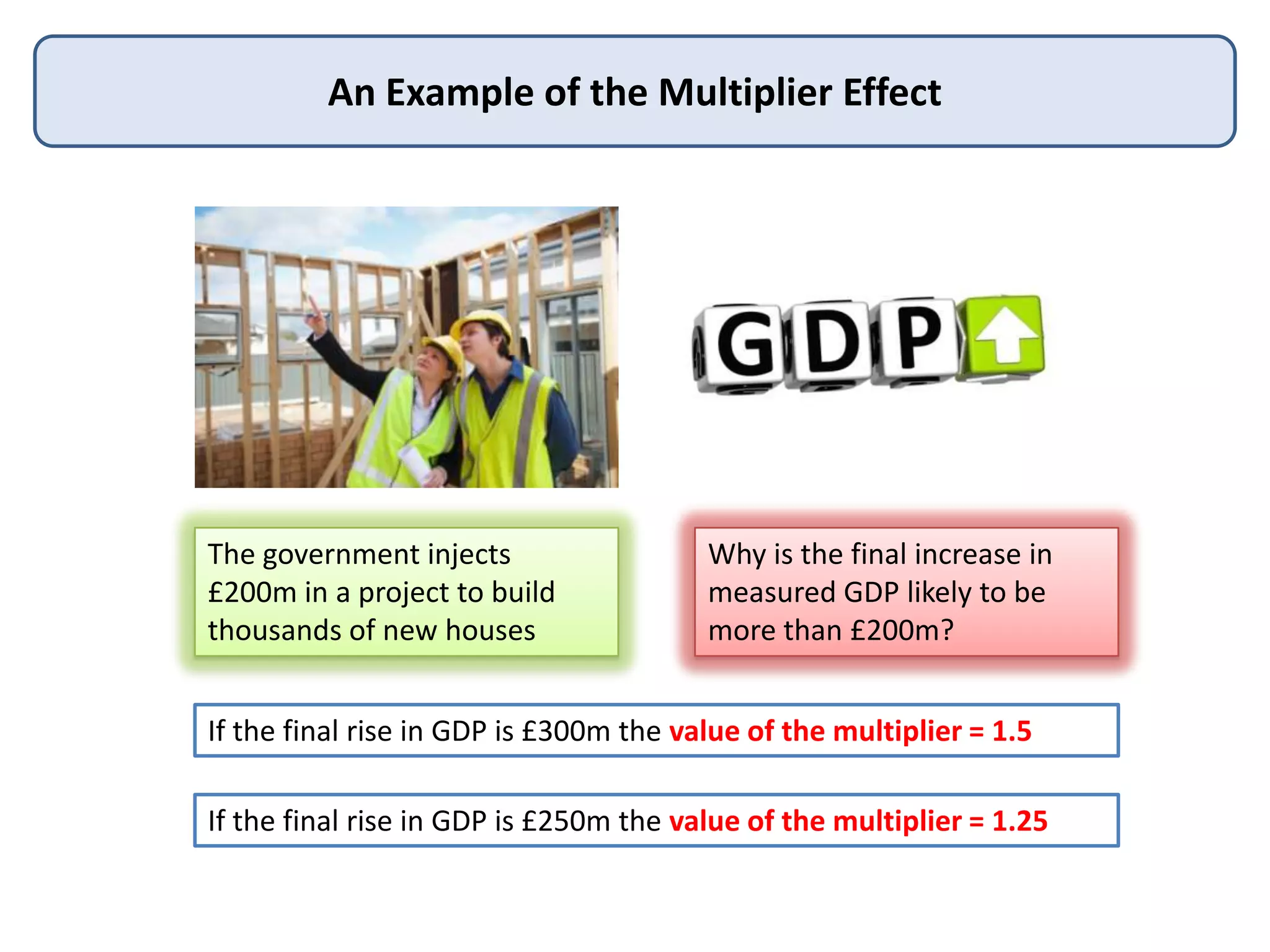

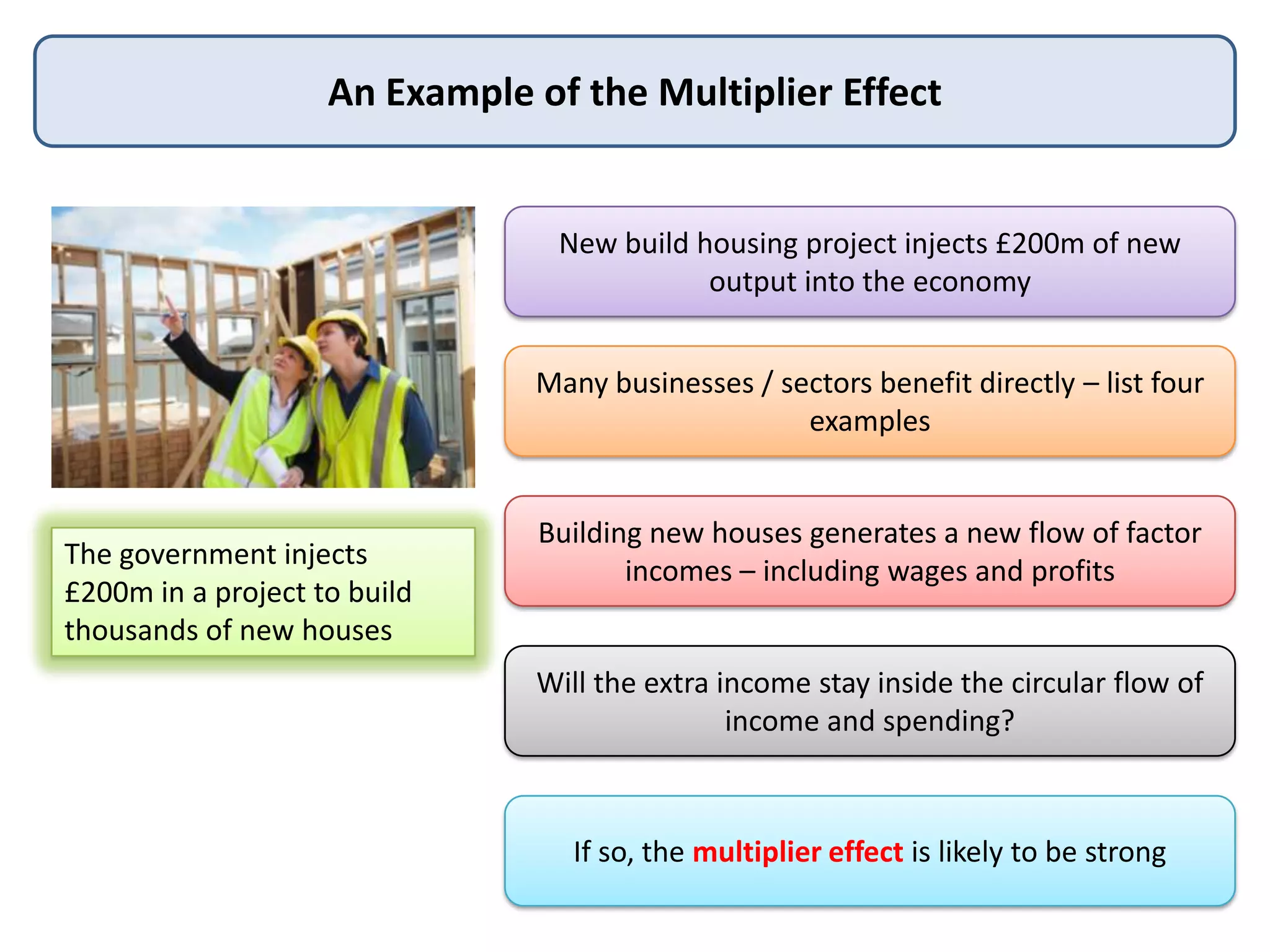

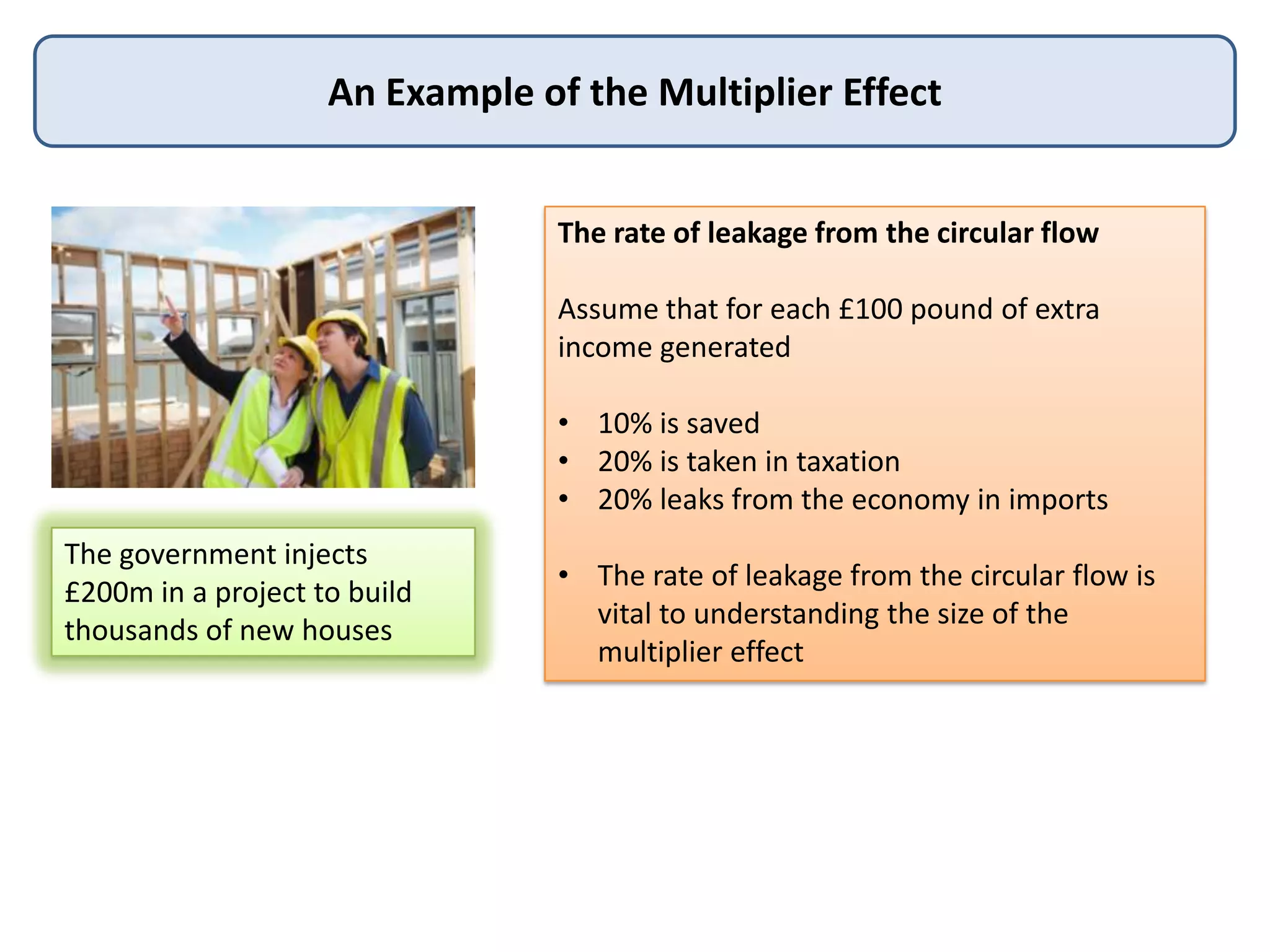

