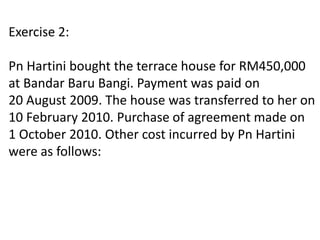

This document provides an overview of Real Property Gains Tax (RPGT) in Malaysia. Some key points:

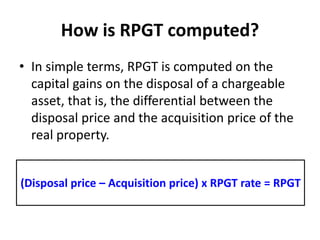

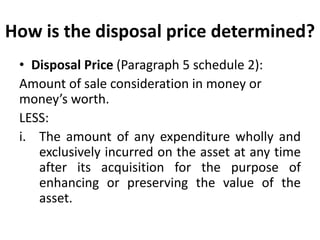

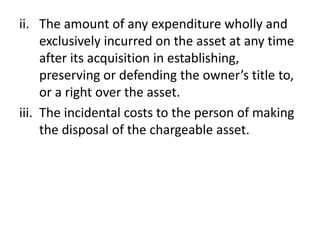

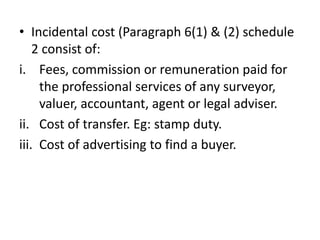

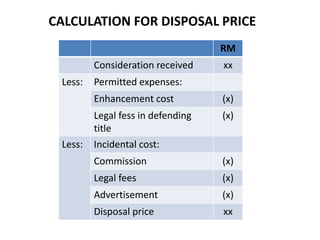

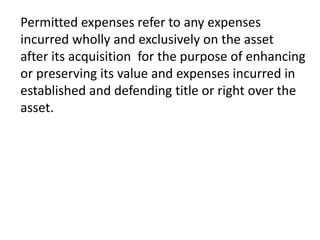

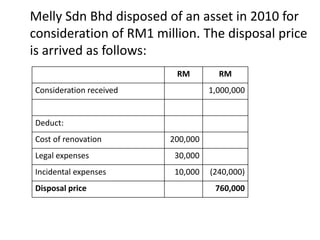

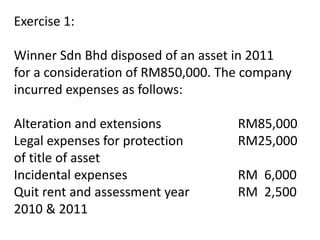

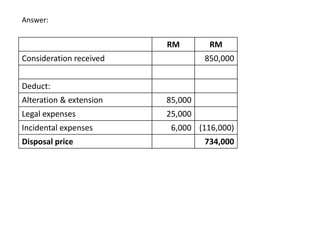

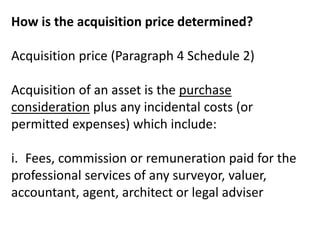

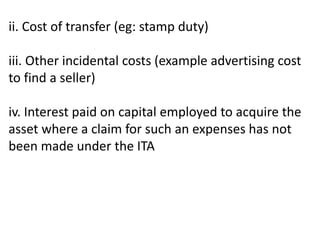

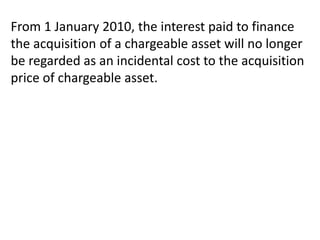

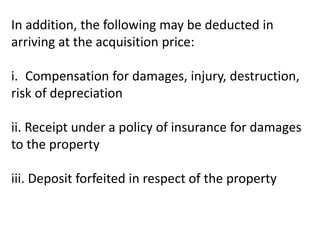

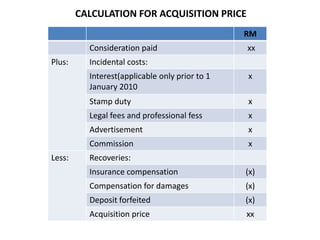

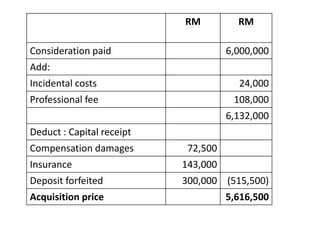

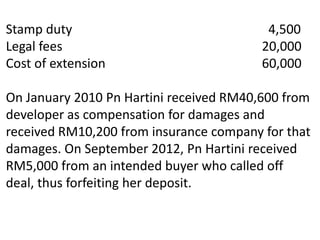

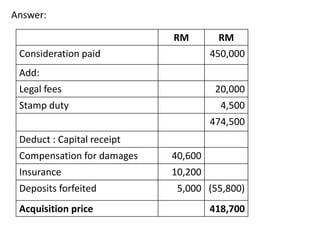

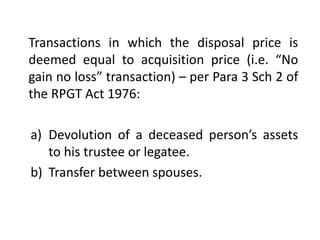

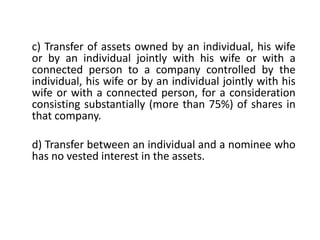

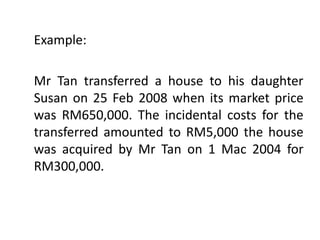

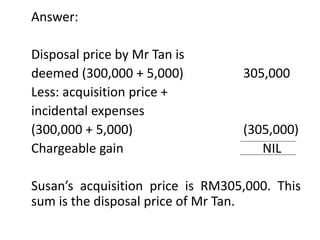

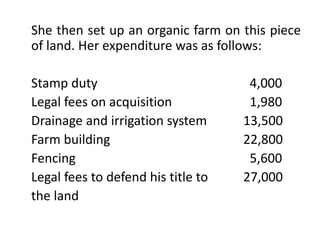

