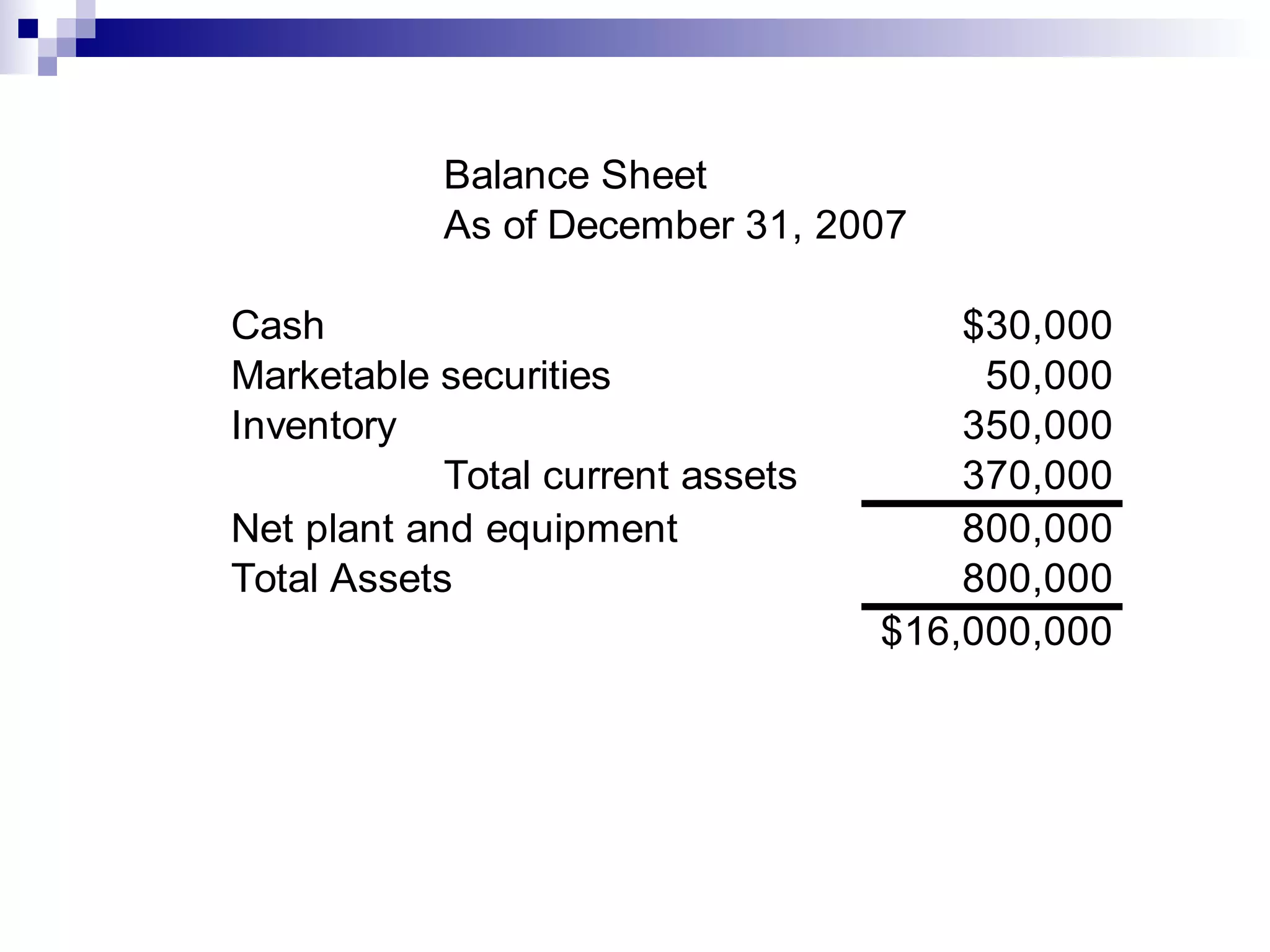

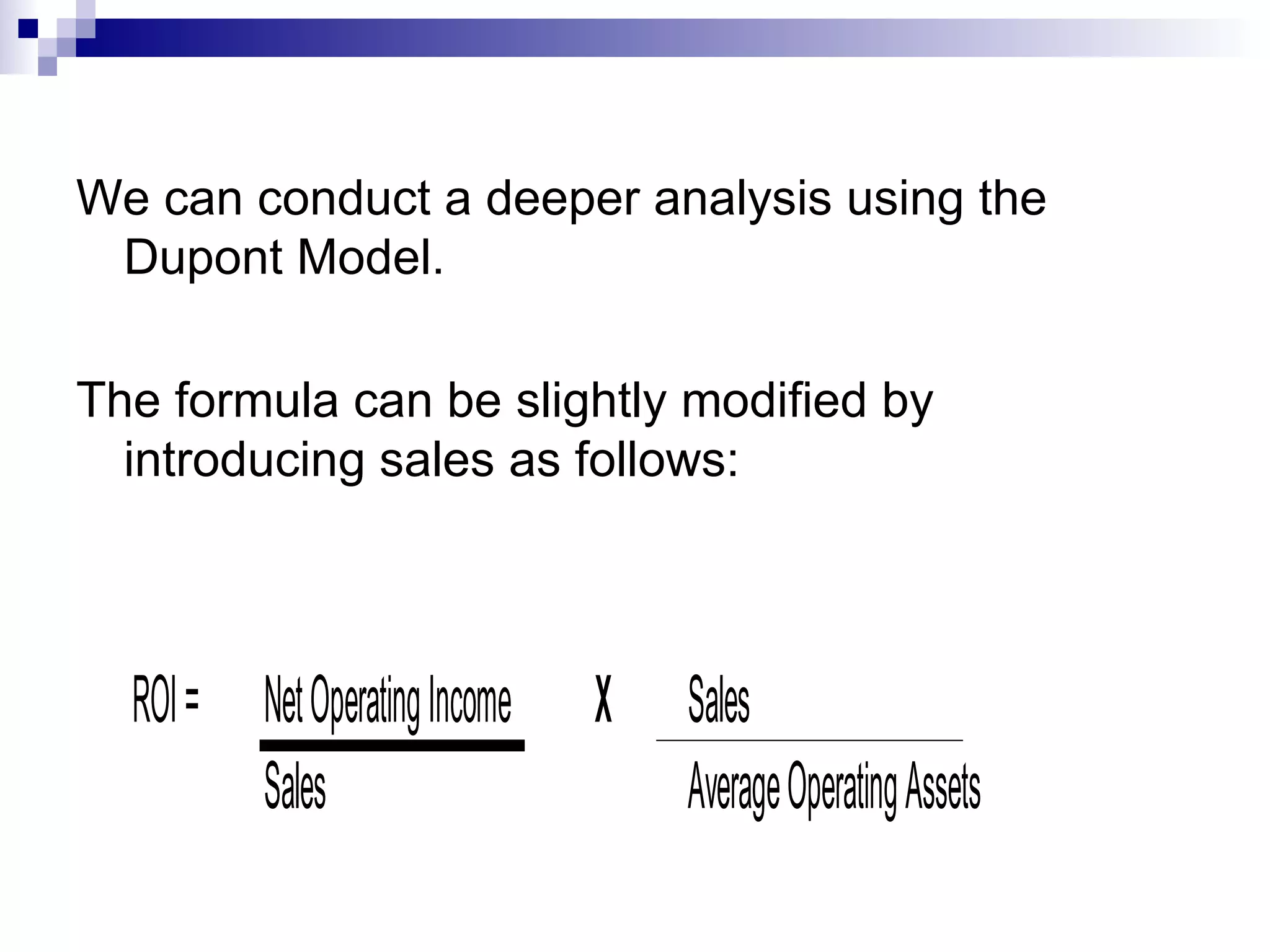

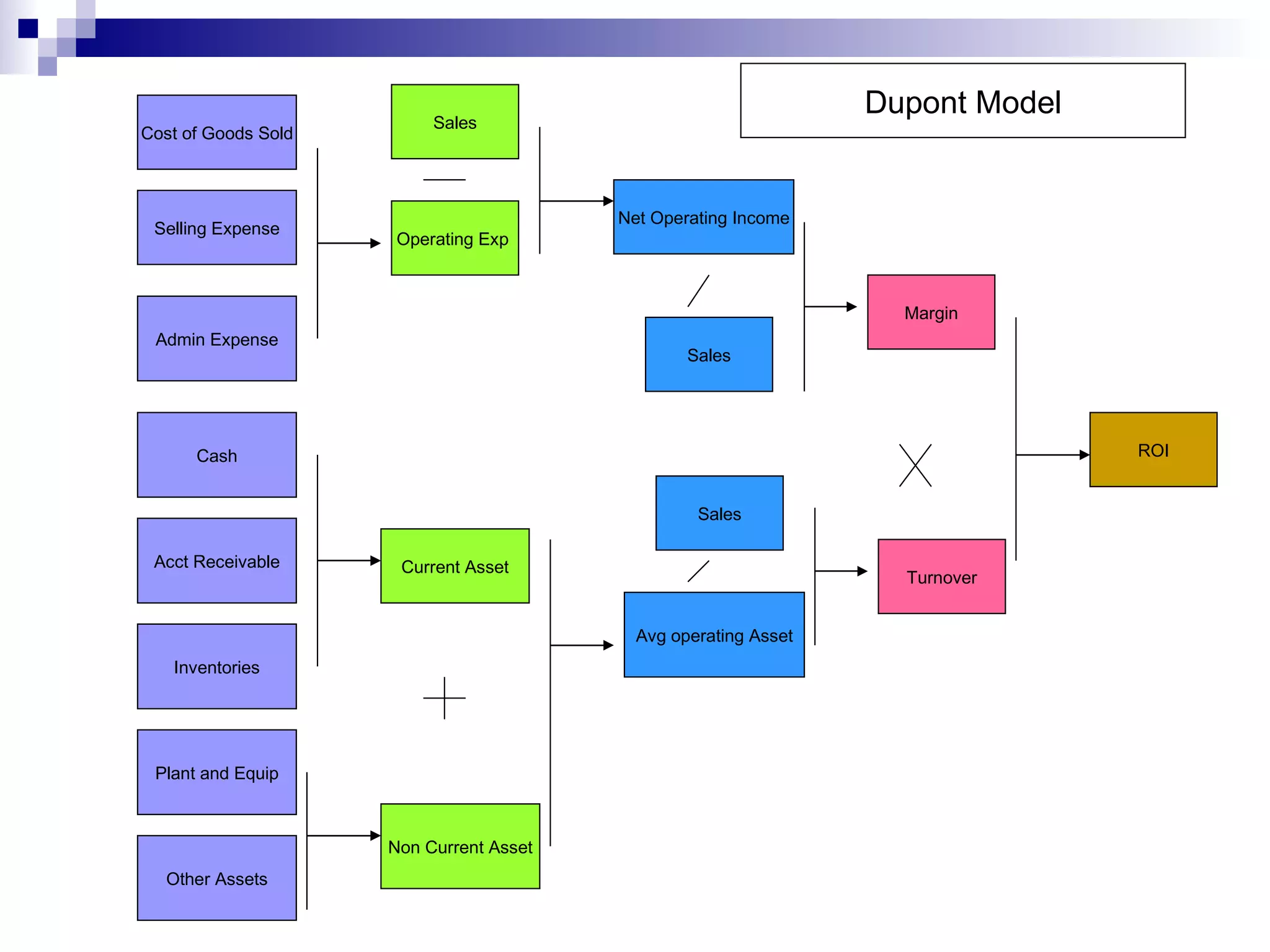

This document discusses return on investment (ROI) and how it is used by corporate headquarters to evaluate the profitability and performance of decentralized business segments or departments. ROI is defined as net operating income divided by average operating assets. It is a measure used to compare the returns of different investment centers and past performance, and help managers identify ways to increase ROI such as increasing sales, reducing expenses, and reducing assets. The balanced scorecard approach can help managers understand the company's strategy for increasing ROI.

![Net operating income is income before interest and taxes (refered to as EBIT [earnings before interest and taxes]). Net income is the bottom line number in the Income Statement and is the total of Sales minus cost of goods sold and the addition of selling and administrative expenses, interest expense minus taxes.](https://image.slidesharecdn.com/ManagerialAccounting101-123280884215-phpapp01/75/Managerial-Accounting-101-6-2048.jpg)