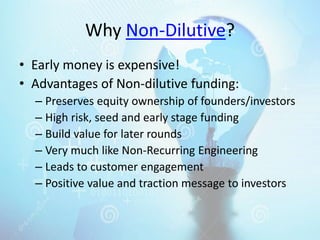

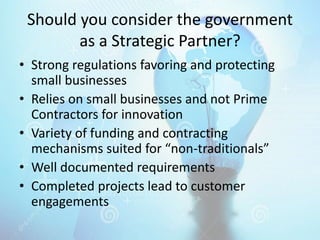

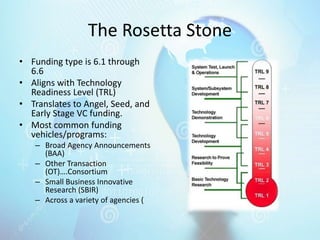

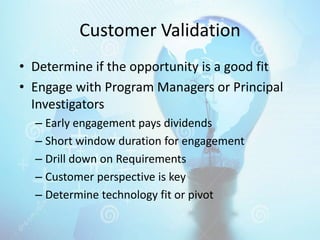

This document provides information on non-dilutive funding sources for technology startups. It discusses the advantages of non-dilutive funding such as preserving founder equity. Government funding sources like Broad Agency Announcements and Small Business Innovation Research grants are recommended options. The process involves customer development, discovery of funding opportunities, and validation by engaging with program managers. Key steps include identifying the right agency and opportunity that aligns with your technology and the funding vehicle's requirements.