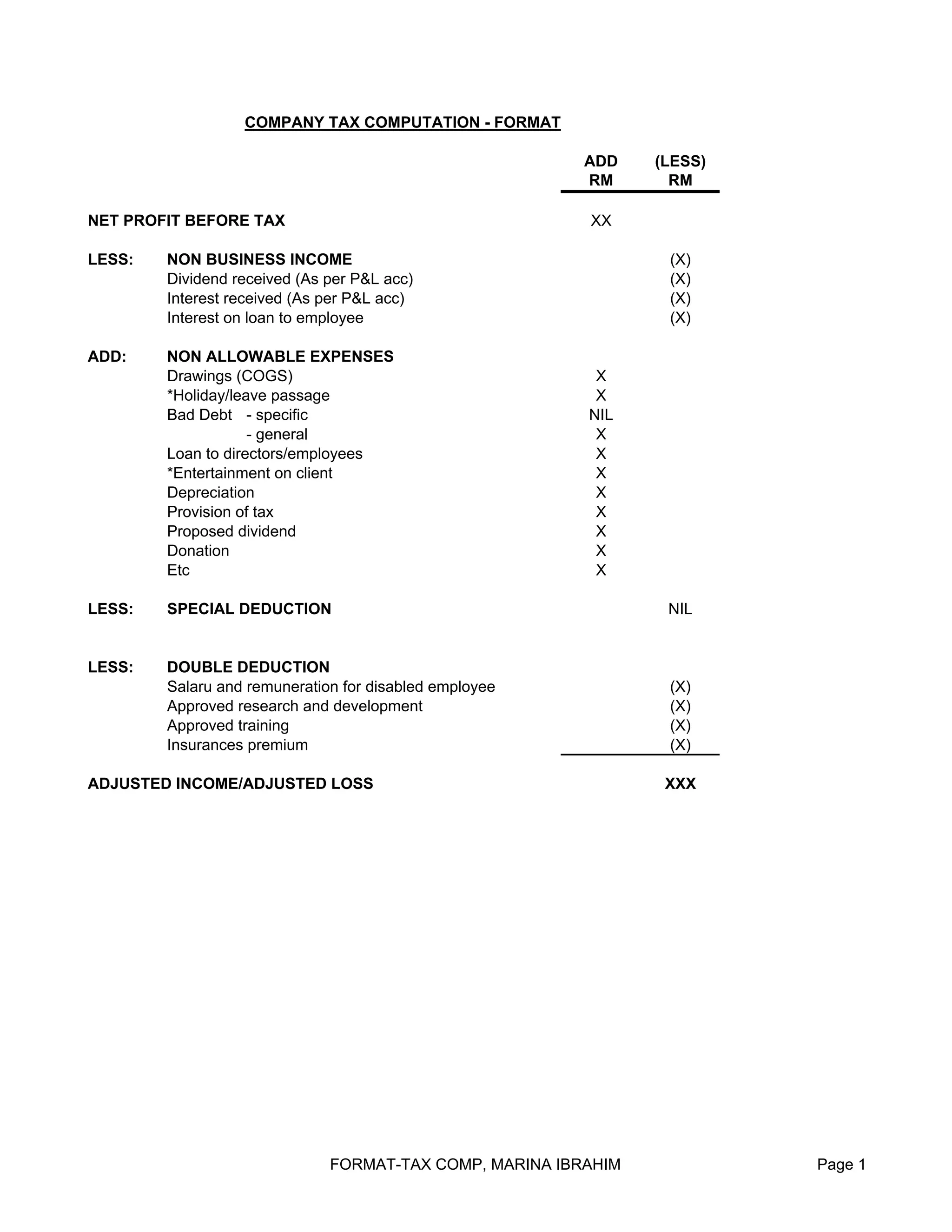

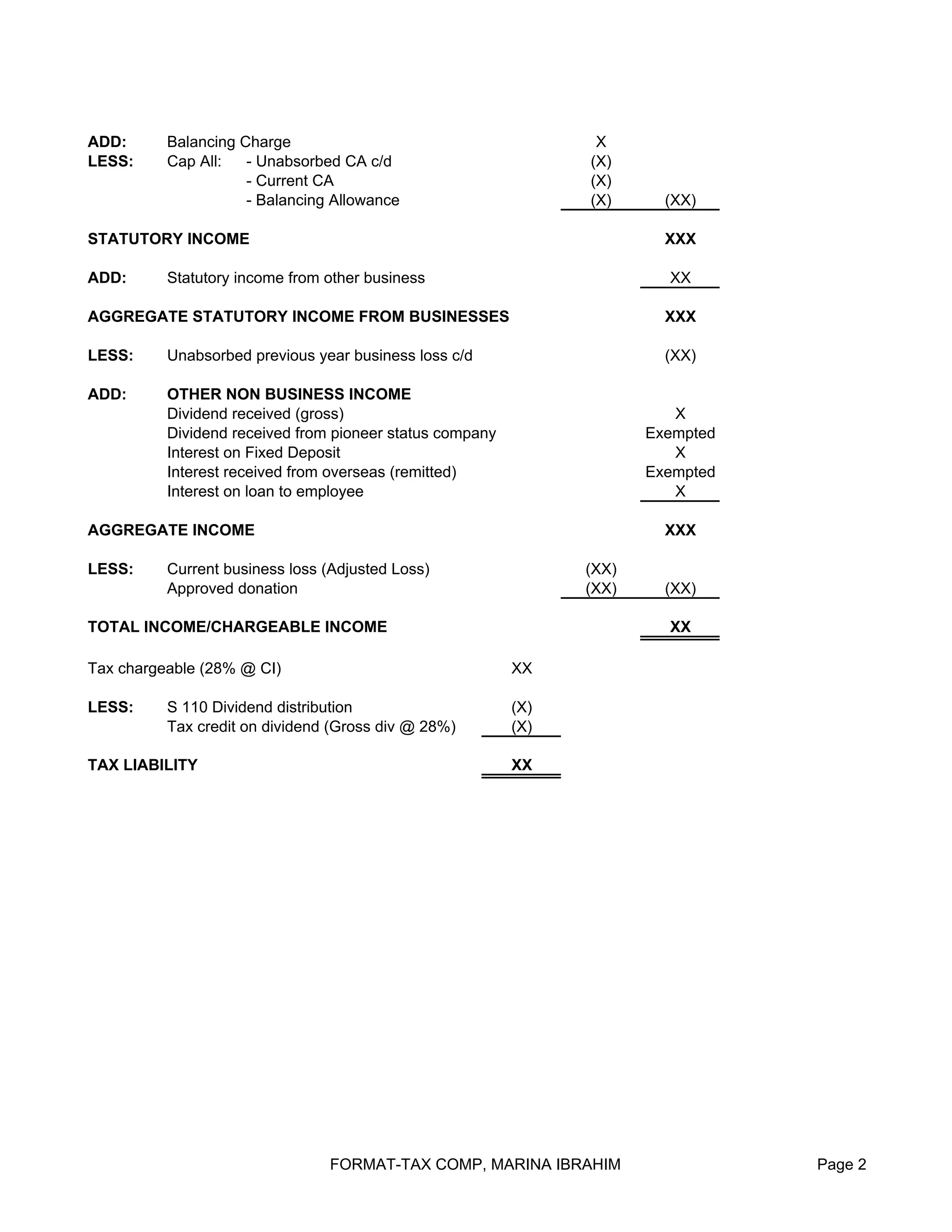

This document outlines the format for computing company tax in Malaysia. It lists items that are added and subtracted from net profit before tax to arrive at statutory income, including non-allowable expenses that are added back and special deductions that are subtracted. It then details the steps to calculate aggregate income, chargeable income, tax chargeable, tax credits, and final tax liability.