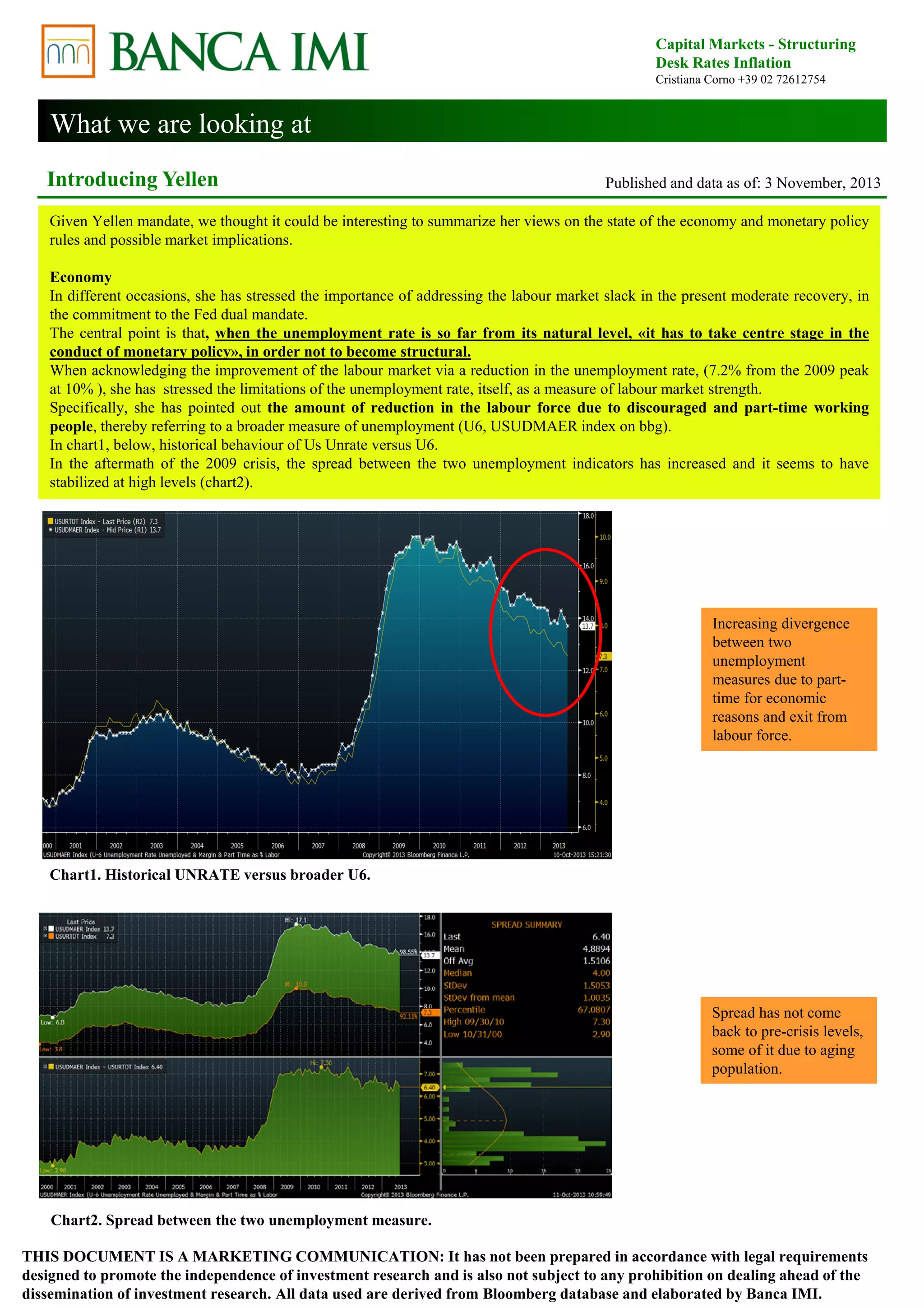

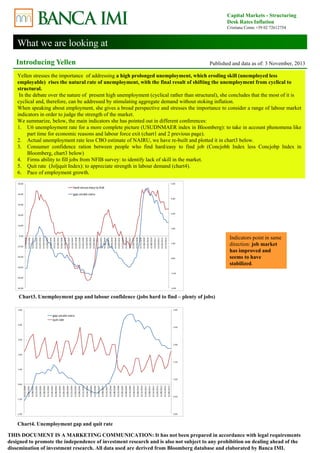

Yellen stresses the importance of addressing high prolonged unemployment to prevent it from becoming structural. She judges the strength of the labor market using multiple indicators including the U6 unemployment rate, the gap between actual and estimated NAIRU rates, and measures of job availability and quits. Yellen supports an "optimal control" monetary policy rule that aims to minimize unemployment and inflation gaps, prescribing lower rates when output gaps are wide. She expects the Fed will follow a balanced monetary policy approach once unemployment falls to around 6.5%, likely in 2014-2015.