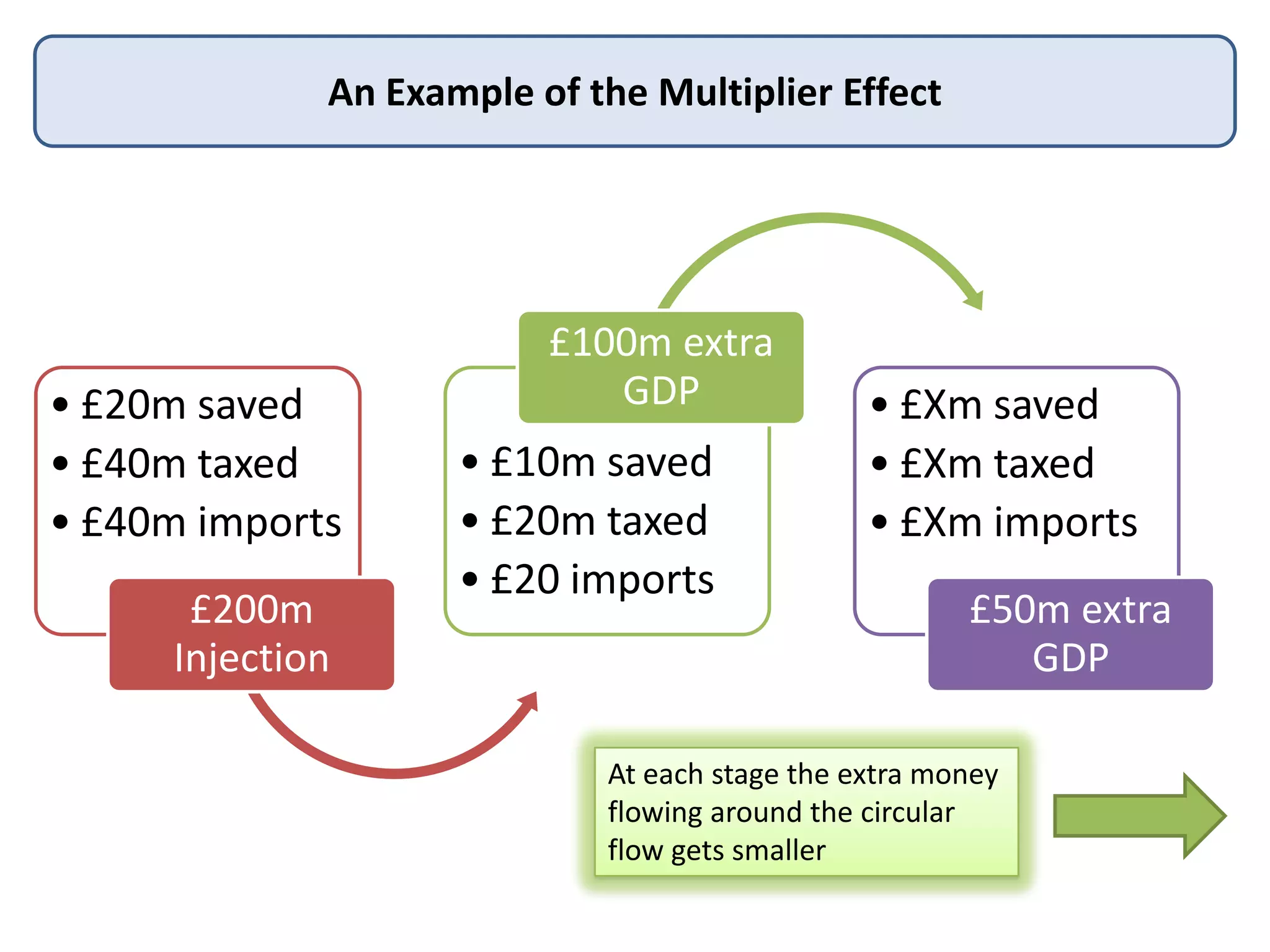

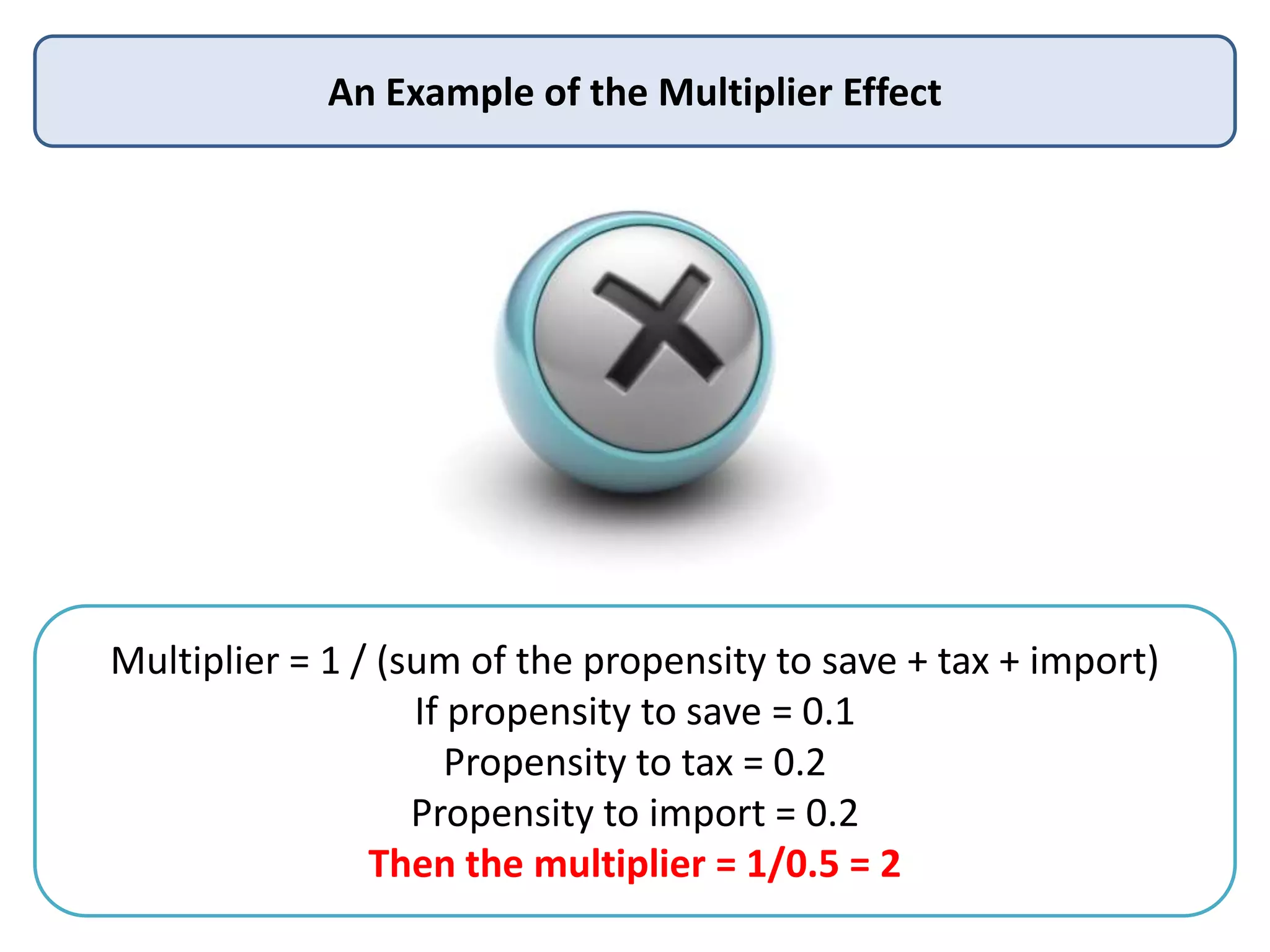

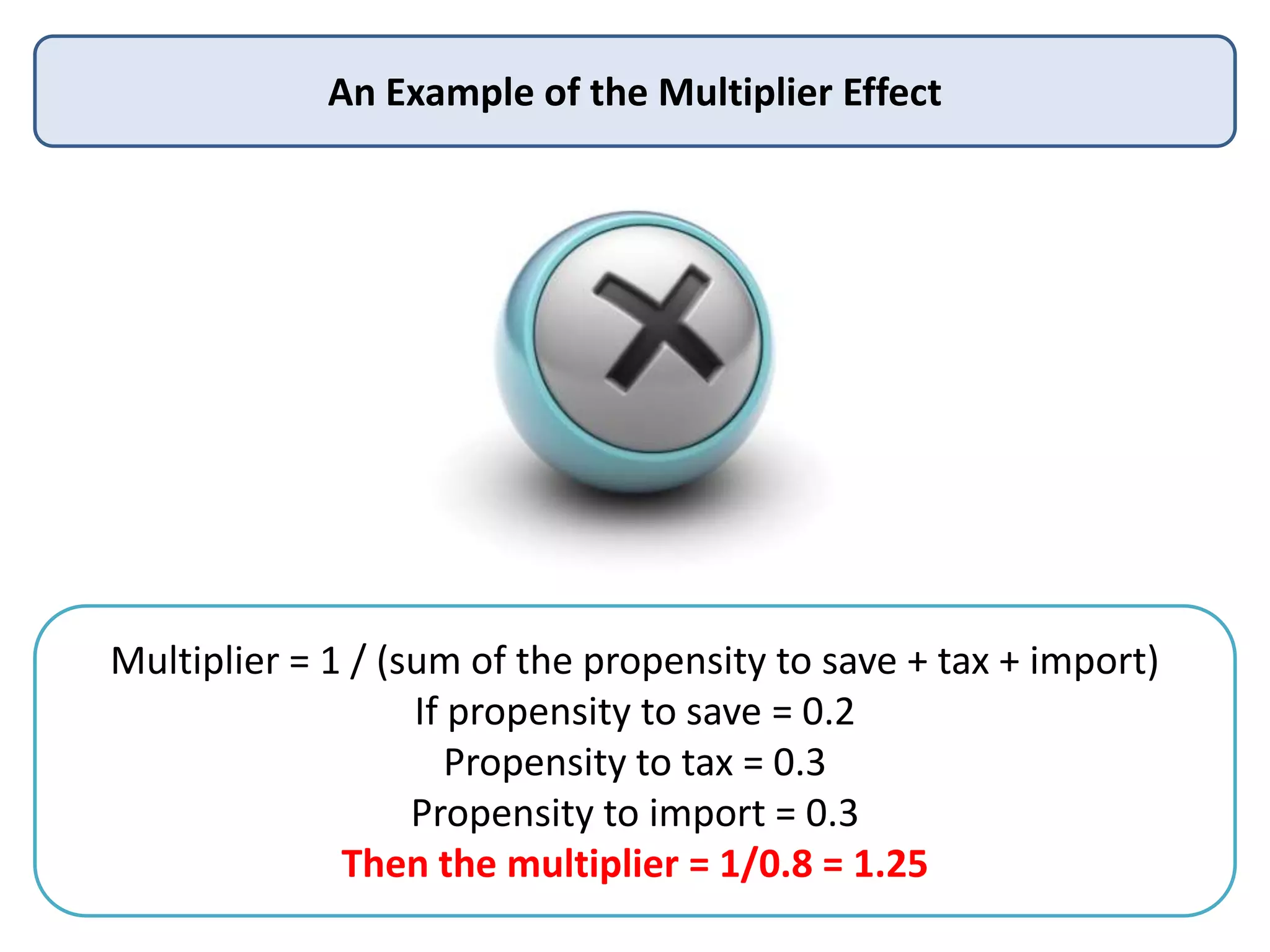

