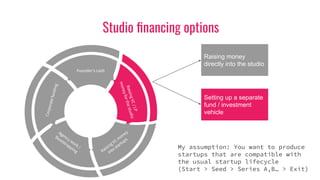

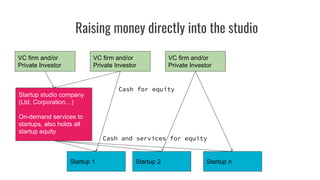

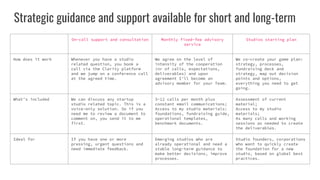

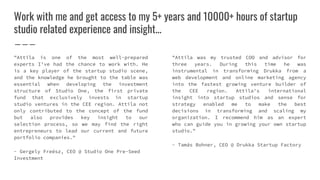

The document outlines the fundamental aspects of fundraising for startup studios, providing guidance on how to structure investments, prepare for investor approaches, and the essentials of an investor deck. It emphasizes the need for a clear vision, operational plans, and a strategic approach to fundraising, with iterative processes for adjustment and evaluation. The content serves as a resource for emerging studio founders, offering insights into financial strategies, organizational structure, and operational templates to facilitate the successful establishment of a startup studio.

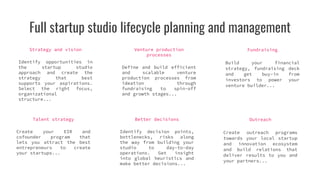

![A basic recipe for a studio investment thesis

+ We believe in [market/technology/trend/opportunity]

+ Our studio wants to achieve [mission statement]

+ Therefore we will produce startups that [startup profile]

+ We are raising [amount] into [investment structure]

+ This money is to finance [cash flow structure]

+ This investment will [benefit for investors]

+ Ultimately we will [long-term vision for the studio]](https://image.slidesharecdn.com/startupstudiofundraisingfundamentals-public-210304181040/85/Startup-studio-fundraising-fundamentals-6-320.jpg)