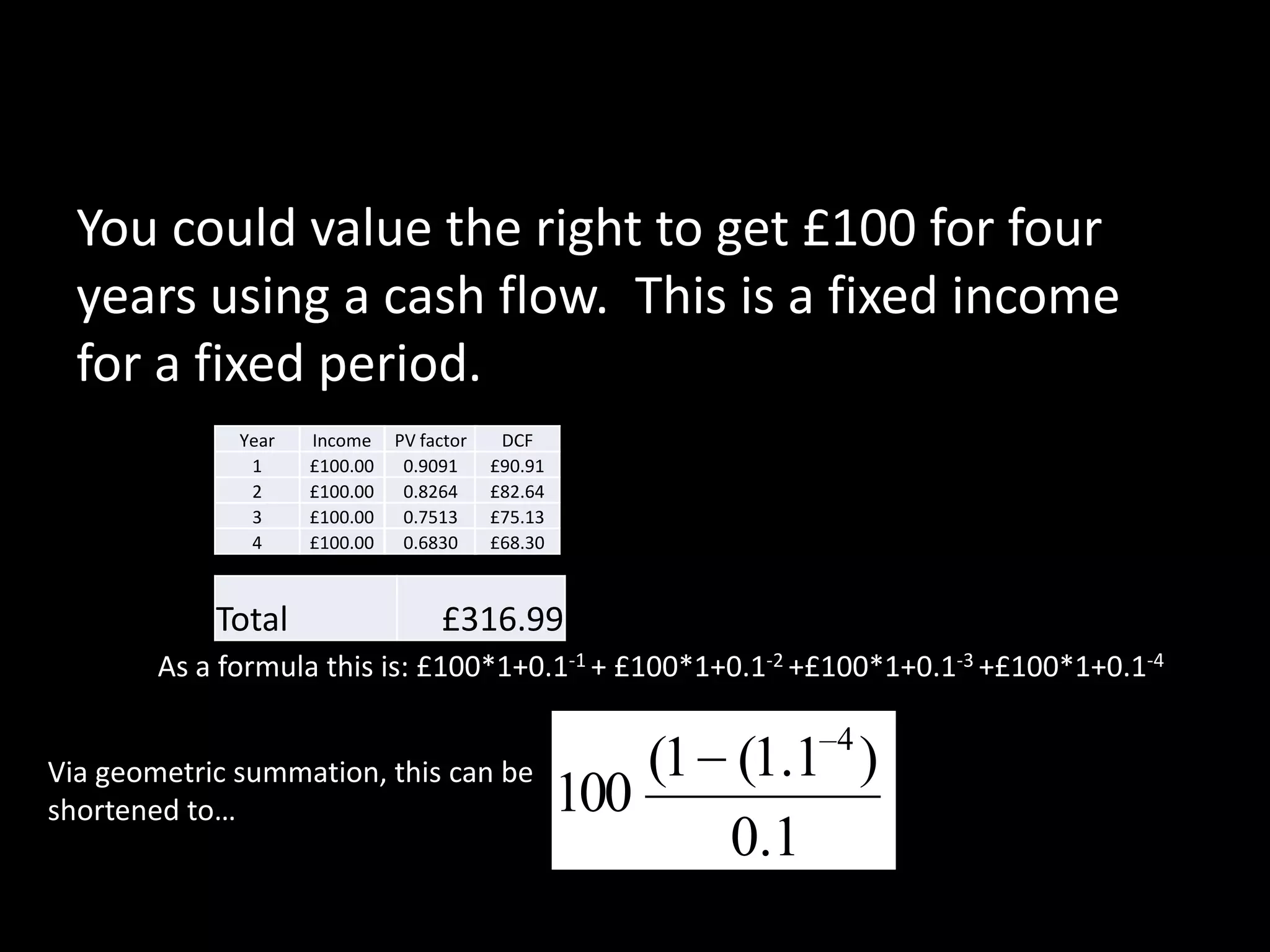

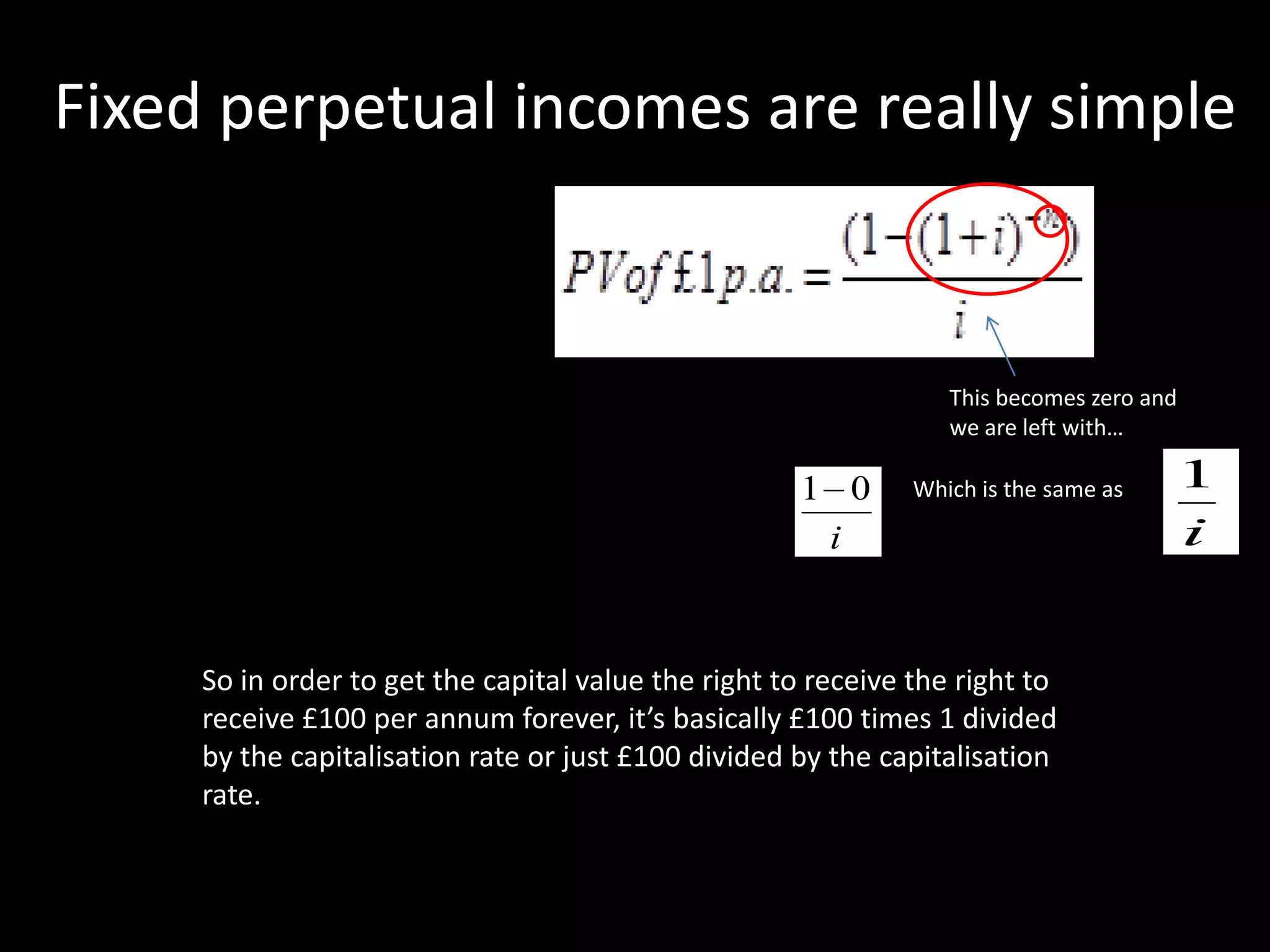

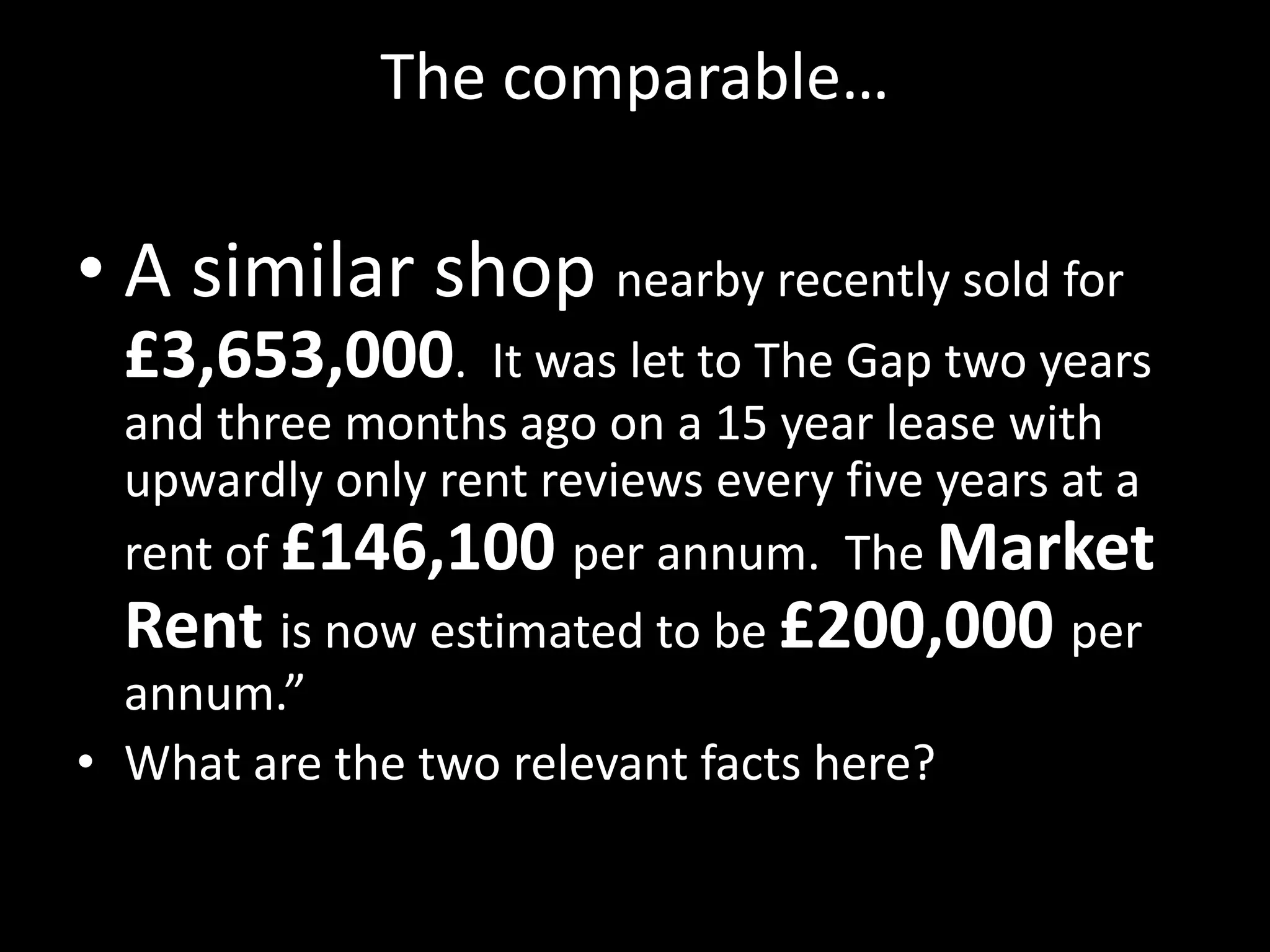

