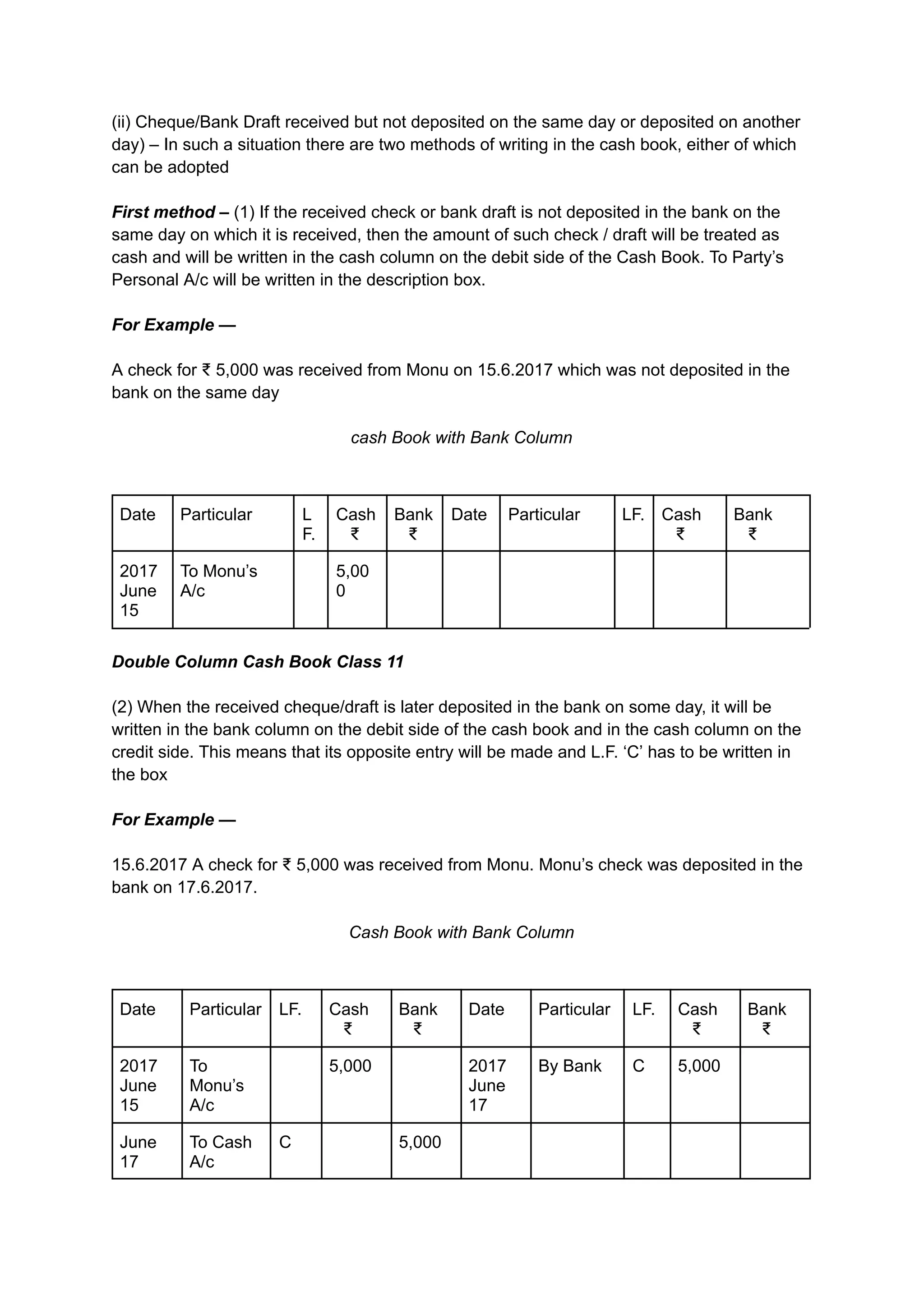

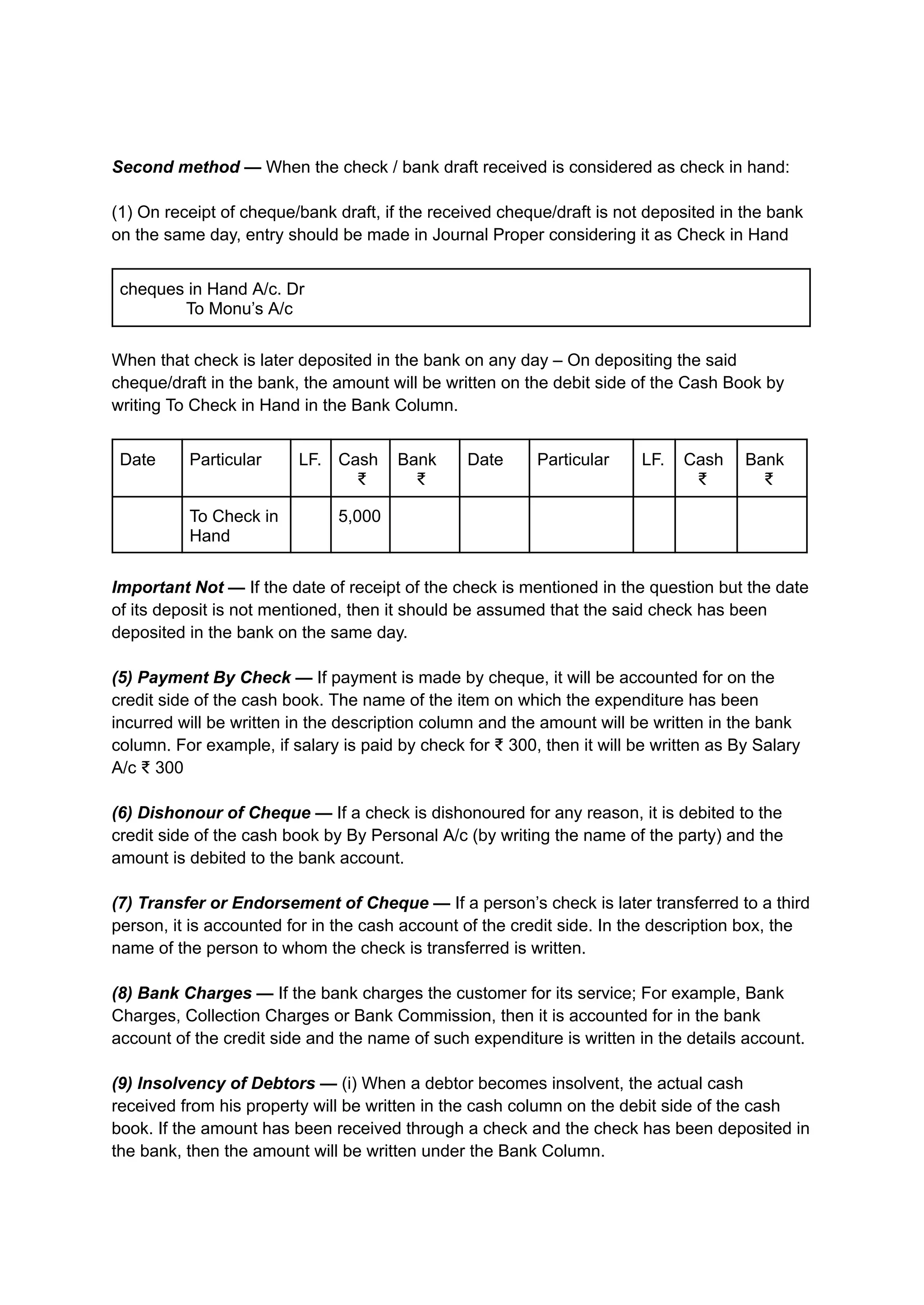

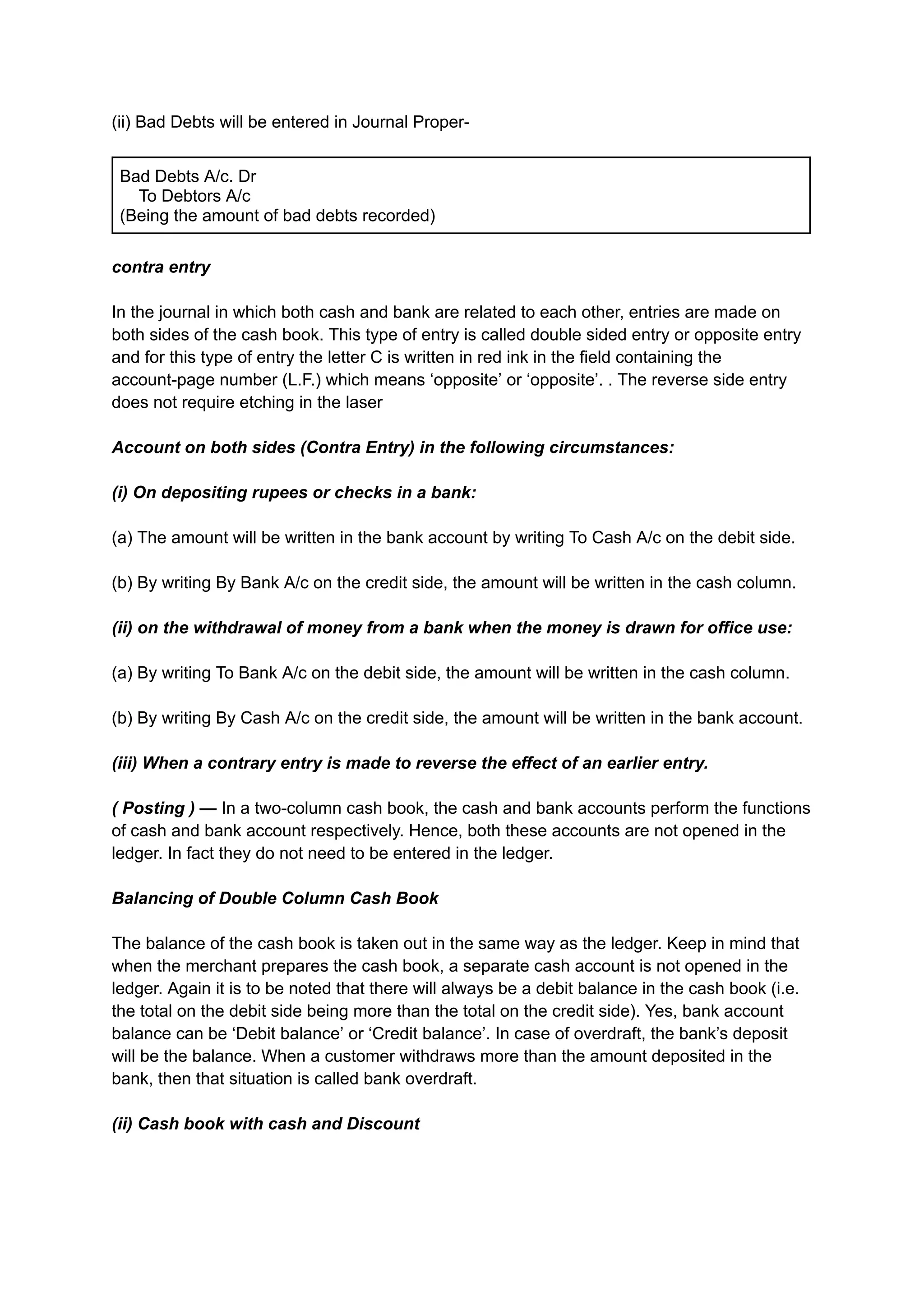

