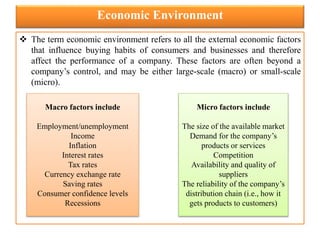

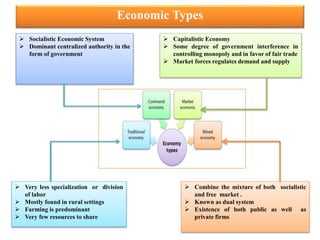

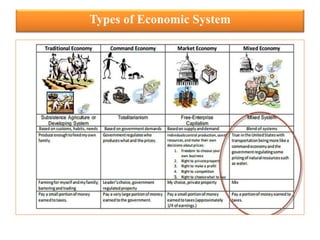

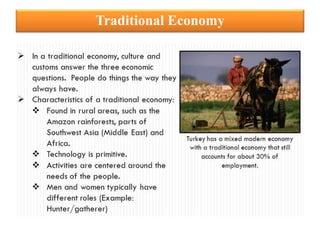

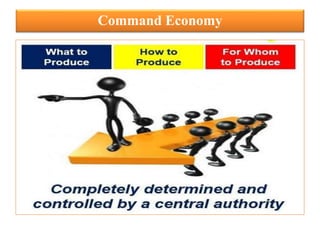

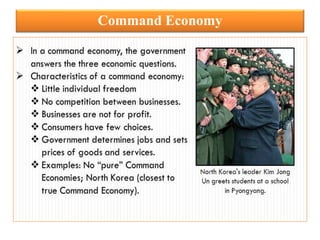

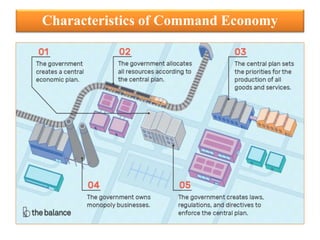

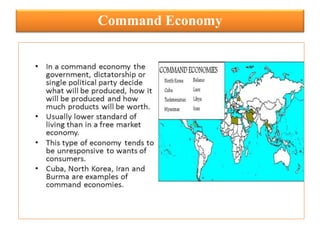

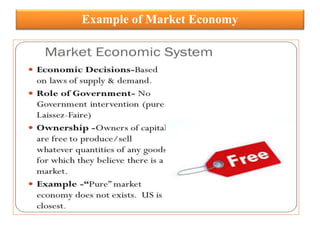

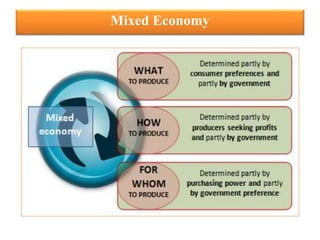

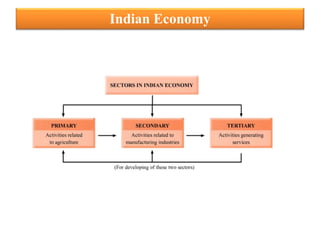

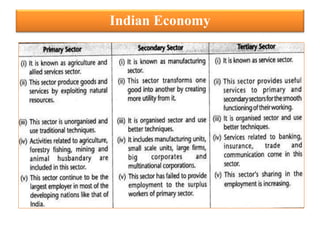

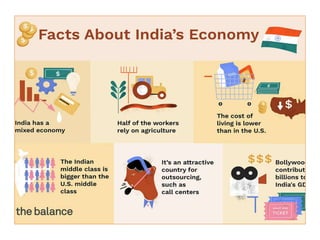

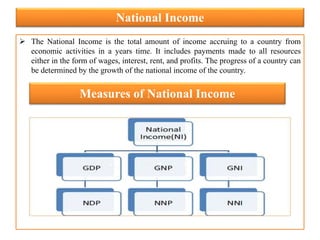

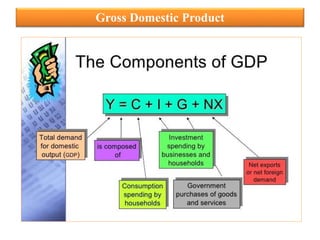

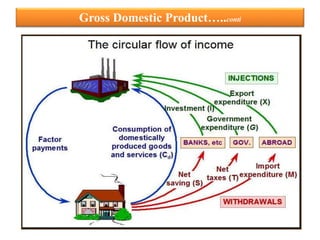

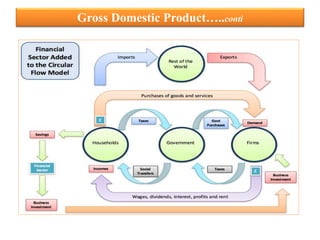

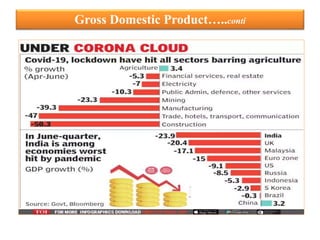

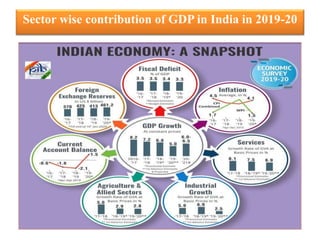

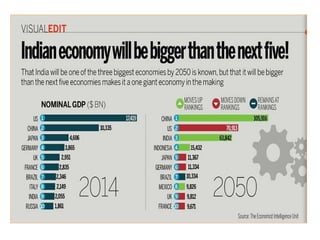

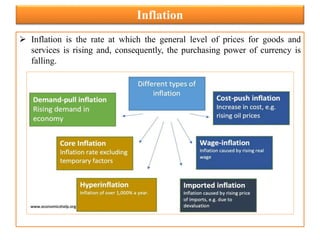