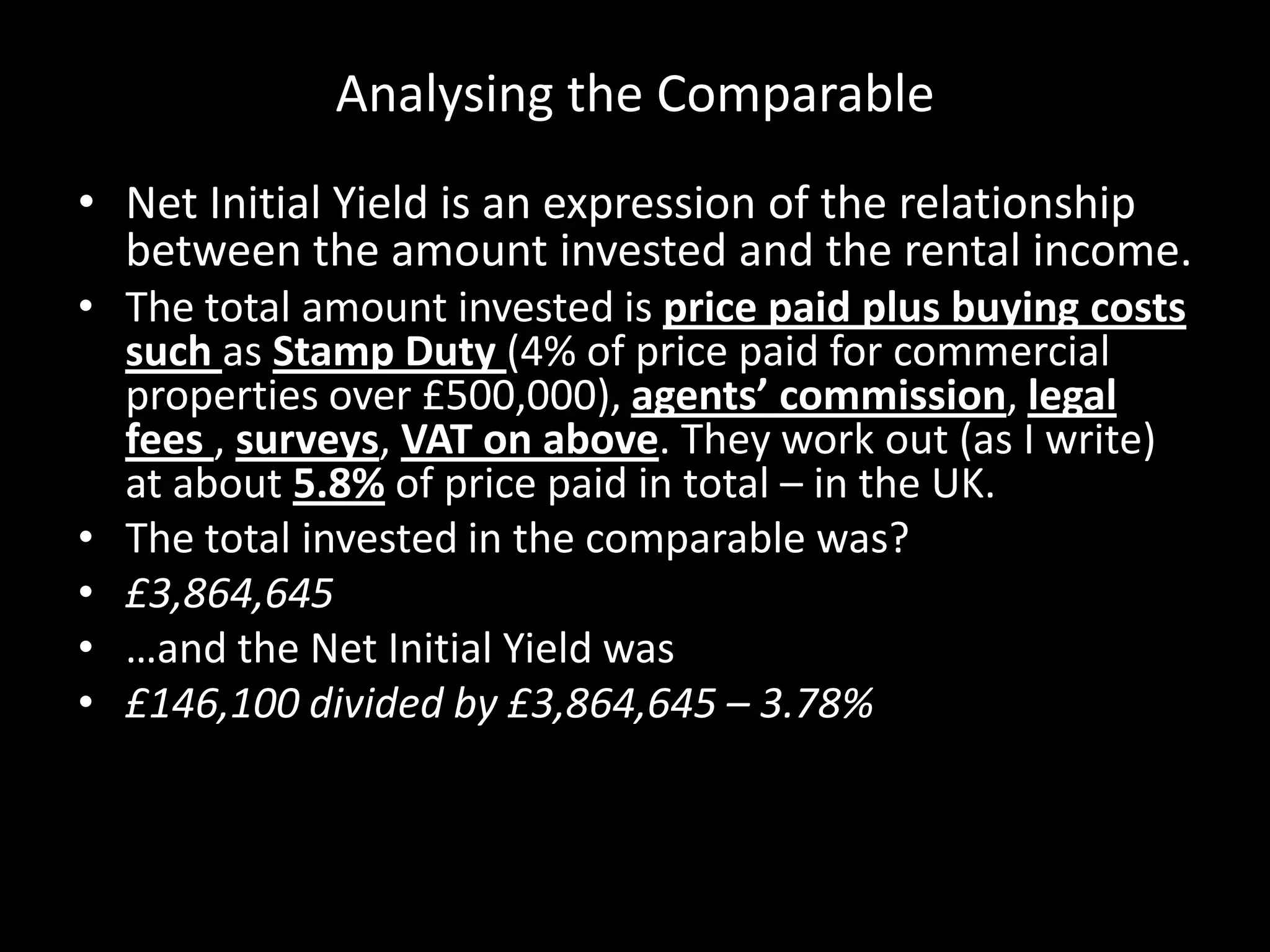

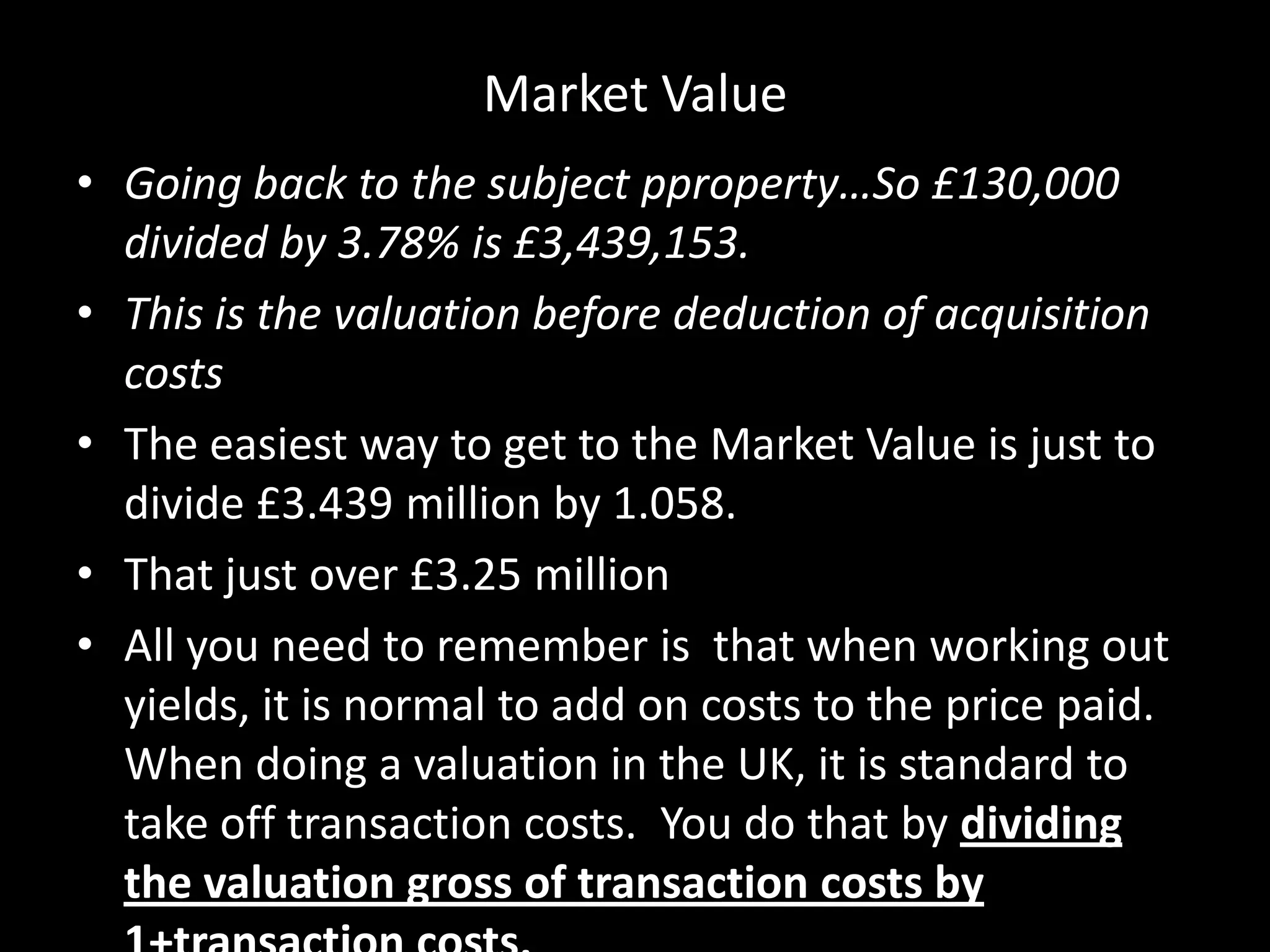

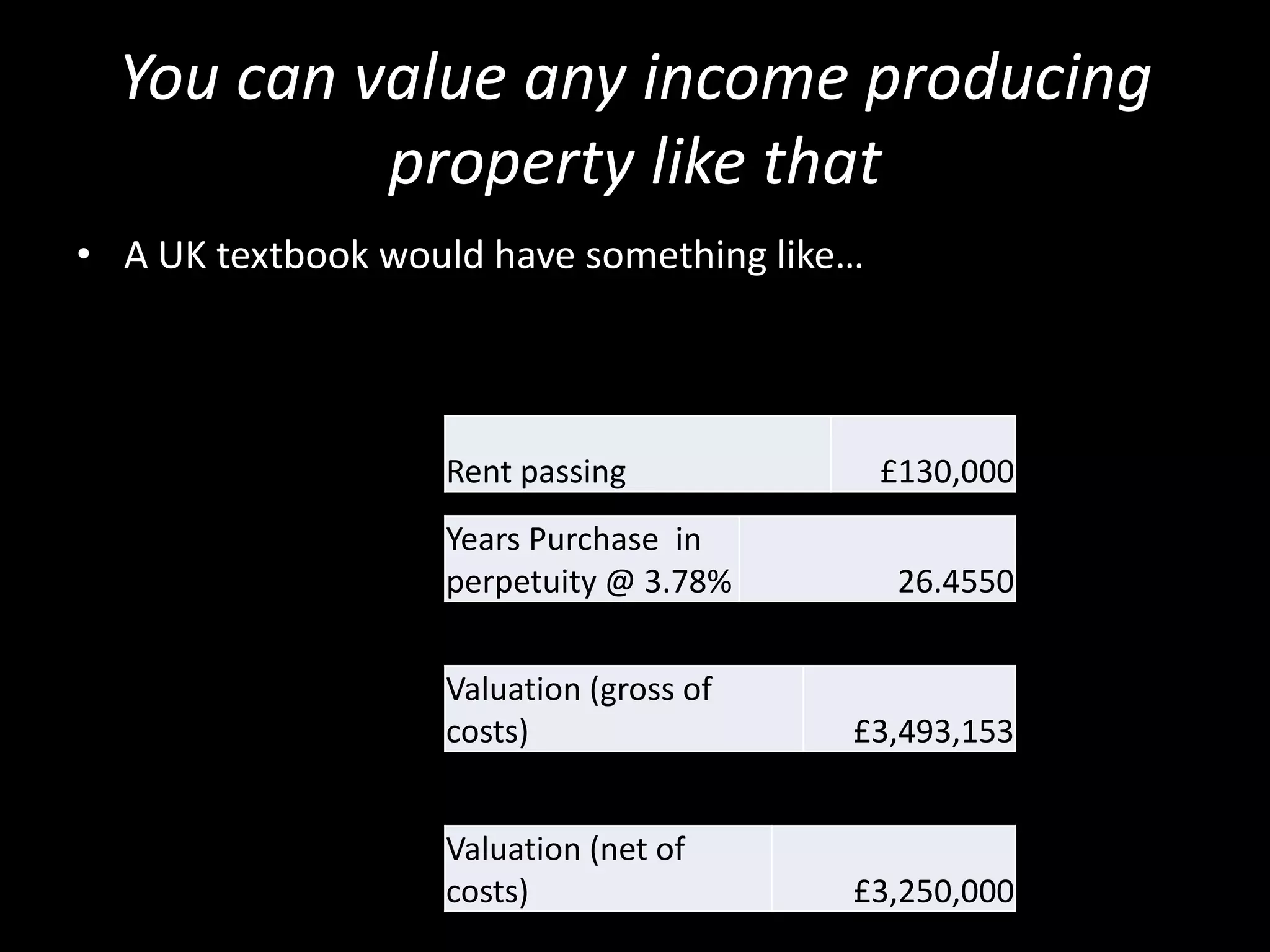

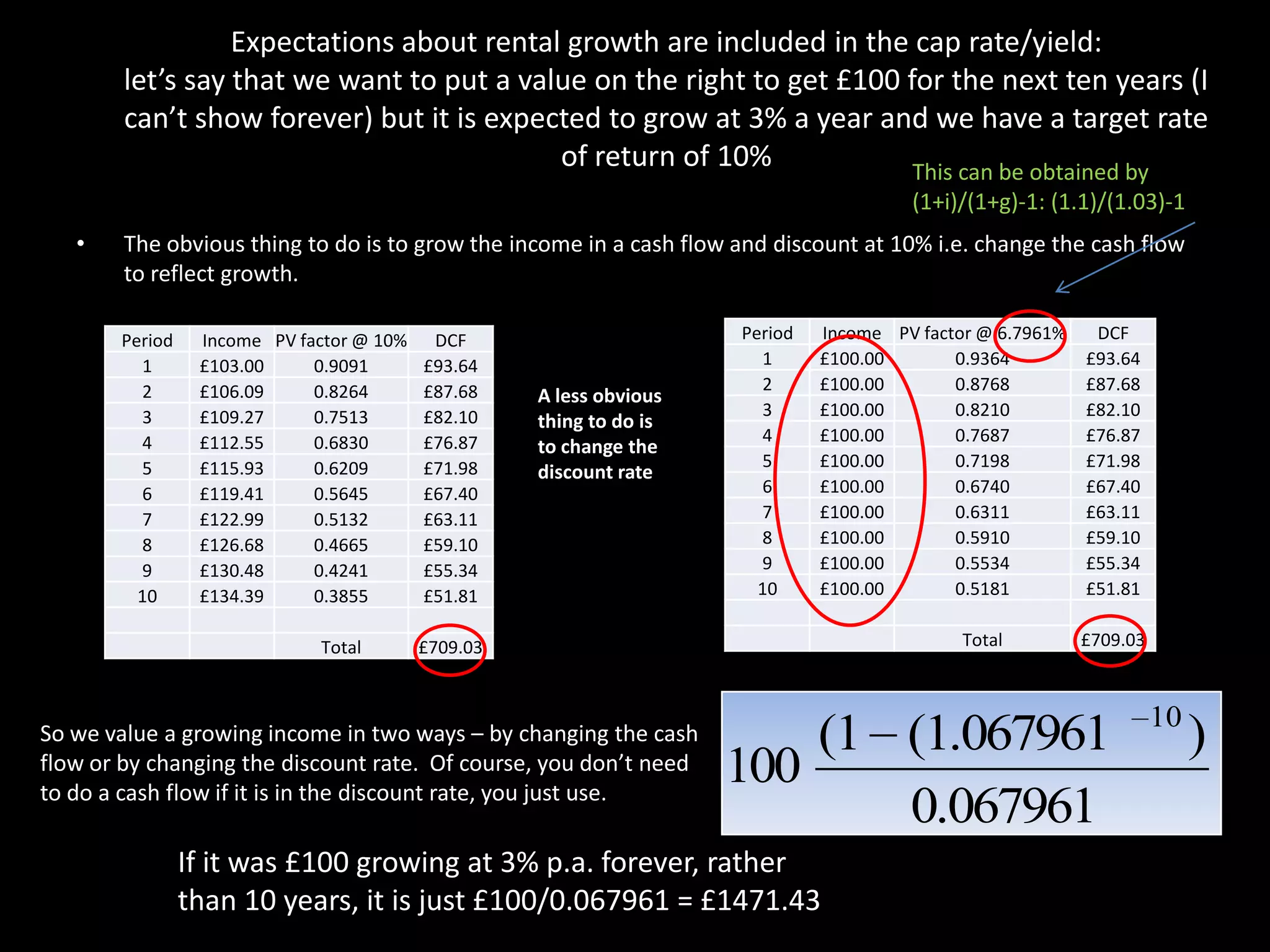

This document discusses commercial property valuation using capitalization rates (yields). It provides an overview of the rationale for valuations, competencies required, and the net initial yield approach. For the net initial yield approach, you need the current rent and estimated net initial yield to calculate the property value. For example, a property with £130,000 annual rent and estimated 3.78% net initial yield would be valued around £3.25 million after accounting for transaction costs. Expectations of rental growth are factored into the capitalization rate. The document provides examples of valuing fixed and growing income streams using discounted cash flows or adjusted discount rates.