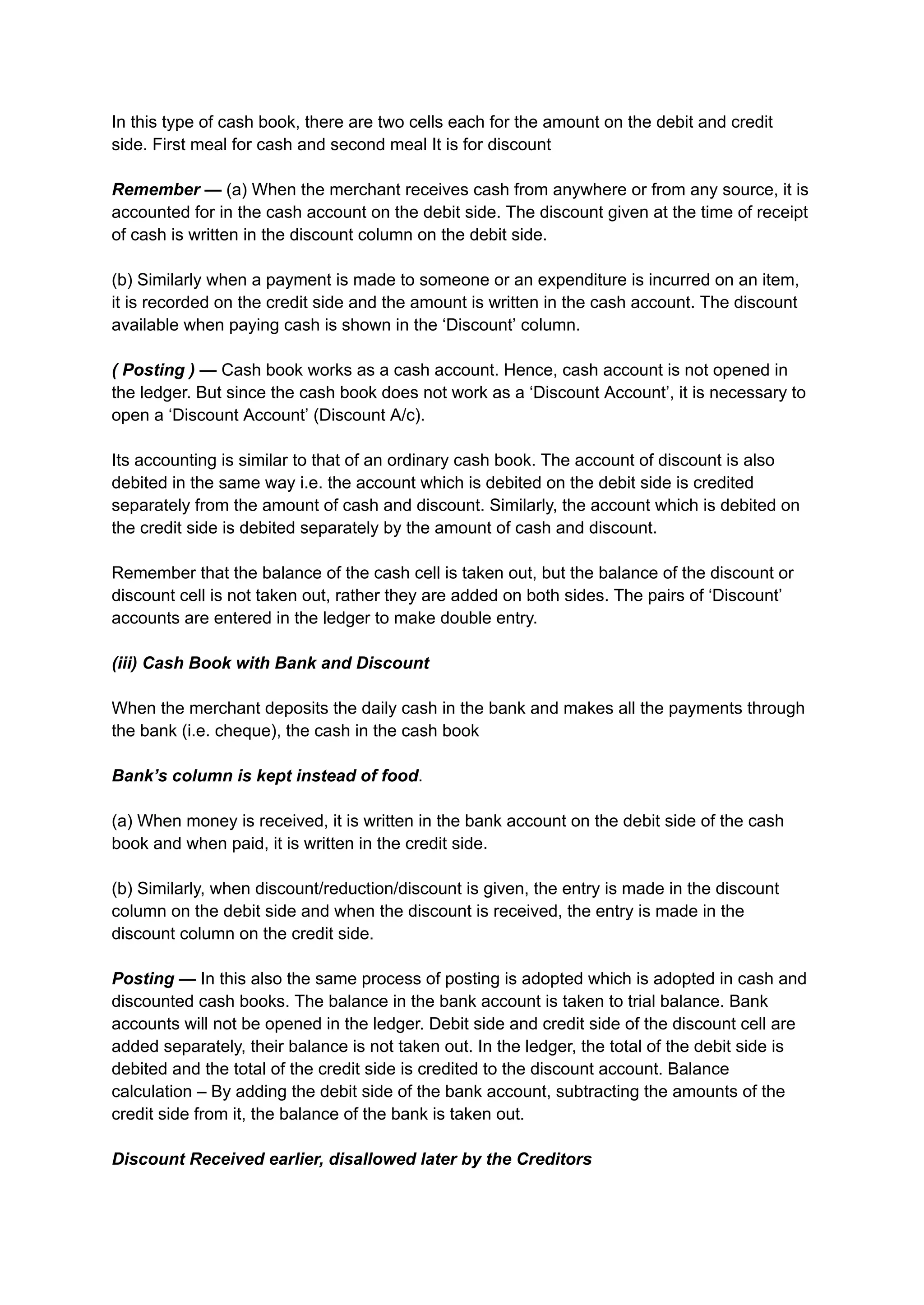

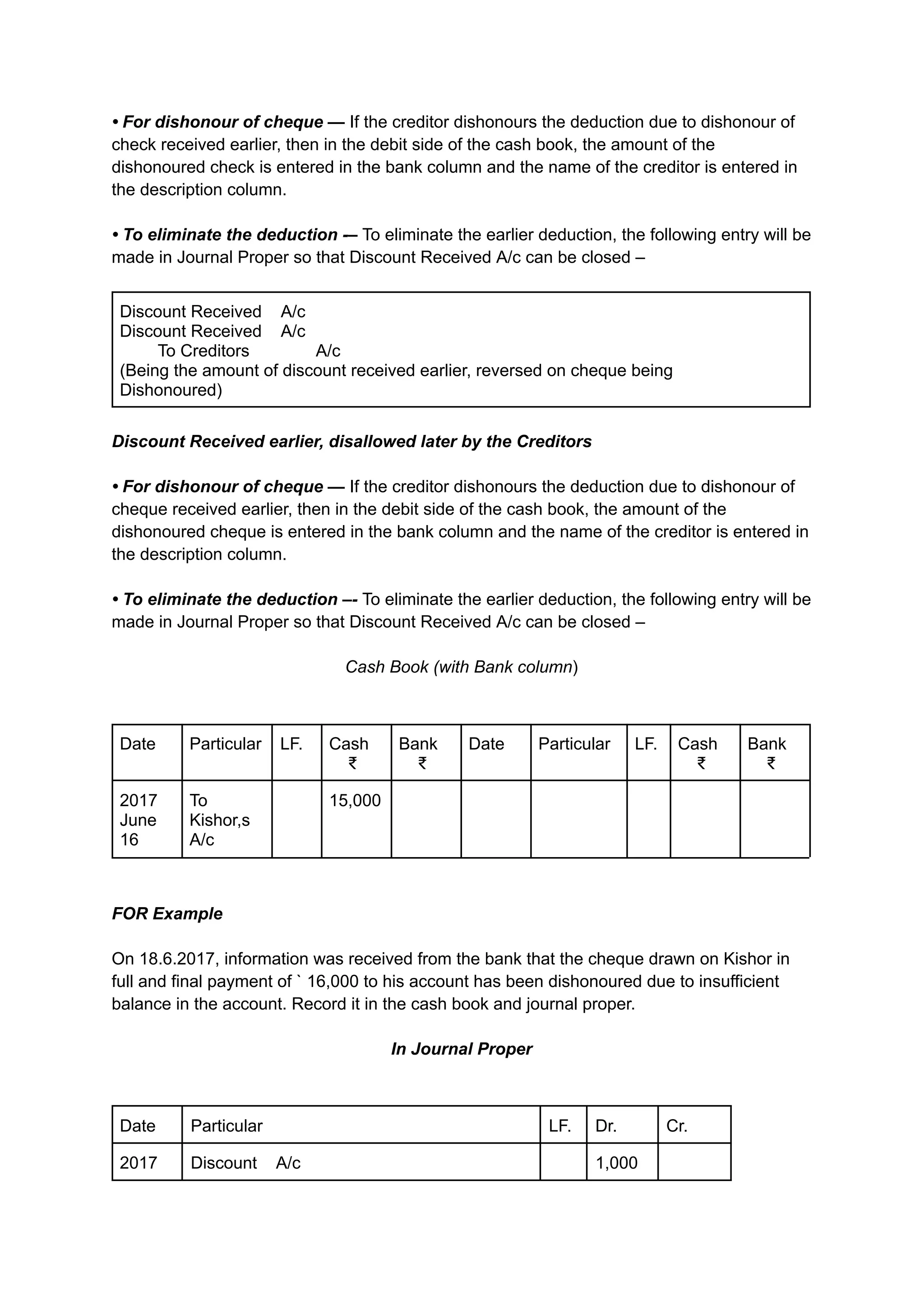

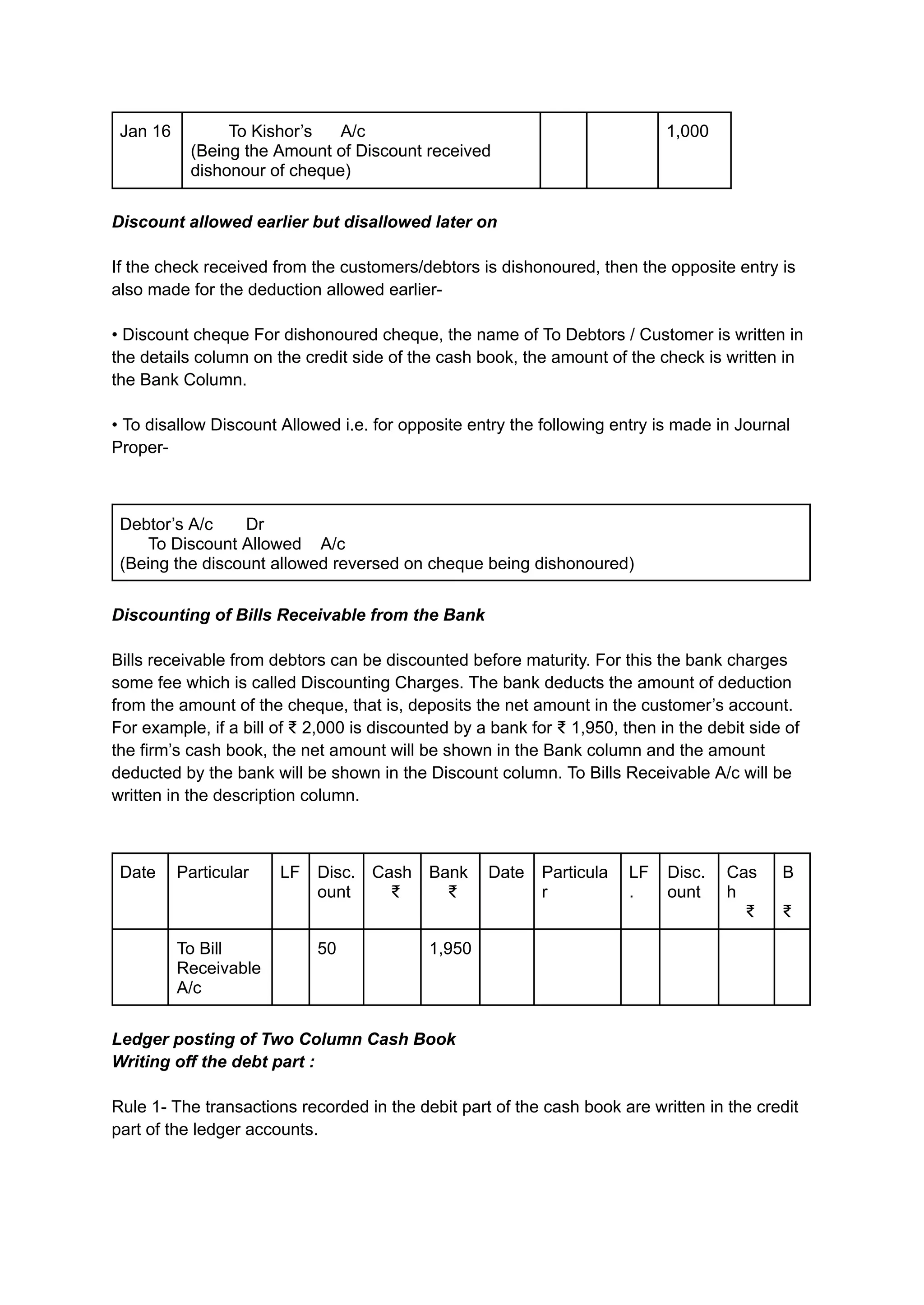

