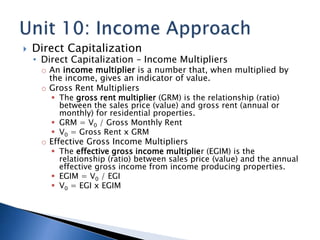

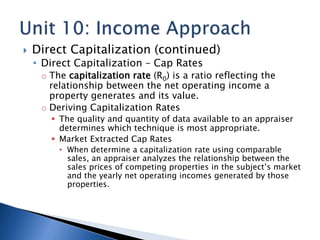

The document provides an overview of the income approach for appraising property. It discusses estimating potential gross income, effective gross income, and net operating income. It then covers direct capitalization methods including income multipliers, capitalization rates derived from market data and the band of investment method, and residual techniques. Yield capitalization or discounted cash flow analysis is also introduced.