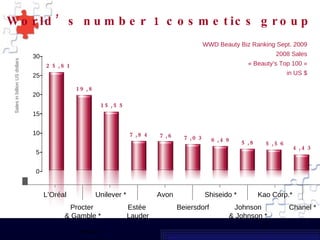

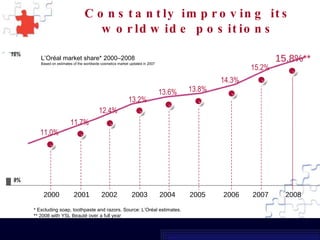

1. L'Oreal is the world's largest cosmetics company with sales of 17.5 billion euros in 2008 across 130 countries.

2. It operates in key distribution channels like hair salons, mass market retailers, selective retailers, and pharmacies.

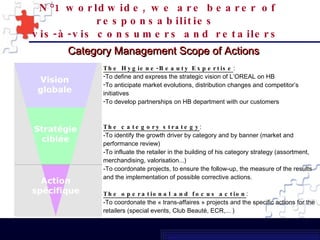

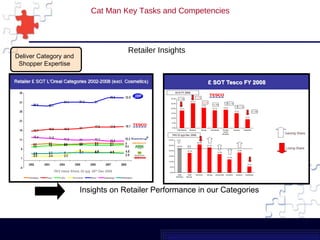

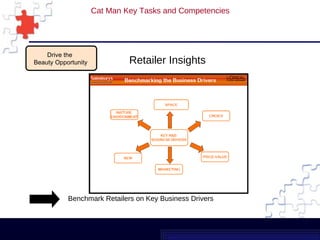

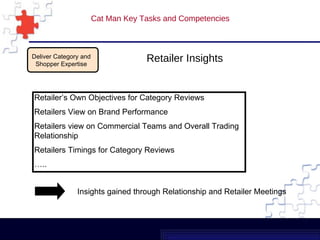

3. L'Oreal works with retailers on category management to optimize shelf space, product assortments, and in-store merchandising based on consumer insights. This helps drive growth for both L'Oreal brands and retailers.