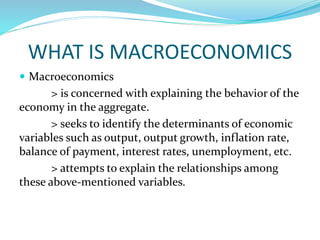

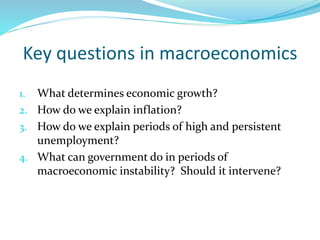

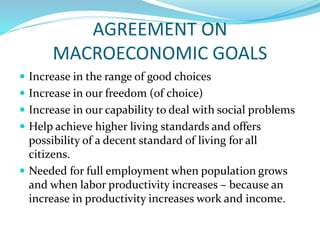

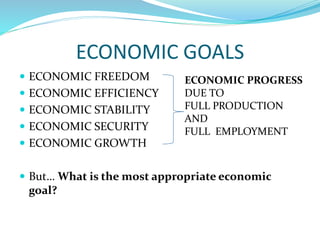

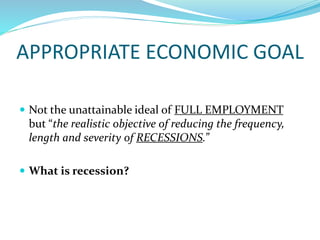

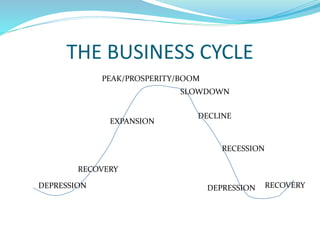

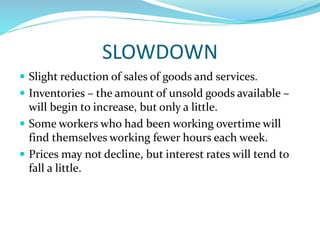

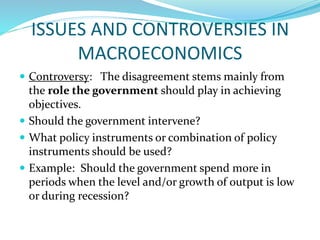

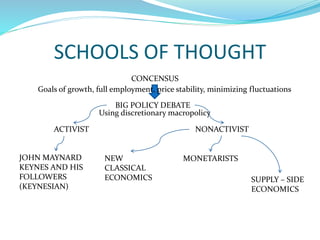

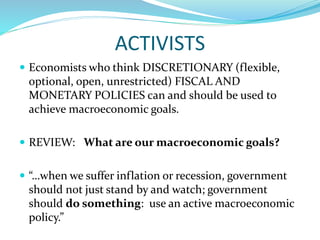

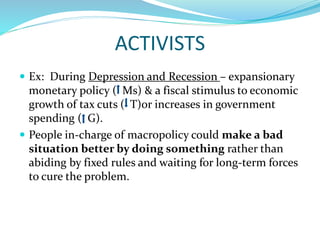

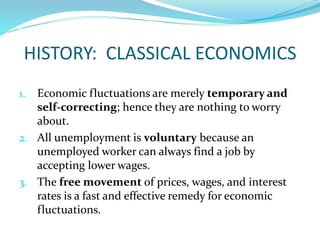

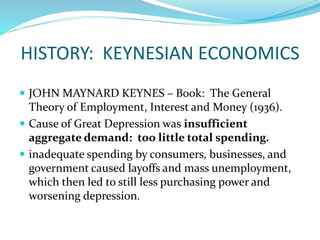

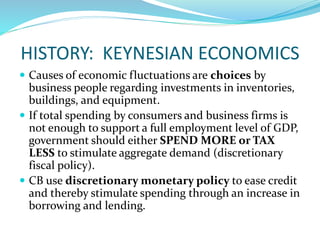

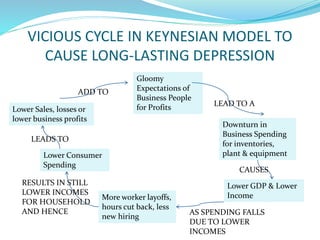

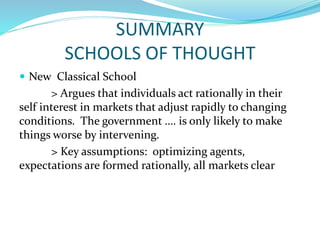

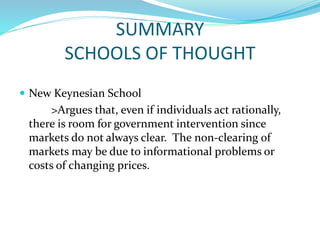

This document provides an introduction to macroeconomics. It defines macroeconomics, discusses key questions in the field, and outlines different schools of thought regarding the appropriate role of government intervention in the economy. The document also summarizes different economic goals and debates around activist versus non-activist policy approaches.