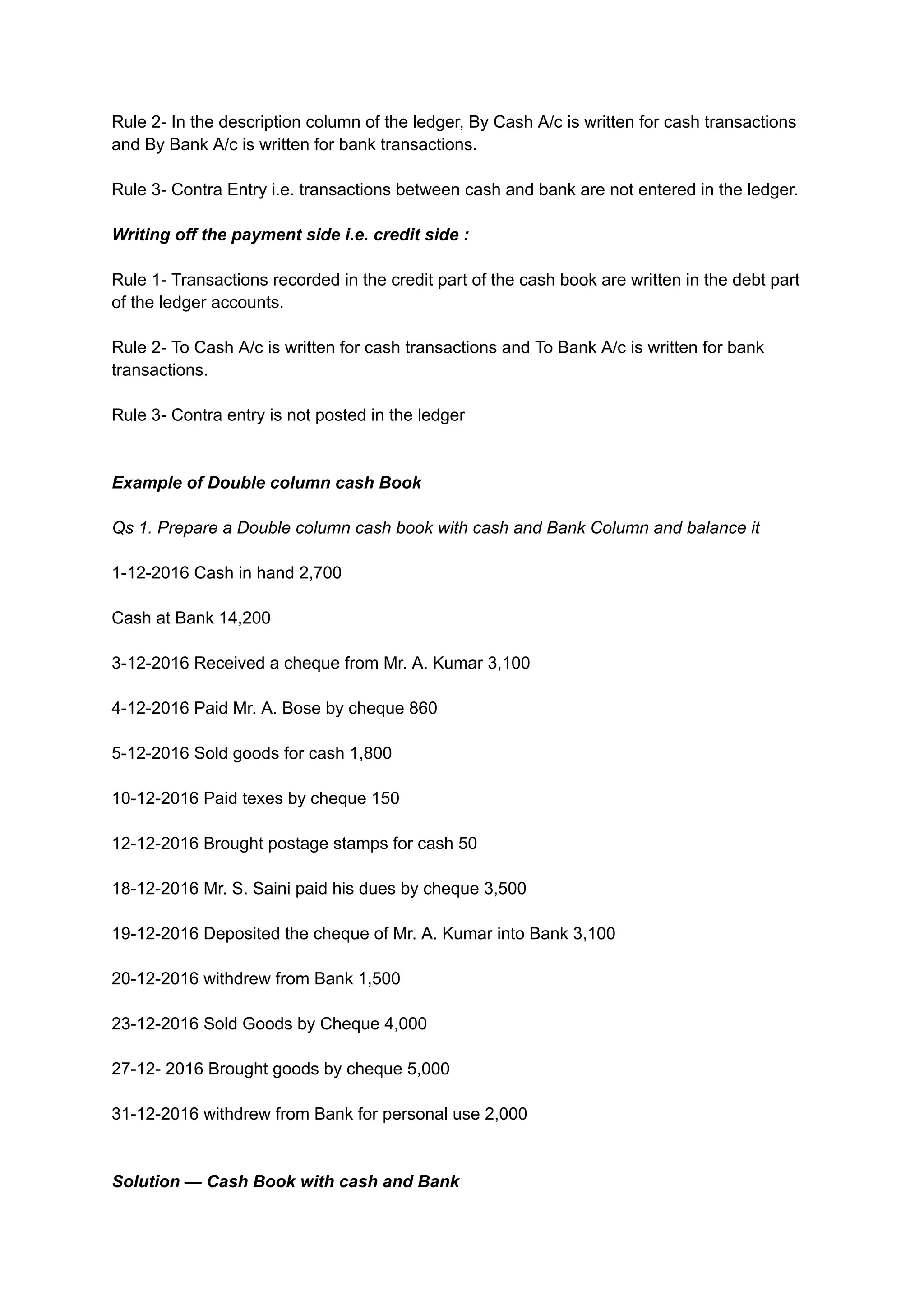

The document explains the concept and usage of a double column cash book, which records cash and bank transactions in separate columns for both debit and credit sides. It details various transactions and their accounting processes, such as cash receipts, payments, cheque handling, and bank overdrafts, emphasizing the need for appropriate entries and balance management. Additionally, it covers different types of double column cash books and the importance of maintaining accurate records for discount transactions.