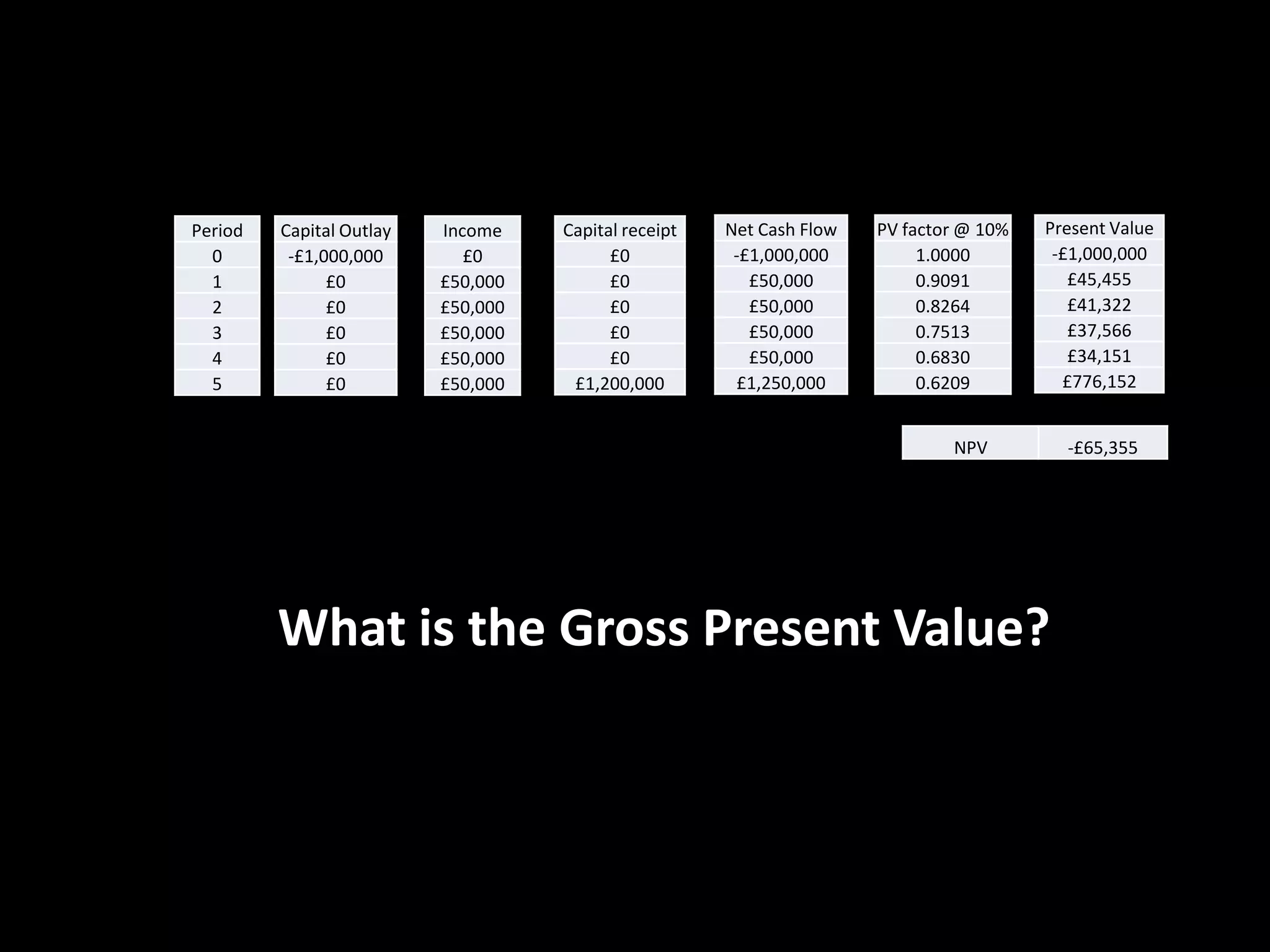

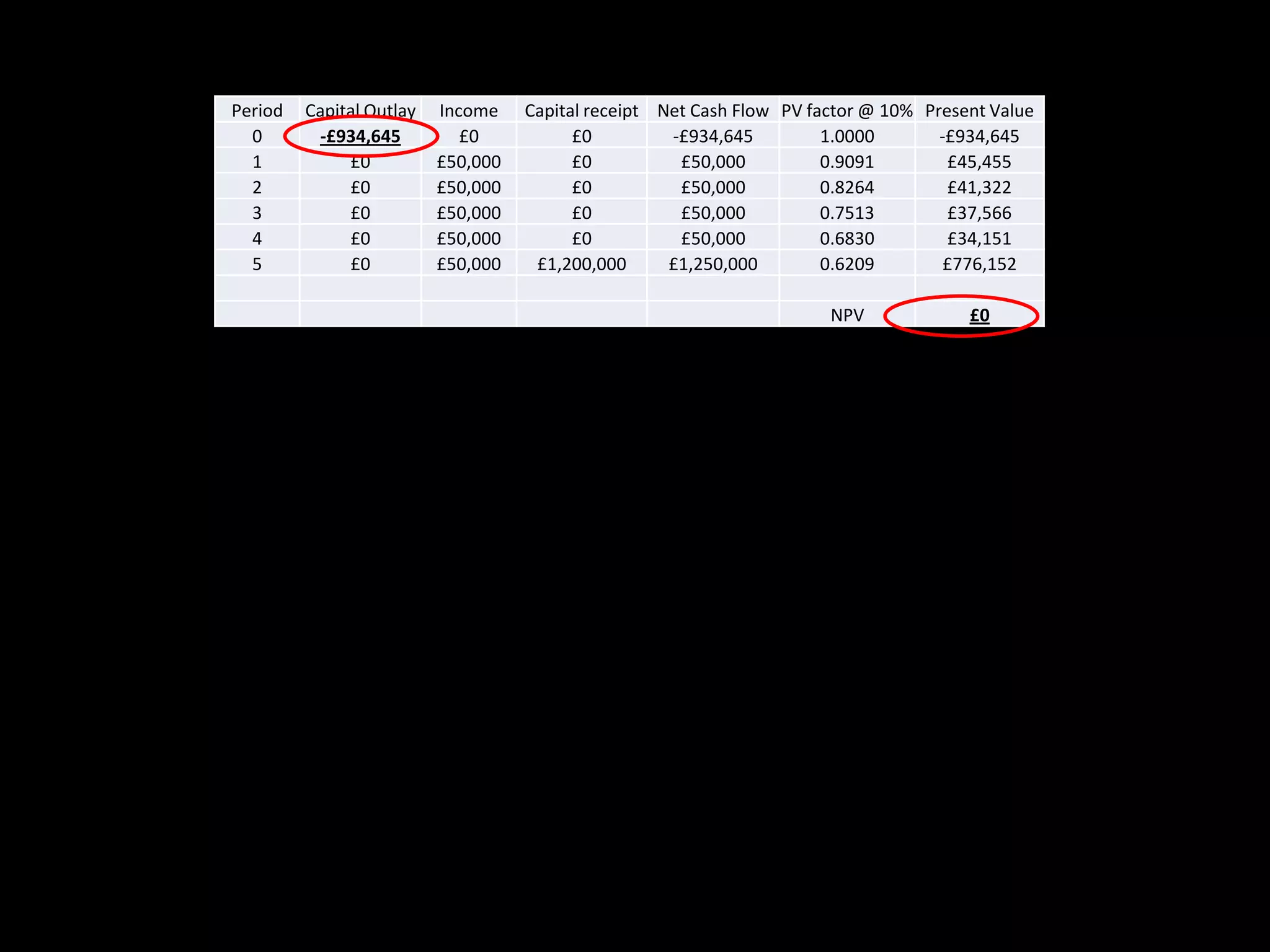

This document discusses methods for evaluating investments, including net present value (NPV), gross present value, and internal rate of return. It provides definitions and formulas for each. As an example, it calculates the NPV, gross present value, and internal rate of return for a hypothetical investment that costs £1,000,000 upfront and generates £50,000 annual income for 5 years, at which point £1,200,000 capital is returned. It performs the calculations and determines that for a 10% target rate of return, the NPV is negative £65,355, while the gross present value and internal rate of return are also provided.