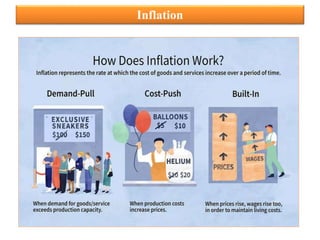

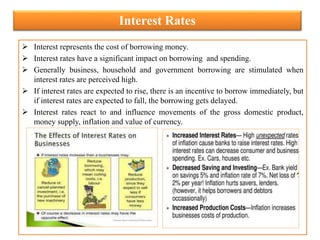

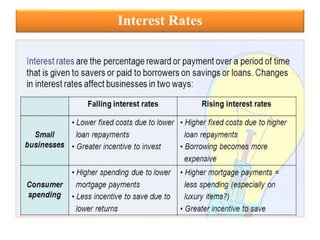

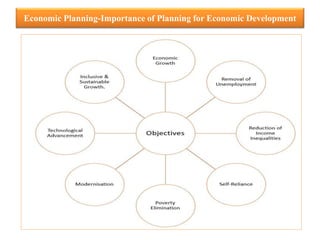

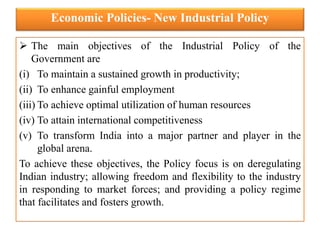

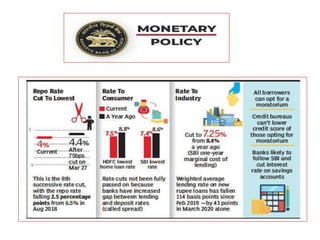

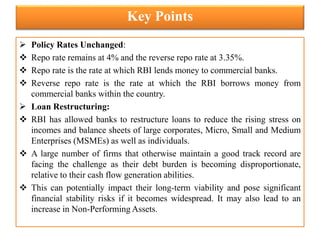

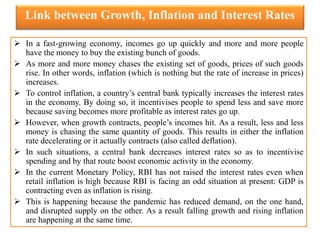

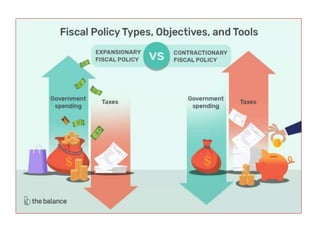

The document discusses key aspects of India's economic environment and policies. It describes macroeconomic factors that influence consumer behavior and business performance. It also outlines different types of economic systems including traditional, command, market and mixed economies. It provides details on India's GDP, inflation, interest rates, economic planning and industrial policies. The document presents an overview of key concepts in India's economic landscape.