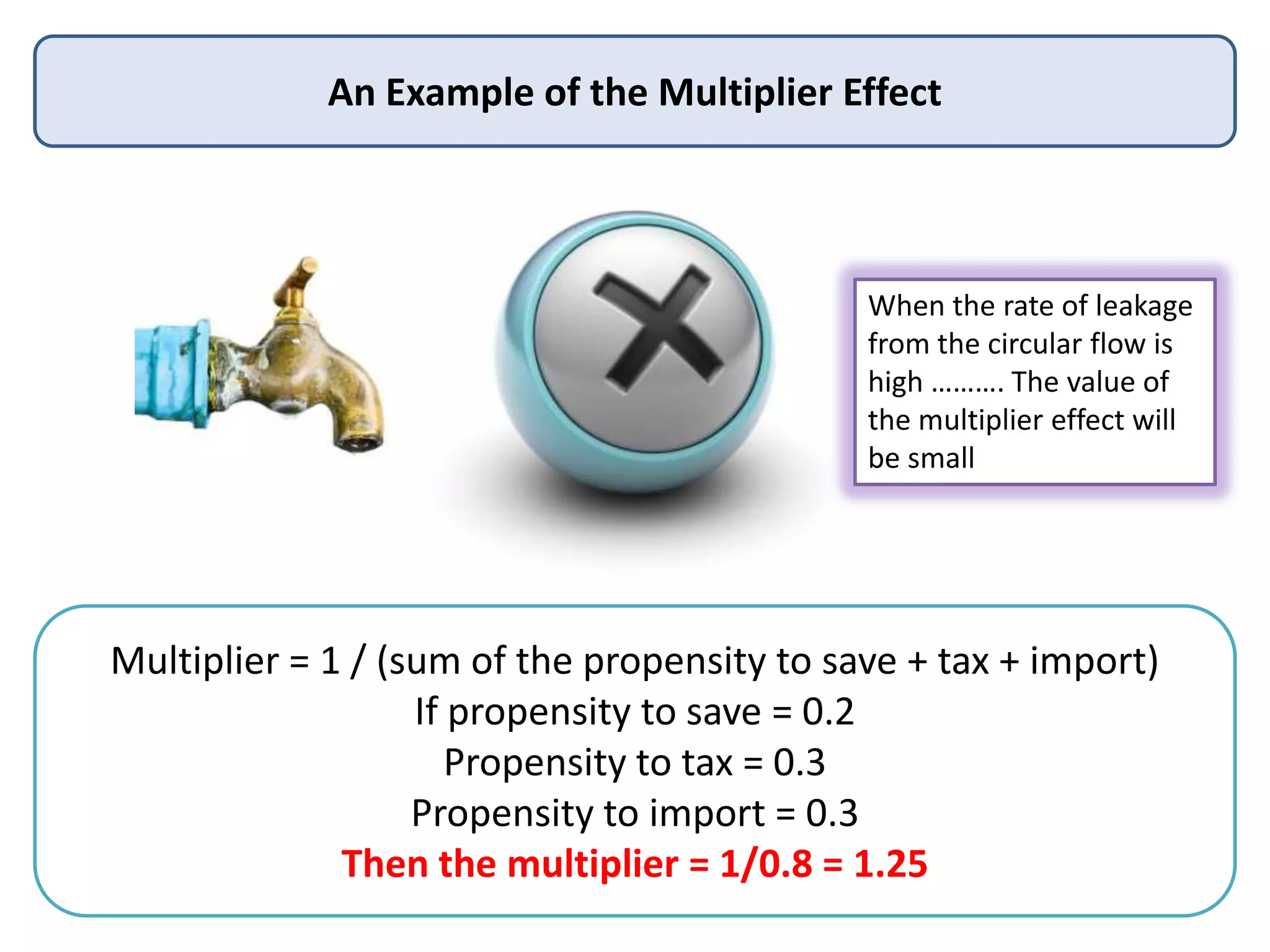

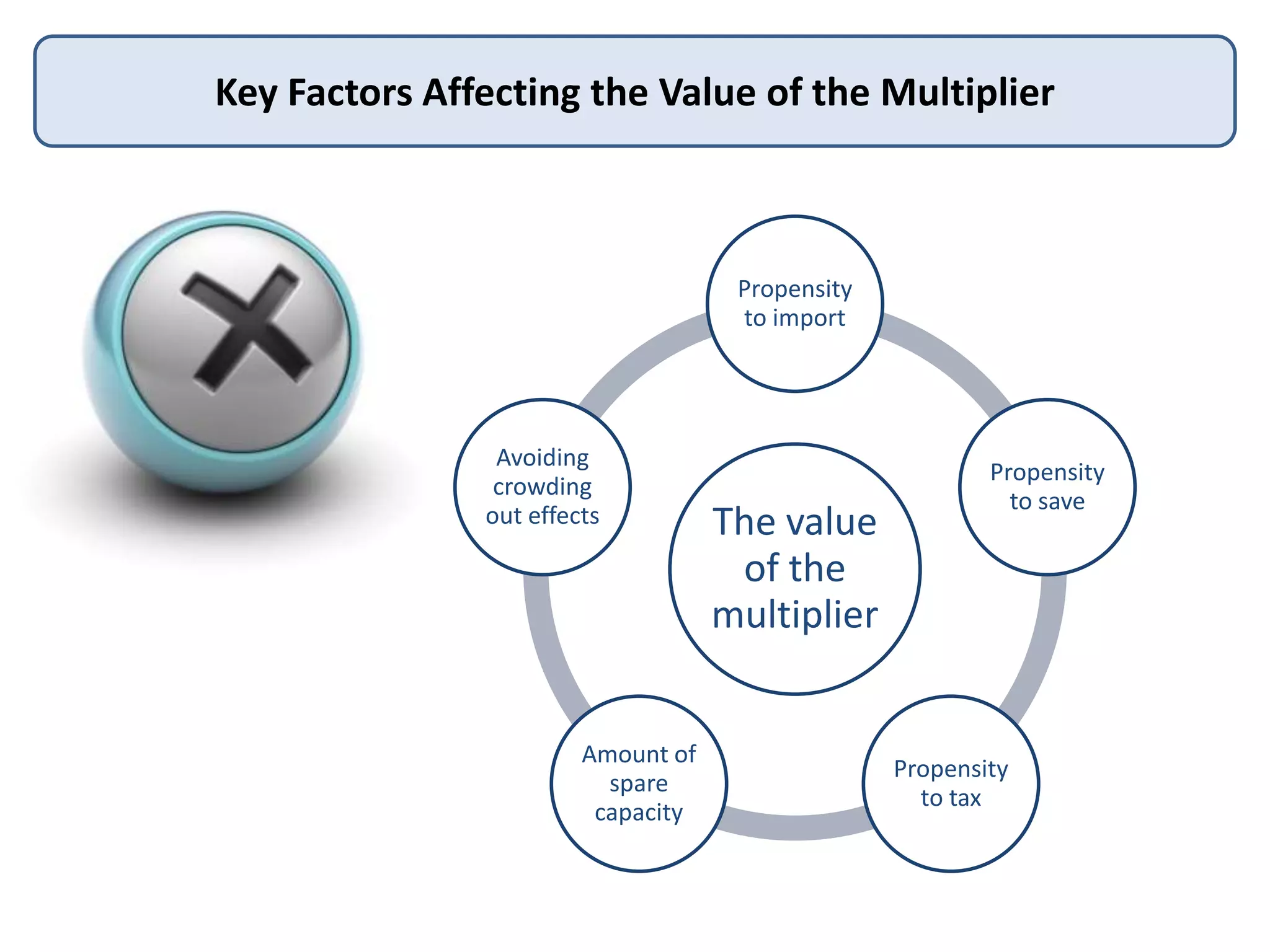

The multiplier effect occurs when an initial change in aggregate demand, such as an increase in government spending, leads to a multiplied impact on real GDP through subsequent rounds of re-spending. The multiplier effect arises because the initial spending increases household incomes and business revenues, which are then spent again on new output, generating further income and demand. This multiplier process can continue, amplified at each round, resulting in an eventual increase in real GDP that is multiple times the size of the initial change in spending. The size of the multiplier depends on factors like the marginal propensity to consume, save, tax and import.