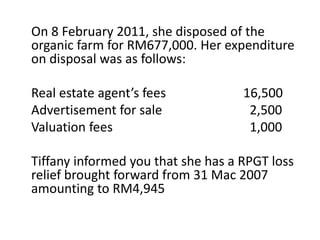

- RPGT is a tax on capital gains from the disposal of real property in Malaysia, including residential/commercial properties and land. The tax is computed based on the difference between the disposal price and acquisition price.

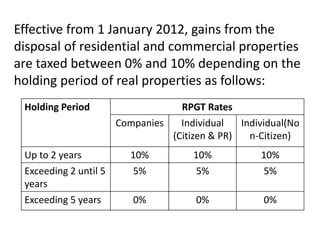

- RPGT rates range from 0-10% depending on the holding period, with longer holding periods subject to lower rates.

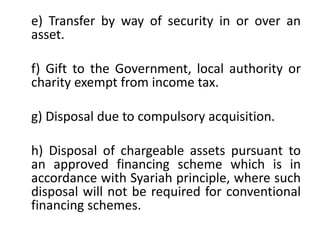

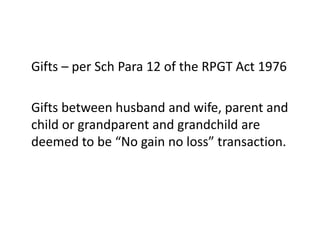

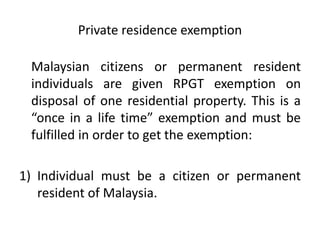

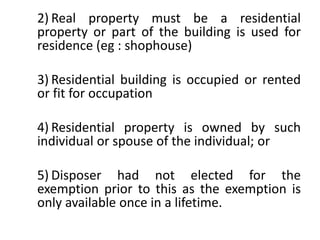

- Various exemptions are available, including for gains below RM10,000 and disposal of a private residence.

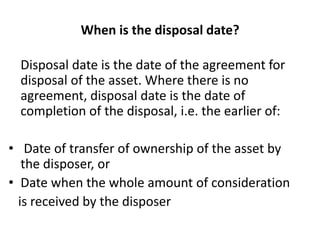

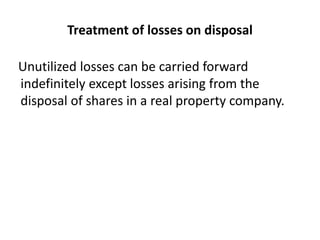

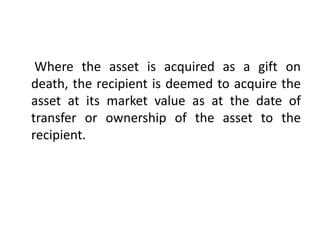

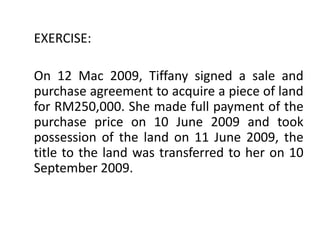

- The acquisition date generally coincides with the disposal date between parties. Losses can be carried forward indefinitely except for shares in real property companies.