The document discusses bond futures, specifically:

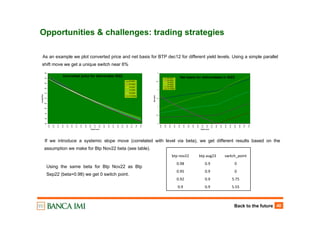

1) Bond futures allow short sellers to deliver any eligible bond, giving them strategic delivery options. This optionality makes bond futures hybrid products.

2) Net basis can approximate the value of delivery options for the cheapest-to-deliver bond, but for other bonds it represents delivery costs plus optionality.

3) At expiration, net basis will be zero for the cheapest-to-deliver bond and positive for other bonds, representing the relative expensiveness of delivering those bonds.

![Back to the future 5

Basis Basics: general

BTPS 5 ½ 09/01/22 BASIS

0

0.2

0.4

0.6

0.8

1

1.2

1.4

10 12 14 18 20 24 27 31 33 35 39 41 45 47 49 53 55 59 61 63 67 69 73 75 77 81 83 87 89 91 95 97

DAYS TO EXPIRY

SPOTPRICE-FORWARDPRICE

Analytically:

BASIS = SPOT - FORWARD

with spot = Ps and forward = [ Ps + ai(t) ] * ( 1 + r(T-t) ) - ai(T), we get:

BASIS = Ps - [( Ps + ai(t) ) + (Ps + ai(t)) * r(T-t) - ai(T)], or

BASIS = - (Ps + ai(t)) * r(T-t) + ai(T) – ai(t)

BASIS = -cost of funding + income coupon = total carry = daily carry * number of days

We expect the basis to be 0 at contract

expiry and to decrease with time

proportionally to the daily carry, with the

main factor of volatility being the repo rate.

)(**)(** tTrMDtTr

y

P

P

Basis s

s

−−=−

Δ

Δ

−=

Δ

Δ

)(*))(( tTtaiP

r

Basis

s −+−=

Δ

Δ](https://image.slidesharecdn.com/presentazionevenicemodificata2-170616123529/85/Presentazione-venice-modificata-6-320.jpg)

![Back to the future 16

Basis Basics: net basis

Net basis or basis net of carry BNOC is defined as:

BNOC(i) = BASIS(i) - CARRY(i) or, as seen before:

Since, as we have see, the delivery option value has been defined as:

the BNOC is an approximation of the delivery option value. It is a pure option value only for the cheapest

to deliver bond, for which holds:

For the other deliverable it is a mix of delivery option value and distance of the bond forward price from the CTD

forward (a measure of expensiveness)

t

t

F

ctdCF

ctdFwd

−==

)(

)(

(DOV)ueoption valdelivery α

)(*)(*)()(n ctdCFctdCFFctdFwdBNOCetbasis tt α=−=

[ ])()(*)()()( iFwdiSFiCFiSiBNOC −−−=

FCFiFwdiBNOC i *)()( −=](https://image.slidesharecdn.com/presentazionevenicemodificata2-170616123529/85/Presentazione-venice-modificata-17-320.jpg)

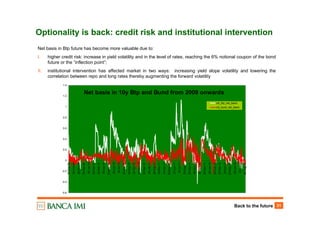

![Back to the future 32

Forward prices are a function of spot price and repo rate:

Pf = [ Ps + ai(t) ] * ( 1 + r(T-t) ) - ai(T)

An increase in rates has the effect:

To lower the forward price via a reduction in spot price

To increase the forward price via an increase of the funding cost

Optionality is back: credit risk and institutional intervention

Even if in the short term the two

rates respond to different forces,

they showed a positive correlation

in the past R^=0.43%.

With repo stuck, independent by

market forces correlation has gone

down, and forward volatility has

increased*.

222

),()()(),()()(2)()()()()( yxCovyVxVyxCovyExExEyVyExVxyVar ++++=Application to Pf formula of the following

With Cov(X,Y) going from negative to zero](https://image.slidesharecdn.com/presentazionevenicemodificata2-170616123529/85/Presentazione-venice-modificata-33-320.jpg)