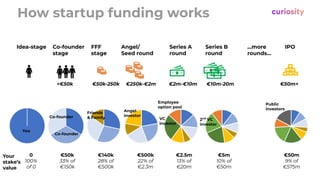

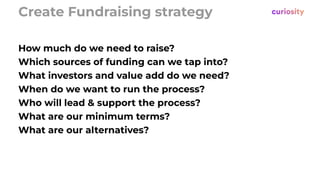

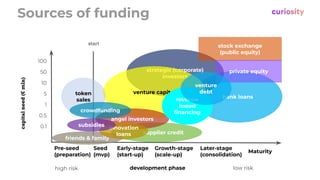

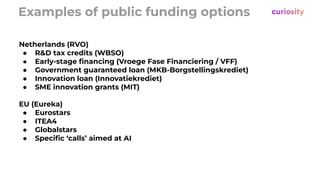

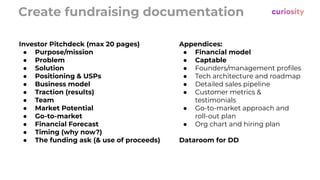

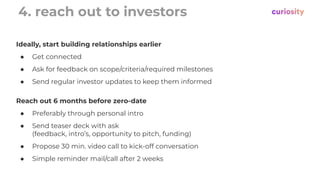

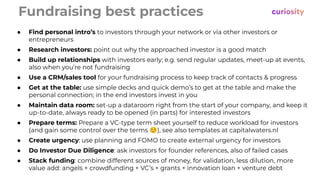

The document provides an overview of a startup fundraising workshop. It discusses why startups raise capital, how startup funding works through different rounds, and the fundraising process which includes creating a strategy, documentation, investor outreach, and due diligence. Key parts of the process are researching investor criteria, negotiating terms, and addressing potential red flags for investors such as inconsistent financial models or founders not thinking big enough. The presentation aims to provide best practices for startups to successfully raise funds.